by Calculated Risk on 1/14/2013 01:30:00 PM

Monday, January 14, 2013

Fed's Williams expects growth to pickup, Concerned about policy "uncertainty"

From San Francisco Fed President John Williams: The Economy and Monetary Policy in Uncertain Times. On the economic outlook:

As far as my outlook is concerned, I expect the economic expansion to gain momentum over the next few years. When final numbers come in, I expect growth in real gross domestic product—the nation’s total output of goods and services—to register about 1¾ percent in 2012. My forecast calls for GDP growth to rise to about 2½ percent this year and a little under 3½ percent in 2014. That pace is sufficient to bring the unemployment rate down gradually over the next few years. Specifically, I anticipate that the unemployment rate will stay at or above 7 percent at least through the end of 2014. And I expect inflation to remain somewhat below the Fed’s 2 percent target for the next few years as labor costs and import prices remain subdued. My forecast takes into account both the fiscal cliff agreement and the various stimulus measures the Fed has put in place.And on uncertainty:

emphasis added

The economy has been growing in fits and starts for the past three-and-a-half years. Every time economic growth appears to be picking up steam, something happens that brings it back down again. Sometimes the barriers to growth are natural, like the tsunami of 2011, and the drought and Superstorm Sandy last year. Other times they are man-made, like the crisis in Europe and our own fiscal cliff drama. ...CR comment: I think the main reason businesses aren't investing more is lack of demand, as opposed to "uncertainty". But it doesn't help having these self-inflicted wounds.

But the direct hangover from the financial crisis is not the only reason for sluggish growth. Most banks and other financial institutions have largely returned to health, and many nonfinancial businesses have been piling up cash. Their balance sheets look exceptionally strong. For businesses that can get credit, interest rates have rarely, if ever, been lower. You would think this is a great time to expand your business. Yet, many businesspeople appear to be locked in a paralyzing state of anxiety. As one of my business contacts said recently, “They’re just not willing to stick their necks out.”

What’s going on? The terrifying financial crisis followed by a bumpy recovery, the crisis and recession in Europe, the budget mess in the United States, questions about taxes and health-care reform—these and other factors have combined to undermine the confidence of Americans and make them suspicious about the durability of the economic recovery. Indeed, an index of policy uncertainty developed by academic economists recently soared to the highest level recorded in over 25 years. In a pattern reminiscent of the debt ceiling debate in the summer of 2011, the recent rise in uncertainty has been accompanied by a sharp drop-off in business and consumer confidence.

FNC: Residential Property Values increased 4.2% year-over-year in November

by Calculated Risk on 1/14/2013 10:27:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: Home Prices Up 0.3% in November; Price Increase Expected to Continue

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that home prices nationally were up 0.3% in November. This was the ninth consecutive month that prices moved higher, leading to a total appreciation rate of 5.3% year to date. For the 12 months ending in November, home prices rose 4.2%, the largest year-over-year increase since October 2006. All three composite indices show similar trends of price recovery. ...The year-over-year change continued to increase in November, with the 100-MSA composite up 4.2% compared to November 2011. The FNC index turned positive on a year-over-year basis in July - that was the first year-over-year increase in the FNC index since year-over-year prices started declining in early 2007 (over five years ago).

Two-thirds of the component markets tracked by the FNC 30-MSA composite index show continued price improvement in November. Las Vegas recorded the largest month-to-month increase, up 3.4% from October. Low inventory has contributed to the city’s rapidly rising prices in recent months. Chicago continues to lag behind other major cities in the housing recovery; home prices declined 0.8% in the 12 months ending in November. The city’s foreclosure sales remain at elevated levels; one in three homes sold are foreclosures or short sales. The recovery in Phoenix continues to significantly outpace the rest of the country. Home prices have surged 23.6% year to date. Foreclosure sales continue to shrink rapidly, making up only 13.0% of total home sales in November.

Click on graph for larger image.

Click on graph for larger image.This graph from FNC shows their Composite 10, 20, and 100 indexes, and the year-over-year change (light blue) in the composite 100 index. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

LPS: Mortgage Delinquency Rates increased slightly in November

by Calculated Risk on 1/14/2013 08:45:00 AM

LPS released their Mortgage Monitor report for November today. According to LPS, 7.12% of mortgages were delinquent in November, up from 7.03% in October, and down from 7.83% in November 2011.

LPS reports that 3.51% of mortgages were in the foreclosure process, down from 3.61% in October, and down from 4.20% in November 2011.

This gives a total of 10.63% delinquent or in foreclosure. It breaks down as:

• 1,999,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,584,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,767,000 loans in foreclosure process.

For a total of 5,350,000 loans delinquent or in foreclosure in November. This is up slightly from 5,300,000 in October, and down from 6,172,000 in November 2011.

This following graph from LPS shows the total delinquent and in-foreclosure rates since 1995.

Click on graph for larger image.

Click on graph for larger image.

Even though delinquencies were up slightly in November, it was mostly seasonal. However there was a large increase in delinquencies in the areas impacted by Hurricane Sandy, From LPS:

The November data also showed that the impact of Hurricane Sandy continued in ZIP codes hit hardest by the storm. While national delinquencies are moving in line with seasonal trends – that is, tending to rise slightly through the remainder of the calendar year – mortgage delinquencies increased sharply in those areas affected by Sandy. Whereas the national delinquency rate has increased 3.7 percent since August of this year, delinquencies in Sandy-impacted ZIPs have risen at more than threefold that pace – climbing 15.4 percent in Conn., 15.2 percent in N.J. and 14.8 percent in N.Y.

The second graph from LPS shows foreclosure starts were off sharply. From LPS:

The second graph from LPS shows foreclosure starts were off sharply. From LPS: The November Mortgage Monitor report released by Lender Processing Services shows the national foreclosure inventory dropped to 3.51 percent in November, representing an almost 10 percent decline from September 2012, when newly instituted National Mortgage Settlement requirements began to influence the pace of first-time foreclosure starts. As noted in last month’s Mortgage Monitor release, LPS expects foreclosure starts to rebound as mortgage servicers incorporate the new procedural requirements into their operations in the coming months.There is much more in the mortgage monitor.

Sunday, January 13, 2013

Sunday Night Futures

by Calculated Risk on 1/13/2013 09:23:00 PM

Monday:

• At 8:45 AM ET, LPS will release their Mortgage Monitor report for November.

• At 4:00 PM Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium. Here is the topic: "Chairman Bernanke visits the University of Michigan for a conversation with Ford School Dean Susan M. Collins on monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy". The event will be streamed live, and Bernanke will take questions on Twitter: #fordschoolbernanke

Weekend:

• Schedule for Week of Jan 13th

• Summary for Week Ending Jan 11th

The Asian markets are mixed tonight; the Shanghai Composite index is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 3 and DOW futures are up 25 (fair value).

Oil prices have moved sideways recently WTI futures at $94.03 per barrel and Brent at $110.83 per barrel. Gasoline prices are down slightly over the last couple of days.

Gasoline Prices up Recently, Expected to be lower than in 2012

by Calculated Risk on 1/13/2013 02:23:00 PM

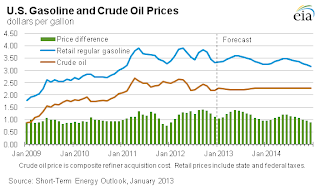

Another update on gasoline prices. From the EIA (Energy Information Administration):

EIA expects that the Brent crude oil spot price, which averaged $112 per barrel in 2012, will fall to an average of $105 per barrel in 2013 and $99 per barrel in 2014. The projected discount of West Texas Intermediate (WTI) crude oil to Brent, which averaged $18 per barrel in 2012, falls to an average of $16 per barrel in 2013 and $8 per barrel in 2014, as planned new pipeline capacity lowers the cost of moving Mid-continent crude oil to the Gulf Coast refining centers.

EIA expects that falling crude prices will help national average regular gasoline retail prices fall from an average $3.63 per gallon in 2012 to annual averages of $3.44 per gallon and $3.34 per gallon in 2013 and 2014, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the EIA forecasts for crude and gasoline. There are some seasonal factors for gasoline with prices rising during the summer. This forecast is mostly just some small changes to current prices, and as we all know, there can be wild event driven swings for oil and gasoline prices.

Below is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices last year. Prices are up a little this year, but still near the recent low.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Jim the Realtor: "Price Pushing"

by Calculated Risk on 1/13/2013 10:33:00 AM

Jim the Realtor posted a short and interesting video.

Since the market is "hot" in Carmel Valley, San Diego, and there is very little inventory, some sellers are pushing up the price with the expected result - no takers.

As Jim notes: "I don't think you are going to buffalo today's buyers. I don't think they are going for. They have access to all the data. They know the comps. They know the one around the corner is priced [significantly less]."

"Price pushing" will probably contribute to some increase in inventory this year.

Saturday, January 12, 2013

No Trillion Dollar Platinum Coin

by Calculated Risk on 1/12/2013 09:59:00 PM

From Joe Weisenthal at Business Insider: White House Rules Out The Trillion Dollar Coin Option To Break The Debt Ceiling

”Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit,” [Anthony Coley, a spokesman for the Treasury Department]I don't think of this as "hostage taking" since I remain confident that Congress will raise the debt ceiling (really just about paying the bills) and pay the bills on time - without any concessions from the White House. A better term would be "economic terrorism" since they are just trying to scare people.

...

From HuffPo:

"There are only two options to deal with the debt limit: Congress can pay its bills or they can fail to act and put the nation into default," said Press Secretary Jay Carney. "When Congressional Republicans played politics with this issue last time putting us at the edge of default, it was a blow to our economic recovery, causing our nation to be downgraded. The President and the American people won't tolerate Congressional Republicans holding the American economy hostage again simply so they can force disastrous cuts to Medicare and other programs the middle class depend on while protecting the wealthy. Congress needs to do its job."emphasis added

It would be better for America, the economy and all parties to raise the debt ceiling sooner rather than later.

The good news is, as Goldman Sachs chief economist Jan Hatzius wrote yesterday:

"By 2015, we expect the federal deficit to be down to $500bn, or just under 3% of GDP. If this forecast is correct, concerns about the federal deficit are likely to diminish over the next few years."That fits with my view for the next few years.

We should all agree: Pay the bills. Stop scaring people. Raise the debt ceiling today.

Unofficial Problem Bank list declines to 832 Institutions

by Calculated Risk on 1/12/2013 04:11:00 PM

The first bank failure of 2013:

Westside eclipsed by Sunwest

Sun burning savers

by Soylent Green is People

From the FDIC: Sunwest Bank, Irvine, California, Assumes All of the Deposits of Westside Community Bank, University Place, Washington

As of September 30, 2012, Westside Community Bank had approximately $97.7 million in total assets and $96.5 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.3 million. ... Westside Community Bank is the first FDIC-insured institution to fail in the nation this year, and the first in Washington.And the unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 11, 2012.

Changes and comments from surferdude808:

The FDIC cranked up a closing team to get the first full week in 2013 underway, otherwise it would have been a quiet week for the Unofficial Problem Bank List. Along with the failure, there was one action termination, which leaves the list count at 832 institutions with assets of $310.7 billion. A year ago, the list held 969 institutions with assets of $391.2 billion.Earlier:

The action termination was Southern First Bank, National Association, Greenville, SC ($779 million Ticker: SFST). The failure was Westside Community Bank, University Place, WA ($98 million), which was the 18th bank to close in Washington since the on-set of the crisis. Next week, we anticipate the OCC will release its actions through mid-December 2012.

• Schedule for Week of Jan 13th

• Summary for Week Ending Jan 11th

Schedule for Week of Jan 13th

by Calculated Risk on 1/12/2013 01:10:00 PM

Earlier:

• Summary for Week Ending Jan 11th

This will be a busy week for economic data. The key reports for this week will be the December retail sales report on Tuesday, and December housing starts on Thursday. On Monday, the focus will be on "a conversation with Fed Chairman Ben Bernanke".

Also the Consumer Price Index (CPI) and Producer Price Index (PPI) for December will be released this week.

For manufacturing, the Fed will release December Industrial Production on Wednesday, and the January NY Fed (Empire state) and Philly Fed surveys will be released this week.

8:45 AM ET: LPS will release their Mortgage Monitor report for November.

4:00 PM: Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium, "Chairman Bernanke visits the University of Michigan for a conversation with Ford School Dean Susan M. Collins on monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy". The even will be streamed live, and Bernanke will take questions on Twitter: #fordschoolbernanke

8:30 AM: Producer Price Index for December. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

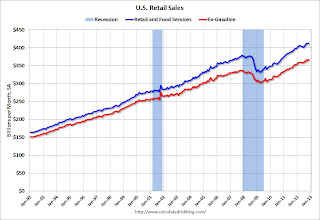

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.

8:30 AM ET: Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales.This graph shows monthly retail sales and food service, seasonally adjusted (total and ex-gasoline) through November. Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.2% in December, and to increase 0.3% ex-autos.

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 0.0, up from minus 8.1 in December (below zero is contraction).

8:30 AM: Corelogic will release their House Price Index for November 2012.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for December. The consensus is for no change in CPI in December and for core CPI to increase 0.1%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This shows industrial production since 1967 through November.

The consensus is for a 0.2% increase in Industrial Production in December, and for Capacity Utilization to increase to 78.5%.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 48, up from 47 in December. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 368 thousand from 371 thousand last week.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts were at 861 thousand (SAAR) in November, down 3.0% from the revised October rate of 888 thousand (SAAR). Single-family starts decreased to 565 thousand in November.

The consensus is for total housing starts to increase to 887 thousand (SAAR) in December, up from 861 thousand in November.

10:00 AM: Philly Fed Survey for January. The consensus is for a reading of 6.0, down from 8.1 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 75.0, up from 72.9.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2012

Summary for Week Ending January 11th

by Calculated Risk on 1/12/2013 08:05:00 AM

There was little economic data released this week. The trade deficit was much higher than expected, however the data might have been impacted by the port strike on the west coast. The BLS reported job openings were up about 12% year-over-year and the 4-week average for initial weekly unemployment claims increased a little. Not much data, but next week will be busy!

Some quarterly data was released for office, apartment and mall vacancy rates and rents. All vacancy rates declined, although both office and mall rates are still near the cycle high - and apartment vacancy rates are already low.

Here are some thoughts on the economy in 2013:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

And here is a summary of last week in graphs:

• Trade Deficit increased in November to $48.7 Billion

Click on graph for larger image.

Click on graph for larger image.

From Commerce: "[T]otal November exports of $182.6 billion and imports of $231.3 billion resulted in a goods and services deficit of $48.7 billion, up from $42.1 billion in October, revised. November exports were $1.7 billion more than October exports of $180.8 billion. November imports were $8.4 billion more than October imports of $222.9 billion."

Exports are 10% above the pre-recession peak and up 3.3% compared to November 2011; imports are near the pre-recession peak, and up 2.5% compared to November 2011.

The increase in the trade deficit in November was due to non-petroleum products. The trade deficit with the euro area was $10.6 billion in November, up from $8.2 billion in November 2011. It appears the eurozone recession is still impacting trade.

Note: The trade deficit might have been skewed by the port strike that started in late November.

• BLS: Job Openings "unchanged" in November

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased slightly in November to 3.676 million, up from 3.665 million in October. The number of job openings (yellow) has generally been trending up, and openings are up about 12% year-over-year compared to November 2011. Quits increased slightly in November, and quits are up 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims at 371,000

From the Department of Labor (DOL): "In the week ending January 5, the advance figure for seasonally adjusted initial claims was 371,000, an increase of 4,000 from the previous week's revised figure of 367,000. The 4-week moving average was 365,750, an increase of 6,750 from the previous week's revised average of 359,000.

From the Department of Labor (DOL): "In the week ending January 5, the advance figure for seasonally adjusted initial claims was 371,000, an increase of 4,000 from the previous week's revised figure of 367,000. The 4-week moving average was 365,750, an increase of 6,750 from the previous week's revised average of 359,000. Weekly claims were above the 362,000 consensus forecast.

Note: There are large seasonal factors in December and January, and that can make for fairly large swings for weekly claims.

• Reis: Office Vacancy Rate declines slightly in Q4 to 17.1%

Reis reported that the office vacancy rate declined slightly to 17.1% from 17.2% in Q3.

Reis reported that the office vacancy rate declined slightly to 17.1% from 17.2% in Q3.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

As Reis noted, net absorption was still positive, even though demand for office space was low - because there is so little new construction. This remains a sluggish recovery for office space, and new construction will stay low until the vacancy rate falls much further.

• Reis: Apartment Vacancy Rate declined to 4.5% in Q4

Reis reported that the apartment vacancy rate fell to 4.5% in Q4, down from 4.7% in Q3 2012. The vacancy rate was at 5.2% in Q4 2011 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate fell to 4.5% in Q4, down from 4.7% in Q3 2012. The vacancy rate was at 5.2% in Q4 2011 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

This was another strong quarter for apartments with the vacancy rate falling and rents rising. With more supply coming online in 2013, the decline in the vacancy rate should slow - but the market is still tight, and Reis expects rents to continue to increase.

• Reis: Mall Vacancy Rate declines in Q4

Reis reported that the vacancy rate for regional malls declined to 8.6% in Q4 from 8.7% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.

Reis reported that the vacancy rate for regional malls declined to 8.6% in Q4 from 8.7% in Q3. This is down from a cycle peak of 9.4% in Q3 2011.For Neighborhood and Community malls (strip malls), the vacancy rate declined to 10.7% in Q4, down from 10.8% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP through Q3. This has increased from the bottom because this includes renovations and improvements. New mall investment has essentially stopped.

The good news is, as Reis noted, new square footage is near a record low, and with very little new supply, the vacancy rate will probably continue to decline slowly.

Vacancy data courtesy of Reis.