by Calculated Risk on 5/14/2013 05:50:00 PM

Tuesday, May 14, 2013

CBO Update: Deficit Shrinking Rapdily

The Congressional Budget Office (CBO) released their new Updated Budget Projections: Fiscal Years 2013 to 2023

If the current laws that govern federal taxes and spending do not change, the budget deficit will shrink this year to $642 billion, the Congressional Budget Office (CBO) estimates, the smallest shortfall since 2008. Relative to the size of the economy, the deficit this year—at 4.0 percent of gross domestic product (GDP)—will be less than half as large as the shortfall in 2009, which was 10.1 percent of GDP.For the current fiscal year, the CBO was projecting a deficit of 5.3%, and they are now projecting a deficit of 4.0%. This is down sharply from 7.0% last year. And the CBO expects the deficit to fall to 2.1% of GDP in 2015.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The rapidly declining deficit might provide policymakers some room to alter the ill-conceived sequestration budget cuts. But at the least, this takes all short term (next 2 to 3 years) deficit reduction proposals off the table. Note: The "debt ceiling" (not paying the bills) is already off the table.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.

Sacramento: Conventional Sales over 68% of Housing Market in April, Highest percentage in Years

by Calculated Risk on 5/14/2013 03:24:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For some time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April 2013, 31.9% of all resales (single family homes) were distressed sales. This was down from 37.5% last month, and down from 60.7% in April 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs decreased to 8.5%, and the percentage of short sales decreased to 23.3%.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently, and there were almost three times as many short sales as REO sales in April.

Active Listing Inventory for single family homes declined 10.3% from last April (the decline in inventory is slowing). Cash buyers accounted for 37.2% of all sales (frequently investors).

Total sales were down 5% from April 2012, but conventional sales were up 64% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increase.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales. This is a sign of a recovering housing market.

Existing Home Inventory is up 13.5% year-to-date on May 13th

by Calculated Risk on 5/14/2013 01:11:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 13.5%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It is possible that inventory could bottom this year - especially if inventory is up 15% to 18% from the seasonal lows by mid-to-late summer.

It will probably be close. Inventory might have already bottomed in early 2013, or might bottom in early 2014. This will be important for price increases ... once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

NY Fed: Consumer Debt declines in Q1, Deleveraging Continues

by Calculated Risk on 5/14/2013 11:00:00 AM

From the NY Fed: New York Fed Report Shows Americans Continue to Improve Household Balance Sheets

In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York announced that households continued to improve their finances during the first three months of 2013. Outstanding household debt declined approximately $110 billion from the previous quarter, due in large part to a reduction in housing-related debt and credit card balances. Meanwhile, delinquency rates for each form of household debt declined, with about 8.1% of outstanding debt in some stage of delinquency, compared with 8.6% the previous quarter. ...Here is the Q1 report: Quarterly Report on Household Debt and Credit

In Q1 2013 total household indebtedness fell to $11.23 trillion; 1.0% lower than the previous quarter and considerably below the peak of $12.68 trillion in Q3 2008. Delinquency rates improved across the board: mortgages (5.4% from 5.6%), HELOC (3.2% from 3.5%), auto loans (3.9% from 4.0%), credit cards (10.2% from 10.6%) and student loans (11.2% from 11.7%). The overall 90+ day delinquency rate dropped from 6.3% to 6.0% this quarter, below the 8.7% peak from three years ago.

“After a temporary deceleration in the previous quarter, the data suggest that household deleveraging has resumed its previous trajectory,” said Wilbert van der Klaauw, senior vice president and economist at the New York Fed. “We’ll look to see if this pace of debt reduction and delinquency improvements will persist in upcoming quarters.”

emphasis added

Mortgages, the largest component of household debt, fell in the first quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.93 trillion, down $101 billion from the level in the fourth quarter of 2012. Balances on home equity lines of credit (HELOC) dropped by $11 billion (2.0%) and now stand at $552 billion. Household non-housing debt balances were roughly flat, with increases in auto and student loans, by $11 billion and $20 billion respectively, offset by decreases in credit card balances ($19 billion) and other consumer loan balances ($10 billion).Here are two graphs from the report:

...

About 309,000 consumers had a bankruptcy notation added to their credit reports in 2013Q1, a 16.8% drop from the same quarter last year, and the ninth consecutive drop in bankruptcies on a year-over-year basis.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased in Q1.

Although overall debt is decreasing, Student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased by $20 billion during the first quarter, to a total of $986 billion as of March 31, 2013.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red) - especially the 120+ days delinquent (orange and yellow).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red) - especially the 120+ days delinquent (orange and yellow). From the NY Fed:

Delinquency rates continue to show improvements across the board in 2013Q1. As of March 31, 8.1% of outstanding debt was in some stage of delinquency, compared with 8.6% in 2012Q4. About $909 billion of debt is delinquent, with $678 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

NFIB: Small Business Optimism Index increases in April

by Calculated Risk on 5/14/2013 08:41:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Owner Roller Coaster Continues

After last month’s disappointing drop in small-business confidence, April’s Index of Small Business Optimism rose 2.6 points to 92.1, just above the recovery average of 90.7. ...In a little sign of good news, only 16% of owners reported weak sales as the top problem (lack of demand). During good times, small business owners usually complain about taxes and regulations - and taxes are now the top problem again.

April was another positive, albeit lackluster month for job creation. Small employers reported increasing employment an average of 0.14 workers per firm in April. This is a bit lower than March’s reading, but still the fifth positive sequential monthly gain. Job creation plans rose 6 points to a net six percent planning to increase total employment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 92.1 in April from 89.5 in March.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Monday, May 13, 2013

Tuesday: Quarterly Report on Household Debt and Credit

by Calculated Risk on 5/13/2013 09:37:00 PM

On inflation from the WSJ: Inflation Continues to Make Itself Scarce

This week will see the release of U.S. producer and consumer price indexes for April. Both will show further deceleration to 0.7% and 1.4% year on year, respectively, according to FactSet. Consumer prices are expanding at their slowest pace since summer 2010, when the Federal Reserve launched "QE2," its second round of bond buying.Those predicting inflation are still wrong. Actually the key concern with prices is that inflation is too low!

It isn't just the U.S. seeing disinflation. Consumer prices in the euro zone rose by just 1.73% year on year in March, the slowest since August 2010. Japan's renewed monetary exertions of recent months haven't yet reversed its outright deflation. Even Chinese inflation has dropped.

Tuesday economic releases:

• At 7:30 AM ET, NFIB Small Business Optimism Index for April. The consensus is for an increase to 90.5 from 89.5 in March.

• At 11:00 AM, The Q1 2013 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. From the NY Fed: "The Quarterly Report provides an updated snapshot of household trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards, auto loans and delinquencies."

Labor Force Participation Rate Research

by Calculated Risk on 5/13/2013 06:04:00 PM

The participation rate has declined sharply since the recession started due both to cyclical reasons and also because of demographics (baby boomers retiring) and long term trends (more 16 to 24 year olds staying in school is an example). A key question is: How much of the recent decline is due to cyclical factors and how much of the decline was expected due to long term factors?

Note: The table at the bottom from Dr. Altig shows the relationship between the participation rate and the unemployment rate.

My view has been that there is a large long term factor, although I have expected some bounce back in the participation rate as the economy improves. Others think there are larger cyclical factors, but they only expect a small bounce back too ...

An FSFRB economic letter using state level data: Will Labor Force Participation Bounce Back?

The U.S. labor force participation rate has declined sharply since 2007, intensifying a downward trend that has been evident since about 2000. Distinguishing between long-term influences on the participation rate, such as demographics, and short-term cyclical effects is important because it helps us understand and predict the future path of macroeconomic variables such as the unemployment rate. Using state-level evidence on the relationship between changes in employment and labor force participation across recessions and recoveries, we find evidence, reinforcing other research, that the recent decline in participation likely has a substantial cyclical component. States that saw larger declines in employment generally saw larger declines in participation. A similar positive relationship was evident in past recessions and recoveries. In the current recovery, it will probably take a few years before cyclical components put significant upward pressure on the participation rate because payroll employment is still well below its pre-recession peak.And from Julie Hotchkiss at the Atlanta Fed: Behavior’s Place in the Labor Force Participation Rate Debate

emphasis added

Casselman, in an October 2012 WSJ article, cites work by my colleagues at the Chicago Fed, who find that while more than two-thirds of the decline in LFPR between 1999 and 2011 is accounted for by changes in the age distribution of the population, "…over the 2008-2011 period...only one-quarter of the...decline of actual LFPR...can be attributed to demographic factors."And from David Altig at the Atlanta Fed: Labor Force Participation and the Unemployment Threshold

This conclusion—that three-quarters of the decline in the LFPR since the beginning of the Great Recession can be attributed to cyclical factors—is supported by other research.

...

Our results suggest that relative to the the average LFPR over the years 2010–12, the average LFPR over the years 2015–17 will rise by about a third of a percentage point—again, if the labor market returns to prerecession conditions. Though higher than today, this level would still leave the LFPR considerably lower than it was before the recession, primarily reflecting the continued downward pressures of aging baby boomers.

[T]aking the Hotchkiss and Rios-Avila research onboard means the assumption of a constant labor force participation rate may not be justified. So, turning again to the Jobs Calculator, the following table answers this question: If we continue on the 208,000-per-month pace of job creation of the last six months, and the labor force participation rate is X, what would the unemployment rate be by June of next year? For reference, the first row of the table replicates the earlier result under the assumption that the participation rate will maintain its current level; the second row takes into account the Hotchkiss and Rios-Avila research; and the third assumes an even larger bounce back in participation:This table shows the impact of the participation rate. If the participation rate stays flat at 63.3% (the current level), than at the current pace of payroll jobs growth, the unemployment rate will fall to 6.5% by June 2014. However if the participation rate rises to 63.6% - with the same payroll assumptions - the unemployment rate will only decline to 7.0% by next June. A significant difference ...

Click on graph for larger image.

It is probably worth noting that the full increase in the Hotchkiss and Rios-Avila estimates happens in the 2015–17 timeframe, raising the interesting possibility that the threshold for considering interest rate increases could occur sometime before the unemployment rate moves back above the threshold. Also, it is not at all obvious that rising labor force participation would necessarily arrive along with a rising unemployment rate. From 1996 through 1999, for example, the participation rate rose by nearly by 0.7 percentage point (the difference between the rates in the first and third rows in the table above), even as the unemployment rate fell by just over 1½ percentage points. The key was the strong employment growth over that period—almost 260,000 payroll jobs per month on average.

I think the state level research is compelling, but I don't expect much of an increase in the participation rate over next few years. And I expect further declines in the overall participation rate over the next 15 to 20 years.

Fannie, Freddie, FHA REO inventory declines in Q1 2013

by Calculated Risk on 5/13/2013 01:36:00 PM

The combined Real Estate Owned (REO) by Fannie, Freddie and the FHA declined to 189,5291 at the end of Q1 2013, down from 192,720 in Q4 2012, and down 9% from 209,077 in Q1 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Click on graph for larger image.

Click on graph for larger image.

Although REO was down for Fannie and Freddie in Q1 from Q4, REO increased for the FHA - this is something to watch.

1 The FHA is currently in the process of updating their reporting procedures, and the most recent data available online is for January 2013. I've obtained FHA REO data for April 2013 (not end of Q1).

When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 5/13/2013 11:46:00 AM

The WSJ has an overview of several economic forecasts: Economic Road Clearing, but the Going Is Slow

The U.S. still employs more than 2.5 million fewer people than when the recession began. At 180,000 jobs a month, it will take until the middle of 2014 to close that gap. Adjust for population growth, and it will take nine more years to return to the prerecession level of employment at the current rate of growth, according to the Brookings Institution.Below is an update of the graph showing job losses from the start of the employment recession, in percentage terms, with a projection assuming the current rate of payroll growth will continue.

This suggests that employment will exceed the pre-recession peak around July 2014 (Private employment will reach a new high around March of 2014).

Of course, as the article notes, this doesn't include adjusting for population growth - but this will still be a major milestone.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is a projection based on recent payroll increases.

It looks like employment will reach a new high in mid-2014, about 78 months after the previous high.

Retail Sales increase 0.1% in April

by Calculated Risk on 5/13/2013 08:30:00 AM

On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.7% from April 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $419.0 billion, an increase of 0.1 percent from the previous month, and 3.7 percent above April 2012. ... The February to March 2013 percent change was revised from -0.4 percent to -0.5 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for February and March were revised up.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 26.4% from the bottom, and now 10.6% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos decreased 0.1%. Retail sales ex-gasoline increased 0.7%.

Excluding gasoline, retail sales are up 24.0% from the bottom, and now 11.4% above the pre-recession peak (not inflation adjusted).

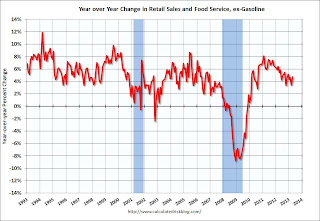

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 4.7% on a YoY basis (3.7% for all retail sales).

This was above the consensus forecast of 0.3% decline in retail sales. Retail sales ex-gasoline (gasoline prices declined in April) were up 0.7% .