by Calculated Risk on 4/18/2013 03:30:00 PM

Thursday, April 18, 2013

Fed's Raskin: Low- and middle-income households hit hardest by Great Recession

From Fed Governor Sarah Bloom Raskin: Aspects of Inequality in the Recent Business Cycle. A few excerpts:

To isolate my proper subject here, I want to be clear that I am not engaging this afternoon with the concern that many Americans have that excessive inequality undermines American ideals and values. Nor will I be investigating the social costs associated with wide distributions of income and wealth. Rather, I want to zero in on the question of whether inequality itself is undermining our country's economic strength according to available macroeconomic indicators.This is an important topic - and Raskin argues that low and middle income households suffered the most during the Great Recession (continuing a long term trend).

...

I will argue that at the start of this recession, an unusually large number of low- and middle-income households were vulnerable to exactly the types of shocks that sparked the financial crisis. These households, which had endured 30 years of very sluggish real-wage growth, held an unusually large share of their wealth in housing, much of it financed with debt. As a result, over time, their exposure to house prices had increased dramatically. Thus, as in past recessions, suffering in the Great Recession--though widespread--was most painful and most perilous for low- and middle-income households, which were also more likely to be affected by job loss and had little wealth to fall back on.

Moreover, I am persuaded that because of how hard these lower- and middle-income households were hit, the recession was worse and the recovery has been weaker. The recovery has also been hampered by a continuation of longer-term trends that have reduced employment prospects for those at the lower end of the income distribution and produced weak wage growth.

...

[I]t is also relevant to consider whether the unusual circumstances--the outsized role of housing wealth in the portfolios of low- and middle-income households, the increased use of debt during the boom, and the subsequent unprecedented shocks to the housing market--may have attenuated the effectiveness of monetary policy during the depths of the recession. Households that have been through foreclosure or have underwater mortgages or are otherwise credit constrained are less able than other households to take advantage of the lower interest rates, either for homebuying or other purposes. In my view, these effects likely clogged some of the channels through which monetary policy traditionally works. As the housing market recovers, though, I think it is possible that accommodative monetary policy could be increasingly potent. As house prices rise, more and more households have enough home equity to gain renewed access to mortgage credit and the ability to refinance their homes at lower rates. The staff at the Federal Reserve Board has estimated that house price increases of 10 percent or less from current levels would be sufficient for about 40 percent of underwater homeowners to regain positive equity.

It is my view that understanding the long-run trends in income and wealth across different households is important in understanding the dynamics of the macroeconomy and thus also may be relevant for setting monetary policy to best reach our goals of maximum employment and price stability. I believe that the accommodative policies of the FOMC and the concerted effort we have made to ease conditions in the mortgage markets will help the economy continue to gain traction. And the resulting expansion in employment will likely improve income levels at the bottom of the distribution. However, given the long-standing trends toward greater income and wealth inequalities, it is unlikely that cyclical improvements in the labor markets will do much to reverse these trends.

CoStar: Commercial Real Estate prices up 5.1% Year-over-year in February

by Calculated Risk on 4/18/2013 01:09:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Pricing Recovery for Commercial Property Continues in February Despite Seasonal Volatility

PRICING RECOVERY CONTINUES DESPITE SEASONAL VOLATILITY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—dipped by 0.7% and 1.4%, respectively, in the month of February 2013, reflecting a continuation of a seasonal pattern first observed in January, in which commercial real estate prices gave back some of the pricing gains from the surge in sales activity at the close of 2012. Despite the recent seasonal dip in activity, commercial real estate prices are still up significantly from year ago levels. The equal-weighted index increased 6.0% since February 2012, while value-weighted index expanded by 5.1% during the same period.

ABSORPTION POSTS SOLID GAINS IN THE FIRST QUARTER: The relative performance of the General Commercial and Investment Grade indices is tied to market fundamentals. Net absorption of available space for the three major property types – office, retail, and industrial – has been positive over the past three years. However, for the majority of that period, absorption has been stronger among properties in the Investment Grade segment as reflected by the faster pricing growth in this index since 2009. More recently though, the General Commercial segment has posted more robust gains in absorption as well, indicating a broader and more sustained commercial real estate recovery.

DISTRESS SALES DECLINE WITH IMPROVING FUNDAMENTALS: The percentage of commercial property selling at distressed prices dropped to 15.9% in February 2013 from over 18% for the previous month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 36.7% from the bottom (showing the demand for higher end properties) and up 5.1% year-over-year. However the Equal-Weighted index is only up 7.1% from the bottom, and up 6.0% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Philly Fed Manufacturing Survey Shows Slower Expansion in April

by Calculated Risk on 4/18/2013 10:09:00 AM

From the Philly Fed: April Manufacturing Survey

Manufacturers responding to the Business Outlook Survey reported near steady business activity in April. The indicator for overall activity remained slightly positive this month, but other broad indicators were mixed. Indicators for new orders and employment were weaker this month. The survey's broad indicators of future activity suggest that firms expect continued growth, but optimism waned compared with last month.Earlier in the week, the Empire State manufacturing survey also indicated slower expansion in April.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March ... The demand for manufactured goods remained weak, with the current new orders index declining from 0.5 to -1.0.

Labor market conditions showed continued signs of weakness, with indexes suggesting lower employment overall. The employment index decreased from 2.7 in March to -6.8 this month, its first negative reading in three months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.

Weekly Initial Unemployment Claims increase to 352,000

by Calculated Risk on 4/18/2013 08:35:00 AM

The DOL reports:

In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500.The previous week was revised up from 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 361,250 - the highest level since January.

Weekly claims were above the 347,000 consensus forecast.

Wednesday, April 17, 2013

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 4/17/2013 09:07:00 PM

Oh my ... from the NY Times DealBook: Mortgage Relief Checks Go Out, Only to Bounce

The first round of the settlement checks were mailed last week. In recent days, problems arose at Rust Consulting, a firm chosen to distribute the checks, people briefed on the matter said. After collecting the $3.6 billion from the banks, these people said, Rust failed to move the money into a central account at Huntington National Bank in Ohio, the bank that issued the checks to homeowners.I think this fits, Stephen Colbert on smoking pot: "If kids want to grow up, break the law, and not suffer any consequences ... they should go into banking!"

...

“It’s the perfect ending for such a debacle,” said Michael Redman, a paralegal who runs 4closurefraud.org ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 347 thousand from 346 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

• At 10:00 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of minus 3.3, up from 2.0 last month (above zero indicates expansion).

• At 1:00 PM, Speech by Fed Governor Sarah Bloom Raskin, Reflections on Inequality and the Recent Business Cycle, At the 22nd Annual Hyman P. Minsky Conference on the State of the U.S. and World Economies, New York, New York

Lawler: Early Look at Existing Home Sales in March

by Calculated Risk on 4/17/2013 04:03:00 PM

From housing economist Tom Lawler:

Based on the limited amount of local realtor reports I’ve seen, I estimate that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.89 million in March, down from February’s preliminary seasonally adjusted pace, and up 9.6% from last March’s seasonally adjusted pace. I estimated that unadjusted sales last month were up 6.3% from last March, and that the lower day count will result in a lower seasonal factor this March vs. last March.

I should note that even after getting many of the late realtor reports for February, my methodology shows a smaller YOY increase in unadjusted existing home sales than that shown in last month’s NAR report – suggesting either an “issue” with my methodology or an “issue” with the NAR’s February report.

Based on the wide sample of realtor reports I have for February, I would have estimated that unadjusted existing home sales this February were about 4.4% higher than last February’s pace. The NAR, in contrast, reported a YOY gain of 6.3% -- with existing SF home sales showing a YOY increase of 4.4% but existing condo/co-op sales showing a puzzling high YOY gain of 20.0%, with condo sales in the South showing a YOY increase of 29.4%. In addition, the NAR reported a monthly increase in the inventory of existing condos/coops for sale of 33.5%, driven by reported “months’ supply” combined with the huge jump in sales. These condo/coop sales and inventory numbers seem “off” to me, but I might be off as well.

CR Note: The NAR will report March existing home sales next Monday, April 22nd.

Fed's Beige Book: Economic activity expanded at "moderate" pace

by Calculated Risk on 4/17/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Dallas based on information collected on or before April 5, 2013."

Reports from the twelve Federal Reserve Districts suggest overall economic activity expanded at a moderate pace during the reporting period from late February to early April. ...And on real estate:

Most Districts noted increases in manufacturing activity since the previous report. Particular strength was seen in industries tied to residential construction and automobiles, while several Districts reported uncertainty or weakness in defense-related sectors. Consumer spending grew modestly, and firms in some Districts cited higher gasoline prices, expiration of the payroll tax cut, and winter weather as factors restraining sales growth. Retailers in several Districts expect continued sales growth in the near term.

Residential real estate activity continued to improve in most Districts, and some Districts, including Cleveland, Richmond, Chicago, Minneapolis, Kansas City, Dallas, and San Francisco, noted increased momentum since the last report. The New York District, in particular, noted especially strong improvement in residential real estate—both in for-sale housing and apartment markets.Residential real estate "continued to improve" and this was the most positive comment on commercial real estate in some time (but any "improvement" for commercial is from a very low level). This suggests moderate growth overall ...

Home sales continued to rise in most Districts. Although homebuyer demand was high in the Boston District, low home inventories were restraining sales, keeping growth modest. Home sales were reportedly strong in both the Atlanta and Dallas Districts. The Richmond District noted low inventories were pushing up contracts to well above listing prices, and the Boston and New York Districts said multiple bids on properties have become more common. Tight inventories and strong sales led to rising home prices in many Districts, including Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco. Within the New York District, condo sales volumes strengthened and low inventories have begun to drive up selling prices in New York City and surrounding areas, while New Jersey home prices were rising modestly and inventories were shrinking with a marked reduction in the number of distressed properties. Contacts in the Boston District also noted a decline in the stock of distressed properties.

New home construction continued to pick up in most Districts, although the Richmond District said that a low supply of residential building materials had stalled construction. ...

Commercial real estate and construction activity improved in most Districts. Office vacancy rates declined in the Boston District and contacts said the construction of mixed-use projects was picking up. The New York District reported that office vacancy rates continued to decline and rents rose in Manhattan.

LA area Port Traffic decreases year-over-year in March

by Calculated Risk on 4/17/2013 10:12:00 AM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for March since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 2% in March, and outbound traffic down slightly, compared to the rolling 12 months ending in February.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Sometimes the sharp seasonal decline happens in February, sometimes in March depending on the timing of the Chinese New Year. This year the sharp seasonal decline happened in March.

My guess is this suggests a decrease in the trade deficit with Asia for March.

MBA: Mortgage Applications Increase, Purchase Index highest since May 2010

by Calculated Risk on 4/17/2013 08:44:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

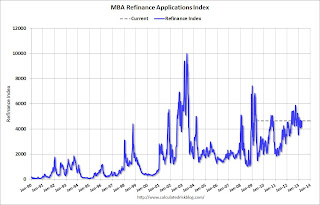

The Refinance Index increased 5 percent from the previous week and is at its highest level since mid-January of 2013. The seasonally adjusted Purchase Index increased 4 percent from one week earlier is at its highest level since May of 2010 and the adjusted Conventional Purchase Index increased 3 percent to the highest level since October 2009.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.67 percent from 3.68 percent, with points increasing to 0.50 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 3.77 percent from 3.79 percent, with points decreasing to 0.27 from 0.36 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

However refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

Tuesday, April 16, 2013

Wednesday: Beige Book, Mortgage Applications

by Calculated Risk on 4/16/2013 08:23:00 PM

Another Spring slowdown?

From Tim Duy at EconomistsView Fed Watch: Another Spring Slowdown?

On net, I think the data is telling us a familiar story: The positives in the US economy are difficult to ignore. Housing starts are a very good indicator of the direction of the economy, and that direction appears to be up. But it doesn't pay to get too carried away with any one quarter's worth of data. Underlying growth has been slow and steady since the end of the recession, with positive quarters offset by negative quarters. And the impact of tighter fiscal policy looks likely to produce a similar trend this year. The light at the end of the tunnel, however, is that as the fiscal effect fades toward the end of this year and into next, activity could finally see a more of the sustained improvement we have been looking for.From Ylan Q. Mui at the WaPo: Spring is a season of growth — but not for the U.S. economy

But, at the moment, that sustained improvement looks ephemeral. That is the message of the bond market as yields plunged back to the 1.7 percent range since the beginning of the year. And the beat-down of commodity prices indicates nervousness on the global outlook as well. If I was a monetary policymaker, I would be paying attention, especially as the inflation numbers are not telling us that imminent tightening is necessary ...

For the third year in a row, the nation’s economic recovery seems to be petering out just as temperatures start to go up. Hiring has dropped off. Shoppers are putting away their wallets. Government spending cuts are looming.I think seasonal adjustments played a role in earlier slowdowns (as did the tsunami in Japan and the problems in Europe), but I think this slowdown is mostly related to fiscal tightening (mostly the payroll tax hike and the sequestration budget cuts). As Tim Duy notes, the fiscal effect should fade towards the end of this year.

That has fueled predictions of an abrupt slowdown over the next few months. Economists are forecasting tepid growth of just over 1 percent during the second quarter of the year.

...

No one seems to have a good explanation for why the recovery has taken a nosedive around the same time each year. ... At first, economists wondered whether the problem was purely technical. The 2008 financial crisis upended mathematical models for how many people are hired and fired on a normal basis, resulting, they hypothesized, in artificial boosts in the fall that evaporated by spring.

But that explanation for the swoon was almost too easy — and certainly too optimistic. It turns out the trouble lay not in the data but in the real world.

In 2011, the problem was international. A tsunami in Japan coincided with a financial crisis in Europe that pushed Greece into default and almost caused a collapse of the continent’s common currency. Last year, economists blamed the weather. The mild winter, they said, siphoned away traditional springtime jobs.

This year, all fingers are pointed at Washington.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of a slow down.