by Calculated Risk on 12/14/2012 03:07:00 PM

Friday, December 14, 2012

Economic Outlook: Where are we?

Once again we are nearing a political event horizon that could significantly impact the economy - and we can't see beyond the horizon. My baseline assumption is an agreement will be reached, probably during the first few weeks of January, and the agreement will mean Federal fiscal drag next year at about the level of the CBO's alternative fiscal scenario. This would suggest modest GDP and employment growth next year, although probably better than in 2012.

Note: There is no clear drop dead date for the "fiscal cliff". Nothing horrible happens on January 1st, but the longer it takes to reach an agreement next year, the larger the negative impact on the economy.

With that assumption, there are two key drivers for additional growth next year. The first is residential investment (construction employment lags investment with a lag, so construction employment should pick up in 2013), and the second is the end of the state and local drag. I've discussed both of these before - see: Two Reasons to expect Economic Growth to Increase - but I think this is worth repeating.

Over the last 3+ years, state and local governments have lost over 700 thousand payroll jobs (including the preliminary estimate of the benchmark revision) and it appears these layoffs are coming to an end. I don't expect state and local government to add much to economic and employment growth next year, but just stopping the drag will help.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

However the drag from state and local governments is ongoing, although the drag in Q3 was small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

Yesterday, the Rockefeller Institute put out an update on state government revenues: State Tax Revenues Showed Continued Yet Slow Growth in the Third Quarter of 2012

The Rockefeller Institute's compilation of preliminary data from 47 states shows that collections from major tax sources increased by 2.1 in nominal terms in the third quarter of 2012 compared to the same quarter of 2011. Tax collections have now risen for 11 straight quarters, beginning with the first quarter of 2010. This growth followed five quarters of declines brought on by the Great Recession.Revenues are not increasing sharply, but they are increasing enough to probably stop most of the layoffs.

...

Among 47 early reporting states, 38 states reported gains while nine states reported declines in total tax revenue collections during the third quarter of 2012.

....

Overall, state tax revenues are showing continued improvement, though the pace of growth has been much slower in the recent quarters compared to historic averages. While state tax revenues have now grown for 11 consecutive quarters, they are still far below where they would have been in the absence of the Great Recession. Nationwide, state tax revenues in fiscal 2012 were less than 1 percent higher than fiscal 2008 in nominal terms. After adjusting for inflation, state tax revenues declined 5 percent in fiscal 2012 compared to fiscal 2008.

And from the NY Times: As State Budgets Rebound, Federal Cuts Could Pose Danger

A fiscal survey of states released Friday by the National Governors Association and the National Association of State Budget Officers found that states expect to collect $692.8 billion in general fund revenues this fiscal year, which is more than they collected in 2008, the last fiscal year before the recession.So there are some reasons for a little optimism, but it is difficult to make projections without knowing the budget agreement.

That is good news, but perhaps not as good as it initially appears. Adjusted for inflation, this year’s revenues are still expected to be 7.9 percent below the 2008 levels.

...

“What we’re really seeing here is there is not enough money to make up for any federal cuts,” said Scott D. Pattison, the executive director of the state budget officers’ association. “What I’ve heard from the state budget people is that they’ve told departments and agencies in state government: Do not expect us to have the money available, even if we wanted to, to make up for federal cuts.”

Key Measures show low inflation in November

by Calculated Risk on 12/14/2012 12:23:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.3% (-3.7% annualized rate) in November. The CPI less food and energy increased 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was above the Fed's target at 2.3% annualized. However trimmed-mean CPI was at 1.6% annualized, and core CPI increased 1.4% annualized. Also core PCE for October increased 1.6% annualized. These measures suggest inflation is mostly below the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis. Also, the FOMC statement this week indicated the Fed will tolerate an inflation outlook "between one and two years ahead" of 2 1/2 percent.

So, with this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

by Calculated Risk on 12/14/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October. In November, manufacturing output increased 1.1 percent after having decreased 1.0 percent in October; in addition to the storm-related rebound, a sizable rise in the production of motor vehicles and parts boosted factory output in November. The output of utilities advanced 1.0 percent, and production at mines rose 0.8 percent. At 97.5 percent of its 2007 average, total industrial production in November was 2.5 percent above its year-earlier level. Capacity utilization for total industry increased 0.7 percentage point to 78.4 percent, a rate 1.9 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

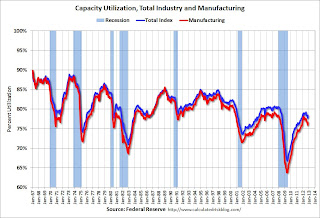

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

BLS: CPI declines 0.3% in November, Core CPI increases 0.1%

by Calculated Risk on 12/14/2012 08:40:00 AM

From the BLS: Consumer Price Index - November 2012

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment. The gasoline index fell 7.4 percent in November; this decrease more than offset increases in other indexes, resulting in the decline in the seasonally adjusted all items index.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% decrease for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in November after a 0.2 percent increase in October. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, slightly lower than the October figure of 2.0 percent. The food index has risen 1.8 percent over the last 12 months, and the energy index has risen 0.3 percent.

The decrease in CPI was mostly due to the recent decline in gasoline prices. On a year-over-year basis, CPI is up 1.8 percent, and core CPI is up 1.9 percent. Both below the Fed's target.

Thursday, December 13, 2012

Friday: CPI, Industrial Production

by Calculated Risk on 12/13/2012 08:27:00 PM

A couple of articles for light evening reading:

From Derek Thompson at the Atlantic: The Best Idea for the Debt Ceiling? Abolish It Forever. It really should be called the "default ceiling". I've been arguing for years - since Reagan demanded a clean bill from Congress in the '80s - that the default ceiling is just for political grandstanding.

From Suzy Khimm at the Wonkblog: New language, same findings: Tax hikes on the rich won’t cripple the economy. Here is the updated Congressional Research Service report. The data speaks.

Note: I still expect some sort of compromise to be reached on the "fiscal cliff", probably in early January.

Thursday economic releases:

• At 8:30 AM ET, the Consumer Price Index for November will be released. The consensus is for CPI to decrease 0.2% in November and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production in November, and for Capacity Utilization to increase to 78.0%.

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

CoStar: Commercial Real Estate prices decrease slightly in October, Up 6% Year-over-year

by Calculated Risk on 12/13/2012 05:30:00 PM

From CoStar: Commercial Property Prices Show Little Movement in October Amid Economic Uncertainty

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—saw very little change in the month of October 2012, dipping -0.1% and -0.8%, respectively, although both improved over quarter and year-ago levels. Recent pricing fluctuations likely signify a more cautious attitude among investors stemming from uncertainty over U.S. fiscal policy heading into 2013.

...

The number of distressed property trades in October fell to 14.8%, the lowest level witnessed since the first quarter of 2009. This reduction in distressed deal volume should result in higher, more consistent pricing, and lead to enhanced market liquidity, giving lenders more confidence to finance deals.

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 35.0% from the bottom (showing the demand for higher end properties) and up 6.1% year-over-year. However the Equal-Weighted index is only up 10.0% from the bottom, and up 5.9% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Sacramento November House Sales: Conventional Sales up 46% year-over-year

by Calculated Risk on 12/13/2012 02:44:00 PM

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In November 2012, 47.6% of all resales (single family homes and condos) were distressed sales. This was down slightly from 47.7% last month, and down from 64.1% in November 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 11.5%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 36.1%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were more than three times as many short sales as REO sales in November (the highest recorded). The gap between short sales and REO sales is increasing.

Total sales were up slightly from November 2011, and conventional sales were up 46% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 56.7% from last November, although listings were up 2% in November compared to October.

Cash buyers accounted for 37.1% of all sales (frequently investors), and median prices were up sharply year-over-year (the mix has changed).

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

Will Housing Inventory Bottom in 2013?

by Calculated Risk on 12/13/2012 11:55:00 AM

Economist Jed Kolko at Trulia writes: Housing in 2013: What’s In, What’s Out. Kolko discusses five predictions for 2013, the first is on inventory:

1. OUT: Will Home Prices Bottom? IN: Will Inventories Bottom? The big question this year was whether home prices had finally hit bottom. We now know the answer is a resounding “Yes”: every major index shows asking and sales prices rising in 2012. The key question in 2013, though, is whether prices will rise enough so that for-sale inventory–which has fallen 43% nationally since the summer of 2010–will hit bottom and start expanding again. The sharp decline in inventory was a necessary correction to the oversupply of homes after the bubble, but now inventory is below normal levels and holding back sales, particularly in California and the rest of the West. Rising prices should lead to more inventory, for two reasons: (1) rising prices encourage new construction, and (2) rising prices encourage some homeowners to sell. The big question for 2013 is whether today’s price gains will continue strongly enough to encourage builders to build and homeowners to sell. Why it matters: more inventory will lead to more sales and give buyers more homes to choose from.This is a very important question for 2013. This graph shows nationwide inventory for existing homes through October.

Click on graph for larger image.

Click on graph for larger image.According to the NAR, inventory declined to 2.14 million in October down from 2.17 million in September. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

If we see the usually seasonal decline in December and January, then NAR reported inventory will probably fall to the 1.80 to 1.85 million range. That would be the lowest level since January 2001.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. When we compare inventory to earlier periods, we need to remember there were essentially no "short sale contingent" listings prior to 2006.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.Inventory decreased 21.9% year-over-year in October from October 2011. This was the 20th consecutive month with a YoY decrease in inventory. It appears that inventory will be down sharply YoY in November too.

Months of supply declined to 5.4 months in October and is now in the normal range. I expect months-of-supply will be under 5 in December and January for the first time since early 2005.

Whenever I talk with real estate agents, I ask why they think inventory is so low. A common answer is that people don't want to sell at the bottom. In a market with falling prices, sellers rush to list their homes, and inventory increases. But if sellers think prices have bottomed, then they believe they can be patient, and inventory declines. Another reason is that many homeowners are "underwater" on their mortgage and can't sell.

If prices increase enough (probably around 5% in 2012) then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.

Another issue is if the Mortgage Debt Relief Act of 2007 is allowed to expire at the end of 2012. If the act isn't extended, many of the contingent short sales will be pulled off the market. Although this doesn't impact active inventory directly, it might have an indirect impact.

Right now my guess is active inventory will bottom in 2013.

Retail Sales increased 0.3% in November

by Calculated Risk on 12/13/2012 09:00:00 AM

On a monthly basis, retail sales increased 0.3% from October to November (seasonally adjusted), and sales were up 3.7% from November 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $412.4 billion, an increase of 0.3 percent from the previous month and 3.7 percent above November 2011. ... The September to October 2012 percent change was unrevised from -0.3 percent.

Click on graph for larger image.

Click on graph for larger image.The change in sales for October was unrevised at a 0.3% decline.

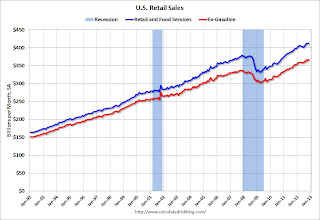

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in November - so only autos bounced back.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in November - so only autos bounced back.Excluding gasoline, retail sales are up 21.3% from the bottom, and now 8.9% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.0% on a YoY basis (3.7% for all retail sales).

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

Weekly Initial Unemployment Claims decline to 343,000

by Calculated Risk on 12/13/2012 08:37:00 AM

The DOL reports:

In the week ending December 8, the advance figure for seasonally adjusted initial claims was 343,000, a decrease of 29,000 from the previous week's revised figure of 372,000. The 4-week moving average was 381,500, a decrease of 27,000 from the previous week's revised average of 408,500.The previous week was revised up from 370,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.

The recent sharp increase in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is almost back to the pre-storm level.

Weekly claims were lower than the 370,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline next week to around 370,000 or so.