by Calculated Risk on 11/13/2012 11:14:00 AM

Tuesday, November 13, 2012

Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

As I noted last week, the "fiscal cliff" includes expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

Here is an article on the emergency unemployment benefits from Michael Fletcher at the WaPo: 2 million could lose unemployment benefits unless Congress extends program

More than 2 million Americans stand to lose their jobless benefits unless Congress reauthorizes federal emergency unemployment help before the end of the year.

...

These workers have exhausted their state unemployment insurance, leaving them reliant on the federal program.

In addition to those at risk of abruptly losing their benefits in December, 1 million people would have their checks curtailed by April if the program is not renewed ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, in October there were 5.00 million workers who had been unemployed for more than 26 weeks and still want a job. This is generally trending down, but is still very high.

As the WaPo article notes, many of these people are surviving on their unemployment benefits.

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/13/2012 08:33:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

The National Federation of Independent Business (NFIB) Small Business Optimism Index rose 0.3 in October to 93.1; the slight uptick in the reading did not seem to indicate a dramatic shift in owner sentiment over the course of the month.

...

One indicator that rose slightly in October is the frequency of reported capital outlays in the past six months, increasing 3 points to 54 percent. ... Weak sales is still the reported No. 1 business problem for 22 percent of owners surveyed. ... October was another weak job creation month, though better than September due primarily to a reduction in terminations which will raise the net jobs number. According to the October survey, owners stopped releasing workers; the average change in employment per firm rose to just 0.02 workers—essentially zero.

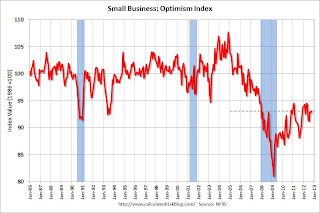

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 93.1 in October from 92.8 in September.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.

Monday, November 12, 2012

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/12/2012 07:08:00 PM

Economist Tom Lawler sent me the following preliminary table today of short sales and foreclosures for a few selected cities in October. Over the weekend I posted some data from Sacramento showing a sharp increase in conventional sales, and that distressed sales have fallen to the lowest level since the Sacramento Association started tracking the data.

There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in all of these cities. In most areas, short sales far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. In the cities listed below, distressed sales are down about 25% from a year ago.

And previously from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| Charlotte | 13.2% | 17.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler on Builder Results

by Calculated Risk on 11/12/2012 02:51:00 PM

A few comments and a table from economist Tom Lawler:

D.R. Horton and Beazer Homes released their operating results for the quarter ended September 30th today. Here is a table showing some summary stats for nine large publicly-traded home builders. The net orders and settlements figures include results from “discontinued operations.”

The combined order backlog of the builders on September 30th, 2012 was 30,461, up 44.6% from last September.

CR Note: I broke Tom's table into two sections - the first for orders and settlements, and the second for prices.

This increase in net orders was about the same as last quarter (year-over-year), and the backlog is continuing to increase.

| Net Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | 5,276 | 4,241 | 24.4% | 5,575 | 4,987 | 11.8% |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Beazer Homes | 1,110 | 1,023 | 8.5% | 1,608 | 1,404 | 14.5% |

| Standard Pacific | 989 | 764 | 29.5% | 861 | 697 | 23.5% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| MDC Holdings | 1,008 | 595 | 69.4% | 1,039 | 707 | 47.0% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 18,953 | 14,906 | 27.2% | 19,422 | 16,685 | 16.4% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | $231,085 | $215,300 | 7.3% |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Beazer Homes | $228,600 | $228,100 | 0.2% |

| Standard Pacific | $369,000 | $346,000 | 6.6% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| MDC Holdings | $308,600 | $289,800 | 6.5% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $271,027 | $254,436 | 6.5% |

A few more thoughts on Fiscal Agreement

by Calculated Risk on 11/12/2012 01:38:00 PM

It is always difficult to guess what policymakers will do!

On Friday I outlined the major components of the "fiscal cliff" and provided my initial guess at a compromise (actually more of a slope, hillock or bluff since Jan 1st is not a drop dead date). The components include expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

According to the updated CBO analysis, this fiscal tightening would cut the deficit in half, but would probably also lead to a new recession in 2013 (the CBO is forecasting unemployment would rise to 9.1% in Q4 2013).

My initial guess was a compromise would be reached and there will be no recession in 2013. My guess is the compromise would include allowing the tax cuts for high income earners and the payroll tax cut to expire, however the tax cuts for low and middle income earners would be extended, the AMT relief would be extended, and the defense cuts would be scaled back. Of course there are many more details.

My initial guess on timing was early in 2013. That was based on a two assumptions:

1) the tax cuts for high income earners would be allowed to expire, and

2) the GOP would not vote for any package that included a tax rate increase.

Since the tax cuts expire on Jan 1st, I figured the GOP could then vote for tax cuts for the middle class. But it is also possible that this agreement could be reached this year, and the bill could be written so there are no tax rate increases (since the tax increases will happen automatically, the bill doesn't have to include the increases).

So it is possible that some agreement will be reached this year. My baseline forecast is that some agreement will be reached and that there will be some Federal fiscal tightening, but the tightening will not lead to a new recession.

Merrill Lynch Revises up 2012 House Price Forecast to 5% increase

by Calculated Risk on 11/12/2012 12:08:00 PM

From Chris Flanagan and Michelle Meyer at Merrill Lynch: Another upward revision to home prices

Back in March, we called the bottom in national home prices. It appears that while we are correct on the timing, we understated the magnitude of the turn. We revised up our forecast in August, but did not go far enough and hence are revising our trajectory again. We now look for S&P Case Shiller prices to be up 5.0% YoY this year (Q4/Q4), compared to our prior forecast of 2.0%. ... Taking a longer perspective, we look for average home price appreciation of 3.3% over the next ten years or a cumulative gain of about 36%. This will modestly outpace the rate of inflation.And on the economic impact:

Our forecast still assumes some slowing in home prices into the end of the year. We forecast S&P Case Shiller national prices to be up 5.6% q/q saar in Q3, following a 9.3% gain in Q2. We look for essentially flat prices in Q4 and a decline of 1.6% in Q1 before prices resume their upward trend. It is important to remember that the housing market is subject to volatility in the best of times; in this distorted market, we cannot expect a smooth pattern.

The key factor driving the increase in home prices is a better alignment of housing supply and demand. Inventory of homes for sale has declined markedly. On an absolute level, listed inventory is at the lowest since 1Q05. And even after accounting for the slow pace of sales, it only takes 5.9 months to clear inventory. Supply is even lower for new construction homes ...

While the initial turn higher in demand was driven by investors, it appears that more recent gains can be attributable to primary homebuyers. The latest results from the Campbell HousingPulse survey shows an increase in the share of sales to current homeowners and a decline in investor share over the past few months ...

The gain in home prices will support economic growth. The traditional way we think about the link between home prices and the economy is through the "wealth effect." The wealth effect captures the amount of additional spending power created (lost) from an increase (decrease) in household wealth. The conventional wisdom is that the marginal propensity to consume out of housing wealth is about 3 to 5 cents per dollar over a three year period. This suggests that the gain in housing wealth will only be a gradual tailwind for the economy.CR Note: Merrill Lynch analysts are using the quarterly Case-Shiller National index (most reporting uses the monthly Case-Shiller Composite 20 index). The Case-Shiller National Index was up 1.1% in Q2 (compared to Q2 2011). Looking at the recent monthly data, Merrill's forecast for 2012 appears about right.

There is also another important link which can show up more quickly – consumer confidence. The turn in home prices, although modest at the start, will help to boost consumer confidence. Simply believing that prices have stopped falling should provide a sense of relief to households. It will also allow households to have greater mobility, generating a more efficient labor market and greater churn in the housing stock. We have already seen a turn higher in consumer sentiment, which is likely correlated with the gain in home prices.

Merrill analysts are expecting prices to increase 3% in 2013. My guess is most of the sharp decline in inventory is now behind us, and I think there are many potential sellers waiting for a better market, and slightly higher prices will probably mean a little more inventory keeping prices from rising quickly.

Note: I wrote about The economic impact of a slight increase in house prices back in August.

Also note the comment about more "primary homebuyers" - that is an important transition along with more conventional sales (as opposed to foreclosures and short sales).

Homebuilders D.R. Horton and Beazer Report Sales Increase

by Calculated Risk on 11/12/2012 09:14:00 AM

D.R. Horton continues to see strong sales growth and expect sales to increase in 2013. Beazer is a laggard, but also expects sales to increase next year. I'll have more on the builders in a couple weeks.

From RTTNews.com: D.R. Horton Q4 Profit Climbs, Tops View

Homebuilder D.R. Horton Inc. Monday reported a sharp increase in fourth-quarter profit, that exceeded analysts' view, as the company benefited from continued improvement in housing market ...Quote from Donald R. Horton, Chairman of the Board:

Homebuilding revenues for the quarter climbed 21 percent to $1.3 billion, while analysts estimated $1.35 billion. The company closed 5,575 homes in the period, up 12 percent from a year earlier.

Net sales orders increased 24 percent and value of net sales orders were up 35 percent from the preceding year.

As at September 30, D.R. Horton sales order backlog of homes under contract jumped 49 percent to 7,240 homes and the value of the backlog increased 61 percent to $1.7 billion.

“We are positioned for a strong start to fiscal 2013, with our highest year-end backlog since fiscal 2007. We have continued to see strong sales demand through October and into November. With 13,000 homes in inventory and 60,000 finished lots controlled, we have the home and lot position to continue to grow our market share and meet increasing customer demand. We look forward to continued improvement in our operating metrics and increased profitability in fiscal 2013.”And from MarketWatch: Beazer Homes's loss widens, sales up double-digits

Beazer Homes fiscal fourth-quarter loss widened as the home builder recorded a large debt extinguishment loss that overshadowed a double-digit revenue rise.

...

Revenue rose 11% to $370.9 million as home construction and land sales climbed. Analysts polled by Thomson Reuters expected a loss of $1.22 a share on $335.1 million in revenue.

The builder's cancellation rate was down at 31.1% from 34.2%. Total home closings were up 17% to 1,608.

New orders rose 10% to 1,110 homes, a rate that is slower than many of the homebuilder's peers. Total backlog units rose 31% from the year-ago quarter.

Sunday, November 11, 2012

Monday: Veterans Day

by Calculated Risk on 11/11/2012 08:21:00 PM

Monday:

• Bond markets and banks will be closed in observance of Veterans Day. The stock market will be open.

• 4:00 AM ET: Eurozone Finance Ministers Meeting

On Greece, from the Financial Times: Greece battles to avert €5bn default

Greece is battling to raise funds to avoid defaulting on a €5bn debt repayment this week ...From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 1 and DOW futures are slightly down.

The country’s debt management office has announced plans to cover the full amount through a treasury bill auction on Tuesday, but Greek banks expected to buy the issue can only raise about €3.5bn of collateral acceptable to the European Central Bank ...

Senior EU officials, however, said they remain doubtful a deal can be struck at Monday’s meeting of finance ministers in Brussels ...

excerpt with permission

Oil prices are down slightly with WTI futures at $85.96 per barrel and Brent at $109.03 per barrel. Gasoline prices have been falling.

Weekend:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Two more questions this week for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

AAR: Rail Traffic "mixed" in October

by Calculated Risk on 11/11/2012 04:54:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for October

The Association of American Railroads (AAR) today reports U.S. rail traffic continues to show mixed results in monthly rail data, and that impacts from Hurricane Sandy can be seen in decreased traffic for week 44.

“The fundamentals of U.S. rail traffic remained roughly the same in October as in recent months: weakness in coal, remarkable growth in petroleum and petroleum products, a slight slowing of growth in intermodal and autos, and mixed results for everything else,” said AAR Senior Vice President John T. Gray.

Intermodal traffic in October saw an increase for the 35th straight month, totaling 1,233,475 containers and trailers, up 1.5 percent (18,710 units) compared with October of 2011. Carloads originated in October totaled 1,422,654 carloads, down 6.1 percent (92,601 carloads) compared with the same month last year. Carloads excluding coal were up 1.9 percent for the month, or 15,609 carloads, compared with the same month last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

Total U.S. rail carload traffic fell 6.1% (92,601 carloads) to 1,422,654 in October 2012 from October 2011 on a non-seasonally adjusted basis (see charts below). That’s the largest year-over-year carload percentage decline since November 2009.The second graph is for intermodal traffic (using intermodal or shipping containers):

As was the case last month too, coal alone more than accounted for the total carload decline in October. Coal carloads were down 16.0% (108,210 carloads) in October 2012 from October 2011.

...

Hurricane Sandy negatively affected rail traffic in the last week of October in the East. As is always the case when bad weather affects rail traffic, some of the lost traffic will be made up, some will not, and it is not possible to precisely determine how much falls into each category.

Graphs reprinted with permission.

Graphs reprinted with permission.On Intermodal traffic:

U.S. rail intermodal traffic rose 1.5% (18,710 containers and trailers) in October 2012 over October 2011 to 1,233,475 units. That’s the 35th straight year-over-year monthly increase, though it was the smallest percentage gain in 14 months.This is more evidence of sluggish growth.

Yesterday:

• Summary for Week Ending Nov 9th

• Schedule for Week of Nov 11th

Sacramento October House Sales: Conventional Sales up 55% year-over-year

by Calculated Risk on 11/11/2012 11:14:00 AM

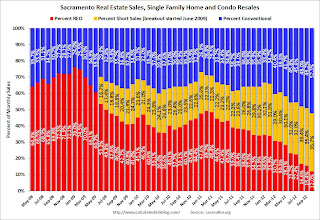

Note: I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement in the Sacramento market.

In October 2012, 47.7% of all resales (single family homes and condos) were distressed sales. This was down from 50.8% last month, and down from 64.1% in October 2011. The is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs fell to 12.0%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.7%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were almost three times as many short sales as REO sales in October. The gap between short sales and REO sales is increasing.

Total sales were up 7% from October 2011, and conventional sales were up 55% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 60.4% from last October, although listings were up 4% in October compared to the previous month.

Cash buyers accounted for 36.9% of all sales (frequently investors), and median prices were up 4.1% from last October.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.