by Calculated Risk on 5/31/2012 11:27:00 AM

Thursday, May 31, 2012

NY Fed: Consumer Deleveraging Continued in Q1, but Student Loan Debt Continued to Grow

From the NY Fed: New York Fed Quarterly Report Shows Student Loan Debt Continues to Grow

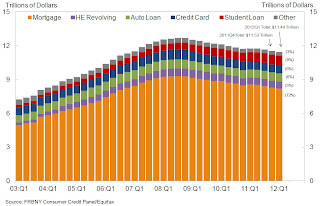

In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York today announced that student loan debt reported on consumer credit reports reached $904 billion in the first quarter of 2012, a $30 billion increase from the previous quarter. In addition, consumer deleveraging continued to advance as overall indebtedness declined to $11.44 trillion, about $100 billion (0.9 percent) less than in the fourth quarter of 2011. Since the peak in household debt in the third quarter of 2008, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.Here is the Q1 report: Quarterly Report on Household Debt and Credit

Mortgage balances shown on consumer credit reports fell again ($81 billion or 1.0%) during the quarter; home equity lines of credit (HELOC) balances fell by $15 billion (2.4%). Household mortgage and HELOC indebtedness are now 11.9% and 14.3%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances stood at $2.64 trillion at the close of the quarter. Student loan indebtedness, the largest component of household debt other than mortgages, rose 3.4% in the quarter, to $904 billion.Here are two graphs:

...

About 291,000 individuals had a foreclosure notation added to their credit reports between December 31 and March 31, about the same as in 2011Q4, but 20.8% below the 2011Q1 level.

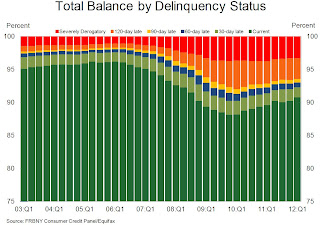

Total household delinquency rates continued their downward trend in 2012Q1. As of March 31, 9.3% of outstanding debt was in some stage of delinquency, compared to 9.8% on December 31, 2011.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q1. This was mostly due to a decline in mortgage debt.

However student debt is still increasing. From the NY Fed:

Over the one year period ending March 31, 2012, student loan balances rose $64 billion. Over the same period, all other forms of household debt (mortgages, HELOCs, auto loans and credit card balances) fell a combined $383 billion.

Since the peak in household debt in 2008Q3, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

About $1.06 trillion of consumer debt is currently delinquent, with $796 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

Chicago PMI declines to 52.7

by Calculated Risk on 5/31/2012 09:55:00 AM

Chicago PMI: The overall index declined to 52.7 in May, down from 56.2 in April. This was below consensus expectations of 56.1 and indicates slower growth in May. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the May Chicago Business Barometer decreased for a third consecutive month to its lowest level since September 2009. The short term trend of the Chicago Business Barometer, and all seven Business Activity indexes, declined in May. Among the Business Activity measures, only the Supplier Delivery index expanded faster while Order Backlogs and Inventories contracted.New orders declined to 52.7 from 57.4, and employment decreased to 57.0 from 58.7.

...

• PRODUCTION and NEW ORDERS lowest since September 2009;

• PRICES PAID lowest since September 2010;

• EMPLOYMENT rate of growth slowed

This is another weak reading, and suggests a decline in the ISM PMI to be released tomorrow.

Weekly Initial Unemployment Claims increase to 383,000

by Calculated Risk on 5/31/2012 08:38:00 AM

Note: The BEA reported that the second estimate of Q1 real GDP growth was 1.9%, lower than the advance estimate of 2.2% and at the consesnus expectation. Real Gross Domestic Income (GDI) was reported at 2.7% annual rate.

The DOL reports:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 383,000, an increase of 10,000 from the previous week's revised figure of 373,000. The 4-week moving average was 374,500, an increase of 3,750 from the previous week's revised average of 370,750.The previous week was revised up from 370,000 to 373,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,500.

The average has been between 363,000 and 384,000 all year.

And here is a long term graph of weekly claims:

This was above the consensus forecast of 370,000.

ADP: Private Employment increased 133,000 in May

by Calculated Risk on 5/31/2012 08:11:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 133,000 from April to May on a seasonally adjusted basis. The estimated gain from March to April was revised down modestly, from the initial estimate of 119,000 to a revised estimate of 113,000.This was below the consensus forecast of an increase of 154,000 private sector jobs in May. The BLS reports on Friday, and the consensus is for an increase of 150,000 payroll jobs in May, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 132,000 in May, after rising a revised 119,000 in April. Employment in the private, goods-producing sector increased 1,000 in May. Manufacturing employment dropped 2,000 jobs, the second consecutive monthly decline.

Note: ADP hasn't been very useful in predicting the BLS report, but this suggests a somewhat weaker than consensus report.

Wednesday, May 30, 2012

Look Ahead: GDP, ADP Employment, Weekly Unemployment Claims, Chicago PMI

by Calculated Risk on 5/30/2012 09:16:00 PM

There are a number of US economic indicators to be released over the next two days, and that may take some of the focus off of Europe (probably not). For Thursday:

• At 8:15 AM ET, the ADP employment report is scheduled for release. This report is for private payrolls only (no government). The consensus is for 154,000 payroll jobs added in May, up from the 119,000 reported last month.

• At 8:30 AM ET, the second estimate of Q1 GDP will be released by the BEA. The consensus is that real GDP increased 1.9% annualized in Q1, slower than the advance estimate of 2.2%. The BEA will also release Q1 Gross Domestice Income (GDI).

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 370 thousand.

• At 9:45 AM, the Chicago Purchasing Managers Index for May will be released. The consensus is for a decrease to 56.1, down slightly from 56.2 in April.

• At 11:00 AM, the New York Fed will release the Q1 2012 Report on Household Debt and Credit (filled with data!)

For the monthly economic question contest (one more questions for May):

Lawler: Pending Home Sales and updated Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/30/2012 05:25:00 PM

CR Note: Earlier this month I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler has been digging up similar data, and he sent me the updated table below for several more distressed areas. For all of these areas, with the exception of Rhode Island, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Lawler noted "all of the below shares are based on MLS data save for California [that uses] Dataquick estimates based on property records."

And Lawler on Pending Home Sales:

Click on graph for larger image.

Click on graph for larger image.

"The National Association of Realtors reported that its Pending Home Sales Index declined by 5.5% on a seasonally adjusted basis in April, after jumping by 3.8% (downwardly revised) in March. April’s PHSI was up 14.4% (SA) from last April. By region, April’s PHSI increased by 0.9% in the Northeast, fell by 0.3% in the Midwest, dropped by 6.8% in the South, and plunged by 12.0% in the West (after jumping by 8.5% in March).

The jump in contracts signed in March, and decline in April, could well have been related to the FHA’s announcement in late February that it was increasing its up-front and annual mortgage insurance premiums effective for FHA case numbers assigned in early April or later."

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

| Rhode Island | 32.6% | 31.3% | ||||

| California | 18.3% | 16.9% | 30.3% | 36.4% | 48.6% | 53.3% |

| Miami-Dade | 47.0% | 59.0% | ||||

| Broward | 38.0% | 50.0% | ||||

House Prices: The Turning Point

by Calculated Risk on 5/30/2012 03:11:00 PM

A post by CR on Yahoo: House Prices: The Turning Point

Edit: I meant "turning" instead of "inflection"

Some data and articles mentioned in the post:

• Real House prices and price-to-rent ratio

• S&P Case-Shiller: Pace of Decline in Home Prices Moderates as the First Quarter of 2012 Ends

• Zillow: Home Values Continue to Climb in April

• CoreLogic: House Price Index increases in March, Down 0.6% Year-over-year

• Trulia: Strong Housing Demand and Tightening Inventories Spark Nearly 2 Percent Rise in Asking Prices over Previous Quarter

• April Existing Home Sales and Inventory

• LPS: “First Look” Mortgage Report

CoreLogic: 66,000 completed foreclosures in April

by Calculated Risk on 5/30/2012 12:26:00 PM

From CoreLogic: CoreLogic® Reports 66,000 Completed Foreclosures Nationally in April

CoreLogic ... today released its National Foreclosure Report for April, which provides monthly data on completed foreclosures and the overall foreclosure inventory. According to the report, there were 66,000 completed foreclosures in the U.S. in April 2012 compared to 78,000 in April 2011 and 66,000* in March 2012. Since the start of the financial crisis in September 2008, there have been approximately 3.6 million completed foreclosures across the country. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure.This is a new monthly report and might help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the national foreclosure inventory as of April 2012 compared to 1.5 million, or 3.5 percent, in April 2011 and 1.4 million, or 3.4 percent, in March 2012.

“There were more than 830,000 completed foreclosures over the past year or, in other words, one completed foreclosure for every 622 mortgaged homes,” said Mark Fleming, chief economist for CoreLogic. “Non-judicial foreclosure markets, like Nevada, Arizona and California, completed two and a half times as many foreclosures over the past year as judicial foreclosure states.”

...

“The inventory of homes in foreclosure in judicial foreclosure states is growing, but this increase is being more than offset by declining inventories in non-judicial states where the processing timelines to clear a foreclosure are shorter,” said Anand Nallathambi, chief executive officer of CoreLogic.

So far we haven't seen a surge in completed foreclosures - or a large increase in REO (lender Real Estate Owned) coming on the market. Note: The foreclosure inventory reported by CoreLogic is lower than either reported by LPS of 4.14% of mortgages or 2 million in foreclosure, and the Mortgage Bankers Association’s (MBA) Q1 report showing 4.39% of loans in the foreclosure process.

My guess is the "surge" in foreclosures will be less than many people expect (see from April: Some thoughts on housing and foreclosures).

NAR: Pending home sales index declined 5.5% in April

by Calculated Risk on 5/30/2012 10:00:00 AM

From the NAR: Pending Home Decline in April but Up Strongly From a Year Ago

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 5.5 percent to 95.5 from a downwardly revised 101.1 in March but is 14.4 percent above April 2011 when it was 83.5. The data reflects contracts but not closings.This was below the consensus of a 0.5% increase for this index.

...

The PHSI in the Northeast rose 0.9 percent to 78.9 in April and is 19.9 percent higher than April 2011. In the Midwest the index slipped 0.3 percent to 93.0 but is 23.0 percent above a year ago. Pending home sales in the South fell 6.8 percent to an index of 105.7 in April but are 13.3 percent higher than April 2011. In the West the index dropped 12.0 percent in April to 94.9 but is 5.1 percent above a year ago.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in May and June.

MBA: Mortgage Rates Drop to New Survey Lows

by Calculated Risk on 5/30/2012 07:00:00 AM

From the MBA: Mortgage Rates Drop to New Survey Lows

The Refinance Index decreased 1.5 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.6 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.91 percent, the lowest rate in the history of the survey, from 3.93 percent, with points increasing to 0.46 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.The purchase index is still very weak. This index has mostly been moving sideways for the last two years, although the 4-week average has increased slightly over the last couple of months.

Mortgates rates fell to another record low last week.