by Calculated Risk on 10/16/2012 05:04:00 PM

Tuesday, October 16, 2012

Lawler: Early Read on September Existing Home Sales

From economist Tom Lawler:

While I’m missing reports from several key areas of the country, realtor/MLS data I’ve seen so far suggest to me that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.70 million in September, down 2.5% from August’s pace but up 9.8% from last September’s pace. At first glance the unadjusted reports suggest a much steeper slowdown in September sales than the above numbers suggest, as YOY sales growth in September was significantly lower than in August in most (though not all markets), and the number of areas seeing a decline in sales from a year ago increased noticeably. This September, however, there were two fewer business days than last September, and this September’s seasonal factor will be materially lower than last September’s (meaning the YOY increase in seasonally adjusted sales will be materially higher than the YOY increase in unadjusted sales).

On the inventory front, there is little doubt that there were fewer homes listed for sale nationally at the end of September than at the end of August. How that will translate into the NAR’s inventory estimate, however, is unclear. Based on very limited historical data comparing the NAR’s numbers (which are “consistently” derived only going back to 2007), to other sources of home listings, I “gueestimate” that the NAR will report a monthly decline in the inventory of existing homes for sale of about 3.2% in September, which would be inventories down about 17.6% from last September.

On the median home sales price front, the NAR’s estimates of late have significantly exceeded my estimates using a “weighted-sales” approach, but my “best guess” is that the NAR will report that the national median existing home sales price in September was up about 10.4% from last September.

CR Note: Based on Lawler's estimates, the NAR will report inventory around 2.39 million units for September, and months-of-supply will be around 6.1 months (unchanged from August). This will be the lowest level of inventory for September since 2004. The consensus is the NAR will report sales of 4.75 million on Friday.

Key Measures show low inflation in September

by Calculated Risk on 10/16/2012 01:42:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in September. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.6% (7.1% annualized rate) in September. The CPI less food and energy increased 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and core CPI rose 2.0%. Core PCE is for August and increased 1.6% year-over-year.

On a monthly basis, two of these measure were above the Fed's target; trimmed-mean CPI was at 2.6% annualized, median CPI was at 2.6% annualized. However core CPI increased 1.8% annualized, and core PCE for August increased 1.3% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target (year-over-year and on a monthly basis).

Report: Housing Inventory declines 17.8% year-over-year in September

by Calculated Risk on 10/16/2012 12:25:00 PM

From Realtor.com: September 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops remained at historic lows, with 1.8 million units for sale in September 2012, down -17.77% compared to a year ago.For sale inventories declined on a year-over-year basis in 143 of the 146 markets tracked by Realtor.com. Fifty two cities saw year-over-year declines greater than 20%.

The median age of inventory was down -11.21% compared to one year ago.

On a month-over-month basis, inventory declined in 126 of 146 markets.

I expect to see smaller year-over-year declines going forward simply because inventory is already very low.

The NAR is scheduled to report September existing home sales and inventory on Friday. The key number in the NAR report will be inventory, and inventory will be down sharply year-over-year again in September.

NAHB Builder Confidence increases in October, Highest since June 2006

by Calculated Risk on 10/16/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 1 point in October to 41. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Edges Higher in October

Builder confidence in the market for newly built, single-family homes edged slightly higher for a sixth consecutive month in October, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The latest, one-point gain brings the index to 41, its strongest level since June of 2006.

“The slight gain in builder confidence this month is an indication that, while still moving forward, the speed at which the housing recovery is proceeding is being moderated by the various constraints such as tight credit, difficult appraisals and more recently, the limited inventory of buildable lots in certain markets,” explained NAHB Chief Economist David Crowe. “These are the complicating factors that make it difficult for builder confidence to reach and surpass the 50-point mark, at which an equal number of builders view sales conditions as good versus poor.”

...

Following substantial increases in the previous month, the HMI components measuring current sales conditions and sales prospects for the next six months each remained unchanged in October at 42 and 51, respectively. Meanwhile, the component measuring traffic of prospective buyers increased 5 points to 35, its highest level since April of 2006.

Builder confidence continued to improve in three out of four regions in October. Looking at three-month moving averages, the HMI gained two points in the Midwest and West to 42 and 44, respectively, and three points in the South, to 39. A three-month moving average for the Northeast’s HMI held unchanged at 29.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September housing starts will be released tomorrow). This was at the consensus estimate of a reading of 41.

Industrial Production increased 0.4% in September, Capacity Utilization increased

by Calculated Risk on 10/16/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.4 percent in September after having fallen 1.4 percent in August. For the third quarter as a whole, industrial production declined at an annual rate of 0.4 percent. Manufacturing output increased 0.2 percent in September but moved down at an annual rate of 0.9 percent in the third quarter. Production at mines advanced 0.9 percent in September, and the output of utilities moved up 1.5 percent. Roughly 0.3 percentage point of the decline in overall industrial production in August reflected the effect of precautionary idling of production in late August along the Gulf of Mexico in anticipation of Hurricane Isaac, and part of the rise in September is a result of the subsequent resumption of activity at idled facilities. At 97.0 percent of its 2007 average, total industrial production in September was 2.8 percent above its year-earlier level. Capacity utilization for total industry moved up 0.3 percentage point to 78.3 percent, a rate 2.0 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.3% is still 2.0 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 97.0. This is 16% above the recession low, but still 3.7% below the pre-recession peak.

The consensus was for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%. IP was slightly above expectations (some bounce back from shut downs related to Hurricane Isaac) and Capacity Utilization was at expectations. Overall Industrial Production has moved sideways this year.

BLS: CPI increases 0.6% in September, Core CPI 0.1%, Cost-Of-Living Adjustment about 1.66%

by Calculated Risk on 10/16/2012 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.0 percent before seasonal adjustment. For the second month in a row, the substantial increase in the all items index was mostly the result of an increase in the gasoline index, which rose 7.0 percent in September after increasing 9.0 percent in August.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was above the consensus forecast of a 0.5% increase for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy rose 0.1 percent for the third month in a row.

The increase in CPI was mostly due to the sharp increase in gasoline prices.

Cost-Of-Living Adjustment (COLA): The BLS reported CPI-W increased to 2281.84 in September, for a Q3 average of 226.936. In Q3 2011, CPI-W average 223.33. The annual Social Security Cost-Of-Living Adjustment will be 1.66% (will be rounded).

Monday, October 15, 2012

Tuesday: CPI, Industrial Production, Homebuilder Confidence

by Calculated Risk on 10/15/2012 08:54:00 PM

From the WSJ: Proposal Would Give Banks Protection in Cases Involving Top-Quality Mortgages

The proposal for the first time would establish a basic national standard for loans, known as a "qualified mortgage."On Tuesday:

As part of its deliberation, the Consumer Financial Protection Bureau is considering providing a full legal shield for high-quality loans that qualify, mandating that judges rule in lenders' favor if consumers contest foreclosures, these people say.

For a smaller category of loans that still meet the "qualified mortgage" guidelines but carry higher interest rates—a group similar to "subprime loans"—lenders would receive fewer protections. In those cases, consumers could argue in court that lenders should have known that they couldn't afford the mortgage.

• At 8:30 AM ET, the Consumer Price Index for September will be released. The consensus is for CPI to increase 0.5% in September and for core CPI to increase 0.2%. This release will determine the Cost-of-living-adjustment for Social Security. Currently I expect COLA to be around 1.6%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for September. The consensus is for Industrial Production to increase 0.2% in September, and for Capacity Utilization to increase to 78.3%.

• At 10:00 AM, the October NAHB homebuilder survey will be released. The consensus is for a reading of 41, up from 40 in September. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good. This index bottomed at 8 in January 2009, and was at or below 22 for over 4 1/2 years.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Sacramento September House Sales: Percentage of distressed sales lowest in years

by Calculated Risk on 10/15/2012 06:54:00 PM

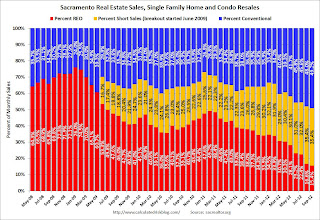

I've been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

Recently there has been a dramatic shift from REO to short sales, and the percentage of distressed sales has been declining. This data would suggest some improvement although the percent of distressed sales is still very high.

In September 2012, 50.8% of all resales (single family homes and condos) were distressed sales. This was down from 52.0% last month, and down from 64.0% in September 2011. The percentage of REOs fell to 15.4%, the lowest since the Sacramento Realtors started tracking the data and the percentage of short sales increased to 35.4%, the highest percentage recorded.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been an increase in conventional sales this year, and there were over twice as many short sales as REO sales in September. The gap between short sales and REO sales is increasing.

Total sales were down 10% from September 2011, however conventional sales were up 23% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - some decline in overall sales as distressed sales decline, but an increase in conventional sales.

Active Listing Inventory for single family homes declined 63.4% from last September, and listings were down 11.1% in September compared to August.

Cash buyers accounted for 35.9% of all sales (frequently investors), and median prices were up 9.6%% from last September.

This seems to be moving in the right direction, although the market is still in distress. We are seeing a similar pattern in other distressed areas to more conventional sales, and a shift from REO to short sales.

The Housing Bottom and the Unemployment Rate

by Calculated Risk on 10/15/2012 04:47:00 PM

Early this year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph (and a repeat of some analysis).

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the current housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

Housing plays a key role for employment too. Here is an update to a graph I've been posting for a few years. This graph shows single family housing starts (through August) and the unemployment rate (inverted) also through September. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts moved sideways for two and a half years and only started increasing last year. This was one of the reasons the unemployment rate remained elevated.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However, following the recent recession with the huge overhang of existing vacant housing units, this key sector didn't participate. This time the unemployment rate started falling before housing starts picked up. Going forward I expect housing activity to increase and help push down the unemployment rate. Unfortunately I expect the housing recovery to be somewhat sluggish.

Correction on Mortgage Modifications

by Calculated Risk on 10/15/2012 01:48:00 PM

On Sunday, I wrote that private modifications were performing better than HAMP. According to the Q2 OCC report, HAMP modifications have a lower redefault rate than private mods:

HAMP modifications perform better than other modifications. Of the 565,751 HAMP modifications implemented since the third quarter of 2009, 68.2 percent remained current, compared with 53.4 percent of other modifications implemented during the same period.The OCC report covers about "60% of all first-lien mortgages in the United States" whereas the Hope Now report I mentioned on Sunday includes data from the non-bank servicers (not included in the OCC report) and is scaled to cover the entire first lien market. I'll have more on modifications soon (Mark Hanson called modifications the "new subprime").

...

Servicers modified 2,543,133 mortgages from the beginning of 2008 through the end of the fourth quarter of 2011. At the end of the first quarter of 2012, 50.7 percent of these modifications remained current or were paid off. Another 7.1 percent were 30 to 59 days delinquent, and 15.1 percent were seriously delinquent. Almost 11 percent were in the process of foreclosure, and 6.3 percent had completed the foreclosure process. More recent modifications that emphasized reduced payments, affordability and sustainability have outperformed modifications implemented in earlier periods.

Also, as a followup to a question in the comments, here is a "heat map" from Zillow on where properties owners have negative equity. Note: you can zoom in on the map, and put the cursor over an area - it will show the distribution of equity.