by Calculated Risk on 3/19/2013 02:28:00 PM

Tuesday, March 19, 2013

Report: Cyprus's Parliament Rejects Bank Deposit Tax

From Business Insider: CYPRUS VOTES AGAINST CONTROVERSIAL BANK BAILOUT DEAL

The Cypriot parliament has voted against the bank bailout deal, with 36 votes against, reports Bloomberg.Back to the drawing board.

19 abstained from voting.

The vote was held in a show of hands.

A few comments on Housing Starts

by Calculated Risk on 3/19/2013 12:15:00 PM

A few comments:

• Total housing starts in February were up 27.7% from the February 2012 pace. Single family starts were up 31.4%. This is a very strong year-over-year increase.

• Even with this significant increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase more than 60% from the current level (917 thousand SAAR in February).

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year, but still well below the 1997 through 2007 level of multi-family completions.

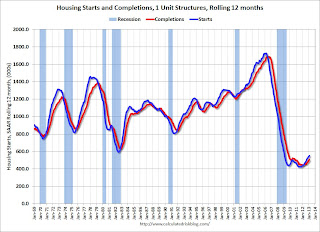

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

CoreLogic: Negative Equity Decreases in Q4 2012

by Calculated Risk on 3/19/2013 09:57:00 AM

From CoreLogic: CoreLogic reports 200,000 More Residential Properties Return to Positive Equity in Fourth Quarter of 2012

CoreLogic ... today released new analysis showing approximately 200,000 more residential properties returned to a state of positive equity during the fourth quarter of 2012. This brings the total number of properties that moved from negative to positive equity in 2012 to 1.7 million and the number of mortgaged residential properties with equity to 38.1 million. The analysis also shows that 10.4 million, or 21.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the fourth quarter of 2012. This figure is down from 10.6 million properties, or 22 percent, at the end of the third quarter of 2012.

... At the end of the fourth quarter, 2.3 million residential properties had less than 5 percent equity, referred to as near-negative equity. Properties that are near negative equity are at risk should home prices fall. ...

“In the fourth quarter we again saw an improvement in the equity position of households,” said Dr. Mark Fleming, chief economist for CoreLogic. “Housing market improvements, particularly in the hardest hit states, are the catalyst for households to regain equity and become participants in 2013’s housing market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 52.4 percent, followed by Florida (40.2 percent), Arizona (34.9 percent), Georgia (33.8 percent) and Michigan (31.9 percent). These top five states combined account for 32.7 percent of negative equity in the U.S."

The second graph shows the distribution of home equity. Just under 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.

The second graph shows the distribution of home equity. Just under 10% of residential properties have 25% or more negative equity - it will be long time before those borrowers have positive equity. But other borrowers are close.More from CoreLogic: "Of the properties in negative equity, 1.8 million, or 3.7 percent of all residential properties with a mortgage, had current estimated loan-to-value (LTV) ratios between 100 and 105, referred to as near-equity. If home prices were to rise another 5 percent, these properties would move into a positive equity position."

According to CoreLogic, 1.7 million borrowers returned to positive equity from negative equity in 2012. I expect a similar number will return to positive equity in 2013.

Housing Starts increase to 917 thousand SAAR in February

by Calculated Risk on 3/19/2013 08:43:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 917,000. This is 0.8 percent above the revised January estimate of 910,000 and is 27.7 percent above the February 2012 rate of 718,000.

Single-family housing starts in February were at a rate of 618,000; this is 0.5 percent above the revised January figure of 615,000. The February rate for units in buildings with five units or more was 285,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 946,000. This is 4.6 percent above the revised January rate of 904,000 and is 33.8 percent above the February 2012 estimate of 707,000.

Single-family authorizations in February were at a rate of 600,000; this is 2.7 percent above the revised January figure of 584,000. Authorizations of units in buildings with five units or more were at a rate of 316,000 in February.

Click on graph for larger image.

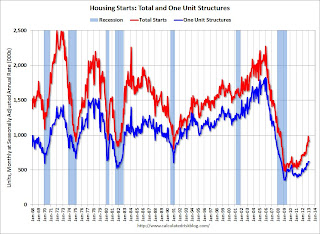

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased slightly in February.

Single-family starts (blue) increased to 618,000 in February and are at the highest level since June 2008.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 90% from the bottom start rate, and single family starts are up about 75% from the post-bubble low.

This was at expectations of 919 thousand starts in February. Starts in February were up 27.7% from February 2012; single family starts were up 31.5% year-over-year. Starts in December and January were revised up, and permits were strong. I'll have more later, but this was another solid report.

Monday, March 18, 2013

Tuesday: Housing Starts

by Calculated Risk on 3/18/2013 07:59:00 PM

First on Cyprus: The bank holiday has been extended through Thursday. Negotiations are ongoing on changes to the depositor levy.

From Izabella Kaminska at Alphaville: First they came for the deposits .... She starts:

This won’t be popular.And she concludes:

But it’s an important alternative to the “it’s expropriation” view on Cyprus.

While the decision to force a bank levy on depositors creates an important precedent, it also represents something much more complex than pure confiscation or forfeiture. ...

The moral of the story being: if you hold money in a weak bank — especially one with no hope of nationalization — better to withdraw your money and spend it on longer lasting durable options instead. That includes everything from durable goods to equities of companies that make durable, long-lasting or innovative goods which are likely to be needed by you and the population in the future ...Deposit insurance doesn't work for a country without their own currency that would be bankrupt if certain banks failed (like Cyprus). Clearly the eurozone needs to have eurozone wide deposit insurance (and eurozone wide bank supervision). Another reason the euro is flawed.

On the lighter side, I suppose the European crisis has been good for geography teachers and many Americans can now find Cyprus on a map.

Tuesday economic releases:

• At 8:30 AM, The Census Bureau will release Housing Starts for February. The consensus is for total housing starts to increase to 919 thousand (SAAR) in February, up from 890 thousand in January and up 28% from the 718 thousand SAAR in February 2012.

Existing Home Inventory is up 6.0% year-to-date on March 18th

by Calculated Risk on 3/18/2013 02:46:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through March 18th - it appears inventory is increasing at a sluggish rate, but faster than in 2011 and 2012. Housing Tracker reports inventory is down -22.2% compared to the same week in 2012 - still a rapid year-over-year decline.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 6.0% (above the peak percentage increase for 2011 and 2012) Right now I think inventory will not bottom until 2014, but it is still possible that inventory will bottom this year.

LA area Port Traffic increases year-over-year in February

by Calculated Risk on 3/18/2013 01:21:00 PM

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for February. LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 4% in February, and outbound traffic down slightly, compared to the rolling 12 months ending in January.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March. Inbound traffic was up sharply year-over-year in February, but that is probably seasonal (perhaps related to timing of the Chinese New Year). This usually means the the sharp seasonal decline will happen in March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March. Inbound traffic was up sharply year-over-year in February, but that is probably seasonal (perhaps related to timing of the Chinese New Year). This usually means the the sharp seasonal decline will happen in March.

For the month of February, loaded outbound traffic was up 4% compared to February 2012, and loaded inbound traffic was up sharply.

This suggest an increase in the trade deficit with Asia for February.

BLS: No State had double digit unemployment in January 2013

by Calculated Risk on 3/18/2013 11:22:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in January. Twenty-five states and the District of Columbia recorded unemployment rate increases, 8 states posted decreases, and 17 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

California and Rhode Island recorded the highest unemployment rates among the states in January, 9.8 percent each.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines - New Jersey is the laggard.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment for the first time since late 2008 (Note: with revisions, no state had double a digit unemployment rate in Dec 2012 too). In early 2010, 18 states and D.C. had double digit unemployment rates.

Nevada has had the highest unemployment rate in the nation since early 2010 (Michigan led the nation before Nevada). Now California and Rhode Island have the highest rate. The unemployment rate in Nevada has fallen very quickly from 12.1% in August 2012 to 9.7% in January 2013.

Builder Confidence declines in March to 44

by Calculated Risk on 3/18/2013 10:05:00 AM

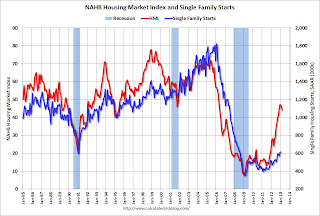

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 2 points in March to 44. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Slips Two Notches in March

Builder confidence in the market for newly built, single-family homes paused for a third consecutive month in March, with a two-point reduction to 44 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“In addition to tight credit and below-price appraisals, home building is beginning to suffer growth pains as the infrastructure that supports it tries to re-establish itself,” explained NAHB Chief Economist David Crowe. “During the Great Recession, the industry lost home building firms, building material production capacity, workers who retreated to other sectors and the pipeline of developed lots. The road to a housing recovery will be a bumpy one until these issues are addressed, but in the meantime, builders are much more optimistic today than they were at this time last year.”

...

While the HMI component gauging current sales conditions declined four points to 47, the component gauging sales expectations in the next six months and the component gauging traffic of prospective buyers both posted gains, of one point to 51 and three points to 35, respectively, in March.

Three-month moving averages for each region’s HMI score were also mixed, with the Northeast holding unchanged at 39, the Midwest and South posting one-point declines to 47 and 46, respectively, and the West registering a four-point increase to 58.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February housing starts will be released tomorrow). This was below the consensus estimate of a reading of 47.

Cyprus Update: Delay

by Calculated Risk on 3/18/2013 08:43:00 AM

From the WSJ: Cyprus Postpones Debate on Deposit-Tax Proposal

The Cypriot parliament is now scheduled to meet Tuesday at 1600 GMT ... The government is also in discussion with its creditors to ease the burden on small depositors. ... The new proposal will see smaller depositors, those with up to €100,000, taxed at 3%; savers with €100,000 to €500,000 taxed at 10%; and those with over €500,000 taxed at 15%, one official said.The Russians are not happy, from the Financial Times: Russia attacks Cyprus bailout plan

Mr Putin ... was among several Russian leaders to criticise the bailout, which came without consultation with Moscow and could cost Russian depositors up to €2bn ...From Bloomberg: Euro Officials Pressing for Cyprus Bank Levy Signal Flexibility

...

“We had an agreement with our EU colleagues that we would take co-ordinated action,” Mr Siluanov pRussia’s finance minister] said. “Our role was to possibly relax the terms for [Cyprus] paying back its credit. As it turns out, the EU took action to levy a tax on deposits, without consulting Russia, and for this reason we will further consider the issue of our participation from the point of view of restructuring the earlier loan.”

excerpt with permission

While demanding that the levy raise the targeted 5.8 billion euros ($7.6 billion), finance officials said easing the cost to smaller savers was up to Cyprus. ... “If the government wants to change the structure of the solidarity levy for the banking sector, the government can decide as such,” European Central Bank Executive Board member Joerg Asmussen said today in Berlin. “What’s important is that the planned revenue of 5.8 billion euros remain.”