by Calculated Risk on 1/08/2013 09:10:00 PM

Tuesday, January 08, 2013

Wednesday: Mall Vacancy Rate

Over there ... from the NY Times: Unemployment Rises to New High in Euro Zone

The euro zone jobless rate rose to 11.8 percent in November from 11.7 percent in October, according to Eurostat, the statistical agency of the European Union. Eurostat estimated that 18.8 million people in the euro zone were unemployed in November, two million more than a year earlier.Austerity at work. The beatings will continue until morale improves.

... on Tuesday, the Federal Statistics Office in Berlin said that German exports declined 3.4 percent while imports slid 3.7 percent in November from a month earlier. The weakness narrowed Germany’s trade surplus to €14.6 billion ...

Wednesday economic releases:

• Early: Reis Q4 2012 Mall survey of rents and vacancy rates. In Q3 Reis reported the regional mall vacancy rate declined to 8.7%, from 8.9% in Q2. The vacancy rate peaked at 9.4% in Q3 2011. For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged at 10.8% in Q3. For strip malls, the vacancy rate peaked at 11.0% in Q2 2011.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Las Vegas Real Estate: Sales and Inventory decreased year-over-year in December

by Calculated Risk on 1/08/2013 04:27:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR reports home prices increased 24 percent in 2012,ranking as third best sales year ever

GLVAR said the total number of local homes, condominiums and townhomes sold in December was 3,624. That’s up from 3,293 in November, but down from 4,250 total sales in December 2011. Compared to November, single-family home sales during December increased by 10.4 percent, while sales of condos and townhomes increased by 8.5 percent. Compared to one year ago, home sales were down 14.3 percent, while condo and townhome sales were down 16.5 percent.A few key points:

...

The total number of homes listed for sale on GLVAR’s Multiple Listing Service declined in December, with a total of 14,601 single-family homes listed for sale at the end of the month. That’s down 6.6 percent from 15,637 homes listed for sale at the end of November and down 24.1 percent from one year ago. ...

[T]he number of available homes listed for sale without any sort of pending or contingent offer by the end of December, GLVAR reported 3,688 single-family homes listed without any sort of offer. That’s down 4.2 percent from 3,849 such homes listed in November and down 58.2 percent from one year ago.

...

GLVAR’s statistics through December 2012 show a dramatic transition from foreclosures to short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. The percentage of existing homes sold as part of a short sale set a new record in December, accounting for 45.8 percent of all sales. Foreclosures, which made up more than half of all sales a few years ago, accounted for only 9.5 percent of all sales in December 2012.

• Inventory decreased in December, and inventory is down 24.1% from Decmeber 2011. For single family homes without contingent offers, inventory is down sharply from a year ago (down 58.2% year-over-year).

• Short sales are more than four times foreclosures now. The GLVAR reported a record 45.8% of sales were short sales in December, and only 9.5% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws). Note: Some of the surge in short sales might have been to beat the expiration of the Mortgage Debt Relief Act of 2007. The Act was extended as part of the fiscal deal, so the number of short sales should remain high in 2013.

• The decline in overall sales is because of fewer foreclosure sales (Las Vegas had a record number of real estate sales in 2011, even higher than at the peak of the bubble in 2005, because of all the distressed sales!). As the market slowly recovers, the number of distressed sales should fall and the number of conventional sales should rise. This has been happening in Las Vegas, although distressed sales were up some in December compared to November due to seasonal factors.

Overall this is a slowly improving distressed market. Note: I ignore the median price because that is impacted by the mix.

Question #6 for 2013: What will happen with Monetary Policy and QE3?

by Calculated Risk on 1/08/2013 01:35:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Note: Here is a review of my 2012 Forecasts

6) Monetary Policy: Currently the Fed is planning to buy $85 billion in Treasury and agency mortgage-backed securities per month as part of the open-ended QE3. Will the Fed continue all year at this pace? Or will the Fed increase their purchase rate? Or will the Fed decrease their purchase rate, stop these purchases, or even sell some securities?

First - I wrote this question before the recent FOMC minutes were released. The minutes revealed that several FOMC members expect QE3 to end in 2013. Of course the level of QE3 purchases in 2013 will be data dependent - if the economy remains sluggish, the unemployment rate remains high, and inflation expectations remain stable, the FOMC will continue to purchase $85 billion per month all year. If the economy picks up, or inflation expectations increase - the FOMC will probably slow or stop their purchases.

It is important to note that slowing or stopping the purchases doesn't mean the Fed is tightening. Policy will remain accomodative all year (I doubt the Fed will purchase securities and reduce their balance sheet in 2013, and it is very doubtful they will raise the Fed Funds rate this year).

Last year I wrote for 2012:

• I expect the Fed will change their communication strategy and add a likely future path of the Fed Funds rate to the quarterly economic forecasts.The Fed introduced the new communication strategy, and then changed it again based on "thresholds" near the end of 2012. On QE3, they waited a little longer than I expected, and the FOMC announced QE3 in September.

• I think QE3 is likely, but more towards mid-year - and [timing] is data dependent.

This year I don't think we will see as many monetary changes.

I expect the FOMC will review their purchases at each meeting just like they used to review the Fed Funds rate. We might see some adjustments during the year, but currently I expect the Fed to purchase securities at about the same level all year.

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Question #7 for 2013: What will happen with house prices in 2013?

by Calculated Risk on 1/08/2013 10:55:00 AM

Earlier I posted some questions for this year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Note: Here is a review of my 2012 Forecasts

7) House Prices: It now appears house prices, as measured by the national repeat sales indexes, bottomed in early 2012? What will happen with house prices in 2013?

Calling the bottom for house prices in 2012 now appears correct.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change in the Case-Shiller Composite 10 and Composite 20 indexes.

The Composite 10 SA was up 3.4% YoY in October, and the Composite 20 SA was up 4.3% year-over-year. Other house price indexes have indicated similar gains. Right now it looks like the Case-Shiller Composite 20 index will finish the year up about 6%.

Note: the year-over-year gain in 2010 was related to the homebuyer tax credit. However, in 2010, prices were still too high based on fundamentals. However, when prices started increasing in 2012, prices were more in line with fundamentals based on price-to-income, price-to-rent and real house prices.

Some of the key factors in 2012 were limited inventory, fewer foreclosures, investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed. In some areas, like Phoenix, there appeared to be a bounce off the bottom.

In 2013, inventories will probably remain low - suggesting more house price increases - and there also tends to be significant momentum in house prices (also suggesting more increases in 2013).

However, even though I expect inventories to be low this year, I think we will see more inventory come on the market in 2013 than 2012, as sellers who were waiting for a better market list their homes, and as some "underwater" homeowner (those who owe more than their homes are worth) finally can sell without taking a loss.

Also I expect more foreclosure in some judicial states, and I think the price momentum in Phoenix and other "bounce back" areas will slow.

All of these factors suggest further prices increases in 2013, but at a slower rate than in 2012. Here are some other house prices forecasts ranging from 1.4% to 4.8% increases in 2013. It looks like I'm in the consensus this year (I was out of the consensus in 2012).

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Reis: Apartment Vacancy Rate declined to 4.5% in Q4

by Calculated Risk on 1/08/2013 08:25:00 AM

Reis reported that the apartment vacancy rate fell to 4.5% in Q4, down from 4.7% in Q3 2012. The vacancy rate was at 5.2% in Q4 2011 and peaked at 8.0% at the end of 2009.

Some data and comments from Reis Senior Economist Ryan Severino:

Vacancy declined by another 20 bps during the fourth quarter to 4.5%. This exceeded performance during the third quarter when vacancy declined by 10 bps. On a year-over-year basis, the vacancy rate declined by 70 bps.

There was a bit of a resurgence in demand for apartment units during the fourth quarter when 45,162 units were absorbed. This represents an increase versus the 24,951 units that were absorbed during the third quarter but a slight decrease versus the 47,396 units that were absorbed during the fourth quarter of 2011. Net absorption has been consistently positive since the second quarter of 2009. For the calendar year 2012, 138,155 units were absorbed. This is a decline from the 172,707 units that were absorbed during calendar year 2011.This decline is not surprising. The market has tightened considerably over the last few years and at this point in the cycle a slight slowing should be anticipated.

New construction also increased during the quarter. 24,614 units were delivered during the fourth quarter, versus 17,378 units during the third quarter. This is also an increase compared to the 10,145 units that were delivered during the fourth quarter of 2011. This is the third consecutive quarter of construction increases and the highest level of quarterly completions since the second quarter of 2010. For calendar year 2012, 66,846 units were completed. This is an increase versus the 42,290 that were completed during 2011.

Asking and effective rents both grew by 0.6% during the fourth quarter. This was below the third quarter performance when asking and effective rents grew by 0.8% and 0.9%, respectively. Both asking and effective rents have consistently increased since the first quarter of 2010. However, this was the weakest performance since the fourth quarter of 2011. Nonetheless, taking a longer‐term view, on a year‐over‐year basis rent growth continues to accelerate. Nationally, asking and effective rents hit another all‐time high during the fourth quarter, propelled by strong demand, limited new supply growth, and a still weak for‐sale housing market.

...

The outlook for 2013 remains stout. Although new completions are expected to accelerate substantially during 2013, demand should remain tight. With demand outpacing new completions, vacancy is expected to continue to decrease, but the rate of decline will slow as the market digests all of the new units coming online. However, given that tightness in the market will persist, rent growth will continue to accelerate – having shorn concessions landlords now feel empowered to raise face‐level asking rents in a more pronounced fashion. The majority of the market will continue to perform well in 2013 as their tenants will have no choice but to continue paying record‐level rents. The greatest risk likely resides in the highest‐quality properties with the most expensive rents, typically class A and above properties. Rents in these high‐quality properties are prohibitively expensive and tenants have already countenanced large annual rent increases. With housing prices remaining relatively low and mortgage rates hovering near record‐low levels, an increasing number of these class A/A+ tenants, who boast high incomes, ample savings, and good credit ratings, will do the math and decide that it is finally time to purchase a home.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

This was another strong quarter for apartments with the vacancy rate falling and rents rising. With more supply coming online in 2013, the decline in the vacancy rate should slow - but the market is still tight, and Reis expects rents to continue to increase.

Monday, January 07, 2013

Tuesday: Apartment Vacancy Rate

by Calculated Risk on 1/07/2013 09:06:00 PM

From Alan Zibel and Nick Timiraos at the WSJ: Watchdog to Set Loan Rules

This week, the Consumer Financial Protection Bureau will define standards that all mortgage lenders are likely to follow when originating home loans. ...In the long run this is an important step. This will insure that most loans are made to a somewhat reasonable standard (43% of pretax income is pretty high) - and no stated income or Alt-A loans will meet these standards (Great news!).

The rules don't specify a minimum down payment and instead focus on ensuring that banks document borrowers' ability to make their monthly loan payments. Loans in which borrowers make only interest payments for a set period and those in which the principal balance can increase are excluded by law from being "qualified" mortgages. ...

CFPB is likely to offer two ways in which lenders can meet the regulator's standard ... Under the first approach, the regulator will consider as qualified mortgages all loans that receive an approval after being run through the automated underwriting engines maintained by [Fannie, Freddie, FHA], even if they aren't ultimately sold to or insured by those institutions.

Under the second approach, loans would be deemed qualified mortgages if borrowers are spending no more than 43% of their pretax income on monthly debt payments.

Tuesday economic release:

• Early: Reis Q4 2012 Apartment survey of rents and vacancy rates. In Q3 Reis reported the apartment vacancy rate declined to 4.6%, from 4.7% in Q2. The vacancy rate peaked at 8.0% in Q4 2008 and Q1 2009. With a combination of more supply coming online, and the probable bottom for house prices (motivating some renters to buy), most of the decline in the vacancy rate is probably behind us.

• At 7:30 AM ET, the NFIB Small Business Optimism Index for December will be released. The consensus is for an increase to 87.9 from 87.5 in November.

• At 3:00 PM, Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $13.2 billion in November.

Housing: Inventory down 24% year-over-year in early January

by Calculated Risk on 1/07/2013 06:57:00 PM

Inventory declines every year in December and January as potential sellers take their homes off the market for the holidays. That is why it helps to look at the year-over-year change in inventory.

According to the deptofnumbers.com for (54 metro areas), overall inventory is down 23.9% year-over-year in early January, and probably at the lowest level since the early '00s.

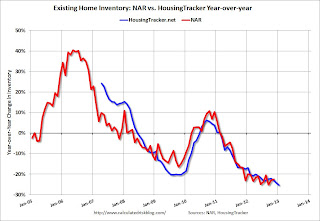

This graph shows the NAR estimate of existing home inventory through November (left axis) and the HousingTracker data for the 54 metro areas through early January.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

On a seasonal basis, housing inventory usually bottoms during the holidays and then starts increasing in February - and peaks in mid-summer. So inventory is probably near the seasonal bottom right now and should start increasing again soon.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the early January listings, for the 54 metro areas, declined 23.9% from the same period last year.

HousingTracker reported that the early January listings, for the 54 metro areas, declined 23.9% from the same period last year.

The year-over-year declines will probably start to get smaller since inventory is already very low. It seems very unlikely we will see 20%+ year-over-year declines this summer, and I think overall inventory might be bottoming right now.

Question #8 for 2013: Will Housing inventory bottom in 2013?

by Calculated Risk on 1/07/2013 04:24:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Note: Here is a review of my 2012 Forecasts

8) Housing Inventory: Over the last few years, we've seen a dramatic plunge in existing home inventory. Will inventory bottom in 2013?

This is an interesting question and the lack of supply is one of the reasons house prices were up about 6% in 2012. Economist Jed Kolko at Trulia wrote about inventory last month:

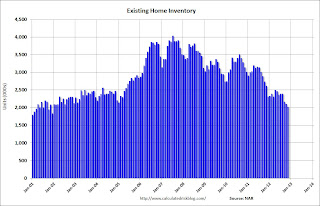

The key question in 2013, though, is whether prices will rise enough so that for-sale inventory–which has fallen 43% nationally since the summer of 2010–will hit bottom and start expanding again. ... Rising prices should lead to more inventory, for two reasons: (1) rising prices encourage new construction, and (2) rising prices encourage some homeowners to sell.This graph shows nationwide inventory for existing homes through November.

Click on graph for larger image.

Click on graph for larger image.According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

If we see the usually seasonal decline in December (not reported yet) and January, then NAR reported inventory will probably fall to the 1.80 to 1.85 million range. That would be the lowest level since January 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. When we compare inventory to earlier periods, we need to remember there were essentially no "short sale contingent" listings prior to 2006.

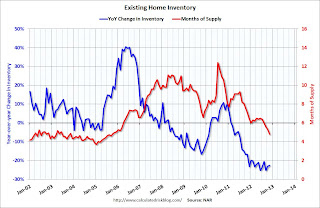

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 22.5% year-over-year in November from November 2011. This was the 21st consecutive month with a YoY decrease in inventory.

Months of supply declined to 4.8 months in November. This is the lowest level based on months-of-supply since September 2005.

Whenever I talk with real estate agents, I ask why they think inventory is so low. A common answer is that people don't want to sell at the bottom. In a market with falling prices, sellers rush to list their homes, and inventory increases. But if sellers think prices have bottomed, then they believe they can be patient, and inventory declines. Another reason is that many homeowners are "underwater" on their mortgage and can't sell.

Note: the Mortgage Debt Relief Act of 2007 was extended for another year. This means homeowners can sell their homes "short" (for less than they owe if the lender approves) and they don't have to pay taxes on the debt forgiveness. This will keep the short sale market active in 2013.

If prices increase enough then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.

Right now my guess is active inventory will bottom in 2013, probably in January. At the least, the rate of year-over-year inventory decline will slow sharply. It will be very interesting to see how much inventory comes on the market during the spring selling season!

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Thoughts on the Budget Deficit

by Calculated Risk on 1/07/2013 01:57:00 PM

Note: The US government is on a fiscal year that runs from October 1st through September 30th of the following year. Fiscal year 2012 ended on September 30th of 2012, and fiscal year 2013 started on October 1, 2012. The graphs below use fiscal year GDP.

A few points on "short term" vs. "long term" issues, and cyclical vs. structural deficits. None of this should be controversial (or political).

1. The "fiscal cliff" was about reducing the deficit too quickly in the short term. This was concerning because a rapid reduction in the deficit (aka "austerity") would probably have taken the economy back into recession. The fiscal agreement reduces the deficit this year compared to fiscal 2012 - the payroll tax hike alone adds almost $120 billion in revenue this year. Those saying "nothing was accomplished" are possibly confusing the short term with the long term.

2. There is a long term budget problem mostly related to spending for health care. I'll have more on this in a future post, but I think it helps to focus on the short term right now.

3. There is a significant difference between a "structural" budget deficit, and a "cyclical" deficit. A cyclical deficit happens when the economy goes into recession because tax revenues decline, and spending on safety net programs like unemployment insurance and food stamps increases. A cyclical deficit is expected during recessions, and the Federal government is (and should be) counter-cyclical. (this should not be controversial).

4. A structural deficit is a mismatch between tax revenue and outlays even during good times. A structural deficit is much worse for the economy than a cyclical deficit since a cyclical deficit will decline as the economy recovers, but a structural deficit is ongoing.

Here are a couple of graphs.

Click on graph for larger image.

Click on graph for larger image.

The first graph shows revenue and outlays as a percent of GDP. Clearly, in fiscal 2012, the government had BOTH a revenue and spending problem. Both revenue and spending have been impacted by the great recession, and are slowly recovering.

There was also a structural deficit starting in fiscal 2002, and even during the housing boom, revenue was below outlays. So the recent low level revenue was due to both cyclical and structural reasons.

In fiscal 2013, revenue will increase due to the payroll tax increase, an increase in the tax rate on high income earners, and an improving economy. Spending will probably decrease as a percent of GDP due to some defense spending cuts and an improving economy.

Here are the data sources for these graphs. CBO: Historical Budget Data and An Update to the Budget and Economic Outlook: Fiscal Years 2012 to 2022, BEA: GDP Tables

The second graph shows the budget deficit each year as a percent of GDP. As David Wessel at the WSJ recently noted: Putting the Brakes on Cutting the Deficit

The second graph shows the budget deficit each year as a percent of GDP. As David Wessel at the WSJ recently noted: Putting the Brakes on Cutting the Deficit

In the depths of the most recent recession, the fiscal year that ended Sept. 30, 2009, the deficit was 10.1% of gross domestic product, the value of all the goods and services produced. Since then, the deficit has declined to 9% of GDP in 2010, 8.7% in 2011 and 7.0% in fiscal 2012. Private analysts predict the deficit will be between 5.5% and 6.0% of GDP in fiscal 2013 ...My guess is the deficit will decline to around 5.5% of GDP this year. If there is no change in policy, I expect the deficit to continue to decline over the next few years.

However, later this decade, the deficit will probably start to increase again, mostly due to rising health care expenditures. This is the long term issue, and health care spending needs to be addressed to put the debt on a sustainable path long term.

The key points are: the cyclical deficit will slowly decline, and there is a long term issue, mostly related to health care costs that we need to start to address in the next few years.

We'd be in better shape without the structural deficit and if we had avoided the great recession (I did my best to alert policymakers in 2005). But that is water over the dam. The bottom line is this is all very solvable.

Office Vacancy Rate and Office Investment

by Calculated Risk on 1/07/2013 10:26:00 AM

Earlier this morning I noted that Reis reported the office vacancy rate declined slightly to 17.1% in Q4 from 17.2% in Q3.

A key question is when will new office investment increase. The answer depends on how quickly the vacancy rate falls. The following graph shows the office vacancy rate and office investment as a percent of GDP. Note: Office investment also includes improvements - and as Reis Senior Economist Ryan Severino noted this morning, there is very little new construction.

Here is Reis Senior Economist Ryan Severino's office forecast for 2013:

"The outlook for 2013 is slightly better than what we experienced in 2012. Although some of the uncertainty over the potential “fiscal cliff” has been resolved, spending decisions still remain and the debt situation in Europe, which oscillates in and out of panic, is still uncertain. Moreover, higher payroll and income taxes are likely to reduce consumption and the government is expected to implement some spending cuts, if not outright sequestration. Nonetheless, job growth is expected to accelerate slightly during 2013 while the unemployment rate is expected to tick marginally lower. Reflecting this moderate improvement, we expect an acceleration in both rent growth and vacancy compression next year, but it is important to keep expectations aligned with reality. And the reality for 2013 is another year of languorous recovery."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

Like Reis, I expect the office vacancy rate to slowly decline, and I don't expect a significant pickup in new investment until the vacancy rate is close to 14%.

Office vacancy data courtesy of Reis.