by Calculated Risk on 9/06/2012 04:15:00 PM

Thursday, September 06, 2012

A Draghi Kind of Day

First, Tim Duy models a few employment indicators Fed Watch: Quick Employment Report Preview

The model forecasts a nonfarm payroll gain of 198k for August. To be sure, the standard error of 88k is large in terms of payroll forecasts; I wouldn't be surprised by anything between 110k and 290k. That said, the current consensus is 125k with a range of 70k to 177k, which seems low to me.And a few articles on the ECB:

From the NY Times: Central Bank to Snap Up Debt, Saying, ‘Euro Is Irreversible’

Mario Draghi, the E.C.B. president, overcame objections by Germany and won nearly unanimous support from the bank’s board for a program of buying government bonds that would effectively spread responsibility for repaying national debts to the euro zone countries as a group.From the WSJ: ECB Unveils Bond-Buying Program

The E.C.B. will buy bonds on open markets, without setting any limits, of countries that ask for help, which Spain is expected to do. The E.C.B. said it would act only after countries agreed on conditions with the euro zone rescue fund, which will be known as the European Stability Mechanism. The E.S.M. would buy bonds directly from governments, taking responsibility for imposing the conditions, while the E.C.B. would intervene in secondary markets.

The bank and its president, Mr. Draghi, have had the quiet support of all European leaders in taking this latest bold action ... Crucially, support for Mr. Draghi includes Berlin and the German chancellor, Angela Merkel.

From the Financial Times: Draghi outlines bond buying plan

And some in-depth analysis at Alphaville including OMT! and Seniority, the SMP, and the OMT

Here are the full ‘technical features’, which Mario Draghi read out at Thursday’s press conference. Three big things stick out:Much more at Alphaville.

- The ECB will apparently make a ‘legal act’ to confirm that its bond holdings under “Outright Monetary Transactions” are pari passu, not senior. ...

- The ECB will relax collateral requirements ... That’s a big, big move for Spanish banks in particular ...

- Conditionality. A slight chink? The ECB could buy bonds under an EFSF-ESM precautionary credit line for a sovereign, short of a maximal full bailout. Here’s the EFSF’s guidelines on the conditions of precautionary credit lines, for example.

Employment Situation Preview

by Calculated Risk on 9/06/2012 12:42:00 PM

In July, the BLS reported there were 163,000 payroll jobs added. This followed three weak months: 68,000 payroll jobs were added in April, 87,000 in May, and 64,000 in June. Some of the spring weakness might have been "payback" for the mild weather earlier in the year, so it might help to look at the average per month. So far this year, the economy has added 151,000 payroll jobs per month (161,000 private sector per month).

Also, there is a strong possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness. In 2010, payrolls picked up in October following a weak period (looking at the data ex-Census), in 2011, payrolls picked up in September. If there is a seasonal distortion, the next four months will probably see some increase too.

Bloomberg is showing the consensus is for an increase of 125,000 payroll jobs in August, and for the unemployment rate to remain unchanged at 8.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in August. This is the strongest ADP report since March, and this would seem to suggest that the consensus for the increase in total payroll employment is too low. However the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in August to 51.6%, down from 52.0% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 12,000 in August.

The ISM non-manufacturing (service) employment index increased in August to 53.8%, up from 49.3% in July. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 160,000 in August.

Added together, the ISM reports suggests about 148,000 jobs added in August.

• Initial weekly unemployment claims averaged about 371,000 in August, up from the 366,000 average for July - but below the 382,000 average for April, May and June. This was about the same level as in the January, February and March period when the BLS reported an average of 226,000 payroll jobs added per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 374,000; down from 388,000 during the reference week in July.

• The final July Reuters / University of Michigan consumer sentiment index increased to 74.3, up from the July reading of 72.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, down from 45,000 in July.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate at 8.1% in August

U.S. unemployment, as measured by Gallup without seasonal adjustment, is 8.1% for the month of August, down slightly from 8.3% measured in mid-August and 8.2% for the month of July. Gallup's seasonally adjusted unemployment rate for August is also 8.1%, a slight uptick from 8.0% at the end of July.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that economic activity picked up a little in August, and that would seem to suggest a stronger than consensus employment report. Also it is possible that there have been some seasonal factor distortions.

The ISM manufacturing reports suggest a gain of around 148,000 payroll jobs, and the ADP report (private only), also suggests the consensus is too low. Initial weekly unemployment claims were near the low for the year during August.

A negative is the weak small business numbers from Intuit.

Overall it seems like the August report will be somewhat stronger than expected.

ISM Non-Manufacturing Index increases in August

by Calculated Risk on 9/06/2012 10:00:00 AM

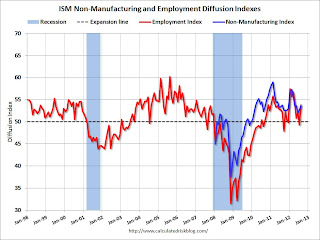

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 32nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in August, 1.1 percentage points higher than the 52.6 percent registered in July. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1.6 percentage points lower than the 57.2 percent reported in July, reflecting growth for the 37th consecutive month. The New Orders Index decreased by 0.6 percentage point to 53.7 percent. The Employment Index increased by 4.5 percentage points to 53.8 percent, indicating growth in employment after one month of contraction. The Prices Index increased 9.4 percentage points to 64.3 percent, indicating substantially higher month-over-month prices when compared to July. According to the NMI™, 10 non-manufacturing industries reported growth in August. Respondents' comments continue to be mixed, and for the most part reflect uncertainty about business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

Weekly Initial Unemployment Claims decline to 365,000

by Calculated Risk on 9/06/2012 08:30:00 AM

The DOL reports:

In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The previous week was revised up from 374,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

ADP: Private Employment increased 201,000 in August

by Calculated Risk on 9/06/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 201,000 from July to August, on a seasonally adjusted basis. The estimated gain from June to July was revised up from the initial estimate of 163,000 to 173,000.This was above the consensus forecast of an increase of 149,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 125,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 185,000 in August, up from 156,000 in July. Employment in the private, goods-producing sector added 16,000 jobs in August. Manufacturing employment rose 3,000, following an increase of 6,000 in July.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Wednesday, September 05, 2012

Thursday: Draghi, Unemployment Claims, ADP, ISM Services

by Calculated Risk on 9/05/2012 07:18:00 PM

Usually during the first week of the month, all of the discussion would be about the employment report. This month focus is on the ECB ...

ECB Governing Council meeting times:

• 7:45 AM ET (1.45 PM CET) Monetary Policy Decision. The expectation is rates will be cut 25 bps.

• 8:30 AM ET (2.30 PM CET) ECB President Mario Draghi Press conference. The expectation is Draghi will announce some sort of short term bond buying program.

Note: I'll post the US data in the morning. For updates on the ECB, I recommend Alphaville. Here is the ECB website and press conference page.

From Cardiff Garcia at Alphaville: More questions pre-Draghi

There are some obvious questions going into Draghi’s meeting on Thursday after a few of the early details were reported today — What will be the terms of conditionality? Where on the curve will the buying be concentrated? — and we’ve got a few more.From the WSJ: ECB Said to Ready Measures as Euro Zone Slide Deepens

The euro zone's economic downturn accelerated during the summer, economic reports Wednesday suggest, raising concerns that even aggressive anticrisis measures from the European Central Bank won't be enough to keep the euro bloc from sliding into a deep recession.On Thursday:

...

The reports raise a vexing problem for ECB policy makers. Even if they announce detailed plans to buy government bonds as a means to lower borrowing costs for crisis-hit countries, the measures' effectiveness may be limited by high unemployment, weak consumer confidence and stagnant growth prospects.

"In the next three to six months, there is nothing the ECB can do to prevent a further slowdown from materializing," said Carsten Brzeski, economist at ING Bank.

• At 8:15 AM ET, the ADP Employment Report for August will be released. This report is for private payrolls only (no government). The consensus is for 149,000 payroll jobs added in August, down from the 163,000 reported last month.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

• At 10:00 AM, the ISM non-Manufacturing Index (Services) for August will be released. The consensus is for an increase to 53.0 from 52.6 in July.

Another question for the September economic contest:

Lawler: Single Family Rental Market: Surging, But by How Much?

by Calculated Risk on 9/05/2012 02:31:00 PM

CR Note: Housing economist Tom Lawler estimates that there are about 2.1 million more single family home rented now than in 2006. This is a key reason for the decline in inventory.

From housing economist Tom Lawler:

Recently there have been a sizable number of media stories on the SF rental market, with the focus on its tremendous growth over the past few years. One reason for the jump in the number of articles is related to the significant increase in the number of entities who have entered this space. It seems almost as if everyone and their mother has either entered the SF rental market or is looking to enter it. Another is that investor demand for SF properties has been very strong while the supply of homes for sale, especially the supply of foreclosed homes, is down significantly, and as a result prices of “distressed” (and other) homes have increased significantly faster than many had expected. And finally, of course, there are stories that a “REO-to-Rental” securitization deal is in the works (if it comes it’ll probably be unrated, as (1) rating agencies don’t really have sufficient data to assign a rating; and (2) unlike in the past, currently rating agencies care about such things!)

Stories of the surge in the SF rental market are not, by the way, limited to California, Arizona, Nevada, or Florida, but are reasonably widespread across the country.

Of course, the explosion in the size of the SF rental market is not new: it was evident several years back. But the growing number of “new” players, combined with the sharply lower inventory of homes for sale and recent rebound in home prices, has made this an increasingly important “story” for the housing market.

It is, unfortunately, not easy to get a good handle on just how rapidly the SF rental market has grown, given the lack of good, timely information on the US housing market. Data from the American Community Survey, e.g., are only available for 2010, and there are some “issues” with that data (as evidenced by the ACS/decennial Census differences currently being explored by Census analysts). There are even bigger issues with data from the Housing Vacancy Survey, which deviated incredibly from the decennial Census (and ACS) on a wide range of “metrics,” and whose estimates appear to systematically understate the number of renter-occupied households. Moreover, the HVS does not explicitly release estimates of the number (or %) of owner vs. renter occupied homes by units in structure.

The HVS does, however, release estimates of (1) the rental and homeowner vacancy rates by units in structure; (2) the % of vacant homes that are 1-unit structures; and (3) the number of total homes for rent and for sale. While unfortunately a consistent time series of these estimates doesn’t go back very far, and unfortunately the HVS relies on the American Housing Survey for estimates of the characteristics of housing units (the AHS doesn’t come close to matching the ACS), the data may have some useful information on trends in the SF rental market.

Unfortunately (gosh, I use that adverb often when describing available US housing data), the HVS’ definition of “1-unit” structures includes not just SF detached and attached homes, but also mobile homes or trailers, tents, and boats.

With that in mind, here are some data on the share of occupied “SF” homes that were occupied by renters from (1) the American Community Survey, and (2) derived shares using the aforementioned tables from the Housing Vacancy Survey. The latter are for the second quarter of each year, as the tables released are quarterly, and it’s a pain to derive yearly average data. The ACS data are based on the one-year estimates. Also shown are comparable “SF” shares from Census 2000.

| Renter Share of Occupied "SF" Homes | ||||

|---|---|---|---|---|

| American Community Survey* | Housing Vacancy Survey** | |||

| SFD | SFD+SFA | SFD+SFA+ MH+Other | SFD+SFA+ MH+Other | |

| Census 2000 | 13.2% | 15.0% | 15.6% | |

| 2006 | 13.1% | 14.8% | 15.7% | 14.5% |

| 2007 | 13.4% | 15.0% | 15.9% | 14.7% |

| 2008 | 14.0% | 15.7% | 16.5% | 15.1% |

| 2009 | 14.8% | 16.5% | 17.3% | 15.4% |

| 2010 | 15.1% | 16.8% | 17.6% | 16.3% |

| 2011 | 18.0% | 16.7% | ||

| 2012 | 18.3% | 17.0% | ||

| SFD - Single family Detached SFA - Single family Attached MH - Manufactured Housing Other - Boats,RVs, Vans, Tents, Etc. * Yearly Average ** Q2 Average | ||||

As the table indicates, both surveys suggest that the renter share of the SF market has increased significantly since the beginning of the housing bust. Given the systematic tendency for the HVS to understate the renter share of the overall housing market (as well as the number of renter-occupied homes), it is not surprising that the HVS estimates (again, derived from table not in the press release) of the renter share of occupied “one-unit” homes is below that of the ACS, though the differential between the two hasn’t changed radically over time.

On September 20th Census plans to release the 2011 ACS results, and the above data strongly suggest that the rental share of the SF market increased from 2010 – and the 2012 ACS data will almost certainly show a gain form 2011. A “reasonable” best guess, based on the admittedly “iffy” HVS data, would be that the 2012 ACS data will show that the renter share of occupied SF detached homes this year will be about 15.7%.

Assuming ACS data were correct, such a share increase would imply that the number of renter-occupied SF detached homes in the US this year is about 11.4 million, almost 2.1 million (or 22%) higher than in 2006, with most of that increase coming after 2007. Not coincidentally, foreclosures ramped up sharply in the latter part of 2007, and REO sales increased significantly in 2008 and remained high through last year.

Renter Share of Occupied SF Detached Homes (ACS-based)

Click on graph for larger image.

Click on graph for larger image.These data are broadly consistent both with anecdotal evidence and by statements from some of the “larger” players in the SF investor space that a fairly large % of investors buying “distressed” SF properties have purchased the home with the intent to rent the home for “several” years – partly because in many parts of the country distressed home prices were low relative to realizable rents (in other words, the “rental yield” was good), and partly because investors expected home prices several years down the road would be higher than current prices.

The surge in the number of properties purchased with the intent to rent (at least for a while) has also almost certainly contributed to the sharp decline in the number of homes listed for sale.

Bloomberg: Merkel Said to Tell Lawmakers She Supports Draghi and Weidmann

by Calculated Risk on 9/05/2012 11:46:00 AM

Thursday is Draghi day (ECB meeting) and the following might seem like a contradiction ...

From Bloomberg: Merkel Said to Tell Lawmakers She Backs Draghi and Weidmann

Chancellor Angela Merkel told lawmakers in Berlin today that she supports both European Central Bank chief Mario Draghi and Bundesbank President Jens Weidmann ... both Draghi and Weidmann are carrying out their respective mandates ... she therefore sees no contradition in supporting them both ...From the Financial Times: Mood improves on hopes for ECB action

The ECB is expected to outline how it may help reduce the borrowing costs of heavily indebted countries in the eurozone – leaks from the ECB reported by news agencies on Wednesday seem to confirm the plan is afoot ...More from Bloomberg: ECB Plan Said to Pledge Unlimited, Sterilized Bond-Buying

Excerpt with permission

Under the blueprint, which may be called “Monetary Outright Transactions,” the ECB would refrain from setting a public cap on yields ... The plan will only focus on government bonds rather than a broader range of assets and will target short-dated maturities of up to about three years, two of the people said.The history of the European crisis has been for policymakers to over promise and under deliver, but the consensus is Draghi will announce some buying of short term bonds.

Trulia: Asking House Prices increased in August, Rent increases slow

by Calculated Risk on 9/05/2012 10:00:00 AM

Press Release: Trulia Reports Asking Home Prices up 2.3 Percent, Biggest Year Over Year Increase Since Recession

Trulia today released the latest findings from the Trulia Price Monitor and the Trulia Rent Monitor, the earliest leading indicators available of trends in home prices and rents. Based on the for-sale homes and rentals listed on Trulia, these monitors take into account changes in the mix of listed homes and reflect trends in prices and rents for similar homes in similar neighborhoods through August 31, 2012.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

Asking prices on for-sale homes–which lead sales prices by approximately two or more months – increased 2.3 percent in August year over year (Y-o-Y) and rose in 68 of the 100 largest metros. Excluding foreclosures, prices rose 3.8 percent Y-o-Y. These are the largest Y-o-Y gains since the recession. Meanwhile, asking prices rose nationally 1.8 percent quarter over quarter (Q-o-Q), seasonally adjusted. Month-over-month (M-o-M) asking prices rose by 0.8 percent, the seventh consecutive month of increases.

...

Nationally, rents rose 4.7 percent Y-o-Y in August, compared to 5.8 percent Y-o-Y in May – making it the slowest rise since March. At the regional level, rents jumped more than 10 percent Y-o-Y in Houston and Seattle, but slowed in Denver, San Francisco, Miami, Oakland and Boston.

...

“Asking prices rose 2.3 percent year over year in August, hitting two housing recovery milestones,” said Jed Kolko, Trulia’s Chief Economist. “First, asking prices rose faster than at any time since the recession. Second, asking prices excluding foreclosures are now rising faster than wages, putting an end to many years of affordability gains. In addition, price gains are catching up with slowing rent increases, which will tip some renters in favor of staying put in their rentals rather than buying a home.”

More from Jed Kolko, Trulia Chief Economist: Asking Prices Rise 2.3% Year Over Year: Biggest Increase Since Recession

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/05/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week to the lowest level since May 2012. The seasonally adjusted Purchase Index decreased 0.8 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.78 percent from 3.80 percent, with points decreasing to 0.37 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years.