by Calculated Risk on 8/17/2012 06:33:00 PM

Friday, August 17, 2012

Preliminary: Fed manufacturing surveys and ISM index for August

Below is a graph I usually post after the release of the NY Fed and Philly Fed manufacturing surveys. Most of the economic data this week was a little more upbeat, but both of these surveys were disappointing ...

This week the Philly Fed survey indicated contraction:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased 6 points, to a reading of ‐7.1. This marks the fourth consecutive negative reading for the index but also its highest reading since MayAnd the NY Fed (Empire State) survey was also weak:

The August Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated over the month. The general business conditions index slipped below zero for the first time since October 2011, falling thirteen points to -5.9.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys declined in August, and has remained negative for three consecutive months. This suggests another weak reading for the ISM manufacturing index.

Lawler: Early Look At Existing Home Sales in July

by Calculated Risk on 8/17/2012 03:35:00 PM

From economist Tom Lawler:

Based on reports from various state and local realtor associations, boards, and/or MLS, I estimate that US existing home sales as estimated by the NAR ran at a seasonally adjusted annual rate of 4.47 million in July, up 2.3% from June’s preliminary estimated pace. On the NAR’s preliminary June sales estimate, which was way below consensus and lower than my below-consensus forecast, state and local realtor/MLS reports released following the NAR’s EHS release were for the most part lower than I had assumed, and seemed to confirm the below-consensus pace of existing home sales in June. By the same token, however, the local realtor data released across the country seemed to suggest that existing home sales were a bit stronger than the NAR’s preliminary estimate (as was the case in May, when sales were revised upward from a SAAR of 4.55 million to 4.62 million). My “best guess” is that June’s existing home sales will be revised upward by a similar amount – from 4.37 million to around 4.44 million. Net, then, I expect that July’s seasonally adjusted existing home sales pace will be little changed from June’s upwardly revised pace.

While June and July existing home sale at first glance seem a bit disappointing relative to previous expectations, a major reason for the weaken-than-consensus sales is a much larger-than-consensus decline in the “distressed” – and especially the foreclosure – share of resales. E.g., in the markets shown in the “distressed home sales share” table [below], the distressed home sales share for those combined markets this July was down about ten percentage points from last July! (The drop for the whole country, of course, was probably smaller). “Non-distressed” sales have actually been running very strong relative to a year ago – for the markets on page one the YOY gain in “non-distressed” sales was over 30% -- and that strength, combined with significant declines in the inventory of homes for sale, has contributed to the upturn in home prices this year.

On the inventory front, the combination of various “trackers” of select metro markets and realtor reports suggests to me that the inventory of existing homes for sale at the end of July was probably down by about 22% or so from a year ago. How that will translate into a NAR estimate, however, is not clear. E.g., firms that track listings and/or folks who track realtor reports were very surprised that the NAR’s existing home inventory fell by 3.2% from June to July, and that July’s inventory number was down 24.4% from last July. I’m guessing that the June inventory number will be revised upward by around 1.7% (reflecting the upward sales revision), and that the NAR’s inventory estimate for July will be down by about 22.2% from last July, which would imply a monthly increase (from an assumed upward revision in June) of 0.8%.

On the median sales price side, for two months in a row the NAR’s preliminary median sales price estimates have been revised downward significantly, with the biggest revisions coming in the Northeast. I wouldn’t be surprised to see a downward revision in the June MSP as well. For July, using a sales-weighted average methodology, I estimate that the July median existing SF home sales price as estimated by the NAR will show YOY gain of about 7.8%.

CR Note: The NAR is scheduled to release the existing home sales report on Wednesday, August 22nd at 10 AM ET. The preliminary consensus is for sales of 4.50 million SAAR in July (close to Lawler's estimate). Based on Lawler's sales and inventory estimates, months-of-supply would be unchanged at 6.6 months.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-July | 11-July | 12-July | 11-July | 12-July | 11-July | |

| Las Vegas | 40.0% | 20.2% | 20.7% | 50.2% | 60.7% | 70.4% |

| Reno | 38.0% | 28.0% | 15.0% | 37.0% | 53.0% | 65.0% |

| Phoenix | 29.5% | 23.6% | 14.6% | 43.1% | 44.1% | 66.7% |

| Sacramento | 32.0% | 22.3% | 22.4% | 39.0% | 54.4% | 61.3% |

| Minneapolis | 9.3% | 11.0% | 24.8% | 34.4% | 34.1% | 45.4% |

| Mid-Atlantic (MRIS) | 11.3% | 10.2% | 8.7% | 15.1% | 20.0% | 25.2% |

| Orlando | 28.2% | 29.4% | 23.7% | 28.2% | 51.9% | 57.6% |

| Southern California | 18.7% | 17.4% | 21.0% | 32.6% | 39.7% | 50.0% |

| California (DQ) | 19.0% | 17.3% | 22.0% | 34.5% | 41.0% | 51.8% |

| Lee County, FL | 17.3% | 18.8% | 15.9% | 30.6% | 33.2% | 49.4% |

| Hampton Roads VA | 29.1% | 30.3% | ||||

| Northeast Florida | 39.0% | 44.1% | ||||

| Sarasota | 32.4% | 38.0%* | ||||

| Chicago | 36.1% | 36.7% | ||||

| Rhode Island | 24.8% | 20.3% | ||||

LA area Port Traffic: Imports and Exports down YoY in July

by Calculated Risk on 8/17/2012 01:48:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for July. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in June.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of July, loaded outbound traffic was down slightly compared to July 2011, and loaded inbound traffic was down 2% compared to July 2011.

For the month of July, loaded outbound traffic was down slightly compared to July 2011, and loaded inbound traffic was down 2% compared to July 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports might increase over the next couple of months, but probably not by much.

This suggests import traffic might be down a little in July.

State Unemployment Rates increased in 44 States in July

by Calculated Risk on 8/17/2012 10:50:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed or slightly higher in July. Forty-four states recorded unemployment rate increases, two states and the District of Columbia posted rate decreases, and four states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 12.0 percent in July. Rhode Island and California posted the next highest rates, 10.8 and 10.7 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Two states - New Jersey and New York - are at the maximum unemployment rate for the recession and set new cycle highs in July.

The New York unemployment rate increased to 9.1%, the previous cycle high was 8.9%. The New Jersey unemployment rate increased to 9.8%, the previous cycle high was 9.7%. Every other state has some blue indicating some improvement.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009, although New Jersey is close. In early 2010, 18 states and D.C. had double digit unemployment rates.

Consumer Sentiment increases in August to 73.6

by Calculated Risk on 8/17/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for August increased to 73.6, up from the July reading of 72.3.

This was above the consensus forecast of 72.0 but still fairly low. Sentiment remains weak due to the high unemployment rate and sluggish economy - and rising gasoline prices probably aren't helping.

Thursday, August 16, 2012

Friday: Consumer sentiment, State Employment and Unemployment

by Calculated Risk on 8/16/2012 09:15:00 PM

First from Bloomberg: U.S. to sell off some mortgages

A $1.7 billion portfolio of nonperforming, federally insured home loans will be offered for sale at auction next month [on Sept 12th].• At 9:55 AM ET, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August) will be released. The consensus is for sentiment to decrease slightly to 72.0 from 72.3 in July.

The loans will be auctioned in pools consisting of homes in Chicago; Phoenix; Newark, N.J.; and Tampa, Fla. ... the portfolio ... consists of 9,442 loans with an average balance of $182,000, for the Department of Housing and Urban Development.

• At 10:00 AM, the Conference Board Leading Indicators for August will be released. The consensus is for a 0.2% increase in this index..

• Also at 10:00 AM, the Regional and State Employment and Unemployment (Monthly) for July 2012 is scheduled to be released.

Earlier on housing starts:

• Housing Starts declined to 746 thousand in July

• Quarterly Housing Starts by Intent compared to New Home Sales

• Comment on Housing, and Starts and Completions

• On Yahoo Daily Ticker: Housing Starts Jump 20% in One Year: Recovery Ahead, Says Bill McBride

Comment on Housing, and Starts and Completions

by Calculated Risk on 8/16/2012 02:57:00 PM

This is a very important year for housing and for the economy. The budding recovery for housing starts and new home sales is positive for GDP and employment. Even though housing starts are increasing, it is from a very low level, and 2012 will still be one of the worst years for housing starts (only 2009, 2010, and 2011 will be worse). But that is good news for the economy: housing starts are on pace to be up 20% from last year (how many sectors are growing 20% this year?), and housing starts could double again over the next several years.

This reminds me of the recovery for auto sales. Auto sales bottomed in February 2009 at close to a 9 million annual sales rate. Now auto sales are running at a 14 million pace; over a 50% increase. That strong increase in auto sales really contributed to GDP growth over the last few years, see from Cardiff Garcia at FT Alphaville: Car-driven GDP growth.

Now we are starting to see a rebound for housing. And housing will have an even larger impact on GDP and employment growth than autos; and housing will probably double from here (more than the 50% increase for autos). Even with the downside risks from Europe and the fiscal cliff, this suggests more growth in the medium term (policy mistakes in the US and Europe are probably the biggest economic risk).

Through July, single family starts are on pace for over 500 thousand in 2012, and total starts are on pace for about 730 thousand. That is up from 431 thousand single family starts in 2011, and 609 thousand total starts. Starts are running above the forecasts for most analysts (however Lawler and the NAHB were close).

But even with the increase in starts, completions will be near record lows again in 2012. Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Completions have barely turned up, but will increase over the next several months.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions. Completions have barely turned up, but will increase over the next several months.

For the sixth consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier on housing starts:

• Housing Starts declined to 746 thousand in July

• Quarterly Housing Starts by Intent compared to New Home Sales

• On Yahoo Daily Ticker: Housing Starts Jump 20% in One Year: Recovery Ahead, Says Bill McBride (Note: Doing the interview was a little more difficult than I expected. The room was mostly dark except the lights in my face. There was a green screen behind me, and I couldn't see Aaron.

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 8/16/2012 01:42:00 PM

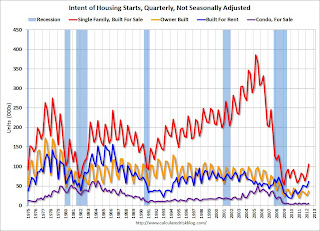

In addition to housing starts for July, the Census Bureau released Housing Starts by Intent for Q2. This is a very useful report.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 106,000 single family starts, built for sale, in Q2 2012, and that was just above the 103,000 new homes sold for the same quarter (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 28% compared to Q2 2011. This is the highest level since 2008.

Owner built starts were up slightly year-over-year from Q2 2011. And condos built for sale are still near the record low.

The 'units built for rent' has increased significantly and is up about 48% year-over-year.

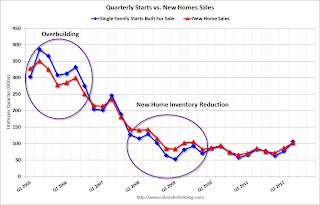

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

For the last 3 years, the builders have sold a few more homes than they started, and inventory levels are now at record lows (117,000 under construction and completed as of June 2012).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Timiraos on Absorption of Excess Vacant Supply of Housing Inventory

by Calculated Risk on 8/16/2012 11:22:00 AM

From Nick Timiraos at the WSJ: Shadow Inventory: How Low New Construction Helps the Outlook

There’s been a lot of attention over the last few years on the “shadow inventory” of potential foreclosures — a pent-up supply of homes that could smother an incipient housing recovery.The record low level of completions over the last four years - and record low level of housing units added to the housing stock - is an important reason for the budding recovery in housing. See: Housing: Record Low Total Completions in 2011. The last four years have seen record low completions, and 2012 will also be very low. This low level of completions means that a significant portion of the excess vacant housing supply has been absorbed. And completions in 2012 will still be very low even with the 20%+ increase in housing starts.

But there’s been comparatively less attention on the lack of new housing construction, which has helped to offset the potential damage from elevated levels of foreclosed properties. New home building has been at its lowest levels since World War II in 2009, 2010, and 2011.

From Timiraos:

“Not too many people talk about the lack of new construction over the last several years, which has set the foundation for a snapback in pricing,” says Michael Sklarz, president of real-estate research firm Collateral Analytics.Nothaft is using the Housing Vacancies and Homeownership (HVS) and that survey is not consistent with other measures (like the decennial Census and the ACS). The Census Bureau is looking into the differences between the surveys, but I'm not confident in using the HVS to estimate the excess vacant supply.

Frank Nothaft, the chief economist at Freddie Mac, elaborated on this point in a research note published last week ... “the relatively small amount of new construction, coupled with increased household formation, has allowed much of the excess vacant inventory to be absorbed over the past few years,” he wrote.

However I do agree with Nothaft that "much of the excess vacant" has been absorbed.

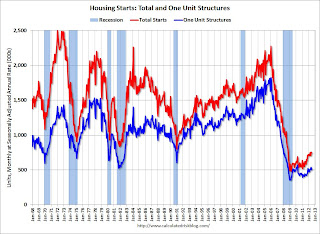

Housing Starts declined to 746 thousand in July

by Calculated Risk on 8/16/2012 08:57:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 746,000. This is 1.1 percent below the revised June estimate of 754,000, but is 21.5 percent above the July 2011 rate of 614,000.

Single-family housing starts in July were at a rate of 502,000; this is 6.5 percent below the revised June figure of 537,000. The July rate for units in buildings with five units or more was 229,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 812,000. This is 6.8 percent above the revised June rate of 760,000 and is 29.5 percent above the July 2011 estimate of 627,000.

Single-family authorizations in July were at a rate of 513,000; this is 4.5 percent above the revised June figure of 491,000. Authorizations of units in buildings with five units or more were at a rate of 274,000 in July.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 746 thousand (SAAR) in July, down 1.1% from the revised June rate of 754 thousand (SAAR). Note that June was revised from 760 thousand.

Single-family starts decreased 6.5% to 502 thousand in July.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up 56% from the bottom start rate, and single family starts are up 42% from the low.

This was slightly below expectations of 750 thousand starts in July, but the key is starts are up solidly from last year. Right now starts are on pace to be up about 20% from 2011. Also note that total permits were at the highest level since 2008.