by Calculated Risk on 2/14/2013 03:02:00 PM

Thursday, February 14, 2013

FNC: Residential Property Values increased 4.9% year-over-year in December

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: U.S. Home Prices Hit Two-Year High

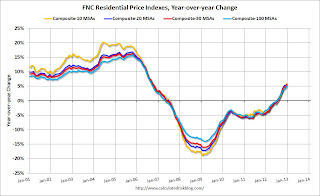

The latest FNC Residential Price Index™ (RPI) shows continuing momentum in the U.S. housing market with home prices rising to a two-year high in December. Despite an unexpected deceleration in economic growth, the ongoing housing recovery has maintained its pace with steady gains in home prices, sending the index up 5.4% year to date. ...The year-over-year change continued to increase in December, with the 100-MSA composite up 4.9% compared to December 2011. The FNC index turned positive on a year-over-year basis in July, 2012, and that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

A stabilizing foreclosure market is contributing to the recovery of the underlying property values. While challenges remain for many hard-hit markets, particularly those undergoing a judicial process for home foreclosures, there are signs that foreclosure prices have bottomed out—the first encouraging development in the long housing recession where a rising underlying market and stabilizing foreclosure prices co-exist. Foreclosures as a percentage of total home sales were 17.8% in December, down from 24.0% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that December home prices remained relatively unchanged from the previous month, but were up 4.9% on a year-over-year basis from the same period in 2011. ... The 30-MSA and 10-MSA composite indices show similar trends of continued price momentum, relatively unchanged from November and up 5.8% from December 2011.

Half of the component markets tracked by the FNC 30-MSA composite index show rising prices in December. ... Although signs of a housing recovery are widening, the degree of market improvement is inconsistent across the country. In Baltimore, Chicago, Houston, and San Antonio, prices were relatively flat over the last 12 months (year-to-year change). In contrast, Phoenix and Denver saw a double-digit growth, led by Phoenix at nearly 23%. The Chicago market continues to underperform other major cities that make up the FNC 30-MSA composite index. The city’s home prices were up only 1.0% on a year-over-year basis, compared to an average of 5.0% among the nation’s largest cities.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Report: Housing Inventory declines 16% year-over-year in January

by Calculated Risk on 2/14/2013 12:00:00 PM

From Realtor.com: January 2012 Real Estate Trend Data

January, the total U.S. for-sale inventory of single-family homes, condos, townhomes and co-ops (SFH/CTHCOPS) dropped to its lowest point since Realtor.com started collecting these data, with 1,477,266 units for sale, down 16.47 percent compared with a year ago and less than half its peak of 3.1 million units in September 2007.Realtor.com only started tracking inventory in September 2007, and this is probably the lowest inventory level in over a decade. On a month-over-month basis, inventory declined 5.6%.

...

On a year-over-year basis, for-sale inventory declined in all but three of the 146 markets tracked by Realtor.com while list prices increased in 71 markets, held steady in 24 markets and declined in 51 markets. The number of markets experiencing year-over-year list price declines has increased in the past six months, underscoring the growing fragility of many housing markets.

Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market following the holidays in mid-to-late January, the NAR will probably report a month-to-month increase in inventory for January (or a smaller decline than Realtor.com).

Click on graph for larger image.

Click on graph for larger image.This graph from Realtor.com shows the reported average monthly inventory over the last few years.

Inventory will be important to track in 2013. There is a good chance that inventory has bottomed, or, at the least, the year-over-year declines in inventory should get much smaller.

My guess is inventory has bottomed, and I expect more inventory will come on the market in areas that have seen recent price appreciation.

The NAR is scheduled to report January existing home sales and inventory on Thursday, Feb 21st.

Report: U.S. Foreclosure Starts Decline in January due to new California Law

by Calculated Risk on 2/14/2013 10:18:00 AM

From RealtyTrac: U.S. Foreclosure Starts Fall to Six-Year Low in January

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2013, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 150,864 U.S. properties in January, a decrease of 7 percent from the previous month and down 28 percent from January 2012.This is a tale of different states, and different laws. Mostly the non-judicial states are resolving delinquent mortgages quicker since foreclosures don't have to go through the court system. However new laws - like the "Homeowners Bill of Rights" in California - are dramatically slowing foreclosures in some non-judicial states.

“The U.S. foreclosure landscape in January was profoundly altered by the effects of new legislation that took effect in California on the first of the year,” said Daren Blomquist, vice president at RealtyTrac. “Dubbed the Homeowners Bill of Rights, this legislation extends many of the principles in the national mortgage settlement — including a prohibition on so-called dual tracking and requiring a single point of contact for borrowers facing foreclosure — to all mortgage servicers operating in California. In addition the new law imposes fines of up to $7,500 per loan for filing of multiple unverified foreclosure documents. As a result, the downward foreclosure trend in California accelerated into hyper speed in January, decisively shifting the balance of power when it comes to the nation’s foreclosure activity.

“For the first time since January 2007 California did not have the most properties with foreclosure filings of any state. Instead that dubious distinction went to Florida, where January foreclosure activity increased on an annual basis for the 11th time in the last 13 months.”

The national decrease in foreclosure starts was caused in large part by a sharp drop in California notices of default (NOD) in January, down 62 percent from December and down 75 percent from January 2012 to the lowest level since October 2005.

Scheduled foreclosure auctions increased from the previous month in 26 states and the District of Columbia, hitting 12-month or more highs in several key judicial foreclosure states, including Florida, Illinois, Pennsylvania, and New Jersey, although foreclosure starts were down on a year-over-year basis in Florida, Illinois and Pennsylvania.

Weekly Initial Unemployment Claims decline to 341,000

by Calculated Risk on 2/14/2013 08:30:00 AM

The DOL reports:

In the week ending February 9, the advance figure for seasonally adjusted initial claims was 341,000, a decrease of 27,000 from the previous week's revised figure of 368,000. The 4-week moving average was 352,500, an increase of 1,500 from the previous week's revised average of 351,000.The previous week was revised up from 366,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 352,500.

Weekly claims were below the 360,000 consensus forecast, and the 4-week average is close to the lowest level since early 2008.

Wednesday, February 13, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 2/13/2013 09:13:00 PM

Jim Hamilton at Econbrowser discusses Brent, WTI, and the price of gasoline: Prices of gasoline and crude oil

West Texas Intermediate is a particular grade of crude oil whose price is usually quoted in terms of delivery in Cushing, Oklahoma. Brent is a very similar crude from Europe's North Sea. As similar products, you'd expect them to sell for close to the same price, and up until 2010 they usually did. But an increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.See Hamilton's discussion for more ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 366 thousand last week.

CoStar: Commercial Real Estate prices up 4.3% Year-over-year

by Calculated Risk on 2/13/2013 04:52:00 PM

Here is a price index for commercial real estate that I follow. CoStar notes a few key trends: 1) Sales volume has increased significantly (highest since 2004), 2) the percent of distressed sales has declined, and 3) it appears price increases have moved beyond core properties (the first to recover). There is much more in the release.

From CoStar: U.S. commercial real estate posts record gain in sales volume and broadening pricing recovery to close 2012

COMMERCIAL REAL ESTATE SALES VOLUME SURGED IN 2012: While rising steadily over the last four years, sales volume reached nearly $64 billion in 2012, a 22% increase from 2011 and the highest annual total since 2004. Activity spiked significantly in December as investors rushed to close deals prior to year-end. In fact, at 1,593, the number of repeat sales in December reached an all-time high since CoStar started tracking the property sales used in the CCRSI.

...

Pricing gains in the value-weighted U.S. Composite Index began earlier in the recovery and have been consistently stronger than pricing gains in its equal-weighted counterpart throughout much of the recovery. This reflects the more rapid recovery at the high end of the market for larger, more expensive properties. It also mirrors the trend in the recent recovery of market fundamentals for commercial property, in which demand for Four-Star and Five-Star office buildings, luxury apartments and modern big-box warehouses has outpaced the broader market. However, pricing trends suggest this may be shifting.

Despite the recent dominance of larger, more-expensive properties in pricing gains, momentum appears to be shifting to the broader market dominated by smaller, less-expensive properties. This shift is apparent in the value-weighted U.S. Composite Index, which posted a 4.3% year-over-year gain in December 2012, slowing from its double-digit growth rate throughout 2011. At the same time, year-over-year growth in the equal-weighted U.S. Composite Index accelerated in the second half of 2012 and registered 8.1% for the year. Taken together, the two trends signify that investors are moving beyond core properties and driving up pricing at the lower end of the market.

Distressed sales made up only 11.5% of observed trades in December 2012, the lowest level witnessed since the end of 2008. This reduction in distressed deal volume has been driving higher, more consistent pricing.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 37.1% from the bottom (showing the demand for higher end properties) and up 4.3% year-over-year. However the Equal-Weighted index is only up 12.8% from the bottom, and up 8.1% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

DataQuick: January Home Sales in SoCal highest in Six Years

by Calculated Risk on 2/13/2013 12:59:00 PM

One of the housing markets I follow closely is southern California. I highlighted a couple of key points in this article: 1) Activity is picking up, especially in the move-up markets, 2) there should be a "supply response" to more activity and rising prices (I expect more supply to come on the market), and 3) foreclosure resales are at the lowest level since 2007.

From DataQuick: Southland Begins 2013 With Sales and Price Gains Vs. Year Earlier

Southern California's housing market started 2013 with the highest January home sales in six years as sales to investors and cash buyers hovered near record levels and move-up activity remained relatively brisk. ...

A total of 16,058 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. ... Last month’s sales were the highest for the month of January since 18,128 homes sold in January 2007, though they were 8.8 percent below the January average of 17,609 sales. The low for January sales was 9,983 in 2008, while the high was 26,083 in 2004.

“This fledgling housing recovery has momentum. Already, price hikes have caused some to question whether it's sustainable, whether it's a 'bubble.' Let's not forget, though, that we're still climbing out of a deep hole from the housing downturn. Regional home sales remain sub-par and prices in many areas are at least 30 to 40 percent below their peaks. That's not to say we don't see risks. Sharp price gains can attract speculation, which could lead to unsustainable, short-term gains in certain submarkets. A lot of today's housing demand is fueled not by spectacular job growth and soaring consumer confidence, but by super-low mortgage rates and unusually high levels of investor and cash purchases. Take away any one of those elements and it will matter,” said John Walsh, DataQuick president.

“For the overall market, price pressures should gradually ease as more homeowners react to rising values. This is the 'supply response' many analysts expect. The idea is that many who've held out for higher prices will be tempted to stick a for-sale sign in the front yard. Fewer will owe more than their homes are worth, enabling them to sell. Construction is already rising, and we could see lenders clear backlogs of distressed properties faster, adding to the supply.”

The move-up market continued to post sizeable sales gains last month. January sales between $300,000 and $800,000 – a range that would include many first-time move-up buyers – shot up 49.6 percent year-over-year. Sales over $500,000 jumped 74.0 percent from one year earlier, while sales over $800,000 rose 84.2 percent compared with January 2012.

Last month foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 15.0 percent of the Southland resale market. That was up slightly from 14.2 percent the month before and down from 32.6 percent a year earlier. In recent months foreclosure resales have been at the lowest level since September 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 25.9 percent of Southland resales last month. That was down from an estimated 26.5 percent the month before and 27.2 percent a year earlier.

Emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/13/2013 10:04:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier.

...

The refinance share of mortgage activity of total applications was unchanged at 78 percent from the previous week. The HARP share of refinance applications was unchanged from last week at 28 percent. The adjustable-rate mortgage (ARM) share of activity increased to 4 percent of total applications.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.75 percent, the highest rate since September 2012, from 3.73 percent, with points unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last three weeks, but activity is still very high - and has remained high for over a year.

There has been a sustained refinance boom, and 78 percent of all mortgage applications are for refinancing.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was off last week - and is still very low, but the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Retail Sales increased 0.1% in January

by Calculated Risk on 2/13/2013 08:48:00 AM

On a monthly basis, retail sales increased 0.1% from December to January (seasonally adjusted), and sales were up 4.7% from January 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $416.6 billion, an increase of 0.1 percent from the previous month and 4.4 percent above January 2012. ... The November to December 2012 percent change was unrevised from +0.5 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for December were unrevised at a 0.5% gain.

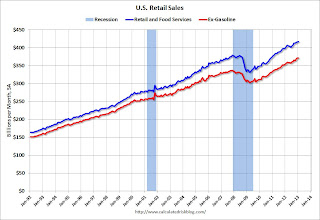

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 25.7% from the bottom, and now 9.9% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes).

The second graph shows the same data, but just since 2006 (to show the recent changes). Retail sales ex-autos increased 0.2%.

Excluding gasoline, retail sales are up 22.8% from the bottom, and now 10.3% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.8% on a YoY basis (4.4% for all retail sales).

This was at the consensus forecast of a 0.1% increase, and might indicate some slowdown in retail spending growth related to the payroll tax increase.

This was at the consensus forecast of a 0.1% increase, and might indicate some slowdown in retail spending growth related to the payroll tax increase.

Tuesday, February 12, 2013

Wednesday: Retail Sales

by Calculated Risk on 2/12/2013 08:44:00 PM

On the deficit, from Jed Graham at investors.com:

Here's a pretty important fact that virtually everyone in Washington seems oblivious to: The federal deficit has never fallen as fast as it's falling now without a coincident recession.This fits with the graph I posted last week:

To be specific, CBO expects the deficit to shrink from 8.7% of GDP in fiscal 2011 to 5.3% in fiscal 2013 if the sequester takes effect and to 5.5% if it doesn't. Either way, the two-year deficit reduction — equal to 3.4% of the economy if automatic budget cuts are triggered and 3.2% if not — would stand far above any other fiscal tightening since World War II.

Until the aftermath of the Great Recession, there were only three such periods in which the deficit shrank by a cumulative 2% of GDP or more. The 1960-61 and 1969-70 episodes both helped bring about a recession.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the Congressional Budget Office (CBO).

The CBO deficit estimates are even lower than my projections.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM ET, Retail sales for January will be released. The consensus is for retail sales to increase 0.1% in January, and to increase 0.2% ex-autos.

• 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for December will be released. The consensus is for a 0.3% increase in inventories.