by Calculated Risk on 6/11/2012 12:23:00 PM

Monday, June 11, 2012

Gasoline Prices decline 16 cent over the past three weeks

There is plenty of confusion regarding the Spanish bank aid. See the Financial Times Alphaville: Just buying time? , An ESM subordination ... save? and on rumors of capital controls.

From Bloomberg: U.S. Gasoline Fell to $3.6243 a Gallon, Lundberg Survey

The average price of regular gasoline at U.S. filling stations declined 15.9 cents in the past three weeks to $3.6243 a gallon, according to Lundberg Survey Inc.The euro has declined further today with the confusion around the Spanish bank aid.

... The price is down 11.62 cents from a year earlier. The highest average this year was $3.9671 during the two weeks ended April 6.

“Europeans’ misfortunes are American fuel consumers gain,” Trilby Lundberg, president of Lundberg Survey, said today in a telephone interview. “Our dollar looks strong against the weaker euro, which has reduced the price of crude.”

Oil prices are down again today. Brent is down to $98.56 per barrel, and WTI is down to $83.36. The lower oil prices will not only lead to lower gasoline prices, but also a lower trade deficit and lower headline inflation (CPI).

The following graph shows the decline in gasoline prices. Gasoline prices are down significantly from the peak in early April. Gasoline prices in the west had been impacted by refinery issues, but prices are now falling there too.

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

CoreLogic: Impact of negative equity on the Supply of Unsold Homes

by Calculated Risk on 6/11/2012 08:59:00 AM

CoreLogic released their June MarketPulse Report today.

Here is a brief excerpt from a piece by Sam Khater, CoreLogic senior economist, on the impact of negative equity on housing supply:

While the rapid decline in months’ supply is typically good news because it indicates a better balance between demand and supply, this decline is occurring less because of an increase in sales and more because of a drop in unsold inventory as a result of negative equity. Negative equity is typically a demand-side obstacle to sales and refinances, but currently is also restricting the supply of homes for sale. Analysis of the 50 largest markets reveals the metropolitan areas with the lowest levels of months’ supply also have the higher shares of negative equity. Markets with negative equity share of 50 percent or more have an average months’ supply of 4.7 months, compared to 8.3 months’ supply for markets with less than a 10 percent negative equity share. The presence of negative equity not only drives foreclosures, reduces the availability of purchase down payments and impedes refinances, but also restricts the ability of owners to list their homes for sale as the demand side of the market improves.Although negative equity is probably contributing to the decline in inventory - especially in certain markets with high levels of negative equity - I think price expectations are a bigger factor in the recent decline in inventory.

Paradoxically, as the flow of REOs has slowed over the last 18 months, negative equity has become a positive force in real estate markets by restricting supply in the face of increasing demand.

Sunday, June 10, 2012

Sunday Night: Asian Stocks and US Futures Up

by Calculated Risk on 6/10/2012 09:24:00 PM

There are no US economic releases scheduled for Monday. The big story will be the aid for Spanish Banks. The next key event in Europe is the Greek election on Sunday June 17th.

The Asian markets are up tonight. The Nikkei is up about 2.3%, and the Hang Seng is up 2.6%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are up about 16, and Dow futures are up 150.

Oil: WTI futures are up to $86.48 (this is down from $109.77 in February) and Brent is back over $100 at $102.14 per barrel.

Saturday:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

For the monthly economic question contest (three more questions for June later this week):

LA Times: "Shortage of homes for sale creates fierce competition"

by Calculated Risk on 6/10/2012 01:15:00 PM

Another story on the sharp decline in home inventory ...

From Alejandro Lazo at the LA Times: Shortage of homes for sale creates fierce competition

Housing inventory has sunk to levels not seen since the bubble years. ... In Southern California, inventories have plunged over the last year. The number of homes listed for sale in April fell 35% in Los Angeles County and was down 42% in Orange, 39% in San Bernardino, 42% in Riverside, 53% in Ventura and 43% in San Diego counties, according to online brokerage Redfin.Negative equity is keeping some people from selling, however most homeowners have positive equity (there are about 75 million owner occupied homes, and about 11 million have negative equity). I think a more important driver of the decline in inventory is price expectations. I agree with Redfin's Kelman who pointed out that "sellers feel they have time on their side".

Many people who bought at the top of the cycle are so deeply underwater, they can't get the price they need to sell and are therefore not bothering to put their homes on the market.

"We know negative equity holds back home sales, but it also holds back the listing of sales," said Sam Khater, an economist with CoreLogic ...

Glenn Kelman, chief executive of Redfin, said the recovery remains tentative but the market has grown competitive because sellers feel they have time on their side, while buyers feel a sense of urgency given low interest rates and relatively cheap prices compared with the bubble years.

"It is a precarious situation, but the real issue is that nobody wants to sell a house right now," Kelman said. "So now we have classes for our real estate agents on how to win a bidding war."

Earlier I argued:

When the expectation is that prices will fall further, marginal sellers will try to sell their homes immediately. And marginal buyers will decide to wait for a lower price. This leads to more inventory on the market.This leads to less inventory on the market.

But when the expectation is that prices are stabilizing (the current situation), sellers will wait until it is convenient to sell. And buyers will start feeling a little more confident.

Yesterday:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

China economic data "mixed"

by Calculated Risk on 6/10/2012 09:16:00 AM

From the WSJ: China Data Signal Some Strength

A raft of data released over the weekend by the Chinese government present a mixed picture, but overall suggest an economy stronger than many market players feared at the end of last week.Some of the data from the WSJ article:

Industrial production was up 9.6% year-over-year (YoY) in May, a stronger pace than in April (9.3%) - however that isn't saying much since April saw the slowest YoY growth since 2009.

CPI increased 3.0% YoY in May, the slowest since June 2010.

Both exports and imports were up in May. Exports were up 15.3% YoY, and import up 12.7%.

Auto sales were up 22.6% YoY, increasing at a faster pace than in April (12.5%).

However overall retail sales increased at a slower pace in May; 13.8% year-over-year compared to 14.1% in April.

Overall this was slightly better than expected.

Yesterday:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

Saturday, June 09, 2012

Unofficial Problem Bank list declines to 923 Institutions

by Calculated Risk on 6/09/2012 07:36:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. (Only US banks).

Here is the unofficial problem bank list for June 8, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Four failures meant four removals from the Unofficial Problem Bank List. The list stands at 923 institutions with assets of $355.7 billion. A year ago, the list held 1,002 institutions with assets of $417.4 billion. After three weeks off, the FDIC got back to closings leading to the following removal s -- Waccamaw Bank, Whiteville, NC ($533 million Ticker: WBNK); Carolina Federal Savings Bank, Charleston, SC ($54 million); First Capital Bank, Kingfisher, OK ($46 million); and Farmers' and Traders' State Bank, Shabbona, IL ($43 million).Earlier:

F & M Bank, Edmond, Oklahoma paid a 7.65 percent deposit premium to acquire First Capital Bank. This appears to be the highest deposit premium paid to complete an assisted acquisition during this crisis. Although the FDIC likes to receive a deposit premium when selling a failed bank, buyers have only been willing to pay one in about one-third of the 443 failures since 2008 and in four transactions buyers have bid a discount.. When paid, the average deposit premium is 1.09 percent. Thus, the premium paid by F&M Bank is very high at 4.7 standard deviations above the average. In a few months, the FDIC will release bidding information for First Capital Bank, which should allow some insight if the premium paid F&M Bank was necessary to close the deal. There have been some transactions where bidders have been too aggressive. For instance, in January 2010, United Valley Bank, Cavalier, ND, paid a 7.35 percent deposit premium to acquire the failed Marshall Bank, National Association, Hallock, MN with the next highest bid was a 1.32 percent premium.

Next week, we anticipate the OCC will release its actions through mid-June 2012.

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

And on Spain:

• Eurogroup statement on Spain

• WSJ: Spain Asks EU for Aid For Its Banks

• NY Times: Spain to Accept Rescue From Europe for Its Ailing Banks

• Financial Times: Spain seeks eurozone bail out

Spain to ask EU for Bank Bailout

by Calculated Risk on 6/09/2012 02:09:00 PM

From the Financial Times: Spain to ask EU for bail out

The Spanish government agreed to seek EU bailout aid for its struggling financial sector on a conference call of eurozone finance ministers Saturday evening.It sounds like the maximum will be €100 billion. Apparently policymakers wanted to get something in place before the Greek election on June 17th.

In exchange, the ministers agreed not to attach any new conditions on Madrid other than its current commitments ...

Excerpt with permission

Earlier:

• Summary for Week Ending June 8th

• Schedule for Week of June 10th

Schedule for Week of June 10th

by Calculated Risk on 6/09/2012 01:05:00 PM

Earlier:

• Summary for Week Ending June 8th

The key report this week is the May retail sales report. For manufacturing, the May NY Fed (Empire state) survey, and the May Industrial Production and Capacity Utilization report will be released this week.

For prices, the May Producer Price Index and Consumer Price Index will be released on Wednesday and Thursday, respectively.

No economic releases scheduled.

7:30 AM: NFIB Small Business Optimism Index for May.

7:30 AM: NFIB Small Business Optimism Index for May. Click on graph for larger image in graph gallery.

The index increased to 94.5 in April from 92.5 in March. This tied February 2011 as the highest level since December 2007

The consensus is for a slight decrease to 94.2 in May.

8:30 AM: Import and Export Prices for April. The consensus is a for a 1.1% decrease in import prices.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Expect record low mortgage rates and probably an increase in refinance activity.

8:30 AM: Producer Price Index for May. The consensus is for a 0.6% decrease in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for May.

8:30 AM ET: Retail Sales for May. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak.

The consensus is for retail sales to decrease 0.2% in May, and for retail sales ex-autos to decrease 0.1%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for April (Business inventories). The consensus is for 0.3% increase in inventories.

8:30 AM: Consumer Price Index for May. The consensus is for headline CPI to decline 0.2% (with the decline in energy prices). The consensus is for core CPI to increase 0.2%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 375 thousand from 377 thousand last week.

8:30 AM ET: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 13.8, down from 17.1 in May (above zero is expansion).

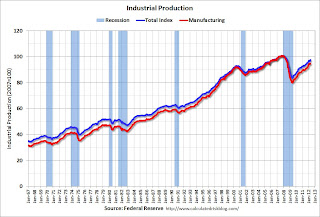

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for May. This shows industrial production since 1967.

The consensus is for no change in Industrial Production in May, and for Capacity Utilization to be unchanged at 79.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for sentiment to decline to 77.5 from 79.3 in May.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for May 2012

Report: Euro zone discussing €100 billion aid for Spanish Banks

by Calculated Risk on 6/09/2012 10:16:00 AM

From the WSJ: Ministers to Discuss $125 Billion in Spain Bank Support

Euro-zone finance ministers will discuss a commitment to provide as much as €100 billion ($125 billion) in support for Spain's ailing banking sector on Saturday afternoon, an official from a euro-zone country said Saturday.

Summary for Week Ending June 8th

by Calculated Risk on 6/09/2012 08:01:00 AM

Most of the news last week was about either Europe or the Fed, especially comments from Fed Chairman Bernanke. The Fed debate is on the possibility and timing of "QE3". The next FOMC meeting is on June 19th and 20th, just after the election in Greece.

This was a light week for US economic data. The trade deficit declined slightly - and will probably decline further in May with falling oil prices. However the weakness in the euro zone is showing up in the trade data as US exports to the euro area declined from $17.1 billion in April 2011 to $16.3 billion in April 2012.

Other data was a little more positive. Initial weekly unemployment claims declined slightly, and the ISM non-manufacturing index increased in May.

Also CoreLogic reported house prices were up year-over-year in April. This is the first year-over-year increase in prices since the bubble burst - except for a brief increase related to the tax credit.

Here is a summary of last week in graphs:

• Trade Deficit declines in April to $50.1 Billion

The first graph shows the monthly U.S. exports and imports in dollars through April 2012.

Click on graph for larger image.

Click on graph for larger image.

Exports decreased in April. Imports decreased even more. Exports are 11% above the pre-recession peak and up 4% compared to April 2011; imports are 2% above the pre-recession peak, and up about 6% compared to April 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through April.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $109.94 per barrel in April, up from $107.95 in March. Import oil prices will probably start to decline in May. The trade deficit with China increased to $24.6 billion in April, up from $21.6 billion in April 2011. Once again most of the trade deficit is due to oil and China.

Exports to the euro area were $16.3 billion in April, down from $17.1 billion in April 2011, so the euro area recession appears to be a drag on US exports.

• ISM Non-Manufacturing Index indicates slightly faster expansion in May

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

The May ISM Non-manufacturing index was at 53.7%, up from 53.5% in April. The employment index decreased in May to 50.8%, down from 54.2% in April - the lowest level since November 2011. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 53.5% and indicates faster expansion in May than in April.

• CoreLogic: House Price Index increases in April, Up 1.1% Year-over-year

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 2.2% in April, and is up 1.1% over the last year.

The index is off 32% from the peak - and is just above the post-bubble low set two months ago.

Excluding the tax credit period, this is the first year-over-year increase since 2006 (March was revised up to a year-over-year increase too). This "stabilization" of house prices is a significant story.

• Fed's Q1 Flow of Funds: Household Real Estate Value increased in Q1

The Federal Reserve released the Q1 2012 Flow of Funds report this week: Flow of Funds.

The Fed estimated that the value of household real estate increased $372 billion to $16.05 trillion in Q1 2012. The value of household real estate has fallen $6.3 trillion from the peak.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $85 billion in Q1. Mortgage debt has now declined by $885 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, is near the lows of the last 30 years, however household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Weekly Initial Unemployment Claims decline to 377,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 377,750.

The average has been between 363,000 and 384,000 all year, and this is the highest level since early May.

This was close to the consensus forecast of 379,000.

• Other Economic Stories ...

• Testimony by Chairman Bernanke on economic outlook and policy

• Fed's Beige Book: Economic activity increased at "moderate" pace, Residential real estate "activity improved"

• Comparing Housing Recoveries

• Housing: Dude, Where's my inventory?

• Trulia Reports Flat Asking Prices in May After Three Straight Months of Increases, as Foreclosure Prices Decline