by Calculated Risk on 2/16/2013 04:30:00 PM

Saturday, February 16, 2013

Unofficial Problem Bank list declines to 812 Institutions

Here is the unofficial problem bank list for Feb 15, 2013.

Changes and comments from surferdude808:

Many changes were made to the Unofficial Problem Bank List this week with a failure and the OCC releasing its enforcement action through mid-January 2013. In all, there were 10 removals and three additions that leave the list at 812 institutions with assets of $303 billion. A year ago, the list held 956 institutions with assets of $389.6 billion.Earlier:

The three additions this week were Acacia Federal Savings Bank, Falls Church, VA ($911 million); The Baraboo National Bank, Baraboo, WI ($739 million); and Commonwealth Bank, FSB, Mount Sterling, KY ($21 million).

The OCC terminated actions against Inter National Bank, McAllen, TX ($2.2 billion); The Kishacoquillas Valley National Bank of Belleville, Belleville, PA ($564 million Ticker: KISB); The First National Bank of Elk River, Elk River, MN ($248 million); Noble Bank & Trust, N.A., Anniston, AL ($169 million); Frontier Bank, Rock Rapids, IA ($151 million); International City Bank, National Association, Long Beach, CA ($144 million); First National Bank of Decatur County, Bainbridge, GA ($111 million); Neighborhood National Bank, Alexandria, MN ($48 million); and The Farmers and Merchants National Bank of Hatton, Hatton, ND ($26 million).

The other removal was the failed Covenant Bank, Chicago, IL ($60 million), which was the third failure this year. Covenant Bank was quite costly to shutter as the FDIC cost estimate is $21.8 million or about 37 percent of the failed bank's assets. The last failure in Chicago, Second Federal Savings and Loan Association of Chicago, in July 2012, was also quite expensive with an estimated cost of 40.3 percent of assets. Excluding Washington Mutual, failure costs have averaged an estimated 24.8 percent of failed assets for the 467 closings since 2008. Prior to the crisis, resolution costs were around 12 percent. Thus, the losses in this crisis are well above historical experience, which suggests the banking regulators did not effectively curb risk taking before the bursting of the bubble and that insolvent institutions have not been closed in a timely manner.

Late in the day on Friday, eyes were focused on New Mexico to see if the state banking department would declare Sunrise Bank of Albuquerque, Albuquerque, NM ($52 million) insolvent as it needed a $1 million capital infusion by 5:30 p.m. According to a media report by SNL Securities, Sunrise's parent, Capitol Bancorp, asked a federal bankruptcy judge to approve a secured loan from unnamed investors that could be used to recapitalize the bank. Capitol Bancorp controls 11 banks on the Unofficial Problem Bank List, of which eight also operating under a Prompt Corrective Action order. In its filing, Capitol Bancorp intimated that a failure of its New Mexico unit would have dire consequences as it could trigger a cross guaranty liability of more than $10 million the FDIC could assess across the other controlled bank units, which could lead to a collapse of the entire company. Capitol Bancorp has agreed to sell its New Mexico bank to Westar Bancorp, but the buyer has not been able to secure the necessary regulatory approvals to consummate the transaction. The FDIC has provided Capitol Bancorp much latitude by issuing at least 16 cross guaranty liability waivers to previously controlled banking units the company has sold as part of its recapitalization efforts. As of 11 p.m. east coast, it has been radio silence as there is no update if the capital made it to the New Mexico unit or if the deadline has been extended. We will continue to monitor and provide updates on Capitol Bancorp. Should a unit fail and if the cross guaranty liability is applied, it could make for a busy night for the FDIC as it is unlikely the units would be purchased by a single buyer given their size and geographic dispersion.

• Summary for Week Ending Feb 15th

• Schedule for Week of Feb 17th

Summary for Week ending February 16th

by Calculated Risk on 2/16/2013 01:11:00 PM

The Industrial Production release was a reporting challenge this week. Expectations were for production to increase 0.1% in January, but the Federal Reserve reported a 0.1% decrease. At first glance, this appears to be disappointing, however production for November and December were revised up significantly, and total production in January was actually above expectations. Here are a few details ...

First, Industrial Production is an index that is set to 100 for a base year, currently 2007. Production in December was originally reported as 98.1 (98.1% of 2007 production). Production in January was reported at 98.6 (98.6% of 2007 levels - yes, production is still below the pre-recession levels). That would have been a 0.5% increase, well above expectations. However production in December was revised up to 98.7, so production in January showed a slight decline.

This is a reminder that we need to look at more than one month of data and that headlines can be a little misleading. Overall - with revisions - the industrial production report was solid.

The key report for the week was January retail sales. This showed an increase of only 0.1% in January indicating sluggish retail sales growth. Retail sales are probably being impacted by the payroll tax increase. Two internal WalMart memo leaked this week suggest the largest US retailer is seeing weak sales, see from Bloomberg: Wal-Mart Executives Sweat Slow February Start in E-Mails. A couple of emails:

"In case you haven’t seen a sales report these days, February MTD sales are a total disaster," Jerry Murray, Wal- Mart’s vice president of finance and logistics, said in a Feb. 12 e-mail to other executives, referring to month-to-date sales. "The worst start to a month I have seen in my ~7 years with the company."This is probably an impact of the payroll tax increase.

...

"Have you ever had one of those weeks where your best- prepared plans weren’t good enough to accomplish everything you set out to do?" [Cameron Geiger, senior vice president of Wal-Mart U.S. Replenishment] asked in a Feb. 1 e-mail to executives. "Well, we just had one of those weeks here at Walmart U.S. Where are all the customers? And where’s their money?"

And here is a summary of last week in graphs:

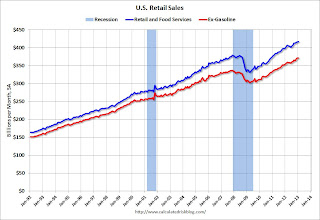

• Retail Sales increased 0.1% in January

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales increased 0.1% from December to January (seasonally adjusted), and sales were up 4.7% from January 2012. Sales for December were unrevised at a 0.5% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was at the consensus forecast of a 0.1% increase, and might indicate some slowdown in retail spending growth related to the payroll tax increase.

• Fed: Industrial Production declined 0.1% in January

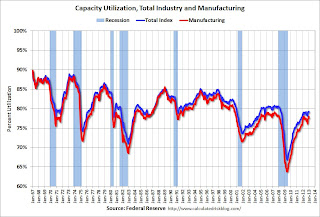

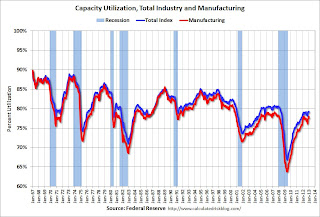

This graph shows Capacity Utilization. The capacity utilization rate for total industry decreased in January to 79.1 percent. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. The capacity utilization rate for total industry decreased in January to 79.1 percent. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 79.1% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007. Note: December 2012 was revised up from 78.8%.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 98.6 (December 2012 was revised up from 98.1). This is 18.2% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly below expectations, however the previous months were revised up significantly.

• Weekly Initial Unemployment Claims decline to 341,000

"In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000."

"In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000."The previous week was revised up from 366,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Weekly claims were below the 360,000 consensus forecast, and the 4-week average is close to the lowest level since early 2008.

• BLS: Job Openings "little changed" in December

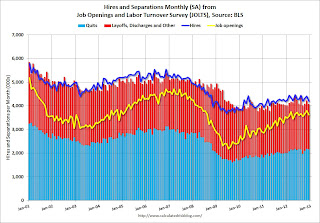

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Jobs openings decreased in December to 3.617 million, down from 3.790 million in November. The number of job openings (yellow) has generally been trending up, but openings are only up 2% year-over-year compared to December 2011.

Quits decreased slightly in December, and quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

• Preliminary February Consumer Sentiment increases to 76.3

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8.

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8. This was slightly above the consensus forecast of 75.0, but still very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and the default threat from Congress. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little.

Schedule for Week of Feb 17th

by Calculated Risk on 2/16/2013 08:53:00 AM

Note: I'll post a summary for last week later today.

There are three key housing reports that will be released this week: January housing starts on Wednesday, January Existing home sales on Thursday, and the homebuilder confidence survey on Tuesday.

Other key releases include the Q4 MBA National Mortgage Delinquency Survey on Thursday, and the FOMC minutes of the January meeting on Wednesday.

For manufacturing, the February Philly Fed survey will be released this week.

For prices, CPI and PPI for January will be released.

All US markets are closed in observance of the President's Day holiday.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in January. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR). Single-family starts increased to 616 thousand in December.

The consensus is for total housing starts to decrease to 914 thousand (SAAR) in January, down from 954 thousand in December.

8:30 AM: Producer Price Index for January. The consensus is for a 0.3% increase in producer prices (0.2% increase in core).

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for January 29-30, 2013.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 341 thousand last week.

8:30 AM: Consumer Price Index for January. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.2%.

9:00 AM: The Markit US PMI Manufacturing Index Flash. The consensus is for a decrease to 55.5 from 56.1 in January.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in December 2012 were 4.94 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 1.1, up from minus 5.8 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for January. The consensus is for a 0.3% increase in this index.

During the day: The MBA's National Mortgage Delinquency Survey for Q4.

No releases scheduled.

Friday, February 15, 2013

Bank Failure #3 in 2013: Covenant Bank, Chicago, Illinois

by Calculated Risk on 2/15/2013 09:07:00 PM

The rate of bank failures has slowed significantly, and most of the recent failures have been pretty small banks. But here is a Friday tradition ...

From the FDIC: Liberty Bank and Trust Company, New Orleans, Louisiana, Assumes All of the Deposits of Covenant Bank, Chicago, Illinois

As of December 31, 2012, Covenant Bank had approximately $58.4 million in total assets and $54.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $21.8 million. ... Covenant Bank is the 3rd FDIC-insured institution to fail in the nation this year, and the first in Illinois.

Update: Table of Short Sales and Foreclosures for Selected Cities in January

by Calculated Risk on 2/15/2013 07:13:00 PM

Economist Tom Lawler sent me this updated table (below) of short sales and foreclosures for several selected cities and areas in January.

Look at the right two columns in the table below (Total "Distressed" Share for Jan 2013 compared to Jan 2012). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Jan 2013 to Jan 2012. Foreclosure sales have declined in almost all of these areas (Orlando is an exception), and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law).

Also there has been a shift from foreclosures to short sales. In most areas, short sales now out number foreclosures (Minneapolis and Orlando are exceptions).

Overall this is moving in the right direction, although some areas are lagging behind.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Jan | 12-Jan | 13-Jan | 12-Jan | 13-Jan | 12-Jan | |

| Las Vegas | 36.2% | 28.1% | 12.5% | 45.5% | 48.7% | 73.6% |

| Reno | 41.0% | 37.0% | 10.0% | 40.0% | 51.0% | 77.0% |

| Phoenix | 17.6% | 29.8% | 16.2% | 27.9% | 33.8% | 57.7% |

| Sacramento | 30.3% | 32.1% | 14.2% | 34.5% | 44.5% | 66.6% |

| Minneapolis | 10.6% | 16.2% | 32.3% | 39.0% | 42.9% | 55.2% |

| Mid-Atlantic (MRIS) | 13.1% | 16.4% | 12.7% | 16.9% | 25.8% | 33.3% |

| Orlando | 23.7% | 37.6% | 26.7% | 26.2% | 50.4% | 63.7% |

| California (DQ)* | 26.1% | 27.0% | 18.7% | 34.3% | 44.8% | 61.3% |

| Bay Area CA (DQ)* | 23.3% | 28.1% | 14.4% | 27.2% | 37.7% | 55.3% |

| So. California (DQ)* | 25.9% | 27.2% | 15.0% | 32.6% | 40.9% | 59.8% |

| Hampton Roads | 34.9% | 37.2% | ||||

| Chicago | 49.0% | 52.0% | ||||

| Charlotte | 18.1% | 21.0% | ||||

| Metro Detroit | 36.3% | 54.5% | ||||

| Memphis* | 25.9% | 36.6% | ||||

| Birmingham AL | 30.2% | 38.2% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler: Publicly-Traded Home Builder Results and Comparison to Census New Home Sales

by Calculated Risk on 2/15/2013 03:28:00 PM

From economist Tom Lawler:

Below is a summary of some selected stats from nine large publicly-traded home builders.

While not shown below, the combined order backlog of these builders on December 31, 2012 was 28,455, up 55.8% from the end of 2011.

As I’ve noted before, comparing these builder results with the Census Bureau’s estimate of overall US new home sales is tricky; first, Census deals with sales cancellations differently from home builder results, and second, there appear to be differences between when builders “book” a sales order and when Census “counts” a sale.

While I only have data for the above builders back to Q2/2009, the limited data suggest that reported builder sales “lead” the Census home sales data. At the bottom is a chart showing Census new home sales data and a two-quarter average of the above builders’ net orders data (shown in index form).

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Beazer Homes | 932 | 724 | 28.7% | 1,038 | 867 | 19.7% | $235,500 | $215,500 | 9.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 17,863 | 13,067 | 36.7% | 20,061 | 15,854 | 26.5% | $282,723 | $263,035 | 7.5% |

Click on graph for larger image.

Click on graph for larger image.The chart suggests that Census’ industry estimates and these nine builders’ net orders moved pretty closely together from 2009 through early 2012. Over the last three quarters, however, these nine builders’ net orders showed considerably more strength that Census’ estimates in the last three quarters of 2012, with the “gap” widening throughout the year. This suggests either that large builders’ share of the new SF home market increased last year, though it also suggests that Census’ new home sales estimate for the last quarter of 2012 may be revised upward.

Mortgage Rates Unchanged in Latest Survey, Up slightly over last few months

by Calculated Risk on 2/15/2013 01:32:00 PM

From Freddie Mac yesterday: 30-Year Fixed-Rate Mortgage Unchanged for Third Consecutive Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates unchanged from the previous week and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.53 percent with an average 0.8 point for the week ending February 14, 2013, the same as last week. Last year at this time, the 30-year FRM averaged 3.87 percent.

15-year FRM this week averaged 2.77 percent with an average 0.8 point, the same as last week. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

The record low in the Freddie Mac survey for a 30 year fixed rate mortgage was 3.31% in November 2012.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

Preliminary February Consumer Sentiment increases to 76.3

by Calculated Risk on 2/15/2013 10:03:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8.

This was slightly above the consensus forecast of 75.0, but still very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and the default threat from Congress. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little.

Earlier, a solid report from the NY Fed: February Empire State Manufacturing Survey indicates conditions for New York manufacturers improved for first time since summer of last year

The general business conditions index rose into positive territory, advancing eighteen points to 10.0. The new orders index also rose sharply, climbing twenty points to 13.3, and the shipments index increased to 13.1. The prices paid index pointed to a continued acceleration in selling prices, and the prices received index, while positive, inched lower. The index for number of employees rose for a third consecutive month and, at 8.1, registered its first positive reading since September, though the average workweek index remained negative.

Fed: Industrial Production declined 0.1% in January

by Calculated Risk on 2/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in January after having risen 0.4 percent in December. In January, manufacturing output decreased 0.4 percent following upwardly revised gains of 1.1 percent in December and 1.7 percent in November. For the fourth quarter as a whole, manufacturing production is now estimated to have advanced 1.9 percent at an annual rate; previously, the increase was reported to have been 0.2 percent. In January, the output of utilities rose 3.5 percent, as demand for heating was boosted by temperatures that fell closer to their seasonal norms; the production at mines declined 1.0 percent. At 98.6 percent of its 2007 average, total industrial production in January was 2.1 percent above its level of a year earlier. The capacity utilization rate for total industry decreased in January to 79.1 percent, a rate that is 1.1 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.1% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007. Note: December 2012 was revised up from 78.8%.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 98.6 (December 2012 was revised up from 98.1). This is 18.2% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly below expectations, however the previous months were revised up significantly.

Thursday, February 14, 2013

Friday: Industrial Production, Consumer sentiment, Empire State Mfg Survey

by Calculated Risk on 2/14/2013 07:29:00 PM

I'd like to mention a few key economic themes that I will write more about soon:

• Residential investment (RI) has bottomed and is now contributing to economic growth. Since RI is usually the best leading indicator for the economy, the economy will probably continue to grow for the next couple of years.

• House prices bottomed in early 2012, and will increase further in 2013 - although not all areas are the same. A key this year will be how much inventory comes on the market (something I will track closely). More inventory would mean smaller house price increases.

• The drag from state and local governments is probably over following four years of austerity.

• Construction employment should pick up in 2013.

• The Federal deficit is declining fairly rapidly, and will decline further over the next few years - before starting to increase again due to health care costs.

Not much has changed, but here were my 10 questions for 2013:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Friday economic releases:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for February. The consensus is for a reading of minus 2.0, up from minus 7.8 in January (below zero is contraction).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.3% increase in Industrial Production in January, and for Capacity Utilization to increase to 78.9%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for February) will be released. The consensus is for a reading of 75.0, up from 73.8.