by Calculated Risk on 2/22/2013 01:58:00 PM

Friday, February 22, 2013

Zillow forecasts Case-Shiller House Price index to increase 6.7% Year-over-year for December, Strong Price increases in January

The Case-Shiller house price indexes will be released next week. I like to check the Zillow forecasts; they have been pretty close.

Zillow Forecast: December Case-Shiller Composite-20 Expected to Show 6.7% Increase from One Year Ago

[W]e predict that next month’s Case-Shiller data (December 2012) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 6.7 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 5.7 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from November to December will be 0.7 percent for the 20-City Composite and 0.6 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for December will not be released until Tuesday, February 26th, almost two months after the end of 2012.Right now it looks like Case-Shiller will be up over 6% in 2012 (through the December / Q4 reports to be released in February).

The December Case-Shiller numbers are forecast to come in stronger than many economists expect. The last few months have hinted at a strong close to 2012, but part of this strength is due to the weak December 2011 numbers to which December’s numbers are compared. ... To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure re-sale numbers, which we also have available more than a month prior to Case-Shiller numbers. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

Note: Zillow also released their January index yesterday: January Annual Home Value Increase Is Largest Since Summer 2006

Zillow’s January Real Estate Market Reports, released today, show that national home values rose 0.7% from December to January to $158,100. January 2013 marks the 15th consecutive month of home value appreciation. On a year-over-year basis, home values were up 6.2% from January 2012 – a rate of annual appreciation [for Zillow index] we haven’t seen since July 2006 (when the rate was 7.5%), before the peak of the housing bubble.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Dec 2011 | 149.59 | 149.77 | 136.60 | 136.84 |

| Case-Shiller (last month) | Nov 2012 | 158.28 | 157.33 | 145.82 | 144.99 |

| Zillow December Forecast | YoY | 5.7% | 5.7% | 6.7% | 6.7% |

| MoM | -0.1% | 0.6% | 0.0% | 0.7% | |

| Zillow Forecasts1 | 158.1 | 158.3 | 145.8 | 146.0 | |

| Current Post Bubble Low | 146.46 | 149.44 | 134.07 | 136.74 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.0% | 5.9% | 8.7% | 6.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Housing: What if inventory keeps falling?

by Calculated Risk on 2/22/2013 01:00:00 PM

Just thinking out loud ... one of my ten economic questions for 2013 was: Will Housing inventory bottom in 2013?. My guess was active inventory would bottom in 2013, "probably in January". At the least, I expected that the rate of year-over-year decline would "slow sharply".

This could still be correct. The NAR reported yesterday that listed inventory fell to 1.74 million units in January, the lowest level since December 1999. This was down 25.3 percent from January 2012.

Note: Inventory will increase seasonally over the next few months (this happens every year), and this is why I'm tracking the weekly inventory data.

Click on graph for larger image.

Click on graph for larger image.

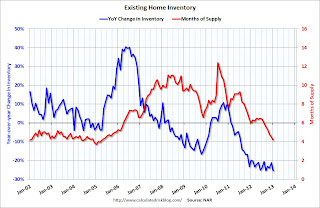

This graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Look at that year-over-year decline (blue line). Inventory has been falling sharply on a year-over-year basis for some time. With the low level of inventory, both in absolute numbers and as a month-of-supply, and the recent price increases in some areas, it would some likely more inventory would come on the market.

But what if this is incorrect? Just imagine if inventory falls another 25% by January 2014. That would be the lowest level of inventory in decades. At the current sales rate, the months-of-supply would fall to 3.2 months. I just don't see that happening. So, it seems likely that at least the rate of inventory decline will slow.

My view has been that if prices increase enough, then some of the potential sellers will come off the fence, and some underwater homeowners would be able to sell. Zillow just reported that 2 Million Homeowners Freed From Negative Equity in 2012; 1 Million More to Come in 2013

Almost 2 million American homeowners were freed from negative equity in 2012, and the overall percentage of all homeowners with a mortgage in negative equity fell to 27.5 percent at the end of the fourth quarter, according to Zillow’s fourth quarter Negative Equity Report.So some of these people can sell now.

The falling negative equity rate is good news for struggling homeowners and is largely attributable to a 5.9 percent bump in home values nationwide last year to a median Zillow Home Value Index of $157,400 (when home values rise, negative equity falls). At the end of 2011, 31.1 percent of homeowners with a mortgage were underwater, or more than 15.7 million people.

I need to think about this, but if inventory keeps falling sharply, we might see stronger house price gains in 2013 than originally expected - and maybe more new homes on the market (although some builders are lot constrained this year). This will be an interesting issue all year.

A Brief Comment on Lumber Prices

by Calculated Risk on 2/22/2013 09:16:00 AM

Joseph Cotterill at the FT Alphaville blog linked to a post on lumber prices last night: Listen to Lumber. The post included a graph on lumber prices over the last few months, and showed a fairly sharp decline in future prices recently. The author wrote:

Over the past few years, the strength in lumber proved to be a leading indicator for the bullish action we had seen in the homebuilders and, frankly, all housing related stocks.I have no comment on housing stocks, but I suspect this decline is either just "noise" following a large price increase, or more supply coming back on the market (remember many mills closed during the housing bust, and I suspect some are coming back online). Back in 2010, after the end of the housing tax credit, I noted that lumber prices collapsed. But the dynamics were different (that was obviously tax credit related and not a real recovery).

This week, though, lumber has sold “limit down” ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph puts the recent decline in context. This graph shows two measures of lumber prices: 1) from Random Lengths through last week (via NAHB), and 2) CME futures (through today).

The recent decline in CME futures hardly shows up.

Thursday, February 21, 2013

Correction: MBA National Delinquency Survey Graph

by Calculated Risk on 2/21/2013 06:41:00 PM

This morning I posted a graph of mortgage delinquencies by "bucket". The graph I posted did not include Q4 2012 (I've updated the previous post). Here is the correct graph showing the improvement in Q4:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.04% from 3.25% in Q3. This is just below 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.16% in Q4, from 1.19% in Q3.

The 90 day bucket decreased to 2.89% from 2.96%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.74% from 4.07% and is now at the lowest level since 2008.

Here was the MBA press release: Mortgage Delinquency and Foreclosure Rates Finished 2012 Down Sharply

And an earlier post on the conference call: Q4 MBA National Delinquency Survey Comments

Existing Home Sales: Conventional Sales up Sharply

by Calculated Risk on 2/21/2013 04:15:00 PM

The NAR reported total sales were up 9.1% from January 2012, but conventional sales are probably up closer to 20% (or more) from January 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes - foreclosures and short sales - accounted for 23 percent of January sales, down from 24 percent in December and 35 percent in January 2012.Although this survey isn't perfect, if total sales were up 9.1% from January 2012, and distressed sales declined from 35% of total sales to 23%, this suggests conventional sales were up sharply year-over-year - a good sign.

And what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory could come on the market and keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

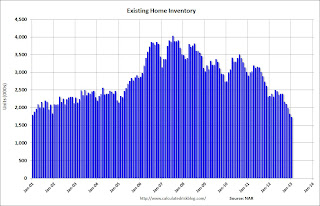

The NAR reported inventory decreased to 1.74 million units in January, down from 1.83 million in December. This is down 25.3% from January 2012, and down 19% from the inventory level in January 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level of inventory since December 1999.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows inventory for January since 2001. In 2005 inventory kept rising all year - and that was a clear sign that the housing bubble was ending. Inventory was very high from 2006 through 2011, and started declining in 2012.

The months-of-supply has fallen to 4.2 months. Since months-of-supply uses Not Seasonally Adjusted (NSA) inventory, and Seasonally Adjusted (SA) sales, I expect months-of-supply to stop declining in February.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in January (black column) are above the sales for for 2009 through 2012, but below the bubble years of 2005 and 2006.

Sales NSA in January (black column) are above the sales for for 2009 through 2012, but below the bubble years of 2005 and 2006. Note that January is usually the weakest month of the year and sales typically increase in March and peak in the summer.

Earlier:

• Existing Home Sales in January: 4.92 million SAAR, 4.2 months of supply

Key Measures show low inflation in January

by Calculated Risk on 2/21/2013 02:57:00 PM

Catching up ... the Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in January. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report. Effective with this release, the median CPI and 16% trimmed-mean CPI have been updated to reflect the annual recalculation of seasonal factors in the monthly CPI report from the BLS.Note: The Cleveland Fed has the median CPI details for January here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat 0.0% (0.3% annualized rate) in January. The CPI less food and energy increased 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.9%. Core PCE is for December and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI increased 3.1% annualized. Also core PCE for December increased 0.2% annualized.

The inflation report for February will be released on March 15th, a few days before the next Fed meeting. But with this low level of inflation and the current high level of unemployment, I expect the Fed will keep the "pedal to the metal" at the meeting of March 19th and 20th.

Q4 MBA National Delinquency Survey Comments

by Calculated Risk on 2/21/2013 12:47:00 PM

A few comments from Mike Fratantoni, MBA Vice President, Single-Family Research and Policy Development, on the Q4 MBA National Delinquency Survey conference call.

• There was a significant drop in most measures of delinquencies.

• Overall delinquencies are still elevated, but the movement is in the right direction.

• Fratantoni expects that we will eventually see lower than historical delinquency rates because of the strong credit quality of recent originations. In response to a question from me, he said that he expects most deliquency measures will be back to normal in "2 to 3" years, but that it will take much longer for the foreclosure inventory to return to normal because of the backlog in judicial states. Jay Brinkmann, MBA’s Chief Economist and Senior Vice President of Research added that some measures (like the 30 delinquency rate) are already back to normal, and that some measures will take longer than others.

• The FHA is showing strong credit quality for origination in 2010, 2011 and 2012. Most of the delinquent loans are from the 2008 and 2009 vintages.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (12.15% in foreclosure down from 13.04% in Q3), New Jersey (8.85% down from 8.87%), New York (6.34% down from 6.46%), Illinois (6.33% down from 6.83%), and Nevada (the only non-judicial state in the top 13 at 5.87% down from 5.93%).

As Fratantoni noted, California (2.06% down from 2.63%) and Arizona (2.02% down from 2.51%) are now well below the national average by every measure.

MBA: "Mortgage Delinquency and Foreclosure Rates Finished 2012 Down Sharply"

by Calculated Risk on 2/21/2013 11:44:00 AM

Note: I'll post more on existing home sales soon, and on mortgage delinquencies later today.

From the MBA: Mortgage Delinquency and Foreclosure Rates Finished 2012 Down Sharply

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 7.09 percent of all loans outstanding at the end of the fourth quarter of 2012, the lowest level since 2008, a decrease of 31 basis points from the previous quarter, and down 49 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey, released today at MBA’s National Servicing Conference and Expo in Dallas, Texas.

While delinquency rates typically increase between the third and fourth quarters of the year, even the non-seasonally adjusted delinquency rate dropped 13 basis points to 7.51 percent this quarter from 7.64 percent last quarter.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started during the fourth quarter was 0.70 percent, the lowest level since the second quarter of 2007, down 20 basis points from last quarter and down 29 basis points from one year ago. The percentage of loans in the foreclosure process at the end of the fourth quarter was 3.74 percent, the lowest level since the fourth quarter of 2008, down 33 basis points from the third quarter and 64 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans 90 days or more past due or in the process of foreclosure, was 6.78 percent, a decrease of 25 basis points from last quarter, and a decrease of 95 basis points from the fourth quarter of 2011.

“We are seeing large improvements in mortgage performance nationally and in almost every state. The 30 day delinquency rate decreased 21 basis points to its lowest level since mid-2007. With fewer new delinquencies, the foreclosure start rate and foreclosure inventory rates continue to fall and are at their lowest levels since 2007 and 2008 respectively,” said Jay Brinkmann, MBA’s Chief Economist and Senior Vice President of Research.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.04% from 3.25% in Q3. This is just below 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.16% in Q4, from 1.19% in Q3.

The 90 day bucket decreased to 2.89% from 2.96%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.74% from 4.07% and is now at the lowest level since 2008.

I'll have more on the delinquency survey later.

Existing Home Sales in January: 4.92 million SAAR, 4.2 months of supply

by Calculated Risk on 2/21/2013 10:00:00 AM

The NAR reports: January Existing-Home Sales Hold with Steady Price Gains, Seller’s Market Developing

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 0.4 percent to a seasonally adjusted annual rate of 4.92 million in January from a downwardly revised 4.90 million in December, and are 9.1 percent above the 4.51 million-unit pace in January 2012.

Total housing inventory at the end of January fell 4.9 percent to 1.74 million existing homes available for sale, which represents a 4.2-month supply 2 at the current sales pace, down from 4.5 months in December, and is the lowest housing supply since April 2005 when it was also 4.2 months.

Listed inventory is 25.3 percent below a year ago when there was a 6.2-month supply. Raw unsold inventory is at the lowest level since December 1999 when there were 1.71 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2013 (4.92 million SAAR) were 0.4% higher than last month, and were 9.1% above the January 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 1.74 million in January down from 1.83 million in December. This is the lowest level of inventory since December 1999. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 1.74 million in January down from 1.83 million in December. This is the lowest level of inventory since December 1999. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 25.3% year-over-year in January from January 2012. This is the 23rd consecutive month with a YoY decrease in inventory.

Inventory decreased 25.3% year-over-year in January from January 2012. This is the 23rd consecutive month with a YoY decrease in inventory.Months of supply declined to 4.2 months in January, the lowest level since April 2005.

This was at expectations of sales of 4.94 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Weekly Initial Unemployment Claims increase to 362,000

by Calculated Risk on 2/21/2013 08:36:00 AM

The DOL reports:

In the week ending February 16, the advance figure for seasonally adjusted initial claims was 362,000, an increase of 20,000 from the previous week's revised figure of 342,000. The 4-week moving average was 360,750, an increase of 8,000 from the previous week's revised average of 352,750.The previous week was revised up from 341,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 360,750 - the highest 4-week average since the first week of January.

Weekly claims were above the 359,000 consensus forecast.