by Calculated Risk on 10/19/2012 08:36:00 AM

Friday, October 19, 2012

Report: Seasonal Retail Hiring to be about the same as in 2011

Each year I track seasonal retail hiring during October, November and December. This usually provides an early clue on holiday retail sales. Currently the NRF is forecasting about the same level of seasonal hiring as last year.

From the National Retail Federation: Expect Solid Growth This Holiday Season

Tempered by political and fiscal uncertainties but supported by signs of improvement in consumer confidence, holiday sales this year will increase 4.1 percent to $586.1 billion. NRF’s 2012 holiday forecast is higher than the 10-year average holiday sales increase of 3.5 percent.Last year was the highest level of seasonal hiring since 2007 (seasonal hiring was especially weak in 2008, and then improved some in 2009). There is also a shift towards online buying that is keeping down seasonal hiring.

...

According to NRF, retailers are expected to hire between 585,000 and 625,000 seasonal workers this holiday season, which is comparable to the 607,500 seasonal employees they hired last year.

Thursday, October 18, 2012

Friday: Existing Home Sales

by Calculated Risk on 10/18/2012 08:37:00 PM

The most important numbers in the existing home sales report, to be released Friday morning, are inventory and percent conventional sales - not total sales (although that will be the focus of most of the media).

Inventory is important because this is "visible inventory" (as opposed to "shadow inventory"), and visible inventory that has the largest impact on prices. The percent of conventional sales is important because this gives a hint as to the health of the overall market.

Imagine if sales move mostly sideways for the next few years, but the number of distressed sales steadily declines. That would be a sign of an improving market.

Unfortunately I'm not very confident in the NAR methodology for estimating the percent of distressed sales. This data comes from a monthly survey for the Realtors® Confidence Index and is an unscientific sample. However the regional data Tom Lawler and I have been tracking suggests the percent of conventional sales is increasing.

In August 2012, the NAR reported "Distressed homes ... accounted for 22 percent of August sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in July and 31 percent in August 2011" and last year, the NAR reported "Distressed homes ... accounted for 30 percent of sales in September (18 percent were foreclosures and 12 percent were short sales), down from ... 35 percent in September 2010."

So it appears the percent of distressed sales is declining (the percent of conventional sales is increasing), and I'd expect the NAR to report distressed sales in the low 20 percent range.

Housing economist Tom Lawler estimates the NAR will report sales of 4.70 million and a monthly decline in the inventory of existing homes for sale of about 3.2% in September.

On Friday:

• At 10:00 AM, the National Association of Realtors (NAR) will releases Existing Home Sales for September. The consensus is for sales of 4.75 million on seasonally adjusted annual rate (SAAR) basis. Sales in August 2012 were 4.82 million SAAR.

• Also at 10:00 AM, the BLS will release the Regional and State Employment and Unemployment report for September 2012.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Low Mortgage Rates and Refinance Activity

by Calculated Risk on 10/18/2012 03:18:00 PM

Freddie Mac reported earlier today: Mortgage Rates Near Record Lows As Home Construction Builds Up Steam

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates edging slightly lower with the 30-year fixed averaging 3.37 percent, just above its all-time record low of 3.36 percent, and the average 15-year fixed dipping to a new all-time record low at 2.66 percent.And the MBA reported yesterday that refinance activity decreased last week, but is still near the highest level since early 2009.

Here is a graph comparing mortgage rates from the Freddie Mac Primary Mortgage Market Survey® (PMMS®) and the refinance index from the Mortgage Bankers Association (MBA).

UPDATE: left axis is MBA refinance index, 1990=100.

Click on graph for larger image.

Click on graph for larger image.It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and that is what we are seeing!

There has also been an increase in refinance activity from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie (see The HARP Refinance Boom Continued in August) .

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey.

The second graph shows the 15 and 30 year fixed rates from the Freddie Mac survey.The Primary Mortgage Market Survey® started in 1971 (15 year in 1991). The 30 year rate is near a record low for the Freddie Mac survey, and rates for 15 year fixed loans is at a now low this week.

Downside Risks

by Calculated Risk on 10/18/2012 12:12:00 PM

Occasionally, over the last several years, I've posted a list of downside risks to economic growth - and here is another one. Currently my forecast is still for sluggish and choppy growth, but I think there are reasons to expect US economic growth to pickup in the next year or two, perhaps to trend growth. As I noted last month in Two Reasons to expect Economic Growth to Increase, residential investment is now a tailwind for the economy, and the drag from state and local government cutbacks is mostly behind us.

There are always many downside risks (meteor strikes, major terrorist attack, war somewhere - possibly with Iran), but I think these are the most probable downside risks:

• The European financial crisis. The European crisis has been threatening to spill over into the US for several years. Looking back, I was writing about Greece, Ireland and Spain sovereign debt issues in 2009. This year the recession in Europe is hitting US exports, but so far there is little financial contagion.

The European situation could spin out of control at any time. Currently the unemployment rate is 25.1% in both Spain and Greece, and that is political unsustainable. There are decisions to made soon regarding Greece (another round of financial help) and Spain (when will they ask for a bailout?) - and also about fiscal union and easing back on austerity.

• The economic slowdown in China. The recession in Europe has spilled over into China, and has led to fears of a sharp slowdown. From the WSJ: China's Growth Continues to Slow

Growth in China's gross domestic product fell to 7.4% in the third quarter compared with a year earlier, China's National Bureau of Statistics said Thursday, down from 7.6% in the second quarter and the weakest since the beginning of 2009. The seventh consecutive deceleration reflected a combination of weak demand from abroad, flagging investment at home, and insufficient spending by China's households to pick up the slack.China reports GDP on a year-over-year basis (the US reports an annualized rate quarterly). A sharp slowdown in China might lead to a higher trade deficit with the US - and also might reveal some financial issues in China. As Warren Buffett said "It's only when the tide goes out that you learn who's been swimming naked."

Data for September showed some signs of stabilization. Industrial output growth rose to 9.2% year-over-year, from 8.9% in August. Exports also bounced back, up 9.9% year-over-year in September, after 2.7% in the previous month. And Chinese refineries processed a record high amount of crude oil, 7% more than a year earlier.

Of course a slowdown in China might lead to lower commodity prices, and that would help many sectors in the US.

• The Fiscal Slope. This is commonly called the "fiscal cliff", but it is more of a slope. This refers to several federal tax increases and spending cuts that are scheduled to happen at the beginning of 2013. This includes ending the Bush-era tax cuts, ending the temporary payroll tax reduction, ending extended unemployment benefits, and some large budget cuts mostly for defense spending. No one expect this to be resolved before the election, but after the election this could become a significant issue. This doesn't have to be resolved immediately - policymakers could wait a few months - but this probably has to be resolved fairly early next year.

My assumption is that some sort of reasonable agreement will be reached and the fiscal slope will only have a minor impact on economic growth in 2012. My guess could be wrong, and policymakers might not be able to reach a deal.

Note: There is also the possibility of stronger than expected growth next year. This could lead to the Federal Reserve slowing or even stopping QE3 - but I think that would be considered a strong positive. Right now, sluggish growth with some pickup in 2013, seems most likely.

Philly Fed: "modest improvement" in Region’s manufacturing sector

by Calculated Risk on 10/18/2012 10:00:00 AM

The Philly Fed manufacturing index showed expansion in October after five consecutive months of contraction. From the Philly Fed: October Manufacturing Survey

Firms responding to the October Business Outlook Survey reported a modest improvement in business activity this month. The survey’s indicators for general activity returned to positive territory, while new orders and shipments recorded levels near zero. But firms reported continuing declines in employment and hours worked. Indicators for the firms’ expectations over the next six months remained positive.Earlier in the week, the NY Fed reported:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 8 points, to 5.7, marking the first positive reading since April.

Labor market conditions at the reporting firms remained weak this month. The current employment index dipped 3 points, to ‐10.7, its lowest reading since September 2009.

emphasis added

The October Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to decline for a third consecutive month. The general business conditions index increased four points but remained negative at -6.2.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys increased in October but was still slightly negative. This suggests another weak reading for the ISM manufacturing index.

Weekly Initial Unemployment Claims increase sharply to 388,000

by Calculated Risk on 10/18/2012 08:30:00 AM

The DOL reports:

In the week ending October 13, the advance figure for seasonally adjusted initial claims was 388,000, an increase of 46,000 from the previous week's revised figure of 342,000. The 4-week moving average was 365,500, an increase of 750 from the previous week's revised average of 364,750.The previous week was revised up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 365,500. This is just above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were higher than the consensus forecast of 365,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom. The large swings over the last two weeks were related to timing and technical factors, and is a reason to use the 4-week average.

Wednesday, October 17, 2012

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 10/17/2012 08:24:00 PM

A couple of articles on housing:

An interesting comment via Nick Timiraos at the WSJ: Why Housing Construction Is Rebounding

Gains in construction should lift the economy. Glenn Kelman, chief executive of real-estate brokerage Redfin, writes in an op-ed at Quartz that builders have been completing “half-built projects” with “skeleton crews” for much of the past year. That hasn’t done too much for job growth. “It takes fewer cooks to prepare leftovers for dinner,” he writes.This could be part of the reason that construction employment is lagging, but I also think we will see upward revisions (the preliminary benchmark revision indicated a fairly large upward revision for construction employment). The construction jobs are coming ...

And from Neil Irwin at the WaPo: September figures may provide signs of a housing recovery

First, it helps to understand how deep, and sustained, this housing depression has been. Residential investment — essentially, housing construction and sales activity — has been below 3 percent of gross domestic product every quarter since the fourth quarter of 2008, closing in on four years. Before this downturn, it had never fallen below 3 percent for even a single quarter (the data go back to 1947).Here is a graph to go along with Irwin's article:

...

Here’s the thing, however: The overbuilding of houses during the boom years, while real, was not extraordinary by historical standards. The underbuilding of houses has been far greater than the excess housing construction during the boom relative to demographic trends.

... other factors are probably major culprits in the housing weakness of the past four years: A terrible job market that has made people unwilling or unable to get a mortgage, an overhang of foreclosures that has kept the market for houses from clearing and extreme caution by banks and other lenders that has made it hard to get mortgages.

Now each of those trends seems to be healing.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of residential investment (RI) as a percent of GDP. Currently RI is 2.4% of GDP; just above the record low. I expect RI to recover back towards 4% of GDP over the next few years giving a boost to GDP and employment.

On Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 339 thousand. Look for a larger than normal upward revision to last week's report (apparently one large state was late with their quarterly filing).

• At 10:00 AM, the Philly Fed Survey for October will be released. The consensus is for a reading of 0.5, up from minus 1.9 last month (above zero indicates expansion).

• Also at 10:00 AM, the Conference Board Leading Indicators for September will be released. The consensus is for a 0.2% increase in this index.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

LA area Port Traffic: Moving Sideways

by Calculated Risk on 10/17/2012 05:41:00 PM

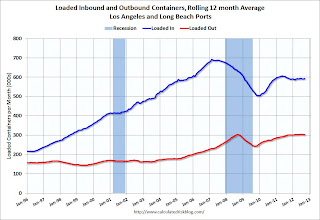

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for September. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up slightly, and outbound traffic is down slightly compared to the 12 months ending in August.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

For the month of September, loaded outbound traffic was down 2% compared to September 2011, and loaded inbound traffic was up 3% compared to September 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase next month, but probably not by much.

DataQuick: California Foreclosure Activity Lowest Since Early 2007

by Calculated Risk on 10/17/2012 02:54:00 PM

From DataQuick: California Foreclosure Activity Lowest Since Early 2007

Three and a half years after peaking, the number of California homes entering the foreclosure process fell last quarter to the lowest level since the early stages of the housing bust. Mortgage default filings hit their lowest point since first-quarter 2007, due in large part to a stronger economy and housing market and more short sales, a real estate information service reported.

A total of 49,026 Notices of Default (NoD) were recorded on residential properties during the third quarter. That was down 10.2 percent from 54,615 for the prior three months, and down 31.2 percent from 71,275 in third-quarter 2011, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 46,760 NoDs were recorded in first-quarter 2007. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

...

Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 26.0 percent of statewide resale activity last quarter. That was up from an estimated 24.0 percent the prior quarter and up from 22.9 percent of all resales a year earlier. The estimated number of short sales last quarter rose 19.0 percent from a year earlier.

Foreclosure resales accounted for 20.0 percent of all California resale activity last quarter, down from a revised 27.8 percent the prior quarter and 34.2 percent a year ago. The figure peaked at 57.8 percent in the first quarter of 2009. The level of foreclosure resales - homes foreclosed on in the prior 12 months - varied significantly by county last quarter, from 5.5 percent in San Francisco County to 35.5 percent in Sutter County.

NoD filings fell last quarter across all home price categories. But mortgage defaults remained far more concentrated in California's most affordable neighborhoods.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. This year will probably the lowest since 2006.

The current level is still far above the peak of the previous housing bust (in 1996). Note: House prices stopped falling in 1996 in California, even though foreclosure activity was still historically high in 1997.

Lawler: Table of Short Sales and Foreclosures for Selected Cities in September

by Calculated Risk on 10/17/2012 01:35:00 PM

CR Note: On Monday I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional).

Economist Tom Lawler has been digging up similar data, and he sent me the following table yesterday for several more distressed areas. A couple of clear patterns have developed:

1) There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in most areas. For two cities, Las Vegas and Reno, short sales are now three times foreclosures, although that is related to the new foreclosure rules in Nevada. Both Phoenix and Sacramento had over twice as many short sales as foreclosures. A year ago, there were many more foreclosures than short sales in most areas. Minneapolis is an exception with more foreclosures than short sales.

2) The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. Chicago is essentially unchanged from a year ago.

Previous comments from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Sep | 11-Sep | 12-Sep | 11-Sep | 12-Sep | 11-Sep | |

| Las Vegas | 44.8% | 23.5% | 13.6% | 49.4% | 58.4% | 72.9% |

| Reno | 41.0% | 29.0% | 12.0% | 38.0% | 53.0% | 67.0% |

| Phoenix | 27.0% | 27.0% | 12.9% | 37.1% | 39.9% | 64.1% |

| Minneapolis | 10.1% | 13.1% | 25.2% | 32.9% | 35.3% | 46.0% |

| Mid-Atlantic (MRIS) | 12.4% | 12.6% | 9.4% | 14.4% | 21.8% | 27.0% |

| California* | 27.0% | 23.8% | 17.7% | 33.8% | 44.7% | 57.6% |

| Orlando | 28.0% | 25.6% | 24.0% | 35.9% | 52.0% | 61.5% |

| Sacramento | 35.4% | 26.1% | 15.4% | 37.9% | 50.8% | 64.0% |

| Charlotte | 15.3% | 20.9% | ||||

| Chicago | 40.6% | 40.0% | ||||

| Hampton Roads VA | 25.4% | 31.6% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Houston | 16.1% | 19.4% | ||||

| Birmingham AL | 26.6% | 31.8% | ||||

| *share of existing home sales, based on property records | ||||||