by Calculated Risk on 10/23/2012 12:08:00 PM

Tuesday, October 23, 2012

Fed: State Coincident Indexes in September show improvement

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2012. In the past month, the indexes increased in 39 states, decreased in five states, and remained stable in six states, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 37 states, decreased in 11 states, and remained stable in two states, for a three-month diffusion index of 52. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index rose 0.2 percent in September and 0.6 percent over the past three months.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 41 states had increasing activity, up from 33 in August (including minor increases). This is the second consecutive year with a weak spot during the summer, and improvement towards the end of the year.

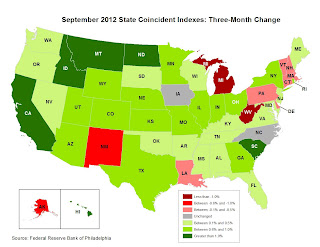

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. The map was all green earlier this year and is starting to turn mostly green again.

Richmod Fed Mfg Survey indicates contraction in October

by Calculated Risk on 10/23/2012 10:00:00 AM

From the Richmond Fed: Manufacturing Activity Pulled Back in October; Optimism Wanes

Manufacturing activity in the central Atlantic region pulled back in October after improving somewhat last month, according to the Richmond Fed's latest survey. The seasonally adjusted index of overall activity was pushed lower as all broad indicators of activity — shipments, new orders and employment — were in negative territory.This suggests contraction in manufacturing activity in the central Atlantic region. It appears some of this contraction may be due to the European recession and reduced exports to Europe.

...

Looking forward, assessments of business prospects for the next six months were less optimistic in October. Contacts at more firms anticipated that new orders, backlogs, capacity utilization, and vendor lead-times will grow more slowly than anticipated a month ago.

...

In October, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost eleven points to −7 from September's reading of 4. Among the index's components, shipments fell eighteen points to −9, new orders moved down thirteen points to finish at −6, and the jobs index held steady at −5.

Bank of Spain: Recession Continues, Deficit to Increase

by Calculated Risk on 10/23/2012 08:37:00 AM

From the WSJ: Bank of Spain Warns on Deficit Targets

Spain's central bank said Tuesday the country's economy contracted slightly less than expected in the third quarter but repeated a warning that tax-revenue shortfalls could cause the government to miss its 2012 budget-deficit target.Another austerity data point. Still the Spanish bond yields are down from the levels of a few months ago with the 10-year yield at 5.55%, and the 2-year yield at 2.98%.

The euro zone's fourth-largest economy contracted by 0.4%, the same as in the second quarter, the Bank of Spain said in a quarterly report. On an annual basis, the contraction was 1.7% ...

The government has said its deficit will rise to 7.4% of GDP this year ...

"The efforts to lower spending at the public sector have had a net contracting effect (on the economy) in the central months of the year," the central bank said. "We see drops in consumption and investment by all levels of government above those seen in previous quarters."

emphasis added

Monday, October 22, 2012

Tuesday: Richmond Fed Mfg Survey

by Calculated Risk on 10/22/2012 07:47:00 PM

There will be plenty of economic data released later this week! There is some sort of political debate tonight at 9 PM ET. The good news is the election will be over on November 6th. The bad news, as Atrios mentioned earlier, is the 2016 election cycle starts on Nov 7th.

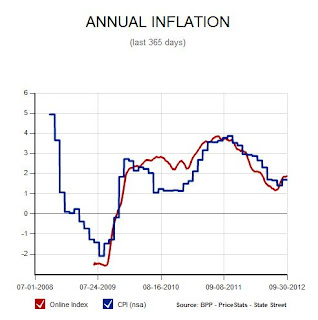

Here is something I like to check occasionally as a different measure for inflation in addition to to CPI from the BLS.

This is the US only index of the MIT Billion Prices Project.

This index uses prices for online goods. From MIT:

These indexes are designed to provide real-time information on major inflation trends, not to forecast official inflation announcements. We are constantly adding new categories of goods, but we do not cover 100% of CPI goods and services. The price of services, in particular, are not easy to find online and therefore are not included in our statistics.

Click on graph for larger image.

Click on graph for larger image.It appears that year-over-year inflation, according to this measure, is under 2.0%. This is another measure that suggests inflation is not currently a problem.

On Tuesday:

• At 10:00 AM ET, the Richmond Fed Survey of Manufacturing Activity for October will be released. The consensus is for an increase to 6 for this survey from 4 in September (above zero is expansion).

LPS: Mortgage delinquencies increased sharply in September, Percent in foreclosure process lowest in 2 years

by Calculated Risk on 10/22/2012 04:15:00 PM

LPS released their First Look report for September today. LPS reported that the percent of loans delinquent increased in September compared to August, but declined about 4% year-over-year. On the other hand, the percent of loans in the foreclosure process declined sharply in September to the lowest level in almost 2 years.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 7.40% from 6.87% in August. The percent of loans in the foreclosure process declined to 3.87% from 4.04% in August. Note: the normal rate for delinquencies is around 4.5% to 5%.

LPS is looking into the reasons for the increase in the delinquency rate, and will probably provide a discussion in the Mortgage Monitor that will be released in early November. Looking at the table below - that shows the LPS numbers for September 2012, and also for last month (August 2012) and one year ago (September 2011) - most of the increase in delinquencies was in the short term category. The number of serious delinquent properties (90+ days and in-foreclosure) declined 70 thousand from August.

The number of delinquent properties, but not in foreclosure, is down about 7% year-over-year (280,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 9% or 190,000 year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Sept 2012 | August 2012 | Sept 2011 | |

| Delinquent | 7.40% | 6.87% | 7.72% |

| In Foreclosure | 3.87% | 4.04% | 4.18% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 2,170,000 | 1,910,000 | 2,250,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,530,000 | 1,520,000 | 1,730,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,940,000 | 2,020,000 | 2,130,000 |

| Total Properties | 5,640,000 | 5,450,000 | 6,130,000 |

FOMC Preview

by Calculated Risk on 10/22/2012 12:25:00 PM

The Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday, with a statement expected at 2:15 PM ET on Wednesday. The FOMC is expected to take no action at this meeting, although the members will probably discuss setting explicit economic targets for ending QE3 purchases or tightening policy ...

From Cardiff Garcia at Alphaville: Early FOMC preview

... there are a few things that might happen, even if we not get the full picture until the minutes come out a few weeks later.Although the Fed might mention the recent pickup in economic activity, they will not change course quickly. From Neil Irwin at the WaPo: How an improving economy makes new Fed policies more potent

The most important item is that the committee will continue discussing whether to adopt explicit economic targets to determine when tightening (ie raising rates from exceptionally low levels) would begin, replacing the current approach of giving a calendar date, which now mid-2015.

A key part of the Fed’s new strategy last month was to announce that the FOMC “expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.” In other words, the central bank aimed to assure the world that it would not pull away the support strut of low interest rates until the economy was well along in recovering, so long as inflation doesn’t threaten to get much above the Fed’s 2 percent target.It looks like the unemployment rate will decline more than the Fed projected (see second table below), but the rate is still high at 7.8% - and 2% GDP is nothing to get too excited about.

Here are the FOMC Sept meeting projections for GDP and unemployment, and the June projections to show the change.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

| June 2012 Projections | 1.9 to 2.4 | 2.2 to 2.8 | 3.0 to 3.5 |

The BEA reported GDP increased at a 2.0% annual pace in Q1, and at a 1.3% annual pace in Q2. Forecasts for Q3 have been revised up recently, but the consensus is only for 1.9% annualized in Q3. So this is still close to the recent projections.

The unemployment rate was at 7.8% in September, and that is below the most recent projections for Q4 2012. That is just one month of data. It is possible that the unemployment situation might not be as bad as the FOMC projected, but the unemployment rate is still very high. The key is there is nothing in the recent data that will make the Fed change course any time soon.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

| June 2012 Projections | 8.0 to 8.2 | 7.5 to 8.0 | 7.0 to 7.7 |

So the FOMC will probably take no action, might mention the recent slight improvement in economic data, and will probably reiterate "If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability." and "To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens."

"The US bright spot"

by Calculated Risk on 10/22/2012 09:13:00 AM

From Kate Mackenzie at FT Alphaville: The US bright spot

It seems odd — and it may well be short-lived — but the US is beginning to shape up as a rare bright spot in the world economy. Or indeed almost the only bright spot in the world’s economy, except for the Gulf petro-states. That is, if you were to base such an assessment solely on Japan’s September export data, released on Monday.Actually it isn't that "odd" as Mackenzie mentions in a note at the bottom: "The FT’s Martin Wolf made a comment along these lines in Sydney last week. Plus, Cardiff has been looking at (very) tentative signs of an upturn in housing and construction for some time now, and that was before Jamie Dimon picked up on it."

Japan’s preliminary September trade data tell a story not dissimilar to China’s — exports to Europe are slowing (unsurprisingly) by a lot, down 26 per cent for the month, year-on-year. Asian exports also fell, by 8.3 per cent. But US exports rose 0.9 per cent. The six months between April and September show a more striking contrast: exports to North America rose 16.6 per cent; while for Asia they fell 4.7 per cent and for Western Europe, there was a 20.8 per cent decline.

This is another reminder that Europe and China pose downside risks, but right now the US is doing better than most other areas.

Sunday, October 21, 2012

Sunday Night Futures

by Calculated Risk on 10/21/2012 09:14:00 PM

Later in the week, there are several key economic releases (Q3 GDP, New Home sales, Durable Goods) and an FOMC announcement on Wednedsy. There are no releases scheduled for tomorrow ...

• Expected: LPS "First Look" Mortgage Delinquency Survey for September.

• At 9:00 PM ET, the Third Presidential Debate: President Obama and former Governor Romney debate Foreign policy at Lynn University in Boca Raton, Florida.

The Asian markets are red tonight, with the Nikkei down 1.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are down slightly.

Oil prices are down with WTI futures down to $90.05 and Brent down at $110.66 per barrel.

Weekend:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

Three more questions this week for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Gasoline Prices down 8 cents over last 2 weeks

by Calculated Risk on 10/21/2012 06:24:00 PM

From Reuters: Average U.S. retail gas prices drop 8 cents in two weeks: survey

Gasoline prices averaged $3.7529 per gallon on October 19, down from $3.8375 on October 5, Trilby Lundberg, editor of the Lundberg Survey, said.Those of us in California are still waiting for the "dramatic crash"! We are still paying well over $4 per gallon because of the recent refinery issues (I filled up Friday and paid $4.50 per gallon, but it looks like prices have fallen further over the last 2 days).

...

Lundberg said further declines in retail gas prices are expected if the cost of crude oil does not rise substantially. She added that in California, gasoline prices could have a "dramatic crash" after refinery problems caused a spike two weeks ago.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.60 per gallon. That is about 8 cents below the current level according to Gasbuddy.com, and I expect prices to fall further. Note: Brent crude spot prices is at $110.76 per barrel (WTI is down to $90.05)

Gasoline prices have been on a roller coaster all year. Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent spike.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st

DOT: Vehicle Miles Driven increased 1.2% in August

by Calculated Risk on 10/21/2012 12:21:00 PM

The Department of Transportation (DOT) reported Friday:

Travel on all roads and streets changed by 1.2% (3.0 billion vehicle miles) for August 2012 as compared with August 2011. Travel for the month is estimated to be 262.4 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.9% (17.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 57 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.

Gasoline prices were up in August compared to August 2011. In August 2012, gasoline averaged of $3.78 per gallon according to the EIA. Last year, prices in August averaged $3.70 per gallon - but even with the increase in gasoline prices, miles driven increased year-over-year in August.Just looking at gasoline prices suggest miles driven will be down in September - especially with the very high prices in California. Nationally gasoline prices averaged $3.91 in September, up sharply from $3.67 a year ago.

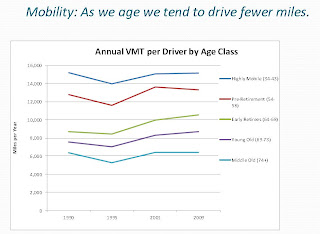

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.I also suspect miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline.

With all these factors, it may be years before we see a new peak in miles driven.

Yesterday:

• Summary for Week Ending Oct 19th

• Schedule for Week of Oct 21st