by Calculated Risk on 5/16/2013 10:25:00 PM

Thursday, May 16, 2013

Friday: Consumer Sentiment

From the WSJ: To Buy Bonds or Not to Buy: Fed Hawks, Doves Air Views

The presidents of the Dallas, Richmond and Philadelphia Federal Reserve banks, long skeptics of the wisdom of the bond buying, said this week that they would like to see the purchases scaled back immediately.The article makes it seem like there is a significant split at the Fed. There isn't.

And San Francisco Fed President John Williams, who has been enthusiastic about the merits of the program, said Thursday that he is still prepared to reduce the size of the purchases "as early as this summer."

The president of the Boston Fed, meanwhile, suggested that there is a case that the Fed should be doing even more to boost the economy.

Some Federal Reserve members carry more weight than others including Fed Chairman Ben Bernanke, Vice Chair Janet Yellen and NY Fed President William Dudley. I'd also pay the most attention to Charles Evans (Chicago Fed), Eric Rosengren (Boston Fed), and John Williams (SF Fed) and a few others. Richard Fisher (Dallas Fed) is entertaining, but has been mostly wrong about the economy.

The reality is there is little significant disagreement at the FOMC, and the I expect the bond purchases to continue at the current level through most if not all of this year.

Friday economic releases:

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 78.0, up from 76.4.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for April 2013.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/16/2013 05:55:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in April.

Look at the two columns in the table for Total "Distressed" Share. In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales in all of these cities. Also there has been a shift from foreclosures to short sales. In all of these areas - except Minneapolis- short sales now out number foreclosures.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | 13-Apr | 12-Apr | |

| Las Vegas | 32.5% | 29.9% | 10.0% | 36.9% | 42.5% | 66.8% | 59.3% | 54.9% |

| Reno | 33.0% | 32.0% | 8.0% | 26.0% | 41.0% | 58.0% | ||

| Phoenix | 12.7% | 25.2% | 11.3% | 18.8% | 24.1% | 44.0% | 42.0% | 47.6% |

| Sacramento | 23.1% | 30.4% | 8.8% | 30.3% | 31.9% | 60.7% | 37.2% | 32.0% |

| Minneapolis | 7.4% | 10.7% | 24.2% | 32.0% | 31.6% | 42.7% | ||

| Mid-Atlantic | 9.9% | 12.2% | 8.6% | 11.0% | 18.5% | 23.2% | 19.4% | 19.4% |

| So. California | 17.7% | 24.3% | 12.4% | 28.8% | 30.1% | 53.1% | 33.5% | 32.2% |

| Bay Area CA | 15.0% | 22.1% | 8.5% | 21.9% | 23.5% | 44.0% | 27.8% | 28.3% |

| Orlando | 21.2% | 29.3% | 20.6% | 25.3% | 41.8% | 54.6% | 54.5% | 53.8% |

| Hampton Roads | 27.8% | 31.0% | ||||||

| Memphis* | 24.8% | 34.9% | ||||||

| Birmingham AL | 24.1% | 35.1% | ||||||

| *share of existing home sales, based on property records | ||||||||

Housing Starts: A few Comments and Quarterly Housing Starts by Intent

by Calculated Risk on 5/16/2013 03:12:00 PM

A few comments:

• Overall the housing starts report was a little disappointing. Even just looking at single family starts (removing the volatile multi-family sector), starts were down 2.1% from March. However single family starts were up 20.8% year-over-year, and that is a solid increase.

• Even with this significant year-over-year increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. This suggests significantly more growth in housing starts over the next few years.

• The Census Bureau (last graph below) released the quarterly report for starts by intent. Single family starts, built for sale were up about 39% compared to Q1 2012. That is a very strong increase.

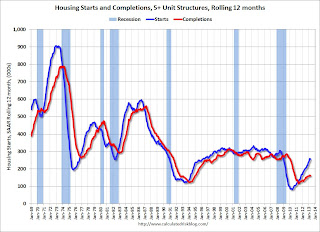

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year. The level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

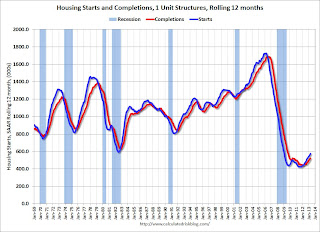

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report this morning. The following shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report this morning. The following shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 39% compared to Q1 2012. This is a significant increase, but still very low, and not even back to 2008 levels.

Owner built starts were basically unchanged from Q1 2012, and condos built for sale are just above the record low.

The 'units built for rent' have increased significantly and are up about 50% year-over-year.

Key Measures show low and falling inflation in April

by Calculated Risk on 5/16/2013 11:49:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.8% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here. Motor fuel declined at a 64% annualized rate in April.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-4.3% annualized rate) in April. The CPI less food and energy increased 0.1% (0.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.7%. Core PCE is for March and increased 1.1% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI increased 0.6% annualized. Also core PCE for March increased 0.4% annualized.

With this low level of inflation - and falling - and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

Philly Fed Manufacturing Survey Shows Contraction in May

by Calculated Risk on 5/16/2013 10:08:00 AM

Note: I'll have more on housing starts and inflation later ...

From the Philly Fed: May Manufacturing Survey

Manufacturing firms responding to the monthly Business Outlook Survey suggest that regional manufacturing activity weakened this month. All of the survey’s broadest current indicators were negative this month, indicating weaker conditions compared with April. The survey’s indicators of future activity improved, however, and suggest that firms expect overall growth over the next six months.Earlier in the week, the Empire State manufacturing survey also indicated contraction in May.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 1.3 in April to -5.2 this month. The current activity index has shown no pattern of sustained growth over the past seven months, generally alternating between positive and negative readings.

Labor market conditions showed continued weakness, with indexes suggesting lower employment overall. The employment index decreased 2 points to -8.7, its second consecutive negative reading. ... The workweek index declined 10 points to -12.4, remaining negative for the fifth consecutive month.

emphasis added

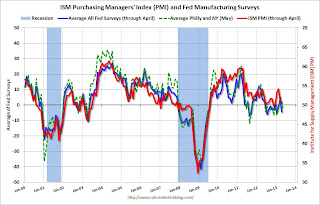

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys turned negative again in May. This suggests another weak ISM report.

Housing Starts decline sharply in April to 853,000 SAAR

by Calculated Risk on 5/16/2013 08:45:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 853,000. This is 16.5 percent below the revised March estimate of 1,021,000, but is 13.1 percent above the April 2012 rate of 754,000.

Single-family housing starts in April were at a rate of 610,000; this is 2.1 percent below the revised March figure of 623,000. The April rate for units in buildings with five units or more was 234,000.

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,017,000. This is 14.3 percent above the revised March rate of 890,000 and is 35.8 percent above the April 2012 estimate of 749,000.

Single-family authorizations in April were at a rate of 617,000; this is 3.0 percent above the revised March figure of 599,000. Authorizations of units in buildings with five units or more were at a rate of 374,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in April following the sharp increase in March (Multi-family is volatile month-to-month).

Single-family starts (blue) declined to 610,000 in April (Note: March was revised up from 619 thousand to 623 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was well below expectations of 969 thousand starts in April, mostly due to the sharp decrease in multi-family starts. Total starts in April were only up 13.1% from April 2012; however single family starts were up 20.8% year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims increase to 360,000

by Calculated Risk on 5/16/2013 08:30:00 AM

The DOL reports:

In the week ending May 11, the advance figure for seasonally adjusted initial claims was 360,000, an increase of 32,000 from the previous week's revised figure of 328,000. The 4-week moving average was 339,250, an increase of 1,250 from the previous week's revised average of 338,000.The previous week was revised up.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 339,250.

Claims were well above the 330,000 consensus forecast.

Wednesday, May 15, 2013

Thursday: Housing Starts, CPI, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 5/15/2013 08:58:00 PM

From Realtor.com: April realtor.com® Report Shows Housing Recovery Accelerating, As List Price And Inventory Increase

In April, the total number of single-family homes, condos, townhomes and co-ops for sale in the U.S. (1,750,839) increased by 4.12 percent month-over-month. On an annual basis, however, inventory decreased by 13.54 percent.Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. I think this is the smallest year-over-year decrease in inventory since at least 2011.

The median age of inventory of for sale listings (81) fell by nearly 11 percent in comparison to April last year.

Only seven markets throughout the nation experienced a one percent or greater year on year increase in housing inventory since April 2012. The Shreveport-Bossier City, LA market lead the pack with an increase of inventory of 19.16 percent since April last year. Springfield, IL; Huntsville, AL; Ocala, FL; El Paso, TX; Albuquerque, NM and Little Rock-North Little Rock, AR markets followed, respectively.

Thursday economic releases:

• At 8:30 AM, the Census Bureau will release Housing Starts for April. The consensus is for total housing starts to decrease to 969 thousand (SAAR) in April mostly because of a decline in multi-family starts.

• Also at 8:30 AM, the Consumer Price Index for April will be released. The consensus is for a 0.3% decrease in CPI in April (due to lower gasoline prices) and for core CPI to increase 0.2%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

• At 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 2.2, up from 1.3 last month (above zero indicates expansion).

• At 12:30 PM, Speech by Fed Governor Sarah Bloom Raskin, Prospects for a Stronger Recovery, At the Society of Government Economists and National Economists Club, Washington, D.C

Lawler: Early Look at Existing Home Sales in April

by Calculated Risk on 5/15/2013 05:31:00 PM

From housing economist Tom Lawler:

Based on a limited sample of reports from state and local realtor groups and/or MLS, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.03 million, up 2.2% from April’s disappointing pace.

On the inventory side, all entities tracking residential listings show a decent-sized increase in national listings from March to April, and local realtor reports suggest a gain as well – probably in the range of about 4%. However, for many years the NAR’s reported inventory gain in April has substantially exceeded that suggested by those who track residential listings, for reasons not readily apparent but that may reflect the timing of “pull-dates” by MLS in the NAR’s sample. Adjusting for this “observation,” my best guess is that the NAR’s existing home inventory number in April will be up 8.8% from March, and down 16.0% from last April.

CR Note: The NAR is scheduled to report April existing home sales next Wednesday, May 22nd. Based on Tom's estimates, this would put inventory at around 2.1 million for April, and months-of-supply around 5.0. This would still be a very low level of inventory - probably the lowest for April since 2001 or so - but this would be the smallest year-over-year decline in inventory since 2011 (when inventory started to decline sharply).

DataQuick: SoCal homes sales highest for month of April since 2006, Distressed Sales down in California

by Calculated Risk on 5/15/2013 03:24:00 PM

From DataQuick: Highest Southland April Home Sales Since '06; Median Price Nears 5-Yr High

Southern California homes sold at the fastest pace for an April in seven years amid the release of pent-up demand for move-up homes and high levels of investor purchases. ... A total of 21,415 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 4.1 percent from 20,581 sales in March, and up 9.5 percent from 19,562 sales in April 2012, according to San Diego-based DataQuick.From DataQuick: Bay Area Median Sale Price Back Over $500,000; Sales Dip Below Year Ago

...

Last month foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 12.4 percent of the Southland resale market. That was down from a revised 13.8 percent the month before and down from 28.8 percent a year earlier. Last month’s figure was the lowest since it was 10.0 percent in August 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was down from an estimated 20.1 percent the month before and 24.3 percent a year earlier.

...

Buyers paying with cash accounted for 33.5 percent of last month's home sales, compared with 35.0 percent the month before and 32.2 percent a year earlier.

A total of 7,621 new and resale houses and condos were sold in the nine-county Bay Area in April. That was up 5.2 percent from 7,243 the month before, and down 0.6 percent from 7,667 for April a year ago. Sales have fallen year-over-year for three consecutive months, mainly reflecting the constrained inventory of homes for sale.Distressed sales are down in California, and foreclosures are back to 2007 levels (although short sales are much higher). Sales in SoCal were the highest for April since 2006 - and the mostly conventional sales. This is a recovering market.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 8.5 percent of resales in April, down from a revised 10.2 percent in March, and down from 21.9 percent a year ago. Last month was the lowest since 8.2 percent in October 2007. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is about 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 15.0 percent of Bay Area resales last month. That was down from an estimated 16.4 percent in March and down from 22.1 percent a year earlier.

...

Buyers who appear to have paid all cash – meaning no sign of a corresponding purchase loan was found in the public record – accounted for 27.8 percent of sales in April. That was down from 30.8 percent the month before and down from 28.3 percent a year earlier.