by Calculated Risk on 3/20/2013 08:07:00 AM

Wednesday, March 20, 2013

MBA: Mortgage Applications decrease

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 75 percent of total applications from 76 percent the previous week.The refinance share has decreased for ten straight weeks and is at its lowest level since early May 2012. ... The HARP share of refinance applications increased to 31 percent from 30 percent the prior week.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.82 percent from 3.81 percent, with points decreasing to 0.38 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

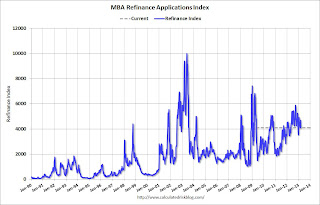

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, but activity has been declining over the last few months.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last year.

Tuesday, March 19, 2013

Wednesday: FOMC Announcement and Press Conference

by Calculated Risk on 3/19/2013 08:23:00 PM

I'm sure Bernanke will be asked about Cyprus in his press conference tomorrow. Also, in January, the FOMC statement contained the sentence: "Although strains in global financial markets have eased somewhat, the Committee continues to see downside risks to the economic outlook." That might be reworked a little ...

Note: Over the weekend, as a preview to the FOMC meeting: FOMC Projections Preview

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Morning, the AIA's Architecture Billings Index for February (a leading indicator for commercial real estate). This has been showing a pickup in billings recently.

• At 2:00 PM, the FOMC Meeting Announcement will be released. No change to interest rates or QE purchases is expected at this meeting.

• Also at 2:00 PM, the FOMC projections will be released. This will include the Federal Open Market Committee (FOMC) participants' quarterly economic projections.

• At 2:30 PM. Fed Chairman Ben Bernanke will hold a press conference.

ATA Trucking Index increases in February

by Calculated Risk on 3/19/2013 05:03:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Edged Higher In February

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.6% in February after increasing 1% in January. (The 1% gain in January was revised down from a 2.4% increase ATA reported on February 19, 2013.) Tonnage has now increased for four straight months, which hasn’t happened since late 2011. Over the last four months, tonnage gained a total of 7.7%. In February, the SA index equaled 123.6 (2000=100) versus 123.0 in January. The highest level on record was December 2011 at 124.3. Compared with February 2012, the SA index was up a solid 4.2%, just below January’s 4.6% year-over-year gain. Year-to-date, compared with the same period in 2012, the tonnage index is up 4.4%. In 2012, tonnage increased 2.3% from 2011.Note from ATA:

“Fitting with several other key economic indicators, truck tonnage is up earlier than we anticipated this year,” ATA Chief Economist Bob Costello said. “While I think this is a good sign for the industry and the economy, I’m still concerned that freight tonnage will slow in the months ahead as the federal government sequester continues and households finish spending their tax returns. A little longer term, I think the economy and the industry are poised for a more robust recovery.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but is up solidly year-over-year.

Report: Cyprus's Parliament Rejects Bank Deposit Tax

by Calculated Risk on 3/19/2013 02:28:00 PM

From Business Insider: CYPRUS VOTES AGAINST CONTROVERSIAL BANK BAILOUT DEAL

The Cypriot parliament has voted against the bank bailout deal, with 36 votes against, reports Bloomberg.Back to the drawing board.

19 abstained from voting.

The vote was held in a show of hands.

A few comments on Housing Starts

by Calculated Risk on 3/19/2013 12:15:00 PM

A few comments:

• Total housing starts in February were up 27.7% from the February 2012 pace. Single family starts were up 31.4%. This is a very strong year-over-year increase.

• Even with this significant increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase more than 60% from the current level (917 thousand SAAR in February).

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

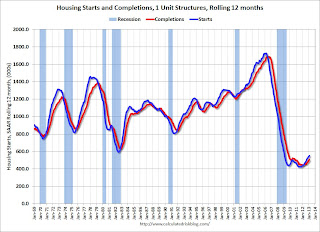

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

CoreLogic: Negative Equity Decreases in Q4 2012

by Calculated Risk on 3/19/2013 09:57:00 AM

From CoreLogic: CoreLogic reports 200,000 More Residential Properties Return to Positive Equity in Fourth Quarter of 2012

CoreLogic ... today released new analysis showing approximately 200,000 more residential properties returned to a state of positive equity during the fourth quarter of 2012. This brings the total number of properties that moved from negative to positive equity in 2012 to 1.7 million and the number of mortgaged residential properties with equity to 38.1 million. The analysis also shows that 10.4 million, or 21.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the fourth quarter of 2012. This figure is down from 10.6 million properties, or 22 percent, at the end of the third quarter of 2012.

... At the end of the fourth quarter, 2.3 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“In the fourth quarter we again saw an improvement in the equity position of households,” said Dr. Mark Fleming, chief economist for CoreLogic. “Housing market improvements, particularly in the hardest hit states, are the catalyst for households to regain equity and become participants in 2013’s housing market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 52.4 percent, followed by Florida (40.2 percent), Arizona (34.9 percent), Georgia (33.8 percent) and Michigan (31.9 percent). These top five states combined account for 32.7 percent of negative equity in the U.S."

The second graph shows the distribution of home equity. Just under 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.

The second graph shows the distribution of home equity. Just under 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.More from CoreLogic: "Of the properties in negative equity, 1.8 million, or 3.7 percent of all residential properties with a mortgage, had current estimated loan-to-value (LTV) ratios between 100 and 105, referred to as near-equity. If home prices were to rise another 5 percent, these properties would move into a positive equity position."

According to CoreLogic, 1.7 million borrowers returned to positive equity from negative equity in 2012. I expect a similar number will return to positive equity in 2013.

Housing Starts increase to 917 thousand SAAR in February

by Calculated Risk on 3/19/2013 08:43:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 917,000. This is 0.8 percent above the revised January estimate of 910,000 and is 27.7 percent above the February 2012 rate of 718,000.

Single-family housing starts in February were at a rate of 618,000; this is 0.5 percent above the revised January figure of 615,000. The February rate for units in buildings with five units or more was 285,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 946,000. This is 4.6 percent above the revised January rate of 904,000 and is 33.8 percent above the February 2012 estimate of 707,000.

Single-family authorizations in February were at a rate of 600,000; this is 2.7 percent above the revised January figure of 584,000. Authorizations of units in buildings with five units or more were at a rate of 316,000 in February.

Click on graph for larger image.

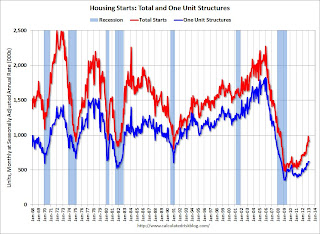

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in February.

Single-family starts (blue) increased to 618,000 in February and are at the highest level since June 2008.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 90% from the bottom start rate, and single family starts are up about 75% from the post-bubble low.

This was at expectations of 919 thousand starts in February. Starts in February were up 27.7% from February 2012; single family starts were up 31.5% year-over-year. Starts in December and January were revised up, and permits were strong. I'll have more later, but this was another solid report.

Monday, March 18, 2013

Tuesday: Housing Starts

by Calculated Risk on 3/18/2013 07:59:00 PM

First on Cyprus: The bank holiday has been extended through Thursday. Negotiations are ongoing on changes to the depositor levy.

From Izabella Kaminska at Alphaville: First they came for the deposits .... She starts:

This won’t be popular.And she concludes:

But it’s an important alternative to the “it’s expropriation” view on Cyprus.

While the decision to force a bank levy on depositors creates an important precedent, it also represents something much more complex than pure confiscation or forfeiture. ...

The moral of the story being: if you hold money in a weak bank — especially one with no hope of nationalization — better to withdraw your money and spend it on longer lasting durable options instead. That includes everything from durable goods to equities of companies that make durable, long-lasting or innovative goods which are likely to be needed by you and the population in the future ...Deposit insurance doesn't work for a country without their own currency that would be bankrupt if certain banks failed (like Cyprus). Clearly the eurozone needs to have eurozone wide deposit insurance (and eurozone wide bank supervision). Another reason the euro is flawed.

On the lighter side, I suppose the European crisis has been good for geography teachers and many Americans can now find Cyprus on a map.

Tuesday economic releases:

• At 8:30 AM, The Census Bureau will release Housing Starts for February. The consensus is for total housing starts to increase to 919 thousand (SAAR) in February, up from 890 thousand in January and up 28% from the 718 thousand SAAR in February 2012.

Existing Home Inventory is up 6.0% year-to-date on March 18th

by Calculated Risk on 3/18/2013 02:46:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through March 18th - it appears inventory is increasing at a sluggish rate, but faster than in 2011 and 2012. Housing Tracker reports inventory is down -22.2% compared to the same week in 2012 - still a rapid year-over-year decline.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 6.0% (above the peak percentage increase for 2011 and 2012) Right now I think inventory will not bottom until 2014, but it is still possible that inventory will bottom this year.

LA area Port Traffic increases year-over-year in February

by Calculated Risk on 3/18/2013 01:21:00 PM

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for February. LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 4% in February, and outbound traffic down slightly, compared to the rolling 12 months ending in January.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March. Inbound traffic was up sharply year-over-year in February, but that is probably seasonal (perhaps related to timing of the Chinese New Year). This usually means the the sharp seasonal decline will happen in March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March. Inbound traffic was up sharply year-over-year in February, but that is probably seasonal (perhaps related to timing of the Chinese New Year). This usually means the the sharp seasonal decline will happen in March.

For the month of February, loaded outbound traffic was up 4% compared to February 2012, and loaded inbound traffic was up sharply.

This suggest an increase in the trade deficit with Asia for February.