by Calculated Risk on 6/10/2013 04:58:00 PM

Monday, June 10, 2013

Existing Home Inventory is up 15.5% year-to-date on June 10th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 15.5%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.4% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Las Vegas Real Estate in May: Year-over-year Inventory decline slows sharply

by Calculated Risk on 6/10/2013 01:34:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR says local housing market, prices heating up

GLVAR said the total number of existing local homes, condominiums and townhomes sold in May was 3,884. That’s up from 3,789 in April, but down from 4,134 total sales in May 2012. ...There are several key trends that we've been following:

...

In May, 31.8 percent of all existing local home sales were short sales, down from 32.5 percent in April. Another 10.3 percent of all May sales were bank-owned properties, up from 10.0 percent of all sales in April. The remaining 57.9 percent of all sales were the traditional type, which was up from 57.5 percent in April.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service decreased in May, with 13,814 single-family homes listed for sale at the end of the month. That’s down 0.5 percent from 13,881 single-family homes listed for sale at the end of April..

As for available homes listed for sale without any sort of pending or contingent offer by the end of May, GLVAR reported 3,297 single-family homes listed without any sort of offer. That’s up 4.3 percent from 3,161 such homes listed in April, but still down 13.2 percent from one year ago.

...

In May, GLVAR reported that 57.9 percent of all existing local homes sold were purchased with cash. That’s down from 59.3 percent in April and just off the peak of 59.5 percent set in February.

emphasis added

1) Overall sales are down year-over-year, but ...

2) Conventional sales are up sharply. In May 2012, only 32.7% of all sales were conventional. This year, in May 2013, 57.9% were conventional. That is an increase in conventional sales of about 66% (of course this is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (about 3 to 1).

4) and probably most interesting right now is that the decline in non-contingent inventory (year-over-year) has slowed sharply. Non-contingent inventory is only down 13.2% year-over-year compared to a year-over-year inventory decrease of 66.3% reported in May 2012. Last month, GLVAR reported a year-over-year decline of 24.1%. It appears the year-over-year inventory decline will be in single digits in June!

This suggests inventory is near a bottom in Las Vegas (A major theme for housing in 2013).

Quick Comment: Recession Calls and Markets

by Calculated Risk on 6/10/2013 12:32:00 PM

Just an update: Back in March I wrote: Business Cycles and Markets . In that post, I pointed out that IF an investor could predict recessions and recoveries (even without being precise), they could significantly outperform the market.

I also pointed out that calling recessions and recoveries is NOT easy. A recent example would be ECRI's recent series of incorrect recession calls. If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 40% increase in the market!

For an investor, one bad business cycle call like that would wipe out most of the advantages from trying to time cycles.

Of course I disagreed with ECRI's recent recession call (I disagreed with their incorrect recession call in 2011 too - I wasn't even on recession watch then and I'm not on recession watch now).

One of my goals with this blog is to try to call the next recession, but I don't think that will happen for some time. Right now I'm optimistic on the economy, especially once most of the fiscal drag is behind us. Of course I might miss the next cycle - no one has a crystal ball.

Q1 2013: Mortgage Equity Withdrawal Strongly Negative

by Calculated Risk on 6/10/2013 09:29:00 AM

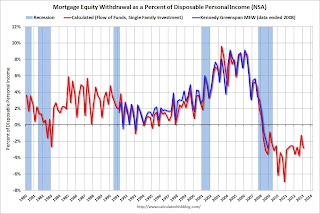

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q1 2013, the Net Equity Extraction was minus $85 billion, or a negative 2.8% of Disposable Personal Income (DPI).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined further in Q1. Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again in the next year or two.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Sunday, June 09, 2013

Sunday Night Futures

by Calculated Risk on 6/09/2013 09:50:00 PM

An interesting article from Nick Timiraos at the WSJ: Housing's Up, but Is Foundation Sound?

The housing-market recovery is here but there's a growing debate among bulls and bears over how long it will last ...I don't expect 2 million units per year at the end of the decade, but I do think the housing recovery will continue.

...

Population growth will require 14 million additional housing units this decade, around three-quarters of them single-family homes, according to Zelman & Associates, a research and advisory firm. Analysts at Zelman estimate that only 5.7 million of those units will be built by 2015, meaning the U.S. would need to add two million homes a year over the last four years of the decade—spurring a big boost of construction that would ripple through the economy.

"There's just not enough shelter," says Ivy Zelman, the firm's chief executive.

...

Joshua Rosner, managing director of Graham Fisher & Co., draws attention to several forces that had helped housing—and the economy—expand over the past few decades but whose end will now hinder growth.

Mr. Rosner first highlights the end of the "democratization" of credit. On the way up, lenders extended loans on better terms to more borrowers during a period in which interest rates were also declining. ... Housing and consumption enjoyed a one-time boost as baby boomers moved from one-income to two-income households during the inflation spells of the 1970s and as those consumers entered their peak consumption years in the 1980s. Those forces fueled homeownership, renovations and second-home buying.

Now, those tailwinds are becoming headwinds, Mr. Rosner says. The democratization of credit ended during the bust, and a new period of much tighter credit standards has replaced it.

Weekend:

• Schedule for Week of June 9th

The Asian markets are green tonight with the Nikkei up 2.9%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 16 (fair value).

Oil prices have moved up a little recently with WTI futures at $96.14 per barrel and Brent at $104.65 per barrel.

Gasoline Prices down slightly Nationally, Higher in Midwest due to Refinery Issues

by Calculated Risk on 6/09/2013 03:33:00 PM

From Reuters: U.S. Midwest gasoline price spike expected to linger

Gasoline prices at the pump in several U.S. Midwestern states have spiked close to record highs this week and were expected to stay near those levels for several weeks due to unexpected outages at key regional refineries ... price spikes have moved east from Midwestern states such as North Dakota, Minnesota and Nebraska, where some cities experienced record high prices a few weeks ago, but the reason is the same -- refineries are undergoing maintenance work.And from Reuters: Steady average gas price belies local ups and downs-survey

The average price for a gallon of gasoline slipped 1.81 cents to $3.6385 on June 7, according to the Lundberg Survey of about 2,500 gas stations across the country. ...Oil prices were up this week, with WTI up to $96.03 per barrel, and Brent at $104.56.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.45 per gallon. That is almost 20 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level, we should expect national gasoline prices to fall below $3.50 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Housing: Watch Inventory

by Calculated Risk on 6/09/2013 11:24:00 AM

I've been watching for sale inventory very closely this year. My guess is inventory probably bottomed early this year. Inventory in many areas is still very low, but when more inventory comes on the market, buyer urgency will wane - and price increases will slow.

Several real estate agents have told me that they think more inventory is about to come on the market in their selling areas based on their discussions with potential sellers. I wouldn't be surprised if inventory builds all year (usually inventory peaks in July or August). We also might see less demand from cash flow investors who have bid up the low end.

Note: I'm confident that prices have bottomed (post-bubble), but if more inventory comes on the market, we will probably see more seasonal price declines this winter than last winter.

Jim the Realtor thinks this home might be a "Canary in Coal Mine" for the $1+ million market in North County San Diego. He thinks this house would have sold quickly earlier this year, and he will be watching to see when it goes pending (it has only been only the market a few days):

Saturday, June 08, 2013

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 6/08/2013 06:25:00 PM

Yesterday on the employment report:

• May Employment Report: 175,000 Jobs, 7.6% Unemployment Rate

• Employment Report Comments and more Graphs

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The 6 to 14 weeks category declined to 1.7%, the lowest since May 2008, but this is still above the "normal" level of under 1.5%.

The long term unemployed is at 2.8% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

The BLS diffusion index for total private employment was at 59.8 in May, up from 55.6 in April.

The BLS diffusion index for total private employment was at 59.8 in May, up from 55.6 in April.For manufacturing, the diffusion index increased slightly to 45.7, up from 45.1 in April.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was fairly widespread in May. This is a good sign for the economy. However, for manufacturing, more companies were decreasing employment than adding jobs again in May.

Schedule for Week of June 9th

by Calculated Risk on 6/08/2013 11:01:00 AM

The key report this week will be May retail sales to be released on Thursday.

For manufacturing, the May Industrial Production survey will be released on Friday.

For prices, PPI for May will be released on Friday.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for May. The consensus is for an increase to 92.3 from 92.1 in April.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

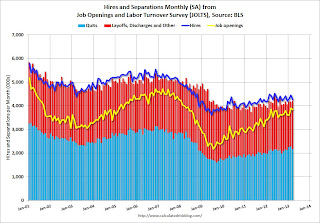

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 3.844 million, down from 3.899 million in February. The number of job openings (yellow) has generally been trending up, but openings are unchanged year-over-year compared to March 2012.

Quits were down in March, and quits are mostly unchanged year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 350 thousand from 346 thousand last week.

8:30 AM ET: Retail sales for May will be released.

8:30 AM ET: Retail sales for May will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 26.4% from the bottom, and now 10.6% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.5% in May, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.3% increase in inventories.

8:30 AM: Producer Price Index for May. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 84.5, unchanged from May.

Unofficial Problem Bank list declines to 760 Institutions

by Calculated Risk on 6/08/2013 08:46:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 7, 2013.

Changes and comments from surferdude808:

As CR posted yesterday, another bank controlled by Capitol Bancorp, LTD (Ticker: CBCRQ), 1st Commerce Bank, North Las Vegas, NV ($20 million) was closed intra-week. According to a report by SNL Securities, the FDIC used its authority that was received within the Federal Deposit Insurance Corporation Improvement Act of 1991 to close 1st Commerce Bank. Normally, the FDIC must wait for the chartering authority to close a bank. However, this authority allows the FDIC to close a bank to limit losses to the insurance fund when the chartering authority is delayed in terminating the charter. As reported, it has been more than a decade since a bank has been closed in this manner and this is only the fourth time the FDIC has exercised this authority since enactment of the legislation. Capitol Bancorp had been litigating the closure of 1st Commerce Bank and had obtained an injunction that was extended until June 10th, but the FDIC stepped around that action. While the FDIC accelerated the closing to limit losses to the insurance fund, 1st Commerce Bank has a failure cost estimate of $9.4 million, which is inordinately high at nearly 47 percent of the bank's assets.

The fate of the remaining seven banks controlled by Capital Bancorp is uncertain. So far, the four failed banks of Capitol Bancorp have cost the FDIC insurance e fund an estimated $44.2 million. The FDIC could assess the $44.2 million failure cost against the seven banks under cross guarantee authority. At March 31, 2013, the seven banks had cumulative equity of $51.8 million. Thus, an assertion of cross guarantee by the FDIC would likely lead to a closing of the seven banks. Some observers believe the FDIC has been generous in not asserting its cross guarantee authority. The geographic dispersion of the franchise, the unusual capital structure of the banks, or the lack of a single buyer could contribute to the piecemeal closings. The most vulnerable units appear to be Bank of Las Vegas, Henderson, NV ($247 million) and Sunrise Bank of Arizona ($206 million). We will continue to monitor the status of the remaining operating banks of Capitol Bancorp.

Meanwhile, the Unofficial Problem Bank List had a net reduction of one institution to 760 after two removals and one addition. Assets total $277.5 billion, which is the first weekly increase since the last week of January 2013. A year ago, the list held 923 institutions with assets of $355.7 billion.

The other removal from failure this week was Mountain National Bank, Sevierville, TN ($437 million Ticker: MNBT), which had a much more pedestrian estimated failure cost at 7.7 percent of assets. The addition was Colonial Bank, FSB, Vineland, NJ ($633 million Ticker: COBK).

Except for any potential follow through closings, we anticipate a quiet week for changes as the OCC will likely wait until June 21st to publish its actions through mid-May 2013.