by Calculated Risk on 5/23/2013 11:47:00 AM

Thursday, May 23, 2013

Kansas City Fed: Regional Manufacturing expanded in May

From the Kansas City Fed: Tenth District Manufacturing Survey Improved Somewhat

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved somewhat, rising above zero for the first time in seven months, and producers’ expectations for future activity also increased.The last regional surveys for May will be released next Tuesday (Dallas and Richmond), and the ISM index for May will be released on Monday, June 1st. Based on the regional surveys released so far, and the Markit Flash PMI released this morning, I expect a fairly weak reading for the ISM index (perhaps at or below 50).

“It was good to finally see a positive number after seven months of modest declines, and for optimism about future activity to return after dropping last month,” said Wilkerson. “Still, activity remains at only about year-ago levels and firms are having difficulty passing cost increases through.”

The month-over-month composite index was 2 in May, up from -5 in both April and March. ... Other month-over-month indexes were mixed. The production index edged up from 1 to 5, and the shipments, new orders, and new orders for export indexes also rose. In contrast, the employment index fell from -3 to -7, while the order backlog index was unchanged.

New Home Sales at 454,000 SAAR in April

by Calculated Risk on 5/23/2013 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 454 thousand. This was up from 444 thousand SAAR in March (March sales were revised up from 417 thousand).

January sales were revised up from 445 thousand to 458 thousand, and February sales were revised up from 411 thousand to 429 thousand. Very strong upward revisions.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in April 2013 were at a seasonally adjusted annual rate of 454,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.3 percent above the revised March rate of 444,000 and is 29.0 percent above the April 2012 estimate of 352,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in April at 4.1 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of April was 156,000. This represents a supply of 4.1 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

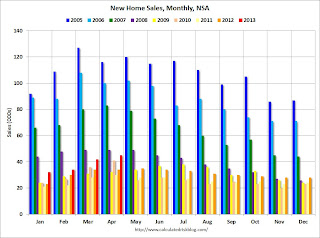

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2013 (red column), 45 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in April. The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was well above expectations of 425,000 sales in April, and a solid report, especially with all the upward revision to previous months. I'll have more soon ...

Weekly Initial Unemployment Claims decline to 340,000

by Calculated Risk on 5/23/2013 08:51:00 AM

The DOL reports:

In the week ending May 18, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 23,000 from the previous week's revised figure of 363,000. The 4-week moving average was 339,500, a decrease of 500 from the previous week's revised average of 340,000.The previous week was revised up from 360,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 339,500.

Claims were slightly below the 345,000 consensus forecast.

Wednesday, May 22, 2013

Thursday: New Home Sales, Weekly Unemployment Claims

by Calculated Risk on 5/22/2013 08:50:00 PM

Most of the coverage of the FOMC minutes today focused on this sentence:

"A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome."Three words: Will Not Happen. Not in June. Probably not this year (although tapering could start late this year).

emphasis added

The real Fed story today was that Fed Chairman Ben Bernanke scolded Congress. In his speech he said:

"Notably, over the past four years, state and local governments have cut civilian government employment by roughly 700,000 jobs, and total government employment has fallen by more than 800,000 jobs over the same period. For comparison, over the four years following the trough of the 2001 recession, total government employment rose by more than 500,000 jobs.And in the Q&A, Bernanke added:

Most recently, the strengthening economy has improved the budgetary outlooks of most state and local governments, leading them to reduce their pace of fiscal tightening. At the same time, though, fiscal policy at the federal level has become significantly more restrictive. In particular, the expiration of the payroll tax cut, the enactment of tax increases, the effects of the budget caps on discretionary spending, the onset of the sequestration, and the declines in defense spending for overseas military operations are expected, collectively, to exert a substantial drag on the economy this year."

“I fully realize the importance of budgetary responsibility, but I would argue that it’s not responsible to focus all of the restraint on the very near term and do nothing about the long term, which is where most of the problem exists. I do think that we would all be better off, with no loss to fiscal sustainability or market confidence, if we had somewhat less restraint in the very near term – this year and next year, say – and more aggressive action to address these very real long-term issues, which threaten within a decade or so to begin to put our fiscal budget on an unsustainable path.”Current policy is "not responsible". Unfortunately most members of Congress weren't even aware that Bernanke was giving them a failing grade! Most of the media reports ignored the reprimand too. Even the FOMC statement mentioned fiscal restraint several times. Oh well ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 345 thousand from 360 thousand last week.

• At 9:00 AM, FHFA House Price Index for March 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.9% increase.

• Also at 9:00 AM, The Markit US PMI Manufacturing Index Flash for May. The consensus is for a decrease to 50.8 from 52.0 in April.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 417 thousand in March.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for May. The consensus is for a reading of minus 2, up from minus 5 in April (below zero is contraction).

Existing Home Sales: A few comments

by Calculated Risk on 5/22/2013 04:52:00 PM

The most important number in the existing home sales report was inventory, and the NAR reported that inventory increased 11.9% in April from March, and is only down 13.6% from April 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of April since 2001, but this is also the smallest year-over-year decline since July 2011. The key points are: 1) inventory is very low, but 2) the inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 9.7% from April 2012, but conventional sales are probably up close to 25% from April 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 18 percent of April sales, down from 21 percent in March and 28 percent in April 2012.Although this survey isn't perfect, if total sales were up 9.7% from April 2012, and distressed sales declined from 28% of total sales to 18%, this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

All-cash sales were at 32 percent of transactions in April, up from 30 percent in March; they were 29 percent in April 2012. Individual investors, who account for most cash sales, purchased 19 percent of homes in April, unchanged from March; they were 20 percent in April 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in April (red column) are above the sales for for 2008 through 2012, and close to the level in 2007. Sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in April: 4.97 million SAAR, 5.2 months of supply

FOMC Minutes: Exit Strategy Discussion

by Calculated Risk on 5/22/2013 02:00:00 PM

Note: I'll have more on existing home sales and Bernanke's testimony later today.

From the Fed: Minutes of the Federal Open Market Committee, April 30-May 1, 2013. A few excerpts on the exit strategy:

After the policy vote, participants began a review of the exit strategy principles that were published in the minutes of the Committee's June 2011 meeting. Those principles, which the Committee issued to clarify how it intended to normalize the stance and conduct of monetary policy when doing so eventually became appropriate, included broad principles along with some details about the timing and sequence of specific steps the Committee expected to take. The participants' discussion touched on various aspects of the exit strategy principles and policy normalization more generally, including the size and composition of the SOMA portfolio in the longer run, the use of a range of reserve-draining tools, the approach to sales of securities, the eventual framework for policy implementation, and the relationship between the principles and the economic thresholds in the Committee's forward guidance on the federal funds rate. The broad principles adopted almost two years ago appeared generally still valid, but developments since then--including the change in the size and composition of SOMA asset holdings--suggested a need for greater flexibility regarding the details of implementing policy normalization, particularly because those details would appropriately depend at least in part upon future economic and financial developments. Also, because normalization still appeared to be well in the future, the Committee might wish to wait and acquire additional experience to inform its plans. In particular, the process of normalizing policy could yield information about the most effective framework for implementing monetary policy in the longer run, and thus about the appropriate size of the SOMA portfolio and level of reserve balances. In addition, several participants raised the possibility that the federal funds rate might not, in the future, be the best indicator of the general level of short-term interest rates, and supported further staff study of potential alternative approaches to implementing monetary policy in the longer term and of possible new tools to improve control over short-term interest rates.Based on comments by Bernanke today, and NY Fed President Dudley yesterday, it sounds likely the Fed will allow the MBS to run off (a change from their previous thinking).

Views differed regarding whether the best course at this point would be to simply acknowledge that certain components of the June 2011 principles had been overtaken by events or rather to formally revise the principles. Acknowledging that the principles need to be updated would help avoid possible confusion regarding the Committee's intentions; waiting to update the principles would allow the Committee to obtain additional information before revising them. It was also mentioned that the public's understanding of the likely exit process might not be improved if the Committee issued only a set of broad principles without providing detailed information on the steps anticipated for normalization. However, issuing revised principles relatively soon could give the public additional confidence that the Committee had the tools and a plan for eventually normalizing the conduct of policy. Moreover, one participant stressed that the Committee's ability to provide forward guidance about the normalization process was a key monetary policy tool, and revised principles would permit use of that tool to help adjust the stance of policy. Participants emphasized that their review of the June 2011 exit strategy principles did not suggest any change in their views about the economic conditions that would eventually warrant beginning the process of normalizing the stance of monetary policy. At the conclusion of the discussion, the Chairman directed the staff to undertake additional preparatory work on this issue for Committee consideration in the future.

emphasis added

AIA: Architecture Billings Index indicates decreased demand for design services in April

by Calculated Risk on 5/22/2013 11:59:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Reverts into Negative Territory for First Time in Nine Months

After indicating increasing demand for design services for the better part of a year, the Architecture Billings Index has reversed course in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 48.6, down from a mark of 51.9 in March. This score reflects a decrease in demand for design services (any score above 50 indicates an increase in billings) and is the lowest mark since July 2012. The new projects inquiry index was 58.5, down from the reading of 60.1 the previous month.

“Project approval delays are having an adverse effect on the design and construction industry, but again and again we are hearing that it is extremely difficult to obtain financing to move forward on real estate projects,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “There are other challenges that have prevented a broader recovery that we will examine in the coming months if this negative trajectory continues. However, given that inquiries for new projects continue to be strong, we’re hopeful that this is just a short-term dip.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.6 in April, down from 51.9 in March. Anything below 50 indicates contraction in demand for architects' services. This decline followed eight consecutive months of expansion.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. The previous increases in this index suggest some increase in CRE investment in the second half of 2013.

Existing Home Sales in April: 4.97 million SAAR, 5.2 months of supply

by Calculated Risk on 5/22/2013 10:00:00 AM

NOTE: Federal Reserve Chairman Ben Bernanke testimony Testimony by Chairman Bernanke on the economic outlook

The NAR reports: April Existing-Home Sales Up but Constrained

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 0.6 percent to a seasonally adjusted annual rate of 4.97 million in April from an upwardly revised 4.94 million in March. Resale activity is 9.7 percent above the 4.53 million-unit level in April 2012.

Total housing inventory at the end of April rose 11.9 percent, a seasonal increase to 2.16 million existing homes available for sale, which represents a 5.2-month supply at the current sales pace, compared with 4.7 months in March. Listed inventory is 13.6 percent below a year ago, when there was a 6.6-month supply, with current availability tighter in the lower price ranges.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April 2013 (4.97 million SAAR) were 0.6% higher than last month, and were 9.7% above the April 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.16 million in April up from 1.93 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer (so some of this increase was seasonal).

According to the NAR, inventory increased to 2.16 million in April up from 1.93 million in March. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer (so some of this increase was seasonal).The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 13.6% year-over-year in April compared to April 2012. This is the 26th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 13.6% year-over-year in April compared to April 2012. This is the 26th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 5.2 months in April.

This was just below expectations of sales of 5.0 million. For existing home sales, the key number is inventory - and inventory is still down sharply year-over-year, although the declines are slowing. This was a solid report. I'll have more later ...

LPS: Mortgage Delinquency Rate falls below 6.5% in April, Lowest since July 2008

by Calculated Risk on 5/22/2013 08:30:00 AM

According to the First Look report for April to be released today by Lender Processing Services (LPS), the percent of loans delinquent decreased in April compared to March, and declined about 10% year-over-year. Also the percent of loans in the foreclosure process declined further in April and were down almost 25% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.21% from 6.59% in March. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.17% in April from 3.37% in March.

The number of delinquent properties, but not in foreclosure, is down about 11% year-over-year (375,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 25% or 543,000 properties year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but declining fairly quickly.

LPS will release the complete mortgage monitor for April in early June.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Apr 2013 | Mar 2013 | Apr 2012 | |

| Delinquent | 6.21% | 6.59% | 6.87% |

| In Foreclosure | 3.17% | 3.37% | 4.20% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,717,000 | 1,842,000 | 1,890,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,394,000 | 1,466,000 | 1,596,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,588,000 | 1,689,000 | 2,131,000 |

| Total Properties | 4,699,000 | 4,997,000 | 5,617,000 |

MBA: Mortgage Applications Decrease in Weekly Survey

by Calculated Risk on 5/22/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage rates increased to their highest level since March last week, leading to the largest single week drop in refinance applications this year,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “The refinance index has fallen almost 19 percent over the past two weeks and is back to its lowest level since late March. Purchase activity declined over the week but is still running about 10 percent above last year’s pace at this time.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.78 percent from 3.67 percent, with points decreasing to 0.39 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

However the index is down almost 20% over the last two weeks, and this is the lowest level since March.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.