by Calculated Risk on 5/16/2013 08:30:00 AM

Thursday, May 16, 2013

Weekly Initial Unemployment Claims increase to 360,000

The DOL reports:

In the week ending May 11, the advance figure for seasonally adjusted initial claims was 360,000, an increase of 32,000 from the previous week's revised figure of 328,000. The 4-week moving average was 339,250, an increase of 1,250 from the previous week's revised average of 338,000.The previous week was revised up.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 339,250.

Claims were well above the 330,000 consensus forecast.

Wednesday, May 15, 2013

Thursday: Housing Starts, CPI, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 5/15/2013 08:58:00 PM

From Realtor.com: April realtor.com® Report Shows Housing Recovery Accelerating, As List Price And Inventory Increase

In April, the total number of single-family homes, condos, townhomes and co-ops for sale in the U.S. (1,750,839) increased by 4.12 percent month-over-month. On an annual basis, however, inventory decreased by 13.54 percent.Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. I think this is the smallest year-over-year decrease in inventory since at least 2011.

The median age of inventory of for sale listings (81) fell by nearly 11 percent in comparison to April last year.

Only seven markets throughout the nation experienced a one percent or greater year on year increase in housing inventory since April 2012. The Shreveport-Bossier City, LA market lead the pack with an increase of inventory of 19.16 percent since April last year. Springfield, IL; Huntsville, AL; Ocala, FL; El Paso, TX; Albuquerque, NM and Little Rock-North Little Rock, AR markets followed, respectively.

Thursday economic releases:

• At 8:30 AM, the Census Bureau will release Housing Starts for April. The consensus is for total housing starts to decrease to 969 thousand (SAAR) in April mostly because of a decline in multi-family starts.

• Also at 8:30 AM, the Consumer Price Index for April will be released. The consensus is for a 0.3% decrease in CPI in April (due to lower gasoline prices) and for core CPI to increase 0.2%.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

• At 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 2.2, up from 1.3 last month (above zero indicates expansion).

• At 12:30 PM, Speech by Fed Governor Sarah Bloom Raskin, Prospects for a Stronger Recovery, At the Society of Government Economists and National Economists Club, Washington, D.C

Lawler: Early Look at Existing Home Sales in April

by Calculated Risk on 5/15/2013 05:31:00 PM

From housing economist Tom Lawler:

Based on a limited sample of reports from state and local realtor groups and/or MLS, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.03 million, up 2.2% from April’s disappointing pace.

On the inventory side, all entities tracking residential listings show a decent-sized increase in national listings from March to April, and local realtor reports suggest a gain as well – probably in the range of about 4%. However, for many years the NAR’s reported inventory gain in April has substantially exceeded that suggested by those who track residential listings, for reasons not readily apparent but that may reflect the timing of “pull-dates” by MLS in the NAR’s sample. Adjusting for this “observation,” my best guess is that the NAR’s existing home inventory number in April will be up 8.8% from March, and down 16.0% from last April.

CR Note: The NAR is scheduled to report April existing home sales next Wednesday, May 22nd. Based on Tom's estimates, this would put inventory at around 2.1 million for April, and months-of-supply around 5.0. This would still be a very low level of inventory - probably the lowest for April since 2001 or so - but this would be the smallest year-over-year decline in inventory since 2011 (when inventory started to decline sharply).

DataQuick: SoCal homes sales highest for month of April since 2006, Distressed Sales down in California

by Calculated Risk on 5/15/2013 03:24:00 PM

From DataQuick: Highest Southland April Home Sales Since '06; Median Price Nears 5-Yr High

Southern California homes sold at the fastest pace for an April in seven years amid the release of pent-up demand for move-up homes and high levels of investor purchases. ... A total of 21,415 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 4.1 percent from 20,581 sales in March, and up 9.5 percent from 19,562 sales in April 2012, according to San Diego-based DataQuick.From DataQuick: Bay Area Median Sale Price Back Over $500,000; Sales Dip Below Year Ago

...

Last month foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 12.4 percent of the Southland resale market. That was down from a revised 13.8 percent the month before and down from 28.8 percent a year earlier. Last month’s figure was the lowest since it was 10.0 percent in August 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was down from an estimated 20.1 percent the month before and 24.3 percent a year earlier.

...

Buyers paying with cash accounted for 33.5 percent of last month's home sales, compared with 35.0 percent the month before and 32.2 percent a year earlier.

A total of 7,621 new and resale houses and condos were sold in the nine-county Bay Area in April. That was up 5.2 percent from 7,243 the month before, and down 0.6 percent from 7,667 for April a year ago. Sales have fallen year-over-year for three consecutive months, mainly reflecting the constrained inventory of homes for sale.Distressed sales are down in California, and foreclosures are back to 2007 levels (although short sales are much higher). Sales in SoCal were the highest for April since 2006 - and the mostly conventional sales. This is a recovering market.

...

Foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 8.5 percent of resales in April, down from a revised 10.2 percent in March, and down from 21.9 percent a year ago. Last month was the lowest since 8.2 percent in October 2007. Foreclosure resales peaked at 52.0 percent in February 2009. The monthly average for foreclosure resales over the past 17 years is about 10 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 15.0 percent of Bay Area resales last month. That was down from an estimated 16.4 percent in March and down from 22.1 percent a year earlier.

...

Buyers who appear to have paid all cash – meaning no sign of a corresponding purchase loan was found in the public record – accounted for 27.8 percent of sales in April. That was down from 30.8 percent the month before and down from 28.3 percent a year earlier.

FNC: House prices increased 5.5% year-over-year in March

by Calculated Risk on 5/15/2013 12:37:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: U.S. Home Prices Up 0.4% in March

The latest FNC Residential Price Index™ (RPI) shows the U.S. housing market continued to recover, recording in March the 13th consecutive price increase. In recent months, the ongoing housing recovery has maintained its pace with steady and persistent gains in home prices despite signs of continued job market weakness and soft economic growth.The year-over-year change slowed a little in March, with the 100-MSA composite up 5.5% compared to March 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that March home prices rose 0.4% from the previous month, and were up 5.5% from a year ago. ... The two narrower composite indices (30-MSA and 10-MSA composites) show similar month-over-month increases but faster year-over-year accelerations at 6.7% and 7.4%, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.7% from the peak.

Builder Confidence increases in May

by Calculated Risk on 5/15/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in May to 44. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Improves in May

Builder confidence in the market for newly built, single-family homes improved three points to a 44 reading on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for May, released today. This gain, from a downwardly revised 41 in April, reflected improvement in all three index components – current sales conditions, sales expectations and traffic of prospective buyers.

...

“While industry supply chains will take time to re-establish themselves following recession-related cutbacks, builders’ views of current sales conditions have improved and expectations for the future remain quite strong as consumers head back to the market in force,” said NAHB Chief Economist David Crowe.

...

All three HMI components posted gains in May. The index gauging current sales conditions increased four points to 48, while the index gauging expectations for future sales edged up a single point to 53 – its highest level since February of 2007. The index gauging traffic of prospective buyers gained three points to 33.

Looking at the three-month moving averages for regional HMI scores, no movement was recorded in the Northeast, Midwest or South, which held unchanged at 37, 45 and 42, respectively. Only the West recorded a decline, of six points to 49 in May.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow). This was slightly above the consensus estimate of a reading of 43.

Fed: Industrial Production decreased 0.5% in April

by Calculated Risk on 5/15/2013 09:15:00 AM

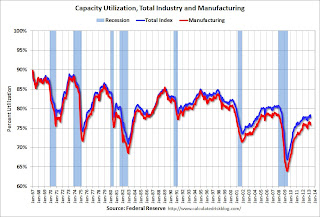

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.5 percent in April after having increased 0.3 percent in March and 0.9 percent in February. Manufacturing output moved down 0.4 percent in April after a decline of 0.3 percent in March. The index for utilities decreased 3.7 percent in April, as heating demand fell back to a more typical seasonal level after having been elevated in March because of unusually cold weather. The output of mines increased 0.9 percent in April. At 98.7 percent of its 2007 average, total industrial production was 1.9 percent above its year-earlier level. The rate of capacity utilization for total industry decreased 0.5 percentage point to 77.8 percent, a rate 0.1 percentage point above its level of a year earlier but 2.4 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in April to 98.7. This is 17.9% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.2% decrease in Industrial Production in April, and for Capacity Utilization to decrease to 78.3%.

Misc: Euro-zone Recession Continues, NY Fed Mfg Survey shows contraction, PPI Declines Sharply

by Calculated Risk on 5/15/2013 08:36:00 AM

• From the BBC: Eurozone recession continues into sixth quarter

The recession across the 17-nation eurozone has continued into a sixth quarter, figures show.The beatings will continue until morale improves ...

The bloc's economy shrank by 0.2% between January and March, according to official figures. ...

The figure marks the longest recession since the euro was launched in 1999.

It was worse than the 0.1% fall expected by economists ...

• From the NY Fed: Empire State Manufacturing Survey

The May 2013 Empire State Manufacturing Survey indicates that conditions for New York manufacturers declined marginally. The general business conditions index fell four points to -1.4, its first negative reading since January. The new orders index also edged into negative territory, and the shipments index fell to zero. ... Employment indexes were mixed, showing both a modest increase in the number of employees and a slight decline in the length of the average workweek.This was below the consensus forecast of a 3.75 reading.

• BLS reports:

The Producer Price Index for finished goods decreased 0.7 percent in April, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. ... The index for finished goods less foods and energy inched up 0.1 percent in April following increases of 0.2 percent in each of the previous four months.

MBA: Mortgage Applications Decrease in Weekly Survey

by Calculated Risk on 5/15/2013 08:18:00 AM

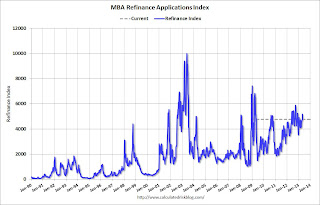

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

...

After declining for seven weeks straight, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.67 percent from 3.59 percent,with points increasing to 0.41 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This rate is at its highest level since the week ending April 12, 2013.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 3.87 percent from 3.79 percent, with points increasing to 0.25 from 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

The decline this week offset the sharp increase last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.

Tuesday, May 14, 2013

Wednesday: Industrial Production, Builder Confidence, PPI, Empire State Mfg Survey

by Calculated Risk on 5/14/2013 09:24:00 PM

A rare mid-week bank closing from the FDIC: Western State Bank, Devils Lake, North Dakota, Assumes All of the Deposits of Central Arizona Bank, Scottsdale, Arizona

As of March 31, 2013, Central Arizona Bank had approximately $31.6 million in total assets and $30.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.6 million. ... Central Arizona Bank is the 13th FDIC-insured institution to fail in the nation this year, and the second in Arizona.This is another Capitol Bancorp controlled bank, and as "surferdude" mentioned last Saturday:

A failure of any one bank subsidiary could trigger the failure of all banking subsidiaries. Through statute referred to as Cross-Guaranty, the FDIC can demand reimbursement for the cost of a failure against any of Capitol Bancorp's still open banking subsidiaries. To facilitate the divestitures, the FDIC has issued at least 16 Cross-Guaranty waivers. ...Wednesday economic releases:

The FDIC has declined to comment if it will assess other banking units of Capitol Bancorp for the estimated $26.2 million cost of the failures. ... Of Capitol Bancorp's remaining bank subsidiaries, seven with aggregate assets of $1.4 billion are on the Unofficial Problem Bank List. It will be worth watching to see if the FDIC pulls the cross-guaranty trigger against any of these.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Producer Price Index for April. The consensus is for a 0.7% decrease in producer prices (0.2% increase in core).

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for May will be released. The consensus is for a reading of 3.75, up from 3.05 in April (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.2% decrease in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 43, up from 42 in April. This index has decreased recently with some builders complaining about higher costs and lack of buildable land. Any number below 50 still indicates that more builders view sales conditions as poor than good.