by Calculated Risk on 11/14/2012 08:30:00 AM

Wednesday, November 14, 2012

Retail Sales declined 0.3% in October

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $411.6 billion, a decrease of 0.3 percent from the previous month, but 3.8 percent above October 2011. ... The August to September 2012 percent change was revised from 1.1 percent to 1.3 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for September were revised up to a 1.3% increase (from 1.1% increase).

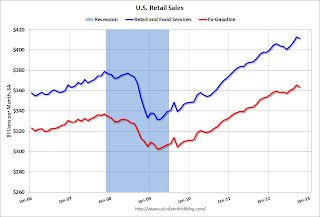

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.2% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.Excluding gasoline, retail sales are up 20.2% from the bottom, and now 8.0% above the pre-recession peak (not inflation adjusted).

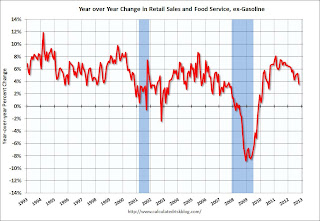

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.5% on a YoY basis (3.8% for all retail sales).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

MBA: Mortgage Applications rebound after Hurricane Sandy, Mortgage Rates fall to Record Low

by Calculated Risk on 11/14/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 13 percent from the previous week, ending a five-week decline. The seasonally adjusted Purchase Index increased 11 percent from one week earlier.Some of this decline in activity was related to Hurricane Sandy.

“Following the decrease in applications two weeks ago due to the effects of superstorm Sandy, mortgage applications in many East Coast states rebounded strongly this week,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Application volume in New Jersey more than doubled over the week, while volume in Connecticut and New York increased more than 60 percent. In addition to the rebound in the states impacted by the storm, the 30 year fixed mortgage rate reached a new record low in the survey.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.52 percent from 3.61 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This record low rate for 30 year fixed mortgages beats the previous survey low of 3.53 percent for the week ending September 28, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The increase this week was mostly just a rebound from the sharp decline the previous week due to Hurricane Sandy.

Tuesday, November 13, 2012

Wednesday: Retail Sales, Producer Price Index, FOMC Minutes

by Calculated Risk on 11/13/2012 09:05:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Fed Leans Toward Clearer Guidance

Under a new approach being considered by senior officials, the Fed would state how high inflation would have to rise or how low unemployment would have to fall before it would begin moving rates ...There might be a mention of possible targets in the FOMC minutes to be released on Wednesday.

"Several of my [Fed] colleagues have advocated such an approach, and I am also strongly supportive," Janet Yellen, the Fed's vice chairwoman, said ...

...

Chicago Fed President Charles Evans wants the Fed to offer assurances it will keep short-term rates low at least until the unemployment rate falls to 7%, as long as inflation remains below 3%. Minneapolis Fed President Narayana Kocherlakota has proposed thresholds of 5.5% for the unemployment rate and 2.25% for inflation.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for activity to rebound following Hurricane Sandy.

• At 8:30 AM, Retail sales for October will be released. Retail sales (especially auto sales) were impacted by Hurricane Sandy. The consensus is for retail sales to decrease 0.2% in October, and for retail sales ex-autos to increase 0.1%.

• Also at 8:30 AM, the Producer Price Index for October will be released. The consensus is for a 0.1% increase in producer prices (0.1% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for September (Business inventories). The consensus is for 0.6% increase in inventories.

• At 2:00 PM, the FOMC Minutes for Meeting of October 23-24, 2012 will be released. Look for a possible discussion of setting targets for exiting QE3.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Fiscal Slope: Alternative Minimum Tax (AMT)

by Calculated Risk on 11/13/2012 05:52:00 PM

Earlier I posted on the Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

Here is another part of the fiscal slope from the WSJ: IRS Warns: AMT Poised to Bite 33 Million Taxpayers

If Congress doesn’t act to extend relief from the alternative minimum tax by the end of 2012 – an important element of the fiscal cliff – the IRS said Tuesday that it would have to enforce the AMT against about 33 million households ...AMT relief is renewed every year. Maybe someday they'll just index it for inflation.

"If there is no AMT patch enacted by the end of the year, the IRS would be forced to operate the 2013 tax filing season based on the expiration of the AMT patch,” the acting IRS commissioner, Steven Miller, wrote in a letter to GOP Sen. Orrin Hatch of Utah on Tuesday. “There would be serious repercussions for taxpayers.”

The AMT was created in the 1960s to make sure that very wealthy people who accumulate a lot of deductions still paid some tax. Over the years, it has begun to hit many middle-class households, at least on paper, in part because it’s not indexed for inflation.

DataQuick: SoCal Home Sales increase in October

by Calculated Risk on 11/13/2012 02:07:00 PM

From DataQuick: Southland Home Sales, Median Price Rise Above Year Ago

Southern California home sales rose sharply in October as move-up buyers joined investors, shifting the mix of homes selling up a notch as foreclosure resales hit a five-year low. ... A total of 21,075 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 18.0 percent from 17,859 sales in September, and up 25.2 percent from 16,829 sales in October 2011, according to San Diego-based DataQuick.The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

...

The Southland’s lower-cost areas continued to post the weakest sales compared with last year. The number of homes that sold below $200,000 fell 11.2 percent year-over-year, while sales below $300,000 dipped 0.3 percent. Sales in these more affordable markets have been hampered by the slowdown in foreclosure activity, which results in fewer foreclosed properties listed for sale, as well as the high percentage of homeowners who still owe more than their homes are worth, meaning they can’t sell and move on.

Sales rose sharply in most mid- to-higher-cost markets in October. Sales between $300,000 and $800,000 – a range that would include many move-up buyers – jumped 41.5 percent year-over-year. October sales over $500,000 rose 55.2 percent year-over-year, while sales over $800,000 rose 52.4 percent compared with October 2011.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 16.3 percent of the Southland resale market last month. That was down from 16.6 percent the month before and 32.8 percent a year earlier. Last month’s level was the lowest since it was 16.0 percent in October 2007. In the current cycle, the foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 26.0 percent of Southland resales last month. That was down slightly from an estimated 27.6 percent the month before and up from 25.4 percent a year earlier.

This report shows why we need to focus on the composition of sales (conventional vs. distressed) as opposed to just overall sales. Sales are declining in the high foreclosures areas because the number of foreclosed properties is declining. But sales are now picking up in other areas, and these are mostly conventional sales.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th.

Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

by Calculated Risk on 11/13/2012 11:14:00 AM

As I noted last week, the "fiscal cliff" includes expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

Here is an article on the emergency unemployment benefits from Michael Fletcher at the WaPo: 2 million could lose unemployment benefits unless Congress extends program

More than 2 million Americans stand to lose their jobless benefits unless Congress reauthorizes federal emergency unemployment help before the end of the year.

...

These workers have exhausted their state unemployment insurance, leaving them reliant on the federal program.

In addition to those at risk of abruptly losing their benefits in December, 1 million people would have their checks curtailed by April if the program is not renewed ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, in October there were 5.00 million workers who had been unemployed for more than 26 weeks and still want a job. This is generally trending down, but is still very high.

As the WaPo article notes, many of these people are surviving on their unemployment benefits.

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/13/2012 08:33:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

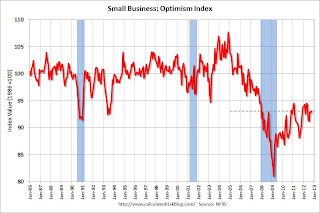

The National Federation of Independent Business (NFIB) Small Business Optimism Index rose 0.3 in October to 93.1; the slight uptick in the reading did not seem to indicate a dramatic shift in owner sentiment over the course of the month.

...

One indicator that rose slightly in October is the frequency of reported capital outlays in the past six months, increasing 3 points to 54 percent. ... Weak sales is still the reported No. 1 business problem for 22 percent of owners surveyed. ... October was another weak job creation month, though better than September due primarily to a reduction in terminations which will raise the net jobs number. According to the October survey, owners stopped releasing workers; the average change in employment per firm rose to just 0.02 workers—essentially zero.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 93.1 in October from 92.8 in September.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.

Monday, November 12, 2012

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/12/2012 07:08:00 PM

Economist Tom Lawler sent me the following preliminary table today of short sales and foreclosures for a few selected cities in October. Over the weekend I posted some data from Sacramento showing a sharp increase in conventional sales, and that distressed sales have fallen to the lowest level since the Sacramento Association started tracking the data.

There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in all of these cities. In most areas, short sales far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. In the cities listed below, distressed sales are down about 25% from a year ago.

And previously from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| Charlotte | 13.2% | 17.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler on Builder Results

by Calculated Risk on 11/12/2012 02:51:00 PM

A few comments and a table from economist Tom Lawler:

D.R. Horton and Beazer Homes released their operating results for the quarter ended September 30th today. Here is a table showing some summary stats for nine large publicly-traded home builders. The net orders and settlements figures include results from “discontinued operations.”

The combined order backlog of the builders on September 30th, 2012 was 30,461, up 44.6% from last September.

CR Note: I broke Tom's table into two sections - the first for orders and settlements, and the second for prices.

This increase in net orders was about the same as last quarter (year-over-year), and the backlog is continuing to increase.

| Net Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | 5,276 | 4,241 | 24.4% | 5,575 | 4,987 | 11.8% |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Beazer Homes | 1,110 | 1,023 | 8.5% | 1,608 | 1,404 | 14.5% |

| Standard Pacific | 989 | 764 | 29.5% | 861 | 697 | 23.5% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| MDC Holdings | 1,008 | 595 | 69.4% | 1,039 | 707 | 47.0% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 18,953 | 14,906 | 27.2% | 19,422 | 16,685 | 16.4% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | $231,085 | $215,300 | 7.3% |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Beazer Homes | $228,600 | $228,100 | 0.2% |

| Standard Pacific | $369,000 | $346,000 | 6.6% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| MDC Holdings | $308,600 | $289,800 | 6.5% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $271,027 | $254,436 | 6.5% |

A few more thoughts on Fiscal Agreement

by Calculated Risk on 11/12/2012 01:38:00 PM

It is always difficult to guess what policymakers will do!

On Friday I outlined the major components of the "fiscal cliff" and provided my initial guess at a compromise (actually more of a slope, hillock or bluff since Jan 1st is not a drop dead date). The components include expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

According to the updated CBO analysis, this fiscal tightening would cut the deficit in half, but would probably also lead to a new recession in 2013 (the CBO is forecasting unemployment would rise to 9.1% in Q4 2013).

My initial guess was a compromise would be reached and there will be no recession in 2013. My guess is the compromise would include allowing the tax cuts for high income earners and the payroll tax cut to expire, however the tax cuts for low and middle income earners would be extended, the AMT relief would be extended, and the defense cuts would be scaled back. Of course there are many more details.

My initial guess on timing was early in 2013. That was based on a two assumptions:

1) the tax cuts for high income earners would be allowed to expire, and

2) the GOP would not vote for any package that included a tax rate increase.

Since the tax cuts expire on Jan 1st, I figured the GOP could then vote for tax cuts for the middle class. But it is also possible that this agreement could be reached this year, and the bill could be written so there are no tax rate increases (since the tax increases will happen automatically, the bill doesn't have to include the increases).

So it is possible that some agreement will be reached this year. My baseline forecast is that some agreement will be reached and that there will be some Federal fiscal tightening, but the tightening will not lead to a new recession.