by Calculated Risk on 5/17/2013 06:15:00 PM

Friday, May 17, 2013

CoStar: Commercial Real Estate prices declined seasonally in March

Here is a price index for commercial real estate that I follow.

From CoStar: Annual Pricing Gains Seen Across All Regions and Property Types Despite Seasonal Slowdown in First Quarter 2013

PRICING RECOVERY SLUGGISH IN THE FIRST QUARTER: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—were slightly negative in March 2013, a continuation of a seasonal pattern witnessed in the last several years which contributed to modest declines in the first quarter. Despite the uneven first quarter performance, commercial real estate prices are still up appreciably from year ago levels. The equal-weighted index, which reflects more numerous smaller transactions, increased 5.7% from March 2012, while the value-weighted index, which is influenced by larger transactions, expanded by 8.1% during the same period.

SEASONALITY CONTINUES TO BE EVIDENT IN THE COMMERCIAL REAL ESTATE MARKET: In each of the past four years, a pricing decline in the first quarter has been preceded by a similar pricing increase in the last quarter of the previous year. These year-end spikes have been consistent with elevated transaction volume as investors rush to close deals, while the first-quarter declines have coincided with a return to more typical trading activity. This volatility is a normal and expected occurrence and should not be interpreted as a regression in real estate prices.

DISTRESS SALES DECLINE: The percentage of commercial property selling at distressed prices dropped to 16.4% in March 2013 from 25.5% in March 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 37.5% from the bottom (showing the demand for higher end properties) and up 8.1% year-over-year. However the Equal-Weighted index is only up 6.8% from the bottom, and up 5.7% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

LA area Port Traffic: Exports down slightly in April

by Calculated Risk on 5/17/2013 12:47:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for April since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 2% in April, and outbound traffic down 2%, compared to the rolling 12 months ending in March.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This year imports bottomed in March, and bounced back in April.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This year imports bottomed in March, and bounced back in April.

My guess is this suggests an increase in the trade deficit with Asia for April.

BLS: Unemployment Rate declined in 40 States in April

by Calculated Risk on 5/17/2013 10:57:00 AM

From the BLS: April jobless rates down in 40 states, up in 3; payroll jobs up in 30 states, down in 18

Regional and state unemployment rates were generally little changed in April. Forty states and the District of Columbia had unemployment rate decreases, three states had increases, and seven states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in April, 9.6 percent. The next highest rates were in Illinois (9.3 percent), Mississippi (9.1 percent), and California (9.0 percent). North Dakota again had the lowest jobless rate, 3.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only four states: Nevada, Illinois, Mississippi, and California. This is the fewest states with 9% unemployment since 2008.

Preliminary May Consumer Sentiment increases to 83.7

by Calculated Risk on 5/17/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May increased to 83.7 from the April reading of 76.4. This is the highest level since July 2007.

This was well above the consensus forecast of 78.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Thursday, May 16, 2013

Friday: Consumer Sentiment

by Calculated Risk on 5/16/2013 10:25:00 PM

From the WSJ: To Buy Bonds or Not to Buy: Fed Hawks, Doves Air Views

The presidents of the Dallas, Richmond and Philadelphia Federal Reserve banks, long skeptics of the wisdom of the bond buying, said this week that they would like to see the purchases scaled back immediately.The article makes it seem like there is a significant split at the Fed. There isn't.

And San Francisco Fed President John Williams, who has been enthusiastic about the merits of the program, said Thursday that he is still prepared to reduce the size of the purchases "as early as this summer."

The president of the Boston Fed, meanwhile, suggested that there is a case that the Fed should be doing even more to boost the economy.

Some Federal Reserve members carry more weight than others including Fed Chairman Ben Bernanke, Vice Chair Janet Yellen and NY Fed President William Dudley. I'd also pay the most attention to Charles Evans (Chicago Fed), Eric Rosengren (Boston Fed), and John Williams (SF Fed) and a few others. Richard Fisher (Dallas Fed) is entertaining, but has been mostly wrong about the economy.

The reality is there is little significant disagreement at the FOMC, and the I expect the bond purchases to continue at the current level through most if not all of this year.

Friday economic releases:

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 78.0, up from 76.4.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for April 2013.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/16/2013 05:55:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in April.

Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | |

| Las Vegas | 32.5% | 29.9% | 10.0% | 36.9% | 42.5% | 66.8% | 59.3% | 54.9% |

| Reno | 33.0% | 32.0% | 8.0% | 26.0% | 41.0% | 58.0% | ||

| Phoenix | 12.7% | 25.2% | 11.3% | 18.8% | 24.1% | 44.0% | 42.0% | 47.6% |

| Sacramento | 23.1% | 30.4% | 8.8% | 30.3% | 31.9% | 60.7% | 37.2% | 32.0% |

| Minneapolis | 7.4% | 10.7% | 24.2% | 32.0% | 31.6% | 42.7% | ||

| Mid-Atlantic | 9.9% | 12.2% | 8.6% | 11.0% | 18.5% | 23.2% | 19.4% | 19.4% |

| So. California | 17.7% | 24.3% | 12.4% | 28.8% | 30.1% | 53.1% | 33.5% | 32.2% |

| Bay Area CA | 15.0% | 22.1% | 8.5% | 21.9% | 23.5% | 44.0% | 27.8% | 28.3% |

| Orlando | 21.2% | 29.3% | 20.6% | 25.3% | 41.8% | 54.6% | 54.5% | 53.8% |

| Hampton Roads | 27.8% | 31.0% | ||||||

| Memphis* | 24.8% | 34.9% | ||||||

| Birmingham AL | 24.1% | 35.1% | ||||||

| *share of existing home sales, based on property records | ||||||||

Housing Starts: A few Comments and Quarterly Housing Starts by Intent

by Calculated Risk on 5/16/2013 03:12:00 PM

A few comments:

• Overall the housing starts report was a little disappointing. Even just looking at single family starts (removing the volatile multi-family sector), starts were down 2.1% from March. However single family starts were up 20.8% year-over-year, and that is a solid increase.

• Even with this significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

• The Census Bureau (last graph below) released the quarterly report for starts by intent. Single family starts, built for sale were up about 39% compared to Q1 2012. That is a very strong increase.

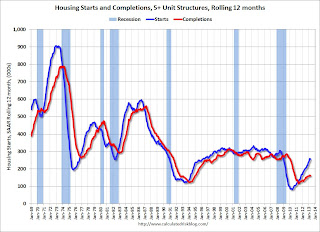

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year. The level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

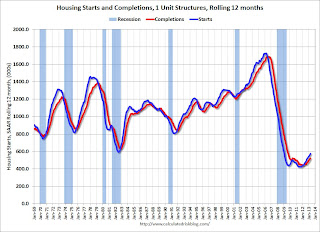

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report this morning. The following shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report this morning. The following shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 39% compared to Q1 2012. This is a significant increase, but still very low, and not even back to 2008 levels.

Owner built starts were basically unchanged from Q1 2012, and condos built for sale are just above the record low.

The 'units built for rent' have increased significantly and are up about 50% year-over-year.

Key Measures show low and falling inflation in April

by Calculated Risk on 5/16/2013 11:49:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.8% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here. Motor fuel declined at a 64% annualized rate in April.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-4.3% annualized rate) in April. The CPI less food and energy increased 0.1% (0.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.7%. Core PCE is for March and increased 1.1% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI increased 0.6% annualized. Also core PCE for March increased 0.4% annualized.

With this low level of inflation - and falling - and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

Philly Fed Manufacturing Survey Shows Contraction in May

by Calculated Risk on 5/16/2013 10:08:00 AM

Note: I'll have more on housing starts and inflation later ...

From the Philly Fed: May Manufacturing Survey

Manufacturing firms responding to the monthly Business Outlook Survey suggest that regional manufacturing activity weakened this month. All of the survey’s broadest current indicators were negative this month, indicating weaker conditions compared with April. The survey’s indicators of future activity improved, however, and suggest that firms expect overall growth over the next six months.Earlier in the week, the Empire State manufacturing survey also indicated contraction in May.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 1.3 in April to -5.2 this month. The current activity index has shown no pattern of sustained growth over the past seven months, generally alternating between positive and negative readings.

Labor market conditions showed continued weakness, with indexes suggesting lower employment overall. The employment index decreased 2 points to -8.7, its second consecutive negative reading. ... The workweek index declined 10 points to -12.4, remaining negative for the fifth consecutive month.

emphasis added

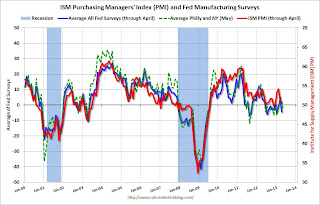

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys turned negative again in May. This suggests another weak ISM report.

Housing Starts decline sharply in April to 853,000 SAAR

by Calculated Risk on 5/16/2013 08:45:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 853,000. This is 16.5 percent below the revised March estimate of 1,021,000, but is 13.1 percent above the April 2012 rate of 754,000.

Single-family housing starts in April were at a rate of 610,000; this is 2.1 percent below the revised March figure of 623,000. The April rate for units in buildings with five units or more was 234,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,017,000. This is 14.3 percent above the revised March rate of 890,000 and is 35.8 percent above the April 2012 estimate of 749,000.

Single-family authorizations in April were at a rate of 617,000; this is 3.0 percent above the revised March figure of 599,000. Authorizations of units in buildings with five units or more were at a rate of 374,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in April following the sharp increase in March (Multi-family is volatile month-to-month).

Single-family starts (blue) declined to 610,000 in April (Note: March was revised up from 619 thousand to 623 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was well below expectations of 969 thousand starts in April, mostly due to the sharp decrease in multi-family starts. Total starts in April were only up 13.1% from April 2012; however single family starts were up 20.8% year-over-year. I'll have more later ...