by Calculated Risk on 6/12/2013 10:20:00 AM

Wednesday, June 12, 2013

CoreLogic: Negative Equity Decreases in Q1 2013, 9.7 Million Properties still with Negative Equity

From CoreLogic: 9.7 Million Residential Properties with a Mortgage Still in Negative Equity

CoreLogic ... today released new analysis showing approximately 850,000 more residential properties returned to a state of positive equity during the first quarter of 2013, and the total number of mortgaged residential properties with equity currently stands at 39 million. The analysis shows that 9.7 million, or 19.8 percent of all residential properties with a mortgage, were still in negative equity at the end of the first quarter of 2013 with a total value of $580 billion. This figure is down from 10.5 million*, or 21.7 percent of all residential properties with a mortgage, at the end of the fourth quarter of 2012.

... At the end of the first quarter of 2013, 2.1 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“The impressive home price gains of 2012 and the beginning of 2013 have had a big impact on the distribution of residential home equity,” said Dr. Mark Fleming, chief economist for CoreLogic. “During the past year, 1.7 million borrowers have regained positive equity. We expect the pent-up supply that falling negative equity releases will moderate price gains in many of the fast-appreciating markets this spring.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 45.4 percent, followed by Florida (38.1 percent), Michigan (32 percent), Arizona (31.3 percent) and Georgia (30.5 percent). These top five states combined account for 32.8 percent of negative equity in the U.S."

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity.

The second graph shows the distribution of home equity. Just over 8% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.

MBA: Mortgage Applications Increase, Mortgage Rates highest since March 2012

by Calculated Risk on 6/12/2013 08:11:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 5 percent from the previous week. Despite the increase in the refinance index last week, the level is still 11 percent lower than two weeks prior and 36 percent lower than the recent peak at the beginning of May. The seasonally adjusted Purchase Index increased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.15 percent, the highest rate since March 2012, from 4.07 percent, with points increasing to 0.48 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

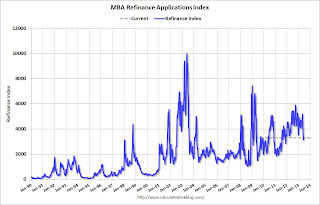

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4%, refinance activity has fallen sharply over the last 5 weeks even with the slight increase last week.

This index is down 36% over the last five weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, June 11, 2013

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/11/2013 09:31:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

Below is another update to the long term graph of the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 32% from the peak, and is still declining. The number of salesperson's licenses has fallen to June 2004 levels.

However brokers' licenses are only off 8% and have only fallen to late 2006 levels - and appear to have stopped falling

Click on graph for larger image.

Click on graph for larger image.

If we look at examinations (and new licensees issued), there are more people obtaining licenses than a year ago. However - since the number of salesperson's licenses are still declining - there are still more people letting their licensees expire.

So far there is no sign of a new bubble in real estate agents!

Comment: Senator Elizabeth Warren and Short Sale Fraud

by Calculated Risk on 6/11/2013 06:53:00 PM

I like Elizabeth Warren, but I was shocked to see this commentary from her: Commentary: FHFA’s Senseless Arm’s-Length Policy on Short Sales (ht jb). Warren argued for having the FHA allow short sales to family members and friends so the owner can stay in the home.

Apparently Ms. Warren isn't familiar with short sale fraud. I've covered this extensively, from Tanta in 2007: Let the Short Sale Scams Begin, from the FBI in 2009: FBI: U.S. Mortgage Fraud "Rampant" and "Escalating" (see short sale fraud), from John Gittelsohn at Bloomberg in 2010: Banks Face Short-Sale Fraud as Home `Flopping' Spreads, from Jim the Realtor in 2010: Jim the Realtor on Short Sales: "Rampant Fraud and Deceit" and Short Sales: Arm’s Length Transactions and many more ...

Lenders have always been afraid of short sales because of fraud. Short sales increased after lenders put many fraud protections in place - such as having all parties sign that there is no undisclosed consideration, that the transaction are arms-length (not to related party) and more. This hasn't stopped all short sale fraud, but it has helped.

Warren writes:

Short sales can make good sense, and private lenders have gone along with them in many cases. But the FHFA – the regulator overseeing the bailed-out housing giants Fannie Mae and Freddie Mac and the financing of about half the country’s outstanding mortgages – has blocked the way.Uh, one of the reasons private lenders have "gone along with" short sales is because they require that the sales be "arms-length". The FHFA has the same requirement - for good reason.

In some of those short sales, friends, families, or nonprofit organizations are willing to buy the home at fair market value, then work out a rental or re-sale to the family living in it. The mortgage company gets the same amount as in a sale to strangers, but the homeowner has a last-chance to save the family home.

Warren seems to think that the lender will get the same amount either way ... not likely. She writes:

The FHFA claims that its policy prevents sweetheart insider deals that benefit the homeowners at the expense of Fannie and Freddie. But that makes no sense when the house is sold at market value or when people affiliated with the homeowner put in the highest bid to save the home. In those cases, the identity of the bidder makes no meaningful difference because Fannie and Freddie’s bottom line stays the same.Warren doesn't understand that short sales don't go to the highest bidder. The first chance to negotiate with the bank goes to someone the homeowner (or agent) picks. Since the homeowner has no financial interest in the property, this creates an agency problem, and opens the door to fraud (I've suggested having the lender hire the agent). The "arms-length" protection is an important tool to prevent fraud.

If friends and family want to help, they could contact the bank about modification and offer to pay down some of the debt, but eliminating the "arms-length" rule would just mean more fraud.

DataQuick: SoCal May Home Sales Highest in 7 Years

by Calculated Risk on 6/11/2013 01:43:00 PM

From DataQuick: Southland May Home Sales Highest in 7 Years; Median Price Hits 5-Year High

A total of 23,034 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 7.6 percent from 21,415 sales in April, and up 3.8 percent from 22,192 sales in May 2012, according to San Diego-based DataQuick.Distressed sales are down in SoCal, and foreclosures are back to 2007 levels (although short sales are much higher). Overall sales in SoCal were the highest for May since 2006.

Last month’s sales were the highest for the month of May since 30,303 Southland homes sold in May 2006, but they were still 10.1 percent below the May average of 25,617 sales since 1988, when DataQuick’s statistics begin. Over the last seven years Southland home sales have been below average for any particular month.

...

“We’re deep into uncharted territory: Amazingly low mortgage rates, a razor-thin inventory of homes for sale, and the release of years’ worth of pent-up demand. Plus there’s a seemingly endless stream of investors and non-investors who pay cash and thereby avoid the loan-qualification process. How this all plays out is educated guesswork at this point. Understandably, speculation continues over whether another housing bubble is forming,” said John Walsh, DataQuick president.

“History suggests that’s a tough call early on. What seems obvious is that if prices keep rising fast they’ll cause many more people to list their homes for sale, and that increase in supply should at least slow the rate of price appreciation,” he said.

...

Last month foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 10.8 percent of the Southland resale market. That was down from 12.4 percent the month before and down from 26.9 percent a year earlier. Last month’s foreclosure resale rate was the lowest since it was 10.0 percent in August 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was the same as the month before and down from 24.3 percent a year earlier.

...

Buyers paying with cash accounted for 31.9 percent of last month's home sales, compared with 34.4 percent the month before and 32.1 percent a year earlier. The peak was 36.9 percent this February, and since 1988 the monthly average is 16.1 percent.

On Walsh's "bubble" comment - I wouldn't call this a "bubble", and I agree with Walsh's comment that supply will probably start to increase and that should slow the price increases.

BLS: Job Openings decreased slightly in April

by Calculated Risk on 6/11/2013 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 3.8 million job openings on the last business day of April, little changed from 3.9 million in March, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.2 percent) also were little changed in April. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was up over the 12 months ending in April for total nonfarm and total private but was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in April to 3.757 million, down from 3.875 million in March. The number of job openings (yellow) has generally been trending up, and openings are up 7% year-over-year compared to April 2012.

Quits were up in April, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

NFIB: Small Business Optimism Index increases in May

by Calculated Risk on 6/11/2013 08:32:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Confidence Edges Up, Reaches May 2012 Level

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May. ...In a little sign of good news, only 16% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Job creation plans rose 6 points to a net 6 percent planning to increase total employment, outcome nice improvement after the 4 point decline in March.

...

Owners were asked to identify their top business problem: 24 percent cited taxes, 23 percent cited regulations and red tape, 16 percent cited weak sales and 2 percent reported financing/access to credit.

Click on graph for larger image.

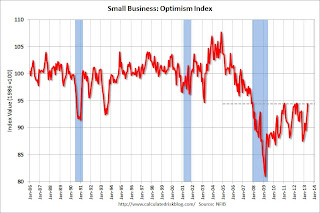

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.4 in May from 92.1 in April. This is still low, but near the post-recession high.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, June 10, 2013

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 6/10/2013 08:38:00 PM

A little good news from the California State Controller: State Finances in May 2013

May was a good month for the State’s fiscal coffers, with revenues coming in well ahead of the estimates contained in the Governor’s revised budget re-leased last month. All three of the state’s principal revenue sources exceeded expectations and total General Fund revenues surpassed projections by close to $800 million or 12.4%. ...Tuesday economic releases:

The better-than-expected revenue performance last month reflects the underlying improvement of California's economy with a moderate but generally widespread resuscitation in the job market, a resurgence in housing, and solid advances in the technology sector. However, we caution against reading too much into May's numbers since this month typically accounts for only 7% of the total year's receipts. June's figures will be much more telling since that is a time when the state typically receives a large influx of tax receipts.

• At 7:30 AM, the NFIB Small Business Optimism Index for May. The consensus is for an increase to 92.3 from 92.1 in April.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for April from the BLS. Jobs openings decreased in March to 3.844 million, down from 3.899 million in February. Job openings were unchanged year-over-year compared to March 2012.

• Also at 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.2% increase in inventories.

Existing Home Inventory is up 15.5% year-to-date on June 10th

by Calculated Risk on 6/10/2013 04:58:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 15.5%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.4% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Las Vegas Real Estate in May: Year-over-year Inventory decline slows sharply

by Calculated Risk on 6/10/2013 01:34:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR says local housing market, prices heating up

GLVAR said the total number of existing local homes, condominiums and townhomes sold in May was 3,884. That’s up from 3,789 in April, but down from 4,134 total sales in May 2012. ...There are several key trends that we've been following:

...

In May, 31.8 percent of all existing local home sales were short sales, down from 32.5 percent in April. Another 10.3 percent of all May sales were bank-owned properties, up from 10.0 percent of all sales in April. The remaining 57.9 percent of all sales were the traditional type, which was up from 57.5 percent in April.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in May, with 13,814 single-family homes listed for sale at the end of the month. That’s down 0.5 percent from 13,881 single-family homes listed for sale at the end of April..

As for available homes listed for sale without any sort of pending or contingent offer by the end of May, GLVAR reported 3,297 single-family homes listed without any sort of offer. That’s up 4.3 percent from 3,161 such homes listed in April, but still down 13.2 percent from one year ago.

...

In May, GLVAR reported that 57.9 percent of all existing local homes sold were purchased with cash. That’s down from 59.3 percent in April and just off the peak of 59.5 percent set in February.

emphasis added

1) Overall sales are down year-over-year, but ...

2) Conventional sales are up sharply. In May 2012, only 32.7% of all sales were conventional. This year, in May 2013, 57.9% were conventional. That is an increase in conventional sales of about 66% (of course this is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (about 3 to 1).

4) and probably most interesting right now is that the decline in non-contingent inventory (year-over-year) has slowed sharply. Non-contingent inventory is only down 13.2% year-over-year compared to a year-over-year inventory decrease of 66.3% reported in May 2012. Last month, GLVAR reported a year-over-year decline of 24.1%. It appears the year-over-year inventory decline will be in single digits in June!

This suggests inventory is near a bottom in Las Vegas (A major theme for housing in 2013).