by Calculated Risk on 2/05/2013 08:23:00 PM

Tuesday, February 05, 2013

Update: Seasonal Pattern for House Prices

There is a clear seasonal pattern for house prices. Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Recently there has been a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

However, house prices - not seasonally adjusted (NSA) - have been pretty strong over the last few months - at the start of the normally weak months.

Click on graph for larger image.

Click on graph for larger image.

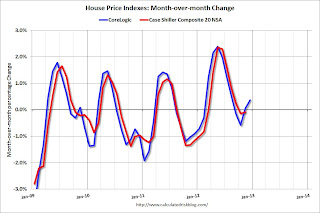

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years (Case-Shiller through November, CoreLogic through December).

The CoreLogic index has been positive in both the November and December reports (CoreLogic is a 3 month weighted average, with the most recent month weighted the most).

Case-Shiller NSA turned negative month-to-month in the October report (also a three month average, but not weighted), but was only slightly negative in November. I expect more inventory to come on the market over the next few months than during the spring of 2011 and 2012, and that might slow the price increases - but it looks like the "off-season" for prices will be pretty strong.

CBO: Deficit to decline to 2.4% of GDP in Fiscal 2015

by Calculated Risk on 2/05/2013 03:36:00 PM

The Congressional Budget Office (CBO) released their new The Budget and Economic Outlook: Fiscal Years 2013 to 2023.

From the WSJ: CBO Sees Rising U.S. Debt, Economic Rebound in 2014

Economic growth and recent legislation have cut the federal budget deficit in half in the past four years ... the Congressional Budget Office said Tuesday in the annual update of its budget and economic forecast.The CBO projects the deficit will decline to 3.7% of GDP in fiscal 2014, and 2.4% of GDP in fiscal 2015.

The CBO said it expected economic growth to be sluggish in 2013, in part because of a sharp drop in government spending, but it sees a better economy in 2014 as the recovery takes hold.

The federal deficit for the fiscal year ending Sept. 30, 2013, is projected to fall to $845 billion, or 5.3% of gross domestic product, said the CBO, which produces nonpartisan reports on the budget and economy for Congress. That is down sharply from the past four years, which each had deficits exceeding $1 trillion. The 2012 deficit amounted to 7% of GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO deficit estimates are even lower than my projections.

After 2015, the deficit will start to increase again according to the CBO, but as I've noted before, we really don't want to reduce the deficit much faster than this path over the next few years, because that will be too much of a drag on the economy.

Trulia: Asking House Prices increased in January

by Calculated Risk on 2/05/2013 11:55:00 AM

Press Release: Asking Prices Up 5.9 Percent Nationally Year-Over-Year, Rents Rose 4.1 Percent

Indicating the strength of the home price recovery, asking prices rose 0.3 percent quarter-over-quarter (Q-o-Q) in January without seasonal adjustment—despite the fact that prices typically fall during the wintertime. Seasonally adjusted, prices rose 2.2 percent Q-o-Q. Moreover, prices rose 0.9 percent month-over-month (M-o-M), the highest monthly gain since the price recovery began. Year-over-year (Y-o-Y), prices rose 5.9 percent; excluding foreclosures, prices rose 6.5 percent.More from Jed Kolko, Trulia Chief Economist: Asking Home Prices Set New Records While Rents Ease as Supply Expands

With more newly-constructed multi-unit buildings coming to completion, rent gains fell behind asking price increases at the national level for the first time since the price recovery began last spring. In January, rents rose 4.1 percent Y-o-Y nationally, slowing down from 4.7 percent in July 2012. Regionally, rent gains cooled the most in San Francisco, where rents rose 2.4 percent versus 11.5 percent in July 2012.

“Rent gains are slowing down because of more supply, not less demand,” explains Jed Kolko, Trulia’s Chief Economist. “Many of the multi-unit buildings that have been under construction over the past two years are now coming onto the market. Renters in San Francisco, Seattle, and Denver are starting to get a touch of relief, even though rising prices might put homeownership out of their reach.”

These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

ISM Non-Manufacturing Index indicates expansion in January

by Calculated Risk on 2/05/2013 10:00:00 AM

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: January 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in January for the 37th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 55.2 percent in January, 0.5 percentage point lower than the seasonally adjusted 55.7 percent registered in December. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.4 percent, which is 4.4 percentage points lower than the seasonally adjusted 60.8 percent reported in December, reflecting growth for the 42nd consecutive month. The New Orders Index decreased by 3.9 percentage points to 54.4 percent, and the Employment Index increased 2.2 percentage points to 57.5 percent, indicating growth in employment for the sixth consecutive month. The Prices Index increased 1.9 percentage points to 58 percent, indicating prices increased at a faster rate in January when compared to December. According to the NMI™, eight non-manufacturing industries reported growth in January. Respondents' comments are mixed about the economy and business conditions; however, the majority of respondents are optimistic about the overall direction."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 55.0% and indicates slightly slower expansion in January than in December.

CoreLogic: House Prices up 8.3% Year-over-year in December

by Calculated Risk on 2/05/2013 08:59:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises for the 10th Consecutive Month in December; Biggest Year-Over-Year Increase Since May 2006

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 8.3 percent in December 2012 compared to December 2011. This change represents the biggest increase since May 2006 and the 10th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.4 percent in December 2012 compared to November 2012. The HPI analysis shows that all but four states are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 7.5 percent in December 2012 compared to December 2011. On a month-over-month basis, excluding distressed sales, home prices increased 0.9 percent in December 2012 compared to November 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that January 2013 home prices, including distressed sales, are expected to rise by 7.9 percent on a year-over-year basis from January 2012 and fall by 1 percent on a month-over-month basis from December 2012, reflecting a seasonal winter slowdown.

...

“December marked 10 consecutive months of year-over-year home price improvements, and the strongest growth since the height of the last housing boom more than six years ago,” said Mark Fleming, chief economist for CoreLogic. “We expect price growth to continue in January as our Pending HPI shows strong year-over-year appreciation.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.4% in December, and is up 8.3% over the last year.

The index is off 26.9% from the peak - and is up 9.4% from the post-bubble low set in February 2012 (the index is NSA, so some of the increase is seasonal).

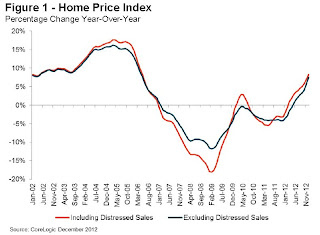

The second graph is from CoreLogic. The year-over-year comparison has been positive for ten consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for ten consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in December - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, February 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 2/04/2013 08:20:00 PM

A different view from Stephen Foley at the Financial Times: House price rebound cruising for a fall

The new flippers of US housing are not the individual speculators of the boom years ... These investors, who have poured into the US housing market since its nadir, are hedge funds and private equity vehicles, and recently (belatedly) individual entrepreneurs. They may be planning to hold the property for a while and harvest rental income in the interim, but decent returns are predicated on a sale, and usually a quick one.Maybe. But these investors initially bought for the cash-flow, and they would only sell now if they could make a solid profit - and that means a higher price. This isn't logic for a "fall" in house prices, rather this is an argument for less future appreciation.

That makes them flippers – and it means that the recent run of strong housing market data may be more chimeric than real.

excerpt with permission

Also - the author argues "individual entrepreneurs" were late to the party and that is incorrect. Many individuals and small groups were ahead of the hedge funds and private equity groups. I've noted my discussions with some of these groups over the last few years, and they are very happy with their properties (I called one group after reading this article, and I was told they have no intention of selling any properties).

Tuesday economic releases:

• At 10:00 AM ET, the ISM non-Manufacturing Index for January. The consensus is for a decrease to 55.0 from 55.7 in December. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for January will be released. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Fed: Some domestic banks "eased lending standards", Demand for some Loans "strengthened"

by Calculated Risk on 2/04/2013 02:00:00 PM

From the Federal Reserve: The January 2013 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the January survey, generally modest fractions of domestic banks reported having eased their standards across major loan categories over the past three months on net. Domestic respondents indicated that demand for business loans, prime residential mortgages, and auto loans had strengthened, on balance, while demand for other types of loans was about unchanged. U.S. branches and agencies of foreign banks, which mainly lend to businesses, reported little change in their lending standards, while demand for their loans was reportedly stronger on net.

...

Within consumer lending, a moderate fraction of domestic banks reported an easing of standards on auto loans, on net, while standards on other types of consumer loans were about unchanged. On balance, banks indicated having eased selected terms on consumer loans over the survey period. A moderate fraction of respondents continued to experience stronger demand for auto loans, on net, while demand for credit card loans was reportedly unchanged.

...

The January survey also included three sets of special questions: The first set asked banks about lending to and competition from banks headquartered in Europe; the second set asked banks about changes in their lending policies on CRE loans over the past year; and the third set asked banks about their outlook for asset quality in major loan categories during 2013. In response to the first set, only a small fraction of domestic banks indicated that lending standards to European banks and their affiliates had been tightened, on net, while foreign respondents' standards were reportedly little changed for such institutions. In response to the second set, respondents indicated that they had eased selected CRE loan terms over the past 12 months on net, with the rest of the surveyed terms having been about unchanged. Finally, respondents' answers for the outlook for asset quality revealed that moderate to large fractions of banks expect improvements in credit quality in most major loan categories on balance.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

These two graphs shows the change in lending standards and demand for CRE (commercial real estate) loans.

Increasing demand and some easing in standards suggests some increase in CRE activity going forward.

In general this survey indicates lending standards are still tight, but some banks are loosening a little - and there is also increasing demand for certain loans.

Housing: Inventory down 22% year-over-year in early February

by Calculated Risk on 2/04/2013 12:39:00 PM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays - and then starts increasing again in February. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 22.2% year-over-year in early February and up slightly from January (on a monthly basis).

This graph shows the NAR estimate of existing home inventory through December (left axis) and the HousingTracker data for the 54 metro areas through early February.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms during the holidays and then starts increasing in February - and peaks in mid-summer. So inventory will probably increase for the next 6+ months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

HousingTracker reported that the early February listings, for the 54 metro areas, declined 22.2% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low.

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm also tracking inventory weekly this year.

If inventory does bottom, we probably will not know for sure until late in the year. Ben at Housing Tracker (Department of Numbers) has provided me weekly inventory data for the last several years and this is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, even with the slight decline last week (probably noise), inventory is already up 3.0%. The next few months will be very interesting for inventory!

Irwin: No Bond Bubble

by Calculated Risk on 2/04/2013 11:11:00 AM

I was going to write about this since I'm asked about a "bond bubble" all the time - but Neil Irwin at the WaPo beat me too it: No, there probably isn’t a bond bubble

One peculiar legacy of the financial crisis is that, among the financial commentariat, there is a tendency to see a bubble whenever the market for a particular asset rises.Yes - people see bubbles everywhere!

[N]o bubble fears are as widespread as the conviction that the markets for government bonds—in the United States in particular, but also in many other nations. It almost passes as a mark of seriousness to argue that Treasuries are the next big bubble to pop, the biggest in a long series that also included the stock market bubble of the late 1990s and the housing and mortgage securities bubble of the 2000s.This reminds me of discussions we had back in 2005 about "what is a bubble"? Back then we were discussing the housing bubble (See: Housing: Speculation is the Key). Here is what I wrote about housing in April 2005:

That kind of talk particular heats up whenever bond prices start to fall a bit, as they have in the last few weeks. (The phrase “bond bubble” appeared in major world publications included in the Nexis database 28 times in January—up from two in January 2012). And it is true that bonds have been in a remarkable 30 year rally, their prices climbing as interest rates have fallen almost constantly since the early 1980s.

It’s certainly true that bond prices could fall (and, conversely, longer-term interest rates rise). On balance, that is more likely to be for good reasons–because the economy is getting back on track–than for bad reasons, like inflation getting out of control.

But I’m not particularly worried that Treasury bonds are a bubble about to pop. Here’s why.

The first, and simplest reason to be skeptical of the bond bubble story is this: What defines a bubble is people buying an asset at ever-rising prices for speculative reasons, not based on the fundamental value of the asset, but because they are assuming somebody else will buy it at a higher price. I see no evidence of this behavior by buyers of Treasury bonds.

I have taken to calling the housing market a "bubble". But how do I define a bubble?With bonds, I don't see speculation, significant leveraged buying, "storage" or any of the other factors that defined a housing "bubble". I think Irwin is correct - there is no bond bubble, and when bond prices eventually fall (and interest rates rise) it will most likely "be for good reasons–because the economy is getting back on track".

A bubble requires both overvaluation based on fundamentals and speculation. It is natural to focus on an asset’s fundamental value, but the real key for detecting a bubble is speculation - the topic of this post. Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.

Lawler: More Home Builder Results for Last Quarter

by Calculated Risk on 2/04/2013 09:09:00 AM

CR Note: the following comments and table are from economist Tom Lawler.

This table is for many of the public home builders as of Dec 2012.

This shows that combined net order are up 37% compared to Q4 2011. As Lawler notes, the combined backlog is up 57.1%!

From Tom Lawler:

The combined order backlog of these companies at the end of 2012 was 26,638, up 57.1% from the end of 2011.

While not all builders comment on pricing trends, those that do have reported increased prices, “pricing power,” and/or lower incentives/price concessions.

As one builder noted, “being able to sell homes at a price that is higher than what it costs to build them is ‘sweet’.”

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg | Dec 2012 | Dec 2011 | % Chg |

| D.R. Horton | 5,259 | 3,794 | 38.6% | 5,182 | 4,118 | 25.8% | $236,067 | $214,740 | 9.9% |

| PulteGroup | 3,926 | 3,084 | 27.3% | 5,154 | 4,303 | 19.8% | $287,000 | $271,000 | 5.9% |

| NVR | 2,625 | 2,158 | 21.6% | 2,788 | 2,391 | 16.6% | $331,900 | $304,600 | 9.0% |

| The Ryland Group | 1,502 | 915 | 64.2% | 1,578 | 1,040 | 51.7% | $270,000 | $254,000 | 6.3% |

| Standard Pacific | 983 | 615 | 59.8% | 973 | 782 | 24.4% | $388,000 | $374,000 | 3.7% |

| Meritage Homes | 1,094 | 749 | 46.1% | 1,240 | 894 | 38.7% | $294,000 | $275,000 | 6.9% |

| MDC Holdings | 869 | 523 | 66.2% | 1,221 | 792 | 54.2% | $318,700 | $291,300 | 9.4% |

| M/I Homes | 673 | 505 | 33.3% | 887 | 667 | 33.0% | $273,000 | $257,000 | 6.2% |

| Total | 16,931 | 12,343 | 37.2% | 19,023 | 14,987 | 26.9% | $285,300 | $265,785 | 7.3% |