by Calculated Risk on 7/17/2012 06:29:00 PM

Tuesday, July 17, 2012

Lawler: Early Read on Existing Home Sales in June

From economist Tom Lawler:

Based on an admittedly limited sample of realtor/MLS reports across the country, I estimate that existing home sale ran at a seasonally adjusted annual rate of 4.56 million in June, little changed from May’s SA pace and up 9.1% from last June’s SA pace. Unadjusted data clearly show a smaller YOY gain in June sales relative to May sales, which was expected, as this May had one more business day than last May, while this June had one fewer business day than last May.CR Note: This would put the months-of-supply at about 6.6 months, unchanged from May. For the month of June, this would be the lowest level of inventory since 2004, and the lowest months-of-supply since 2005. The NAR is scheduled to report June sales on Thursday.

It is worth noting that in several “distressed” markets, sales this June were down from a year ago, even though in many of these markets non-distressed (and especially non-foreclosure) sales, were up -- in some cases by a lot.

On the inventory front, various entities that track listings showed modestly different trends, though all show big YOY declines. Realtor.com, e.g., reported that the AVERAGE number of listings in the month of June was up 0.5% from May, but down 19.4% from last June, while HousingTracker.Net reported that average listings (actually, the average number of listings on Mondays) in June in the 54 metro markets it tracks were down 1.3% from May and down 22.0% from last June. Looking at these data, combined with realtor reports, my “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end of June will be about 2.5 million, up 0.4% from May but down 20.9% from last June.

On the median sales price front, it’s pretty clear that the national median existing SF sales price this June will show another YOY gain – the fourth in a row – though local realtor/MLS data suggest that June’s YOY increase will be a bit less than May’s. My best guess is that the NAR’s estimate of the median existing SF home sales price in June will be up about 6.4% from last June.

Tom also sent me the following updated table on distressed sales. From Lawler: "Note that all of these shares are based on MLS data or realtor reports save for those for Southern California, which come from Dataquick and are based on property records."

CR Note: Notice the decline in distressed sales. Foreclosure are down in all these areas, and short sales are up in most.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-June | 11-June | 12-June | 11-June | 12-June | 11-June | |

| Las Vegas | 34.2% | 21.6% | 27.8% | 47.2% | 62.0% | 68.8% |

| Reno | 37.0% | 25.0% | 21.0% | 41.0% | 58.0% | 66.0% |

| Phoenix | 32.8% | 27.0% | 14.1% | 40.8% | 46.8% | 67.8% |

| Sacramento | 31.0% | 22.2% | 23.2% | 43.0% | 54.2% | 65.2% |

| Mid-Atlantic (MRIS) | 10.2% | 10.0% | 8.7% | 14.9% | 18.9% | 24.9% |

| Minneapolis | 9.6% | 10.5% | 25.1% | 33.9% | 34.6% | 44.3% |

| Southern California | 17.7% | 17.9% | 24.5% | 32.9% | 42.2% | 50.8% |

| Northeast Florida | 36.3% | 43.2% | ||||

| Hampton Roads | 28.8% | 29.7% | ||||

| Chicago | 33.5% | 36.0% | ||||

| Charlotte | 14.2% | 30.6% | ||||

And from DataQuick on SoCal:

The number of homes sold in Southern California rose above a year earlier for the sixth month in a row in June, the result of robust investor demand and significant sales gains for mid- to high-end homes.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 24.5 percent of the Southland resale market last month, down from a revised 26.9 percent the month before and 32.9 percent a year earlier. Last month’s figure was the lowest since foreclosure resales were 24.3 percent of the resale market in December 2007. In the current cycle, the figure hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 17.7 percent of Southland resales last month. That was down slightly from an estimated 18.0 percent the month before and 17.9 percent a year earlier.

First Look at 2013 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/17/2012 03:21:00 PM

The BLS reported this morning: "The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.6 percent over the last 12 months to an index level of 226.036 (1982-84=100). For the month, the index decreased 0.2 percent prior to seasonal adjustment."

CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is an explanation ...

The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W1 for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and not seasonally adjusted.

Since the highest Q3 average was in 2011, at 223.233, we only have to compare to last year. Note: The last few years we needed to compare to Q3 2008 since that was the previous highest Q3 average.

Click on graph for larger image.

Click on graph for larger image.

This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Currently CPI-W is above the Q3 2011 average. If the current level holds, COLA would be around 1.3% for next year (the current 226.036 divided by the Q3 2011 level of 223.233).

This is very early, but it appears COLA will be slightly positive next year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.This is based on a one year lag. The National Average Wage Index is not available for 2011 yet, but wages probably didn't increase much from 2010. If wages increased the same as last year, and COLA is positive (seems likely right now), then the contribution base next year will be increased to around $112,500 from the current $110,100.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is CPI-W during Q3 (July, August and September).

(1) CPI-W usually tracks CPI-U (headline number) pretty well. From the BLS:

The Bureau of Labor Statistics publishes CPIs for two population groups: (1)the CPI for Urban Wage Earners and Clerical Workers (CPI-W), which covers households of wage earners and clerical workers that comprise approximately 32 percent of the total population and (2) the CPI for All Urban Consumers (CPI-U) ... which cover approximately 87 percent of the total population and include in addition to wage earners and clerical worker households, groups such as professional, managerial, and technical workers, the self- employed, short-term workers, the unemployed, and retirees and others not in the labor force.

Key Measures show slowing inflation in June

by Calculated Risk on 7/17/2012 01:09:00 PM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment. ... The index for all items less food and energy rose 0.2 percent in June, the fourth consecutive such increase.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in June. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was virtually flat at 0.0% (0.5% annualized rate) in June. The CPI less food and energy increased 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

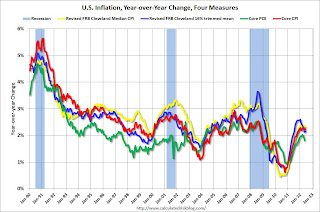

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 2.2%, and core CPI rose 2.2%. Core PCE is for May and increased 1.8% year-over-year.

Most of these measures show inflation on a year-over-year basis are still above the Fed's 2% target, but it appears the inflation rate is slowing. On a monthly basis (annualized), most of these measure were below the Fed's target; median CPI was at 1.5%, trimmed-mean CPI was at 1.9%, and Core PCE for May was at 1.4% - although core CPI was at 2.5%.

NAHB Builder Confidence increases strongly in July, Highest since March 2007

by Calculated Risk on 7/17/2012 10:35:00 AM

Earlier ... The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 6 points in July to 35. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Six Points in July

Builder confidence in the market for newly built, single-family homes rose six points to 35 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for July, released today. This is the largest one-month gain recorded by the index in nearly a decade, and brings the HMI to its highest point since March of 2007.

"Builder confidence increased by solid margins in every region of the country in July as views of current sales conditions, prospects for future sales and traffic of prospective buyers all improved,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla.

...

Every HMI component recorded gains in July. The components gauging current sales conditions and traffic of prospective buyers each rose six points, to 37 and 29, respectively, while the component gauging sales expectations for the next six months rose 11 points to 44.

Likewise, every region posted HMI gains in July. The Northeast registered an eight-point gain to 36, while the Midwest gained three points to 34, the South gained five points to 32 and the West gained 12 points to 44.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the July release for the HMI and the May data for starts (June housing starts will be released tomorrow). A reading of 35 was well above the consensus.

Bernanke: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 7/17/2012 10:00:00 AM

Federal Reserve Chairman Ben Bernanke testimony "Semiannual Monetary Policy Report to the Congress" Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate:

Reflecting its concerns about the slow pace of progress in reducing unemployment and the downside risks to the economic outlook, the Committee made clear at its June meeting that it is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.Here is the CNBC feed.

Here is the C-Span Link

Industrial Production increased 0.4% in June, Capacity Utilization increased

by Calculated Risk on 7/17/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in June after having declined 0.2 percent in May. In the manufacturing sector, output advanced 0.7 percent in June and reversed a decrease of 0.7 percent in May. In the second quarter of 2012, manufacturing output rose at an annual rate of 1.4 percent, a marked deceleration from its strong gain of 9.8 percent in the first quarter. The largest contribution to the increase in the second quarter came from motor vehicles and parts, which climbed 18.2 percent; excluding motor vehicles and parts, manufacturing output edged up 0.1 percent. Outside of manufacturing, the output of mines advanced 0.7 percent in June, while the output of utilities decreased 1.9 percent. For the quarter, however, the output of mines fell at an annual rate of 1.2 percent, while the output of utilities rose 14.9 percent. At 97.4 percent of its 2007 average, total industrial production in June was 4.7 percent above its year-earlier level. Capacity utilization for total industry moved up 0.2 percentage point in June to 78.9 percent, a rate 1.4 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is still 1.4 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in June to 97.4. This is 16.7% above the recession low, but still 3.3% below the pre-recession peak.

The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%. The increase IP was slightly above expectations, but Capacity Utilization was below expectations.

BLS: CPI unchanged in June

by Calculated Risk on 7/17/2012 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of unchanged for CPI and a 0.2% increase in core CPI.

...

The energy index fell 1.4 percent as the gasoline index declined for the third month in a row; other energy indexes were mixed. The food index rose 0.2 percent after being unchanged last month as the index for food at home turned up in June.

The index for all items less food and energy rose 0.2 percent in June, the fourth consecutive such increase.

Report: Housing Inventory declines 19.4% year-over-year in June

by Calculated Risk on 7/17/2012 06:00:00 AM

From Realtor.com: June 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops (SFH/CTHCOPS) remained at historic lows with 1.88 million units for sale in June, down -19% compared to a year ago, and -39% below its peak of 3.10 million units in September, 2007 when Realtor.com began monitoring these markets.Realtor.com also reports that inventory was up 0.5% from the May level.

The median age of the inventory dropped to 84 days, which is down -9.67% on an annual basis.

With some notable exceptions, the majority of housing markets showed signs of continued improvement in June. On a year-over-year basis, the for-sale inventory declined in all but 2 (Shreveport, LA and Philadelphia, PA) of the 146 markets covered by Realtor.com, while list prices increased in 101 markets, held steady in 26 markets, and declined in just 19 markets. This pattern is in stark contrast to trends observed in June 2011, when median list prices were down -1% or more on an annual basis in 79 of the 146 markets covered by Realtor.com.

The NAR is scheduled to report June existing home sales and inventory this Thursday, July 19th.

Monday, July 16, 2012

Tuesday: Bernanke, CPI, Industrial Production, Builder Confidence

by Calculated Risk on 7/16/2012 10:09:00 PM

This will be a busy day for economic data, but first from Tim Duy: A Slap in The Face

The retail sales number should be a slap in the face for any FOMC members sitting on the fence. ... Note ... that the 2010 slowdown in sales did not foreshadow a recession. But it did foreshadow the Jackson Hole speech and QE2. With that in mind, I would expect Federal Reserve Chairman Ben Bernanke to acknowledge the deceleration of activity when he marches up to Capitol Hill this week. And such acknowledgement would be a signal that more easing is on its way.• At 8:30 AM ET, the Consumer Price Index for June will be released. The consensus is for headline CPI to be unchanged in June and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for June. The consensus is for Industrial Production to increase 0.3% in June, and for Capacity Utilization to increase to 79.2%.

• At 10:00 AM, the July NAHB homebuilder confidence survey will be released. The consensus is for a reading of 30, up slightly from 29 in June.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will provide the Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs. Bernanke's comments will be analyzed closely for any comments about QE3, although he hasn't used this forum in the past to hint at further action.

For the July contest:

LA area Port Traffic: Imports and Exports up YoY in June

by Calculated Risk on 7/16/2012 07:34:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up about 0.4%, and outbound traffic is up about 0.5% compared to May.

In general, inbound and outbound traffic has been moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of June, loaded outbound traffic was up 4.8% compared to June 2011, and loaded inbound traffic was up 6.3% compared to June 2011.

For the month of June, loaded outbound traffic was up 4.8% compared to June 2011, and loaded inbound traffic was up 6.3% compared to June 2011.

This suggests imports from Asia might be up in June, and exports to Asia up too.