by Calculated Risk on 5/15/2013 12:37:00 PM

Wednesday, May 15, 2013

FNC: House prices increased 5.5% year-over-year in March

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: U.S. Home Prices Up 0.4% in March

The latest FNC Residential Price Index™ (RPI) shows the U.S. housing market continued to recover, recording in March the 13th consecutive price increase. In recent months, the ongoing housing recovery has maintained its pace with steady and persistent gains in home prices despite signs of continued job market weakness and soft economic growth.The year-over-year change slowed a little in March, with the 100-MSA composite up 5.5% compared to March 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that March home prices rose 0.4% from the previous month, and were up 5.5% from a year ago. ... The two narrower composite indices (30-MSA and 10-MSA composites) show similar month-over-month increases but faster year-over-year accelerations at 6.7% and 7.4%, respectively.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.7% from the peak.

Builder Confidence increases in May

by Calculated Risk on 5/15/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 3 points in May to 44. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Improves in May

Builder confidence in the market for newly built, single-family homes improved three points to a 44 reading on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for May, released today. This gain, from a downwardly revised 41 in April, reflected improvement in all three index components – current sales conditions, sales expectations and traffic of prospective buyers.

...

“While industry supply chains will take time to re-establish themselves following recession-related cutbacks, builders’ views of current sales conditions have improved and expectations for the future remain quite strong as consumers head back to the market in force,” said NAHB Chief Economist David Crowe.

...

All three HMI components posted gains in May. The index gauging current sales conditions increased four points to 48, while the index gauging expectations for future sales edged up a single point to 53 – its highest level since February of 2007. The index gauging traffic of prospective buyers gained three points to 33.

Looking at the three-month moving averages for regional HMI scores, no movement was recorded in the Northeast, Midwest or South, which held unchanged at 37, 45 and 42, respectively. Only the West recorded a decline, of six points to 49 in May.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow). This was slightly above the consensus estimate of a reading of 43.

Fed: Industrial Production decreased 0.5% in April

by Calculated Risk on 5/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

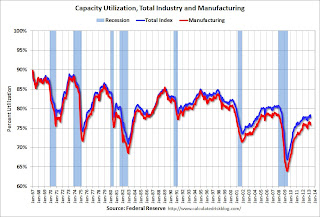

Industrial production decreased 0.5 percent in April after having increased 0.3 percent in March and 0.9 percent in February. Manufacturing output moved down 0.4 percent in April after a decline of 0.3 percent in March. The index for utilities decreased 3.7 percent in April, as heating demand fell back to a more typical seasonal level after having been elevated in March because of unusually cold weather. The output of mines increased 0.9 percent in April. At 98.7 percent of its 2007 average, total industrial production was 1.9 percent above its year-earlier level. The rate of capacity utilization for total industry decreased 0.5 percentage point to 77.8 percent, a rate 0.1 percentage point above its level of a year earlier but 2.4 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.4 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in April to 98.7. This is 17.9% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.2% decrease in Industrial Production in April, and for Capacity Utilization to decrease to 78.3%.

Misc: Euro-zone Recession Continues, NY Fed Mfg Survey shows contraction, PPI Declines Sharply

by Calculated Risk on 5/15/2013 08:36:00 AM

• From the BBC: Eurozone recession continues into sixth quarter

The recession across the 17-nation eurozone has continued into a sixth quarter, figures show.The beatings will continue until morale improves ...

The bloc's economy shrank by 0.2% between January and March, according to official figures. ...

The figure marks the longest recession since the euro was launched in 1999.

It was worse than the 0.1% fall expected by economists ...

• From the NY Fed: Empire State Manufacturing Survey

The May 2013 Empire State Manufacturing Survey indicates that conditions for New York manufacturers declined marginally. The general business conditions index fell four points to -1.4, its first negative reading since January. The new orders index also edged into negative territory, and the shipments index fell to zero. ... Employment indexes were mixed, showing both a modest increase in the number of employees and a slight decline in the length of the average workweek.This was below the consensus forecast of a 3.75 reading.

• BLS reports:

The Producer Price Index for finished goods decreased 0.7 percent in April, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. ... The index for finished goods less foods and energy inched up 0.1 percent in April following increases of 0.2 percent in each of the previous four months.

MBA: Mortgage Applications Decrease in Weekly Survey

by Calculated Risk on 5/15/2013 08:18:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

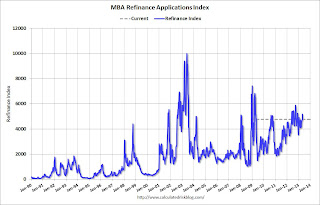

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

...

After declining for seven weeks straight, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.67 percent from 3.59 percent,with points increasing to 0.41 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This rate is at its highest level since the week ending April 12, 2013.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) increased to 3.87 percent from 3.79 percent, with points increasing to 0.25 from 0.20 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

The decline this week offset the sharp increase last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is just off the high for the year set last week.

Tuesday, May 14, 2013

Wednesday: Industrial Production, Builder Confidence, PPI, Empire State Mfg Survey

by Calculated Risk on 5/14/2013 09:24:00 PM

A rare mid-week bank closing from the FDIC: Western State Bank, Devils Lake, North Dakota, Assumes All of the Deposits of Central Arizona Bank, Scottsdale, Arizona

As of March 31, 2013, Central Arizona Bank had approximately $31.6 million in total assets and $30.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.6 million. ... Central Arizona Bank is the 13th FDIC-insured institution to fail in the nation this year, and the second in Arizona.This is another Capitol Bancorp controlled bank, and as "surferdude" mentioned last Saturday:

A failure of any one bank subsidiary could trigger the failure of all banking subsidiaries. Through statute referred to as Cross-Guaranty, the FDIC can demand reimbursement for the cost of a failure against any of Capitol Bancorp's still open banking subsidiaries. To facilitate the divestitures, the FDIC has issued at least 16 Cross-Guaranty waivers. ...Wednesday economic releases:

The FDIC has declined to comment if it will assess other banking units of Capitol Bancorp for the estimated $26.2 million cost of the failures. ... Of Capitol Bancorp's remaining bank subsidiaries, seven with aggregate assets of $1.4 billion are on the Unofficial Problem Bank List. It will be worth watching to see if the FDIC pulls the cross-guaranty trigger against any of these.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Producer Price Index for April. The consensus is for a 0.7% decrease in producer prices (0.2% increase in core).

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for May will be released. The consensus is for a reading of 3.75, up from 3.05 in April (above zero is expansion).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.2% decrease in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 43, up from 42 in April. This index has decreased recently with some builders complaining about higher costs and lack of buildable land. Any number below 50 still indicates that more builders view sales conditions as poor than good.

CBO Update: Deficit Shrinking Rapdily

by Calculated Risk on 5/14/2013 05:50:00 PM

The Congressional Budget Office (CBO) released their new Updated Budget Projections: Fiscal Years 2013 to 2023

If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008. Relative to the size of the economy, the deficit this year—at 4.0 percent of gross domestic product (GDP)—will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.For the current fiscal year, the CBO was projecting a deficit of 5.3%, and they are now projecting a deficit of 4.0%. This is down sharply from 7.0% last year. And the CBO expects the deficit to fall to 2.1% of GDP in 2015.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The rapidly declining deficit might provide policymakers some room to alter the ill-conceived sequestration budget cuts. But at the least, this takes all short term (next 2 to 3 years) deficit reduction proposals off the table. Note: The "debt ceiling" (not paying the bills) is already off the table.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.

Sacramento: Conventional Sales over 68% of Housing Market in April, Highest percentage in Years

by Calculated Risk on 5/14/2013 03:24:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For some time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April 2013, 31.9% of all resales (single family homes) were distressed sales. This was down from 37.5% last month, and down from 60.7% in April 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 8.5%, and the percentage of short sales decreased to 23.3%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently, and there were almost three times as many short sales as REO sales in April.

Active Listing Inventory for single family homes declined 10.3% from last April (the decline in inventory is slowing). Cash buyers accounted for 37.2% of all sales (frequently investors).

Total sales were down 5% from April 2012, but conventional sales were up 64% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales. This is a sign of a recovering housing market.

Existing Home Inventory is up 13.5% year-to-date on May 13th

by Calculated Risk on 5/14/2013 01:11:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 13.5%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It is possible that inventory could bottom this year - especially if inventory is up 15% to 18% from the seasonal lows by mid-to-late summer.

It will probably be close. Inventory might have already bottomed in early 2013, or might bottom in early 2014. This will be important for price increases ... once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

NY Fed: Consumer Debt declines in Q1, Deleveraging Continues

by Calculated Risk on 5/14/2013 11:00:00 AM

From the NY Fed: New York Fed Report Shows Americans Continue to Improve Household Balance Sheets

In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York announced that households continued to improve their finances during the first three months of 2013. Outstanding household debt declined approximately $110 billion from the previous quarter, due in large part to a reduction in housing-related debt and credit card balances. Meanwhile, delinquency rates for each form of household debt declined, with about 8.1% of outstanding debt in some stage of delinquency, compared with 8.6% the previous quarter. ...Here is the Q1 report: Quarterly Report on Household Debt and Credit

In Q1 2013 total household indebtedness fell to $11.23 trillion; 1.0% lower than the previous quarter and considerably below the peak of $12.68 trillion in Q3 2008. Delinquency rates improved across the board: mortgages (5.4% from 5.6%), HELOC (3.2% from 3.5%), auto loans (3.9% from 4.0%), credit cards (10.2% from 10.6%) and student loans (11.2% from 11.7%). The overall 90+ day delinquency rate dropped from 6.3% to 6.0% this quarter, below the 8.7% peak from three years ago.

“After a temporary deceleration in the previous quarter, the data suggest that household deleveraging has resumed its previous trajectory,” said Wilbert van der Klaauw, senior vice president and economist at the New York Fed. “We’ll look to see if this pace of debt reduction and delinquency improvements will persist in upcoming quarters.”

emphasis added

Mortgages, the largest component of household debt, fell in the first quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.93 trillion, down $101 billion from the level in the fourth quarter of 2012. Balances on home equity lines of credit (HELOC) dropped by $11 billion (2.0%) and now stand at $552 billion. Household non-housing debt balances were roughly flat, with increases in auto and student loans, by $11 billion and $20 billion respectively, offset by decreases in credit card balances ($19 billion) and other consumer loan balances ($10 billion).Here are two graphs from the report:

...

About 309,000 consumers had a bankruptcy notation added to their credit reports in 2013Q1, a 16.8% drop from the same quarter last year, and the ninth consecutive drop in bankruptcies on a year-over-year basis.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q1.

Although overall debt is decreasing, Student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased by $20 billion during the first quarter, to a total of $986 billion as of March 31, 2013.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red) - especially the 120+ days delinquent (orange and yellow).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red) - especially the 120+ days delinquent (orange and yellow). From the NY Fed:

Delinquency rates continue to show improvements across the board in 2013Q1. As of March 31, 8.1% of outstanding debt was in some stage of delinquency, compared with 8.6% in 2012Q4. About $909 billion of debt is delinquent, with $678 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.