by Calculated Risk on 1/17/2013 09:25:00 AM

Thursday, January 17, 2013

Weekly Initial Unemployment Claims decline to 335,000

The DOL reports:

In the week ending January 12, the advance figure for seasonally adjusted initial claims was 335,000, a decrease of 37,000 from the previous week's revised figure of 372,000. The 4-week moving average was 359,250, a decrease of 6,750 from the previous week's revised average of 366,000.

The previous week was revised up from 371,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 359,250.

This was the lowest level for weekly claims since January 2008, and the 4-week average is near the low since early 2008. Note: Data for January has large seasonal adjustments - and can be very volatile, but this is still good news.

Weekly claims were below the 368,000 consensus forecast.

Earlier:

• Housing Starts increase sharply to 954 thousand SAAR in December

Housing Starts increase sharply to 954 thousand SAAR in December

by Calculated Risk on 1/17/2013 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 954,000. This is 12.1 percent above the revised November estimate of 851,000 and is 36.9 percent above the December 2011 rate of 697,000.

Single-family housing starts in December were at a rate of 616,000; this is 8.1 percent above the revised November figure of 570,000. The December rate for units in buildings with five units or more was 330,000.

An estimated 780,000 housing units were started in 2012. This is 28.1 percent above the 2011 figure of 608,800.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 903,000. This is 0.3 percent above the revised November rate of 900,000 and is 28.8 percent above the December 2011 estimate of 701,000.

Single-family authorizations in December were at a rate of 578,000; this is 1.8 percent above the revised November figure of 568,000. Authorizations of units in buildings with five units or more were at a rate of 301,000 in December.

Click on graph for larger image.

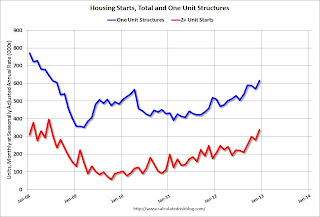

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply from November.

Single-family starts (blue) increased to 616,000 thousand in December.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total housing starts were at 954 thousand (SAAR) in December, up 12.1% from the revised November rate of 851 thousand (SAAR).

Total starts has doubled from the bottom start rate, and single family starts are up about 75 percent from the low

This was well above expectations of 887 thousand starts in December. Starts in December were up 36.9% from December 2011, and starts are up 28.1% from the 2011 level. I'll have more soon ...

Wednesday, January 16, 2013

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 1/16/2013 08:37:00 PM

James Hamilton quotes several economists (Republican and Democrat): Debt-ceiling economics and politics. Hamilton concludes:

The real purpose of the debt ceiling is political-- it gives the minority party an opportunity to grandstand as if they're somehow holding the line on the deficits that are the necessary mathematical result of previous spending and tax legislation. The political game is to force the majority party to push through the debt-ceiling increase and then try to embarrass them for their votes, relying on the stupidity of voters not to see the posturing for what it really is. But when different parties control the two houses of Congress, the only chumps in this game are the legislators who still try to play the same hand.Thursday would be a good day to vote to pay the bills! Sooner is better than later ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 368 thousand from 371 thousand last week.

• Also at 8:30 AM, Housing Starts for December will be released. The consensus is for total housing starts to increase to 887 thousand (SAAR) in December, up from 861 thousand in November.

• At 10:00 AM, the Philly Fed Manufacturing Survey for January. The consensus is for a reading of 6.0, down from 8.1 last month (above zero indicates expansion).

Report: Housing Inventory declines 17% year-over-year in December

by Calculated Risk on 1/16/2013 04:01:00 PM

From Realtor.com: December 2012 Real Estate Trend Data

The total U.S. for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) in December dropped to its lowest point since Realtor.com has been collecting these data, with 1,565,425 units for sale, down 17.32% compared to a year ago and roughly half its peak of 3.1 million units in September 2007. The median age of the inventory also decreased 9.01% on a year-over-year basis.Note: Realtor.com only started tracking inventory in September 2007, but this is probably the lowest level in a decade. On a month-over-month basis, inventory declined 6.5%. Some of the decline in December is seasonal because some sellers take their homes off the market for the holidays.

...

On a year-over-year basis, the for-sale inventory declined in all but one of the 146 markets tracked by Realtor.com, while list prices increased in 66 markets, held steady in 31 markets and declined in 49 markets.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

Tom Lawler sent me this note today:

"Realtor.com’s monthly numbers reflect the daily average number of listings in a month, as opposed to most local realtor reports and the NAR’s existing home inventory number, which are end-of-month estimates."

Click on graph for larger image.

Click on graph for larger image."Here is a comparison of Realtor.com’s for-sale inventory numbers and the NAR’s existing home inventory estimate.

As noted above, the Realtor.com data reflect monthly average listings, while the NAR estimates are end-of-month listings. Given the “normal” tendency for listings at the end of December to be well below the monthly average, the NAR December inventory number is likely to show a significantly larger monthly decline that the Realtor.com number."

The NAR is scheduled to report December existing home sales and inventory on Tuesday, January 22nd.

Fed's Beige Book: Economic activity expanded at "modest or moderate" pace

by Calculated Risk on 1/16/2013 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded since the previous Beige Book report, with all twelve Districts characterizing the pace of growth as either modest or moderate. ... Overall, holiday sales were reported as being modestly higher than in 2011, though sales were below expectations for contacts in many of the Districts.And on real estate:

Since the previous Beige Book, consumer spending increased to some degree in all twelve Districts. Across the nation, holiday sales grew modestly compared with last year but came in below expectations in the New York, Cleveland, Atlanta, Chicago, and San Francisco Districts. ... Citing concerns that consumers will spend cautiously due to ongoing fiscal uncertainty, retail contacts and auto dealers reported a slightly dimmer, though positive, outlook for future sales.

Existing residential real estate activity expanded in all Districts that reported; growth rates were described as moderate or strong in nine Districts. Contacts in the Boston District attributed their strong sales growth to low interest rates, affordable prices, and rising rents. All Districts reporting on price levels saw increases; New York and Chicago reported only very minor increases. The five Districts that reported on housing inventories all reported falling levels. New residential construction (including repairs) expanded in all but one District of those Districts that reported. Contacts in the Kansas City District reported that increased lumber and drywall costs limited construction, causing a slight decline this period. Hurricane Sandy disrupted construction activity initially in New York, but this has since led to increased work for subcontractors on repairs and reconstruction.This suggests sluggish growth overall, with "moderate or strong" growth for real estate.

Though a little weaker than residential real estate, reports on sales and leasing of nonresidential real estate are still mostly positive--described as modest on average. The Boston District reported a drop in leasing beyond normal seasonal trends; contacts cited fiscal cliff uncertainty as a factor. Minneapolis and Kansas City reported increased demand and tightening commercial real estate markets. Philadelphia, St. Louis, and Dallas all reported more modest increases in nonresidential real estate activity. Nonresidential construction is weaker than residential, with only slight to modest growth.

Key Measures show low inflation in December

by Calculated Risk on 1/16/2013 11:59:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.9% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat 0.0% (-0.2% annualized rate) in December. The CPI less food and energy increased 0.1% (1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for November and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.1% annualized, and core CPI increased 1.2% annualized. Also core PCE for November increased 1.6% annualized. These measures suggest inflation is below the Fed's target of 2% on a year-over-year basis.

With this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

Builder Confidence unchanged in January

by Calculated Risk on 1/16/2013 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged in January at 47. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Holds Steady in January

Builder confidence in the market for newly built, single-family homes was unchanged in January, remaining at a level of 47 on the National Association of Home Builders/Wells Fargo Housing Market Index, released today. This means that following eight consecutive monthly gains, the index continues to hold at its highest level since April of 2006.

...

“Builders’ sentiment remains very close to the index’s tipping point of 50, where an equal number of builders view conditions as good and poor, and fundamentals indicate continued momentum in housing this year,” said NAHB Chief Economist David Crowe. “However, persistently tight mortgage credit conditions, difficulties in obtaining accurate appraisals and the ongoing stalemate in Washington over critical economic concerns continue to impede the housing recovery.”

...

The index’s components were mixed in January. The component gauging current sales conditions remained unchanged at 51. Meanwhile, the component gauging sales expectations in the next six months fell one point to 49 and the component gauging traffic of prospective buyers gained one point to 37.

The HMI three-month moving average was up across all regions, with the Northeast and Midwest posting a two-point gain to 36 and 50, respectively. The South registered a three-point gain to 49 and the West posted a four-point increase to 51.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the January release for the HMI and the November data for starts (December housing starts will be released tomorrow). This was slightly below the consensus estimate of a reading of 48.

Fed: Industrial Production increased 0.3% in December

by Calculated Risk on 1/16/2013 09:28:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.3 percent in December after having risen 1.0 percent in November when production rebounded in the industries that had been negatively affected by Hurricane Sandy in late October. For the fourth quarter as a whole, total industrial production moved up at an annual rate of 1.0 percent. Manufacturing output advanced 0.8 percent in December following a gain of 1.3 percent in November; production edged up at an annual rate of 0.2 percent in the fourth quarter. The output at mines rose 0.6 percent in December, and the output of utilities fell 4.8 percent as unseasonably warm weather held down the demand for heating. At 98.1 percent of its 2007 average, total industrial production in December was 2.2 percent above its year-earlier level. Capacity utilization for total industry moved up 0.1 percentage point to 78.8 percent, a rate 1.5 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is still 1.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in December to 98.1. This is 17.5% above the recession low, but still 2.6% below the pre-recession peak.

Both Industrial Production and Capacity Utilization were slightly above expectations.

BLS: CPI unchanged in December, Core CPI increases 0.1%

by Calculated Risk on 1/16/2013 08:39:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - December 2012

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in December on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment. The gasoline index declined again in December, but other indexes, notably food and shelter, increased, resulting in the seasonally adjusted all items index being unchanged.On a year-over-year basis, CPI is up 1.7 percent, and core CPI is up 1.9 percent. Both below the Fed's target. This was at the consensus forecast of no change for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in December, the same increase as in November. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, the same figure as last month.

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

Tuesday, January 15, 2013

Wednesday: CPI, Industrial Production, Homebuilder Confidence, Beige Book

by Calculated Risk on 1/15/2013 08:30:00 PM

Former Republican Senator Alan Simpson was on CNBC today. Here was the Q&A on the debt ceiling:

Maria Bartiromo: "Do you believe the GOP should be using the debt ceiling as leverage point to get the President to agree to the cuts?"

Alan Simpson: "I think that would be a grave mistake. I don’t think that would solve anything. I know they are going to try it, and how far you go with a game of chicken, I have no idea. But I can tell you … you can’t, you really can’t … This is stuff we’ve already indebted ourselves. If you’re a real conservative – a really honest conservative, without hypocrisy – you’d want to pay your debt. And that’s what this is, they are not running up anything new."

I disagree with Simpson on many issues, but I agree with this point. No honest conservative would vote against paying the bills. So lets have a vote tomorrow. Wednesday would be a good day to authorize paying the bills (aka raising the "debt ceiling") and put this nonsense behind us.

The real budget issues are the "sequester" and the "continuing resolution". See my earlier post: After the Debt Ceiling is increased ... Make sure to check the graph of the deficit as a percent of GDP; it might surprise some people.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Consumer Price Index for December. The consensus is for no change in CPI in December and for core CPI to increase 0.1%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for December. The consensus is for a 0.2% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.5%.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in December. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts.