by Calculated Risk on 5/21/2013 08:37:00 PM

Tuesday, May 21, 2013

Wednesday: Existing Home Sales, Bernanke Testimony and more

From Tim Duy at Economist'sView: Fed Watch: And Then There is Bernanke. Duy discusses the various Fed speeches this week and concludes:

So many voices, so many views. Looking through the noise, I think there is strong interest in tapering QE now that we have a string of job reports pointing to substantial and sustainable improvement in labor markets, but, given the fiscal contraction, little willingness to pull the trigger on tapering until we see another two or three similar reports. On net, I think disinflation concerns will move to the back-burner as long as inflation expectations are stable.Wednesday economic releases:

Still, at the same time, the Fed wants to keep its options open, as they are very much cognizant that past efforts to pull back on easing have been premature. Hence the talk that future moves could be up or down, which is really just plain confusing because why would the Fed even begin tapering if they thought there was a reasonable chance of having to reverse course the next month? It is even more confusing given that some officials seem to care about inflation, but others labor markets. The former says more purchases, arguably the latter says less. And I am not sure they have a consensus view of what would be the pace of tapering even if they all could agree on the forecast and relevant indicators. No wonder communications is a problem. Back to Dudley:

An important challenge for us will be to think carefully about what combination of actions and communications will best ensure that when we do eventually judge that it is appropriate to begin normalizing policy, the initial tightening of financial market conditions is commensurate to what we desire. There is a risk is that market participants could overreact to any move in the process of normalization.It seems that lacking a more clear, consistent framework for the exit from quantitative easing, the risk of miscommunication is high. Hence, we are all looking toward tomorrow's speech by Federal Reserve Chairman Ben Bernanke to provide the clarity that appears very much needed.

• At 9:55 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 4.92 million SAAR. Economist Tom Lawler is estimating the NAR will report a April sales rate of 5.03 million.

• Also at 10:00 AM, Testimony by Fed Chairman Ben Bernanke, Economic Outlook, Before the Joint Economic Committee, U.S. Congress

• At 2:00 PM, the FOMC Minutes for Meeting of April 30-May 1, 2013 will be released.

• During the day, the AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

Fed's Dudley: "Lessons at the Zero Bound: The Japanese and U.S. Experience"

by Calculated Risk on 5/21/2013 03:25:00 PM

As president of the NY Fed, William Dudley is a key member of the FOMC. He clearly supports QE ...

From NY Fed President William Dudley: Lessons at the Zero Bound: The Japanese and U.S. Experience. A few excerpts:

In terms of our asset purchase program, I believe we should be prepared to adjust the total amount of purchases to that needed to deliver a substantial improvement in the labor market outlook in the context of price stability. In doing this, we might adjust the pace of purchases up or down as the labor market and inflation outlook changes in a material way. For me, the base case forecast is not the sole consideration—how confident we are about that outcome is also important.This is a reminder that the next change in asset purchases could be either to buy more or less per month depending on the economy. Note: Earlier in this speech Dudley noted that "complementary fiscal" policy is important, but of course fiscal policy is currently not "complementary" - and is a significant drag.

Because the outlook is uncertain, I cannot be sure which way—up or down—the next change will be. But at some point, I expect to see sufficient evidence to make me more confident about the prospect for substantial improvement in the labor market outlook. At that time, in my view, it will be appropriate to reduce the pace at which we are adding accommodation through asset purchases. Over the coming months, how well the economy fights its way through the significant fiscal drag currently in force will be an important aspect of this judgment.

And on the eventual exit strategy:

We are also learning about how best to prepare for the eventual normalization of monetary policy. For example, we may need to update our thinking with respect to the so-called exit principles that we published in June 2011 in order to bring them up to date with developments since then, and ensure they do not unnecessarily constrain our ability to conduct policy in the most effective way today.Allowing the MBS to run off would be a significant change to the exit strategy.

Those exit principles stated that we would first stop reinvesting, then raise short-term interest rates, and finally sell agency mortgage backed securities over a three-to-five year period. This seems stale in several respects. In particular, how does one time the end of reinvestment given that we now have economic thresholds that govern the timing of liftoff? Also, the thresholds are thresholds, not triggers. Thus it is hard to link the timing of the end of reinvestment to the unknown liftoff date for short-term rates.

More broadly, it may be desirable to update our thinking around the path and composition of the balance sheet over time, in light of our capacity to shape this path in a way that mitigates potential costs and risks. For example, the agency MBS portfolio is substantially larger today than it was when the original exit principles were devised. To the extent that the Committee wants to reduce the risk of disrupting market functioning during normalization, it could decide to indicate that it will avoid selling the MBS portfolio during the early stages of the normalization process. Moreover, to the extent that the Committee wants to mitigate the risk of a sharp increase in long-term rates, it could judge that it would prefer not to commit to agency MBS sales. Expectations about future MBS sales or actual sales have the potential to generate or amplify such an upward spike in long-term rates. If the Committee believes that it could be costly in terms of credibility to incur a period of no remittances to Treasury—a notion I am personally somewhat skeptical about—avoiding MBS sales would also reduce this risk. Indeed, the Committee might conclude that it was better on all three counts to allow the agency MBS securities to run off passively over time.

ATA Trucking Index decreases slightly in April

by Calculated Risk on 5/21/2013 12:39:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Fell 0.2% in April

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 0.2% in April after rising 0.9% in March. (The 0.9% gain in March was unchanged from what ATA reported on April 23, 2013.) In April, the SA index equaled 123.2 (2000=100) versus 123.5 in March. The highest level on record was December 2011 at 124.3. Compared with April 2012, the SA index was up 4.3%, which is the largest year-over-year gain since January of this year (4.7%). Year-to-date, compared with the same period in 2012, the tonnage index is up 4%.Note from ATA:

“The slight drop in tonnage during April fit with trends from other industries that drive a significant amount of truck freight, such as manufacturing and housing,” ATA Chief Economist Bob Costello said, noting that in April, compared with the previous month, factory output slipped 0.4% while housing starts plunged 16.5%.

“After rising significantly late last year and in January of this year, truck tonnage has been bouncing around a narrow, but elevated band over the last three months.” he said. “It is also worth noting that the year-over-year comparisons are much better than expected just a few months ago and I’m hearing good comments about freight so far in May.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but is up solidly year-over-year.

Philly Fed: State Coincident Indexes increased in 45 States in April

by Calculated Risk on 5/21/2013 11:06:00 AM

From the Philly Fed:

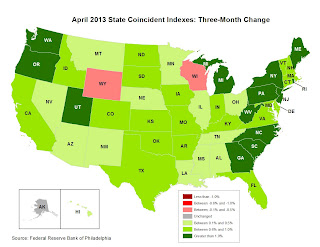

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2013. In the past month, the indexes increased in 45 states, decreased in four states, and remained stable in one (Minnesota), for a one-month diffusion index of 82. Over the past three months, the indexes increased in 47 states, decreased in two (Wisconsin and Wyoming), and remained stable in one (Alaska), for a three-month diffusion index of 90.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 46 states had increasing activity, the ninth consecutive month with 45 or more states showing increases.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map is mostly green again and suggests that the recovery is geographically widespread.

Zillow: House Prices up over 5% year-over-year in March, Case-Shiller expected to show 9.8% YoY increase

by Calculated Risk on 5/21/2013 08:58:00 AM

From Zillow: Annual U.S. Home Value Appreciation Exceeds 5 Percent for Sixth Straight Month in April

U.S. home values continued to climb in April, increasing 0.5 percent from March to $158,300, according to the April Zillow Real Estate Market Reports. Home values were up 5.2 percent year-over-year, marking the sixth consecutive month of annual home value appreciation at or above 5 percent. The last time national home values were at this level was in June 2004.The Case-Shiller house price indexes for March will be released Tuesday, May 28th. Zillow has started forecasting the Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

A majority (55 percent) of the 365 metros covered saw home values climb in April from March. Of the 30 largest metro areas covered, Sacramento experienced the largest monthly increase, with home values rising 3.4 percent. Other large metro areas with notable monthly increases include Las Vegas (3 percent) and San Francisco (2.8 percent).

“April marks the sixth straight month of annual home value appreciation of 5 percent or above, the longest such streak since the height of the bubble in 2006. In the short term, this has been welcome news for homeowners. But in the long term, this cannot be sustained, and consumers entering the market today should not expect this kind of appreciation to last,” said Zillow Chief Economist Dr. Stan Humphries. “Overall, we expect home value appreciation to moderate as more supply comes on line over the next year, but in some areas, runaway home value appreciation, combined with expected interest rate hikes in coming years, runs a real risk of pricing out many potential buyers. Home values in these areas will have to flatten or even fall to come back in line.”

The Zillow Home Value Forecast calls for 4 percent appreciation nationally from April 2013 to April 2014.

Zillow: March Case-Shiller Composites To Show Annual Appreciation Above 9%

[W]e predict that ... Case-Shiller data (March 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 9.8 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 9.3 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from February to March will be 0.9 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for March will not be released until Tuesday, May 28.The following table shows the Zillow forecast for March.

...

To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure resale numbers, which we also have available more than a month prior to Case-Shiller numbers. ...

The ZHVI does not include foreclosure resales and shows home values for March 2013 up 5.1 percent from year-ago levels. ... Further details on our forecast can be found here ...

| Zillow March Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Mar 2012 | 146.46 | 150.36 | 134.07 | 140.12 |

| Case-Shiller (last month) | Feb 2013 | 159.24 | 162.37 | 146.57 | 149.80 |

| Zillow Forecast | YoY | 9.3% | 9.3% | 9.8% | 9.8% |

| MoM | 0.5% | 0.9% | 0.5% | 0.9% | |

| Zillow Forecasts1 | 160.1 | 164.1 | 147.3 | 151.0 | |

| Current Post Bubble Low | 146.46 | 149.45 | 134.07 | 136.86 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 9.3% | 9.8% | 9.8% | 10.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Monday, May 20, 2013

Discussion on Inequality and Economic Growth

by Calculated Risk on 5/20/2013 05:47:00 PM

From 6:30 to 8:00 PM ET, the will be a live stream of professors Tony Atkinson and Paul Krugman discussing inequality and growth at CUNY. The dialogue will be moderated by Chrystia Freeland.

As we endure the slow, uneven recovery from the “Great Recession,” there is no more critical or timely question than that of the relationship between economic growth and inequality. Join two preeminent economists as they assess the connection between prosperity for some and poverty for others. Paul Krugman is professor of economics at Princeton University, a Nobel laureate, and a New York Times columnist. He is the author of numerous books, including the recently published End This Depression Now! Sir Tony Atkinson, professor of economics at Oxford's Nuffield College, is one of the world’s foremost scholars of inequality and author or editor of more than thirty books on inequality and related topics. He recently coedited Top Incomes: A Global Perspective, a volume that analyses high-end income inequality around the world.Chrystia Freeland will be taking questions at #GCinequality

This is a very interesting topic. Intuitively it seems higher inequality should lead to slower growth (I think it would at the extreme!), but I'm not sure the relationship between inequality and growth is clear.

UPDATE: Here is a replay video (starts around 55 minutes into video):

Existing Home Inventory is up 17.7% year-to-date on May 20th

by Calculated Risk on 5/20/2013 03:37:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 17.7%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.1% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

Lumber Prices decline Sharply over last month

by Calculated Risk on 5/20/2013 01:12:00 PM

Just over a month ago I mentioned that lumber prices were nearing the housing bubble highs. Since then prices have declined sharply, with prices off about 20% from the recent highs.

Some of the decline could be related to additional supply coming on the market, and some due to less buying from China (several sources are reporting that China has pulled back significantly on buying North American lumber).

On additional supply, two months ago the WSJ had an article about some producers increasing supply:

Georgia-Pacific, the largest U.S. producer of plywood ... plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now 20% off the recent highs.

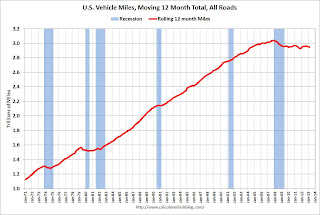

DOT: Vehicle Miles Driven decreased 1.5% in March

by Calculated Risk on 5/20/2013 10:37:00 AM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -1.5% (-3.7 billion vehicle miles) for March 2013 as compared with March 2012. Travel for the month is estimated to be 248.8 billion vehicle miles.

The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 64 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.This is because gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

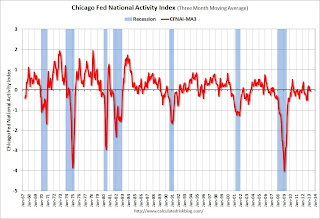

Chicago Fed: "Economic Activity Slower in April"

by Calculated Risk on 5/20/2013 08:36:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in April

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.53 in April from –0.23 in March. Three of the four broad categories of indicators that make up the index decreased from March, and none of the categories made a positive contribution to the index in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.04 in April from –0.05 in March. April’s CFNAI-MA3 suggests that growth in national economic activity was very near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed in April, and growth was near the historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.