by Calculated Risk on 1/11/2013 08:59:00 PM

Friday, January 11, 2013

Goldman's Hatzius: 10 Questions for 2013

Some short excerpts from a research note by Goldman Sachs chief economist Jan Hatzius:

1.Will the 2013 tax hike tip the economy back into recession?

No. To be sure, it will likely deal a heavy blow to household finances, and we therefore expect consumer spending to be weak this year. ...

2.Will growth pick up in the second half?

Yes. This forecast is based on the assumption that the drag from fiscal retrenchment—i.e., the ex ante reduction in the government deficit—diminishes in the second half of 2013 but the boost from the ex ante reduction in the private sector financial balance remains large. In our forecast, this causes a pickup in real GDP growth to a 2½% annualized rate in 2013H2, and further to around 3% in 2014.

...

3.Will capital spending growth accelerate?

Yes. We expect a pickup from around zero in the second half of 2012 to about 6% in 2013 on a Q4/Q4 basis. This would contribute 0.6 percentage points to real GDP growth and offset most of the likely slowdown in consumer spending growth.

...

4.Will the housing market continue to recover?

Yes. The fundamentals for housing activity point to further large gains in the next couple of years.

...

6.Are profit margins bound to shrink in 2013?

No.

...

7.Will core inflation accelerate significantly?

No. We expect inflation as measured by the PCE price index excluding food and energy to stay around 1½%, moderately below the Fed’s 2% target.

...

8.Will there be a bond market scare over the budget deficit?

No. ... the large government deficits of the past five years are closely related to the dramatic balance sheet adjustment in the private sector. ... As the private sector balance sheet adjustment comes closer to completion, we expect the government deficit to diminish gradually ... By 2015, we expect the federal deficit to be down to $500bn, or just under 3% of GDP. If this forecast is correct, concerns about the federal deficit are likely to diminish over the next few years.

...

9.Will the Federal Reserve stop buying assets?

No. Admittedly, the minutes of the December 11-12 FOMC meeting suggest that most Fed officials currently expect QE3 to end by late 2013. But we would not make too much of this. For one thing, it is important to remember that the outlook for monetary policy depends on the outlook for the economy.

...

10.Will interest rates rise?

Not much. ... At the longer end of the curve, we do expect a small increase in 10-year Treasury yields to 2.2% by the end of 2013.

Lawmakers urge the President to consider "any lawful steps" to pay the bills

by Calculated Risk on 1/11/2013 07:55:00 PM

From the NY Times: ‘Any Lawful Steps’ Urged to Avert Default

“In the event that Republicans make good on their threat by failing to act, or by moving unilaterally to pass a debt-limit extension only as part of unbalanced or unreasonable legislation, we believe you must be willing to take any lawful steps to ensure that America does not break its promises and trigger a global economic crisis — without Congressional approval, if necessary,” wrote Senators Harry Reid of Nevada, Richard J. Durbin of Illinois, Charles E. Schumer of New York and Patty Murray of Washington.I remain confident that the debt ceiling will be raised, and that the US Government will pay the bills.

...

Democratic leadership aides said the Senate would probably take up legislation in early February that would allow the president to raise the debt ceiling on his own in set increments, perhaps of $1 trillion. Congress would have the ability to reject the increase, but that would take a two-thirds majority.

That plan was first used at the suggestion of Senator McConnell in 2011 to solve the last debt-ceiling impasse.

However "fear" will start slowing the economy soon - just like in 2011 - and the House will receive (and deserves) all of the blame for any damage done to the economy.

I assume the House is looking for a way out, and maybe another McConnell bill is the solution.

Nomura on China: Expect 8% Year-over-year growth in Q4

by Calculated Risk on 1/11/2013 04:21:00 PM

From Wendy Chen at Nomura:

After slowing for seven straight quarters, we expect China's GDP growth to rebound to 8% in Q4 2012.The China data releases are scheduled for next Friday.

We expect real GDP growth to rebound to 8.0% y-o-y in Q4 from a low of 7.4% in Q3, underpinned by accommodative monetary and fiscal policies, inventory destocking coming to an end and a modest improvement in exports. Industrial production growth is likely to rise to 10.6% y-o-y in December from 10.1%, as a return to more normal inventories lifts production. We expect fixed asset investment to rise slightly to 20.8% y-o-y (ytd) in December from 20.7% in November, driven by infrastructure investment and possibly real estate investment. We expect retail sales to grow by 15.6% y-o-y in December from 14.9%, aided by easier financing conditions and rising asset prices.

It appears China's growth is picking up in the short term, but growth will probably slow again. Michael Pettis wrote last month: Three cheers for the new data?

I expected that politics would require a jump in growth over the rest of this year and the beginning of the next, this “good growth” tells us nothing about the health of the underlying economy. It only tells us how difficult politically the transition is likely to be.

...

Growth rates in China will continue to slow dramatically in the next few years, and if there are temporary lulls, as there must be, these do not represent any sort of “bottoming out” at all. They simply represent the fact that Beijing cannot afford politically to allow the adjustment to taker place too quickly, and from time to time Beijing is are going to step on the investment accelerator to speed things up temporarily.

Question #1 for 2013: US Fiscal Policy

by Calculated Risk on 1/11/2013 10:46:00 AM

Last year I posted Ten Economic Questions for 2013. Here are my thoughts on the #1 question - and what I consider the #1 downside risk to the US economy in 2013.

Note: Here is a review of my 2012 Forecasts

1) US Policy: This is probably the biggest downside risk for the US economy in 2013. I assume some sort of fiscal agreement will be reached soon, but how much austerity will be included? What will happen with the Alternative Minimum Tax (AMT)? What about emergency unemployment benefits? What about extending the mortgage relief for debt forgiveness (important for short sales)?

And what about other policy in 2013 such as the "default ceiling" (aka debt ceiling)? In 2011, the threat of a US government default slowed the economy to almost a standstill for a month. Right now the White House is taking the Ronald Reagan approach (when the Democrats pulled a similar reckless stunt) and they are saying President Obama will only sign a clean debt ceiling bill. Good. Hopefully default is off the table, but you never know.

Comments: Since I posted this question, a fiscal agreement was reached to avert the "fiscal cliff". Although I would have structured the agreement differently, the key goal of reducing the amount of austerity in 2013 was achieved - unfortunately the media did a generally poor job of explaining the "fiscal cliff", and I suspect most people thought it was about reducing the deficit, when the main concern was reducing the deficit too quickly in 2013 and taking the economy back into recession.

As far as specifics that I mentioned in the question, the AMT was fixed long term, emergency unemployment benefits were extended, and the relief for mortgage debt forgiveness was extended for another year (important for short sales). These are all positives for the US economy.

Unfortunately there are still several fiscal issues remaining for this year. The "sequester" (automatic spending cuts) still needs to be resolved, the "debt ceiling" needs to be raised, and a “continuing resolution” needs to be passed or the government will be shut down.

The so-called "debt ceiling" is really just about paying the bills. Here are a few things to know:

1) The House will raise the debt ceiling before the deadline, and the US will pay the bills.

2) The House majority has no leverage on the "debt ceiling"; as I've noted before, the House majority holds a losing hand and everyone knows it. The sooner they fold (and raise the debt ceiling) the better for everyone. As we saw in 2011, there are real world consequences for waiting until the last minute.

3) Those thinking there are no consequences for missing the deadline, I suggest reading the new (January 7th) Debt Limit Analysis by analysts at the Bipartisan Policy Center. From a political perspective, missing the deadline will, in the words of Republican Senator Mitch McConnell, make the "Republican brand toxic". It would be political suicide, so it will not happen.

Hopefully the House will fold their losing hand soon. If they are planning on taking the country to the brink, and betting voters will forget like after 2011, I think that is another losing bet.

Although the negotiations on the "sequester" will be tough, I suspect something will be worked out (remember the goal is to limit the amount of austerity in 2013). The issue that might blow up is the “continuing resolution", and that might mean a partial shut down of the government. This wouldn't be catastrophic (like the "debt ceiling"), but it would still cause problems for the economy and is a key downside risk.

And a final prediction: If we just stay on the current path - and the "debt ceiling" is raised, and a reasonable agreement is reached on the "sequester", and the “continuing resolution" is passed - I think the deficit will decline faster than most people expect over the next few years. Eventually the deficit will start to increase again due to rising health care costs (this needs further attention), but that isn't a short term emergency.

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Trade Deficit increased in November to $48.7 Billion

by Calculated Risk on 1/11/2013 08:51:00 AM

The Department of Commerce reported:

[T]otal November exports of $182.6 billion and imports of $231.3 billion resulted in a goods and services deficit of $48.7 billion, up from $42.1 billion in October, revised. November exports were $1.7 billion more than October exports of $180.8 billion. November imports were $8.4 billion more than October imports of $222.9 billion.The trade deficit was much larger than the consensus forecast of $41.1 billion.

The first graph shows the monthly U.S. exports and imports in dollars through October 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in November. US trade has slowed recently.

Exports are 10% above the pre-recession peak and up 3.3% compared to November 2011; imports are near the pre-recession peak, and up 2.5% compared to November 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The increase in the trade deficit in November was due to non-petroleum products.

Oil averaged $97.45 in November, down from $99.75 per barrel in October. The trade deficit with China increased to $28.95 billion in November, up from $26.78 billion in November 2011. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $10.6 billion in November, up from $8.2 billion in November 2011. It appears the eurozone recession is still impacting trade.

Note: The trade deficit might have been skewed by the port strike that started in late November.

Thursday, January 10, 2013

Friday: Trade Deficit

by Calculated Risk on 1/10/2013 09:09:00 PM

Friday economic releases:

• At 8:30 AM ET, the Trade Balance report for November from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $41.1 billion in November from $42.2 billion in October. Export activity to Europe will be closely watched due to economic weakness. Note: the strike at the ports of Long Beach and Los Angeles started in late November and impacted this report.

• Also at 8:30 AM, Import and Export Prices for December. The consensus is a 0.1% increase in import prices.

This seems crazy, from the WSJ: Can I Buy Your House, Pretty Please?

In an echo of the last housing boom, ardent pitch letters from eager home buyers are popping up again in hot U.S. real-estate markets like Silicon Valley, Seattle, San Diego, suburban Chicago and Washington, D.C., housing economists and real-estate brokers say.Pitch letters?

The heartfelt missives, often accompanied by personal photos, aim to create an emotional bond that can give their writers an edge—especially in situations where multiple bidders are vying for the same house. ...

“The market has gotten so crazy that money alone doesn’t talk,’’ explained Glenn Kelman, chief executive of Redfin

The California Budget Surplus

by Calculated Risk on 1/10/2013 05:00:00 PM

Back in November I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”And today from Reuters: California Governor's budget has surprise: a surplus

The state expects $98.5 billion in revenues and transfers and plans spending $97.7 billion, according to the proposal published on the state Department of Finance website.This is a tentative surplus, and there is plenty of debt, but this is another small positive step. The plan in California is to increase spending slightly in the upcoming year after several years of budget cuts.

That leaves a surplus of $851 million for the year, in addition to a projected $785 million surplus for the current fiscal year, which ends in June, allowing the state to put $1 billion toward a rainy day fund.

Brown said he saw a balanced budget for the next four years.

Spending in the upcoming year is set to rise 5 percent, or $4.7 billion, from the current 2012-13 budget. Schools and universities will see a $4 billion boost, health care spending will rise $1.2 billion, while transfers to local government will drop $2.1 billion.

As I mentioned in the previous post, moving from state and local budget cuts to some small increases will be a plus for the economy.

Question #2 for 2013: Will the U.S. economy grow in 2013?

by Calculated Risk on 1/10/2013 01:30:00 PM

Note: Sometimes it is useful to jot down a few thoughts on how the economy is expected to perform. This isn't to test my forecasting skills; sometimes I learn more when I get something wrong!

Some years I make some big out-of-consensus calls, but my forecasts this year are mostly in line with the consensus.

Earlier I posted some questions for this year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Note: Here is a review of my 2012 Forecasts

2) Economic growth: Heading into 2013 there are still significant downside risks from the European financial crisis and from U.S. fiscal policy. Will the U.S. economy grow in 2013? Or will there be another recession?

There are several positives for the economy at the beginning of 2013: residential investment is picking up (usually the best leading indicator for the economy), the state and local government layoffs and cutbacks appear to be ending, and a substantial amount of household deleveraging has already happened.

Here are a couple of graph on household debt (and debt service):

This graph from the the NY Fed shows aggregate consumer debt decreased in Q3. This was mostly due to a decline in mortgage debt.

Household debt peaked in Q2 2008 and has been declining for over four years. There is probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

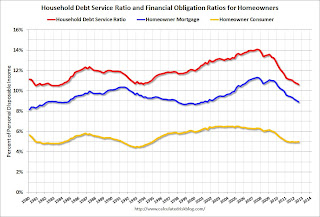

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The second graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio has declined back to early 1980s levels, and is near the record low - thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is at 1994 levels.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. Now, with falling interest rates, and less mortgage debt (mostly due to foreclosures), the ratio is back to 2001 levels. This will probably decline further, but for many homeowners, the obligation ratio is low.

There are always downside risks from Europe and China, but usually with these positive trends I'd expect a pickup in US growth in 2013. However, the recent austerity (aka "fiscal cliff") - especially the payroll tax increase compared to 2012 - will be a drag on economic growth this year.

Here is a graph showing the rolling real GDP growth (over 4 quarters) since 2000 through Q3 2012. The rolling four quarter graph smooths out the quarterly up and downs, and show that the US economy has been growing at a little over 2% for the last few years.

Here is a graph showing the rolling real GDP growth (over 4 quarters) since 2000 through Q3 2012. The rolling four quarter graph smooths out the quarterly up and downs, and show that the US economy has been growing at a little over 2% for the last few years.

We still don't know the size of the "sequester", but right now it appears the drag from austerity will probably offset the pickup in the private sector - and we can expect another year of sluggish growth in 2013 probably in the 2% range again.

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

BLS: Job Openings "unchanged" in November

by Calculated Risk on 1/10/2013 10:15:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in November was 3.7 million, unchanged from October.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The level of total nonfarm job openings was 2.4 million at the end of the recession in June 2009.

...

The number of quits (not seasonally adjusted) was little changed over the 12 months ending in November for total nonfarm and total private.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased slightly in November to 3.676 million, up from 3.665 million in October. The number of job openings (yellow) has generally been trending up, and openings are up about 12% year-over-year compared to November 2011.

Quits increased slightly in November, and quits are up 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

Weekly Initial Unemployment Claims at 371,000

by Calculated Risk on 1/10/2013 08:37:00 AM

The DOL reports:

In the week ending January 5, the advance figure for seasonally adjusted initial claims was 371,000, an increase of 4,000 from the previous week's revised figure of 367,000. The 4-week moving average was 365,750, an increase of 6,750 from the previous week's revised average of 359,000.

The previous week was revised down from 372,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 365,750.

Weekly claims are very volatile during and just after the holiday season, but even with the increase, the 4-week average is near the low for last year.

The recent spike was due to hurricane Sandy.

Weekly claims were above the 362,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: There are large seasonal factors in December and January, and that can make for fairly large swings for weekly claims.