by Calculated Risk on 4/21/2013 01:26:00 PM

Sunday, April 21, 2013

Housing: Some thoughts on Investor Buying, Inventory and recent Price Increases

One of the key themes I've mentioned over the last year is the increase in conventional sales and the corresponding decline in distressed sales (Foreclosures and short sales). I've argued this increase in conventional sales is a sign of a healing market.

Tom Lawler has sent me some rough data that suggests much of the increase in conventional sales in California has been due to investor buying (mostly large institutional investors buying single family homes to rent). As an example, reports are Blackstone has purchased 20,000 homes nationally and Colony Capital has purchased 7,000 homes. And there a number of other large players. There groups have continued to buy even as the number of foreclosures has declined.

Note: some of the smaller investor groups I've mentioned on this blog have stopped buying (they started buying at the low end in late 2008). They say the numbers no longer make sense.

Historically single family rentals were a mom-and-pop venture, and these large institutional buyers are a significant change in the market. These buyers are one of the reason the current active inventory is so low (other reasons include "underwater" homeowners who can't sell, potential sellers unable to find a new home to buy, and a change in seller psychology "not wanting to sell at the bottom").

This investor buying is making it very difficult for first time buyers to find a home, and this is probably keeping some potential buyers as renters - and maybe pushing up some buyers to higher price points just to buy.

In the short run (the next few years), I don't think these institutional buyers will have a negative impact on the market. It seems unlikely they will be large sellers, and they will probably maintain the homes that they purchase. However this could impact the housing market in the future, especially the move-up market, since the move-up market usually needs previous first-time buyers to sell their first homes. Obviously institutional sellers will not be move-up buyers.

The impacts of this investor buying are something to consider. Below is some comments and data from Tom Lawler. He makes a couple of key points: 1) owner occupied buying is actually down a little in California, and 2) it appears the investors are moving up to higher price points.

The following is from economist Tom Lawler:

Dataquick [released estimates for all-cash and absentee buyer shares] for the Southern California area and the Bay Area, which are shown on the [below], along with the foreclosure and short sales shares for each area, as well as the median sales price for all-cash transactions and absentee buyer transactions.

There are a few interesting things to note: first, while the foreclosure share of resales was down sharply from last March to this March, and last month’s short-sales share was down from a year ago, both areas saw an increase in both the all-cash share of sales and in the “absentee” buyer share of sales. This confirms anecdotal reports that “investors,” rather than curtailing purchases because of declines in “distressed” properties for sale, have increasingly been purchasing non-foreclosure properties, and possibly even non-distressed properties. Second, the median sales price for homes sold to “all-cash” buyers and to “absentee” buyers – and, of course, there is a lot of overlap in these two – increased by a lot more than the overall median sales price in both areas, also shown on the next page.

| Dataquick Estimates, California Home Sales | ||||

|---|---|---|---|---|

| All-Cash Share | Absentee Buyer Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | 34.1% | 32.4% | 30.6% | 28.2% |

| Bay Area | 31.1% | 29.4% | 27.3% | 24.2% |

| Median Sales Price, All-Cash Share | Median Sales Price, Absentee Buyer Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | $280,750 | $215,000 | $274,000 | $212,000 |

| Bay Area | $325,000 | $250,000 | $324,000 | $250,000 |

| Foreclosure Share | Short Sales Share | |||

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| SoCal | 13.9% | 31.5% | 21.5% | 24.6% |

| Bay Area | 10.7% | 25.5% | 19.0% | 23.8% |

| Median Prices1 | SoCal | Bay Area | ||||

|---|---|---|---|---|---|---|

| 13-Mar | 12-Mar | % Chg | 13-Mar | 12-Mar | % Chg | |

| All Transactions | $345,500 | $280,000 | 23.4% | $436,000 | $358,000 | 21.8% |

| All-Cash | $280,750 | $215,000 | 30.6% | $325,000 | $250,000 | 30.0% |

| Absentee Buyer | $274,000 | $212,000 | 29.2% | $324,000 | $250,000 | 29.6% |

This confirms anecdotal reports that “investors” in California have been “moving up” the price points at which they purchase homes.

Finally, while the sharp drop in the “distressed” share of sales over the last year indicates that there was strong YOY growth in “non-distressed” sales, the increase in the absentee buyer share of sales indicates that sales last months to folks planning to occupy the home they were purchasing were down from a year ago in both areas.

| New and Resale Home Sals, Socal and Bay Area | |||

|---|---|---|---|

| 13-Mar | 12-Mar | % Chg. | |

| Southern California | |||

| Total | 20,581 | 19,953 | 3.1% |

| Owner Occupant | 14,283 | 14,326 | -0.3% |

| Bay Area | |||

| Total | 7,263 | 7,723 | -6.0% |

| Owner Occupant | 5,280 | 5,854 | -9.8% |

These data strongly suggest the investor buying – a lot of which was all-cash and a lot of which has or will become rental units (witness the sharp drop in home listings in California, suggesting that few of the investor purchases were for quick flipping) – has been a major driver of the housing and home price recovery in California.

Shiller on Housing: "Could be an auspicious time to buy"

by Calculated Risk on 4/21/2013 10:07:00 AM

I think Professor Shiller has changed his view ... writing in the NY Times: Before Housing Bubbles, There Was Land Fever

"With rates now relatively low, this could be an auspicious time to buy a house with a fixed-rate mortgage. That could make good sense for people who aren’t out to bet on the housing or mortgage markets but are instead focused on settling into a home for the long term."It might be an "auspicious" time to buy ... if someone can find a home for sale (there is so little inventory in many areas).

Saturday, April 20, 2013

Schedule for Week of April 21st

by Calculated Risk on 4/20/2013 06:34:00 PM

Earlier:

• Summary for Week Ending April 19th

The key reports this week are the Q1 advance GDP report to be released on Friday, New home sales for March on Tuesday, and existing home sales for March on Monday.

There are also two more regional manufacturing surveys to be released this week.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for sales of 5.03 million on seasonally adjusted annual rate (SAAR) basis. Sales in February were at a 4.98 million SAAR. Economist Tom Lawler is estimating the NAR will report a March sales rate of 4.89 million.

A key will be inventory and months-of-supply.

9:00 AM: FHFA House Price Index for February 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase

9:00 AM: The Markit US PMI Manufacturing Index Flash for April. The consensus is for a decrease to 54.2 from 54.9 in March.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for an increase in sales to 419 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 411 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April. The consensus is for a reading of 3.0 for this survey, unchanged from March (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

11:00 AM: Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.

8:30 AM: Q1 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 3.1% annualized in Q1.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q1 GDP.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 73.0, up from 72.3.

Summary for Week ending April 19th

by Calculated Risk on 4/20/2013 12:45:00 PM

According to the Fed's Beige book released last week, "economic activity expanded at a moderate pace" recently with housing leading the way. That is reflected in the data released.

Housing starts were at the highest level since June 2008. The monthly increase was a related to a surge in multi-family starts (there is significant month-to-month variability in multi-family starts), however single family starts were up 28.7% year-over-year, a strong increase too. And even with the recent increase in starts, housing starts - especially single family starts - are still low, and we will probably see continued growth over the next few years. Since residential investment is usually the best leading indicator for the economy, this suggests the economy will continue to grow over the next couple of years.

Of course manufacturing is seeing more sluggish growth (as reflected in the Empire State and Philly Fed manufacturing surveys for April). And initial weekly unemployment claims have increased recently - perhaps related to the sequestration budget cuts.

But overall the data suggests continued growth.

Here is a summary of last week in graphs:

• Housing Starts increased to 1.036 million SAAR in March

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: Permits, Starts and Completions "Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,036,000. This is 7.0 percent above the revised February estimate of 968,000 and is 46.7 percent above the March 2012 rate of 706,000.

Single-family housing starts in March were at a rate of 619,000; this is 4.8 percent below the revised February figure of 650,000. The March rate for units in buildings with five units or more was 392,000."

This was well above expectations of 930 thousand starts in March, mostly due to the sharp increase in multi-family starts - and the highest level since June 2008. Starts in March were up 46.7% from March 2012; single family starts were up 28.7% year-over-year. Starts in February were revised up sharply. This was a strong report.

• Fed: Industrial Production increased 0.4% in March

From the Fed: Industrial production and Capacity Utilization

From the Fed: Industrial production and Capacity Utilization

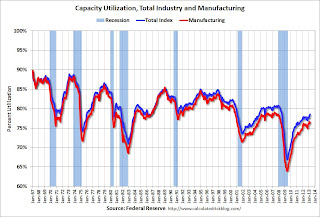

"Industrial production rose 0.4 percent in March after having increased 1.1 percent in February. ... The rate of capacity utilization for total industry moved up in March to 78.5 percent, a rate that is 1.2 percentage points above its level of a year earlier but 1.7 percentage points below its long-run (1972--2012) average."

This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in March to 99.5. This is 18.8% above the recession low, but still 1.3% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

• NMHC Apartment Survey: Market Conditions Tighten in April

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey "Market Tightness Index rose to 54 from 45."

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and 2014, than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

• Key Measures show low inflation in March

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

This graph shows the year-over-year change for these four key measures of inflation: median CPI, trimmed-mean CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.1% annualized, trimmed-mean CPI was at 0.7% annualized, and core CPI increased 1.3% annualized. Also core PCE for February increased 0.7% annualized.

With this low level of inflation and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

• New York and Philly Fed Manufacturing Surveys Show Slower Expansion in April

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the NY Fed: Empire State Manufacturing Survey "Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month." This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

From the Philly Fed: April Manufacturing Survey "The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March."

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.

• Weekly Initial Unemployment Claims increase to 352,000

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The DOL reports: "In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 361,250 - the highest level since January.

Weekly claims were above the 347,000 consensus forecast.

Unofficial Problem Bank list declines to 781 Institutions

by Calculated Risk on 4/20/2013 10:14:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 19, 2013.

Changes and comments from surferdude808:

The FDIC got back to closing banks with a vengeance and, as anticipated, the OCC released its actions through mid-March 2013, which caused many changes to the Unofficial Problem Bank list. In all, there were seven removals and two additions that leave the list at 781 institutions with assets of $288.5 billion. A year ago, the list held 976 institutions with assets of $422.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

The OCC terminated actions against American National Bank, Wichita Falls, TX ($462 million); Legacy National Bank, Springdale, AR ($275 million); and The First National Bank of Kemp, Kemp, TX ($55 million). Farmers State Bank, Faith, SD ($48 million) left the list through an unassisted merger.

The FDIC closed three banks this week. It has been about six months since the FDIC last closed three or more banks on a Friday night. The departures through failure include Heritage Bank of North Florida, Orange Park, FL ($111 million); First Federal Bank, Lexington, KY ($100 million); and Chipola Community Bank, Marianna, FL ($39 million). The two failures in Florida bring that state's cumulative failure total to 68 since the on-set of the financial crisis, which only trails the 85 failures in Georgia. The 68 failures in Florida have cost the FDIC insurance fund an estimated $12.8 billion.

The two additions were Hometown Bank of The Hudson Valley, Walden, NY ($155 million Ticker: HTWC) and Advance Bank, Baltimore, MD ($61 million).

Next week, the FDIC should release its actions through March 2013.

Friday, April 19, 2013

Update: Federal and State improving Fiscal Situation

by Calculated Risk on 4/19/2013 07:58:00 PM

A couple of updates ...

From Goldman Sachs economist Alec Phillips: The Federal Budget Deficit: Shrinking Faster

The federal deficit continues to shrink. Through the first six months of the fiscal year, revenues have come in higher than expected, while spending has come in lower than expected. As a result we are lowering our deficit forecast for the current and next two fiscal years.There are still longer term issues, but the deficit is shrinking fairly quickly.

Earlier this year we lowered our FY2013 deficit forecast from $900bn (5.6% of GDP) to $850bn (5.3%). In light of recent trends, we are lowering it again to $775bn (4.8%). Spending in the fiscal year to date is lower than a year ago and the nominal growth rate is lower than it has been in decades. Revenues have also exceeded expectations, with a 12% gain fiscal year to date. What is more notable is that the strength in revenues preceded the payroll tax hike at the start of the year, and the spending decline does not seem to reflect sequestration, which has just started to take effect.

We expect the improvement to continue for the next few years. Although we had already expected additional cyclical improvement and residual fiscal policy tightening to reduce the deficit further in 2014 and 2015, we have reduced our estimates a bit further, to $600bn (3.5% of GDP) and $475bn (2.7%).

The Controller of California has a website showing daily income tax collections compared to last year. The California budget expects personal income taxes of $51.4 billion as if April 30th. Right now, as of Thursday April 18th, net income taxes are at $53.3 billion - ahead of plan with more collections to come.

Just one state, but we are seeing an improving fiscal situation at the Federal and State levels.

Bank Failures #7 & 8 in 2013: Both in Florida

by Calculated Risk on 4/19/2013 06:14:00 PM

From the FDIC: FirstAtlantic Bank, Jacksonville, Florida, Assumes All of the Deposits of Heritage Bank of North Florida, Orange Park, Florida

As of December 31, 2012, Heritage Bank of North Florida had approximately $110.9 million in total assets and $108.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $30.2 million. ... Heritage Bank of North Florida is the seventh FDIC-insured institution to fail in the nation this year, and the first in Florida.From the FDIC: First Federal Bank of Florida, Lake City, Florida, Assumes All of the Deposits of Chipola Community Bank, Marianna, Florida

As of December 31, 2012, Chipola Community Bank had approximately $39.2 million in total assets and $37.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.3 million. ... Chipola Community Bank is the eighth FDIC-insured institution to fail in the nation this year, and the second in Florida.That makes three so far today ... the FDIC back at work.

Bank Failure #6 in 2013: First Federal Bank, Lexington, Kentucky

by Calculated Risk on 4/19/2013 05:37:00 PM

From the FDIC: Your Community Bank, New Albany, Indiana, Assumes All of the Deposits of First Federal Bank, Lexington, Kentucky

As of December 31, 2012, First Federal Bank had approximately $100.1 million in total assets and $93.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.7 million. ... First Federal Bank is the sixth FDIC-insured institution to fail in the nation this year, and the first in Kentucky.Currently the FDIC is on pace to close around 20 banks in 2013. This will be the lowest number of failures since 2007 (or maybe 2008 if the pace picks up a little).

The following table shows the number of failures per year during the current cycle (this says nothing about the size of the failures):

| Year | Bank Failures |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 157 |

| 2011 | 92 |

| 2012 | 51 |

| 20131 | 6 |

| 1 2013 so far | |

DataQuick on California Home Sales: Foreclosures lowest since September 2007

by Calculated Risk on 4/19/2013 03:20:00 PM

From DataQuick: California March Home Sales

An estimated 37,764 new and resale houses and condos sold statewide last month. That was up 31.5 percent from 28,719 in February, and up 0.8 percent from 37,481 sales in March 2012, according to San Diego-based DataQuick.Sales are still below the average level for the month of March, but the key is the percentage of distressed sales - especially foreclosures - is declining.

It’s normal for sales to shoot up between February and March. California March sales have varied from a low of 24,565 in 2008 to a high of 68,848 in 2005. Last month's sales were 13.5 percent below the average of 43,648 sales for all the months of March since 1988, when DataQuick's statistics begin.

...

Of the existing homes sold last month, 15.2 percent were properties that had been foreclosed on during the past year – the lowest level since foreclosure resales were 12.6 percent of the resale market in September 2007. Last month’s figure compares with 18.0 percent in February and 32.8 percent a year earlier. Foreclosure resales peaked at 58.8 percent in February 2009.

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 21.5 percent of the homes that resold last month. That was down from an estimated 22.4 percent the month before and 24.5 percent a year earlier.

...

Indicators of market distress continue to decline. Foreclosure activity remains well below year-ago and peak levels reached several years ago. Financing with multiple mortgages is low, while down payment sizes are stable, DataQuick reported.

emphasis added

The NAR will report March existing home sales next Monday, April 22nd.

BLS: Unemployment Rate declined in 26 States in March

by Calculated Risk on 4/19/2013 10:52:00 AM

From the BLS: Jobless rate down in 26 states, up in 7 in March; payroll jobs down in 26 states, up in 23

Regional and state unemployment rates were little changed in March. Twenty-six states and the District of Columbia had unemployment rate decreases, 7 states had increases, and 17 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in March, 9.7 percent. The next highest rates were in Illinois (9.5 percent) and California and Mississippi (9.4 percent each). North Dakota again had the lowest jobless rate, 3.3 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines - New Jersey remains the laggard.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only seven states: Nevada, Mississippi, Illinois, California, North Carolina, Rhode Island and New Jersey. In early 2010, almost half the states had an unemployment rate above 9%.