by Calculated Risk on 2/15/2013 09:07:00 PM

Friday, February 15, 2013

Bank Failure #3 in 2013: Covenant Bank, Chicago, Illinois

The rate of bank failures has slowed significantly, and most of the recent failures have been pretty small banks. But here is a Friday tradition ...

From the FDIC: Liberty Bank and Trust Company, New Orleans, Louisiana, Assumes All of the Deposits of Covenant Bank, Chicago, Illinois

As of December 31, 2012, Covenant Bank had approximately $58.4 million in total assets and $54.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $21.8 million. ... Covenant Bank is the 3rd FDIC-insured institution to fail in the nation this year, and the first in Illinois.

Update: Table of Short Sales and Foreclosures for Selected Cities in January

by Calculated Risk on 2/15/2013 07:13:00 PM

Economist Tom Lawler sent me this updated table (below) of short sales and foreclosures for several selected cities and areas in January.

Look at the right two columns in the table below (Total "Distressed" Share for Jan 2013 compared to Jan 2012). In every area that reports distressed sales, the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Look at the middle two columns comparing foreclosure sales for Jan 2013 to Jan 2012. Foreclosure sales have declined in almost all of these areas (Orlando is an exception), and some of the declines have been stunning (the Nevada sales were impacted by a new foreclosure law).

Also there has been a shift from foreclosures to short sales. In most areas, short sales now out number foreclosures (Minneapolis and Orlando are exceptions).

Overall this is moving in the right direction, although some areas are lagging behind.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Jan | 12-Jan | 13-Jan | 12-Jan | 13-Jan | 12-Jan | |

| Las Vegas | 36.2% | 28.1% | 12.5% | 45.5% | 48.7% | 73.6% |

| Reno | 41.0% | 37.0% | 10.0% | 40.0% | 51.0% | 77.0% |

| Phoenix | 17.6% | 29.8% | 16.2% | 27.9% | 33.8% | 57.7% |

| Sacramento | 30.3% | 32.1% | 14.2% | 34.5% | 44.5% | 66.6% |

| Minneapolis | 10.6% | 16.2% | 32.3% | 39.0% | 42.9% | 55.2% |

| Mid-Atlantic (MRIS) | 13.1% | 16.4% | 12.7% | 16.9% | 25.8% | 33.3% |

| Orlando | 23.7% | 37.6% | 26.7% | 26.2% | 50.4% | 63.7% |

| California (DQ)* | 26.1% | 27.0% | 18.7% | 34.3% | 44.8% | 61.3% |

| Bay Area CA (DQ)* | 23.3% | 28.1% | 14.4% | 27.2% | 37.7% | 55.3% |

| So. California (DQ)* | 25.9% | 27.2% | 15.0% | 32.6% | 40.9% | 59.8% |

| Hampton Roads | 34.9% | 37.2% | ||||

| Chicago | 49.0% | 52.0% | ||||

| Charlotte | 18.1% | 21.0% | ||||

| Metro Detroit | 36.3% | 54.5% | ||||

| Memphis* | 25.9% | 36.6% | ||||

| Birmingham AL | 30.2% | 38.2% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler: Publicly-Traded Home Builder Results and Comparison to Census New Home Sales

by Calculated Risk on 2/15/2013 03:28:00 PM

From economist Tom Lawler:

Below is a summary of some selected stats from nine large publicly-traded home builders.

While not shown below, the combined order backlog of these builders on December 31, 2012 was 28,455, up 55.8% from the end of 2011.

As I’ve noted before, comparing these builder results with the Census Bureau’s estimate of overall US new home sales is tricky; first, Census deals with sales cancellations differently from home builder results, and second, there appear to be differences between when builders “book” a sales order and when Census “counts” a sale.

While I only have data for the above builders back to Q2/2009, the limited data suggest that reported builder sales “lead” the Census home sales data. At the bottom is a chart showing Census new home sales data and a two-quarter average of the above builders’ net orders data (shown in index form).

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Beazer Homes | 932 | 724 | 28.7% | 1,038 | 867 | 19.7% | $235,500 | $215,500 | 9.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 17,863 | 13,067 | 36.7% | 20,061 | 15,854 | 26.5% | $282,723 | $263,035 | 7.5% |

Click on graph for larger image.

Click on graph for larger image.The chart suggests that Census’ industry estimates and these nine builders’ net orders moved pretty closely together from 2009 through early 2012. Over the last three quarters, however, these nine builders’ net orders showed considerably more strength that Census’ estimates in the last three quarters of 2012, with the “gap” widening throughout the year. This suggests either that large builders’ share of the new SF home market increased last year, though it also suggests that Census’ new home sales estimate for the last quarter of 2012 may be revised upward.

Mortgage Rates Unchanged in Latest Survey, Up slightly over last few months

by Calculated Risk on 2/15/2013 01:32:00 PM

From Freddie Mac yesterday: 30-Year Fixed-Rate Mortgage Unchanged for Third Consecutive Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates unchanged from the previous week and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.53 percent with an average 0.8 point for the week ending February 14, 2013, the same as last week. Last year at this time, the 30-year FRM averaged 3.87 percent.

15-year FRM this week averaged 2.77 percent with an average 0.8 point, the same as last week. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

The record low in the Freddie Mac survey for a 30 year fixed rate mortgage was 3.31% in November 2012.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

Preliminary February Consumer Sentiment increases to 76.3

by Calculated Risk on 2/15/2013 10:03:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for February increased to 76.3 from the January reading of 73.8.

This was slightly above the consensus forecast of 75.0, but still very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and the default threat from Congress. People will slowly adjust to the payroll tax increase, and the threat of default is now behind us ... and sentiment has improved a little.

Earlier, a solid report from the NY Fed: February Empire State Manufacturing Survey indicates conditions for New York manufacturers improved for first time since summer of last year

The general business conditions index rose into positive territory, advancing eighteen points to 10.0. The new orders index also rose sharply, climbing twenty points to 13.3, and the shipments index increased to 13.1. The prices paid index pointed to a continued acceleration in selling prices, and the prices received index, while positive, inched lower. The index for number of employees rose for a third consecutive month and, at 8.1, registered its first positive reading since September, though the average workweek index remained negative.

Fed: Industrial Production declined 0.1% in January

by Calculated Risk on 2/15/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in January after having risen 0.4 percent in December. In January, manufacturing output decreased 0.4 percent following upwardly revised gains of 1.1 percent in December and 1.7 percent in November. For the fourth quarter as a whole, manufacturing production is now estimated to have advanced 1.9 percent at an annual rate; previously, the increase was reported to have been 0.2 percent. In January, the output of utilities rose 3.5 percent, as demand for heating was boosted by temperatures that fell closer to their seasonal norms; the production at mines declined 1.0 percent. At 98.6 percent of its 2007 average, total industrial production in January was 2.1 percent above its level of a year earlier. The capacity utilization rate for total industry decreased in January to 79.1 percent, a rate that is 1.1 percentage points below its long-run (1972--2012) average.

emphasis added

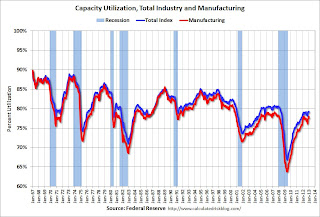

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.1% is still 1.1 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007. Note: December 2012 was revised up from 78.8%.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in January to 98.6 (December 2012 was revised up from 98.1). This is 18.2% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were slightly below expectations, however the previous months were revised up significantly.

Thursday, February 14, 2013

Friday: Industrial Production, Consumer sentiment, Empire State Mfg Survey

by Calculated Risk on 2/14/2013 07:29:00 PM

I'd like to mention a few key economic themes that I will write more about soon:

• Residential investment (RI) has bottomed and is now contributing to economic growth. Since RI is usually the best leading indicator for the economy, the economy will probably continue to grow for the next couple of years.

• House prices bottomed in early 2012, and will increase further in 2013 - although not all areas are the same. A key this year will be how much inventory comes on the market (something I will track closely). More inventory would mean smaller house price increases.

• The drag from state and local governments is probably over following four years of austerity.

• Construction employment should pick up in 2013.

• The Federal deficit is declining fairly rapidly, and will decline further over the next few years - before starting to increase again due to health care costs.

Not much has changed, but here were my 10 questions for 2013:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Friday economic releases:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for February. The consensus is for a reading of minus 2.0, up from minus 7.8 in January (below zero is contraction).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.3% increase in Industrial Production in January, and for Capacity Utilization to increase to 78.9%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for February) will be released. The consensus is for a reading of 75.0, up from 73.8.

FNC: Residential Property Values increased 4.9% year-over-year in December

by Calculated Risk on 2/14/2013 03:02:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: U.S. Home Prices Hit Two-Year High

The latest FNC Residential Price Index™ (RPI) shows continuing momentum in the U.S. housing market with home prices rising to a two-year high in December. Despite an unexpected deceleration in economic growth, the ongoing housing recovery has maintained its pace with steady gains in home prices, sending the index up 5.4% year to date. ...The year-over-year change continued to increase in December, with the 100-MSA composite up 4.9% compared to December 2011. The FNC index turned positive on a year-over-year basis in July, 2012, and that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

A stabilizing foreclosure market is contributing to the recovery of the underlying property values. While challenges remain for many hard-hit markets, particularly those undergoing a judicial process for home foreclosures, there are signs that foreclosure prices have bottomed out—the first encouraging development in the long housing recession where a rising underlying market and stabilizing foreclosure prices co-exist. Foreclosures as a percentage of total home sales were 17.8% in December, down from 24.0% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that December home prices remained relatively unchanged from the previous month, but were up 4.9% on a year-over-year basis from the same period in 2011. ... The 30-MSA and 10-MSA composite indices show similar trends of continued price momentum, relatively unchanged from November and up 5.8% from December 2011.

Half of the component markets tracked by the FNC 30-MSA composite index show rising prices in December. ... Although signs of a housing recovery are widening, the degree of market improvement is inconsistent across the country. In Baltimore, Chicago, Houston, and San Antonio, prices were relatively flat over the last 12 months (year-to-year change). In contrast, Phoenix and Denver saw a double-digit growth, led by Phoenix at nearly 23%. The Chicago market continues to underperform other major cities that make up the FNC 30-MSA composite index. The city’s home prices were up only 1.0% on a year-over-year basis, compared to an average of 5.0% among the nation’s largest cities.

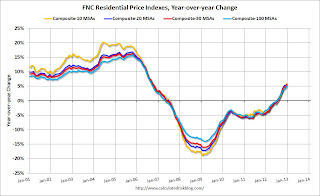

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Report: Housing Inventory declines 16% year-over-year in January

by Calculated Risk on 2/14/2013 12:00:00 PM

From Realtor.com: January 2012 Real Estate Trend Data

January, the total U.S. for-sale inventory of single-family homes, condos, townhomes and co-ops (SFH/CTHCOPS) dropped to its lowest point since Realtor.com started collecting these data, with 1,477,266 units for sale, down 16.47 percent compared with a year ago and less than half its peak of 3.1 million units in September 2007.Realtor.com only started tracking inventory in September 2007, and this is probably the lowest inventory level in over a decade. On a month-over-month basis, inventory declined 5.6%.

...

On a year-over-year basis, for-sale inventory declined in all but three of the 146 markets tracked by Realtor.com while list prices increased in 71 markets, held steady in 24 markets and declined in 51 markets. The number of markets experiencing year-over-year list price declines has increased in the past six months, underscoring the growing fragility of many housing markets.

Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market following the holidays in mid-to-late January, the NAR will probably report a month-to-month increase in inventory for January (or a smaller decline than Realtor.com).

Click on graph for larger image.

Click on graph for larger image.This graph from Realtor.com shows the reported average monthly inventory over the last few years.

Inventory will be important to track in 2013. There is a good chance that inventory has bottomed, or, at the least, the year-over-year declines in inventory should get much smaller.

My guess is inventory has bottomed, and I expect more inventory will come on the market in areas that have seen recent price appreciation.

The NAR is scheduled to report January existing home sales and inventory on Thursday, Feb 21st.

Report: U.S. Foreclosure Starts Decline in January due to new California Law

by Calculated Risk on 2/14/2013 10:18:00 AM

From RealtyTrac: U.S. Foreclosure Starts Fall to Six-Year Low in January

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2013, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 150,864 U.S. properties in January, a decrease of 7 percent from the previous month and down 28 percent from January 2012.This is a tale of different states, and different laws. Mostly the non-judicial states are resolving delinquent mortgages quicker since foreclosures don't have to go through the court system. However new laws - like the "Homeowners Bill of Rights" in California - are dramatically slowing foreclosures in some non-judicial states.

“The U.S. foreclosure landscape in January was profoundly altered by the effects of new legislation that took effect in California on the first of the year,” said Daren Blomquist, vice president at RealtyTrac. “Dubbed the Homeowners Bill of Rights, this legislation extends many of the principles in the national mortgage settlement — including a prohibition on so-called dual tracking and requiring a single point of contact for borrowers facing foreclosure — to all mortgage servicers operating in California. In addition the new law imposes fines of up to $7,500 per loan for filing of multiple unverified foreclosure documents. As a result, the downward foreclosure trend in California accelerated into hyper speed in January, decisively shifting the balance of power when it comes to the nation’s foreclosure activity.

“For the first time since January 2007 California did not have the most properties with foreclosure filings of any state. Instead that dubious distinction went to Florida, where January foreclosure activity increased on an annual basis for the 11th time in the last 13 months.”

The national decrease in foreclosure starts was caused in large part by a sharp drop in California notices of default (NOD) in January, down 62 percent from December and down 75 percent from January 2012 to the lowest level since October 2005.

Scheduled foreclosure auctions increased from the previous month in 26 states and the District of Columbia, hitting 12-month or more highs in several key judicial foreclosure states, including Florida, Illinois, Pennsylvania, and New Jersey, although foreclosure starts were down on a year-over-year basis in Florida, Illinois and Pennsylvania.