by Calculated Risk on 5/15/2012 05:49:00 PM

Tuesday, May 15, 2012

Misc: NY Fed Manufacturing Survey, Remodeling Index

A couple of releases earlier this morning ...

• From the NY Fed: May Empire State Manufacturing Survey indicates manufacturing activity expanded at a moderate pace

The May Empire State Manufacturing Survey indicates that manufacturing activity expanded in New York State at a moderate pace. The general business conditions index rose eleven points to 17.1. The new orders index inched up to 8.3, and the shipments index shot up eighteen points to 24.1. ... Employment index readings remained relatively healthy, suggesting that employment levels and hours worked continued to expand. ... The index for number of employees was little changed at 20.5, and the average workweek index rose six points to 12.1.This was above the consensus forecast of 10.0, up from 6.6 in April (above zero is expansion).

• From BuildFax:

Residential remodels authorized by building permits in the United States in March were at a seasonally-adjusted annual rate of 2,781,000. This is 1 percent below the revised February rate of 2,811,000 and is 10 percent above the March 2011 estimate of 2,522,000.Even with the decline in March, the remodeling in is up 10% year-over-year.

"Overall, March 2012 had lower remodeling activity than February, which saw significantly greater-than-expected activity, likely due to the unseasonably warm winter weather," said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census. The BFRI is seasonally-adjusted using the X12 procedure.

Lawler: Update Table of Short Sales and Foreclosures for Selected Cities

by Calculated Risk on 5/15/2012 03:12:00 PM

CR Note: Last week I posted some distressed sales data for Sacramento. I'm following the Sacramento market to see the change in mix over time (short sales, foreclosure, conventional). Economist Tom Lawler sent me the updated table below for several other distressed areas. For all of these areas, the share of distressed sales is down from April 2011 - and for the areas that break out short sales, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

In five of the seven cities that break out short sales, there are now more short sales than foreclosure sales!

Economist Tom Lawler also wrote today: Plunge in Foreclosures Pushes Up REO Prices/Down REO Price Discounts

ForeclosureRadar released its April Foreclosure Report, which covers foreclosure activity in Arizona, California, Nevada, Oregon, and Washington. According to the report, foreclosure starts fell sharply in April in all five states, and completed foreclosure sales declined in all five states, with sizable drops from March in all states save for Washington. And in Arizona, California, and Nevada, record high percentages (44.6%, 41,1%, and 50.7%) of completed foreclosure sales were sold to third parties, rather than becoming bank REO. In its write-up, FR lamented that “we are seeing unprecedented government intervention into the foreclosure process leaving underwater homeowners in limbo, while stealing opportunity from investors and first time buyers." In discussing the “stolen opportunities,” FR noted that “In both Arizona and Nevada winning bids on the courthouse steps on average equal the current estimated value of those properties,” and that “(i)n California the discount between market value and winning bid have on average declined to 12.3 percent” – substantially lower than a year ago. According to FR, “(t)his leaves investors who intend to resell their purchases with record low profits after eviction, repairs, and closing costs.”

An increasing number of investors, of course, are buying REO with plans to rent the properties out, which has not only intensified demand but has reduced the supply of homes offered for sale.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Apr | 11-Apr | 12-Apr | 11-Apr | 12-Apr | 11-Apr | |

| Las Vegas | 29.9% | 23.8% | 36.9% | 46.3% | 66.8% | 70.1% |

| Reno | 32.0% | 31.0% | 26.0% | 38.0% | 58.0% | 69.0% |

| Phoenix | 25.2% | 19.7% | 18.8% | 44.5% | 44.0% | 64.2% |

| Sacramento | 30.4% | 22.2% | 30.3% | 44.6% | 60.7% | 66.8% |

| Minneapolis | 10.9% | 10.0% | 32.0% | 43.3% | 42.9% | 53.3% |

| Mid-Atlantic (MRIS) | 12.2% | 11.8% | 11.0% | 20.9% | 23.2% | 32.7% |

| Orlando | 29.4% | 25.4% | 25.5% | 40.2% | 54.9% | 65.6% |

| Northeast Florida | 38.1% | 50.3% | ||||

| Hampton Roads | 31.0% | 35.0% | ||||

Key Measures of Inflation in April

by Calculated Risk on 5/15/2012 11:52:00 AM

Earlier today the BLS reported:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in April on a seasonally adjusted basis ... The gasoline index fell 2.6 percent in April and accounted for most of the decline in energy, though the indexes for natural gas and fuel oil decreased as well. ... The index for all items less food and energy rose 0.2 percent in April, the same increase as in March.The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in April. The 16% trimmed-mean Consumer Price Index increased 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

...

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers was flat at 0.0% (0.4% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.3%, and core CPI rose 2.3%. Core PCE is for March and increased 2.0% year-over-year.

These measures show inflation on a year-over-year basis is mostly still above the Fed's 2% target.

NAHB Builder Confidence increases in May, Highest since May 2007

by Calculated Risk on 5/15/2012 10:05:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased 5 points in May to 29. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Rises Five Points in May

Builder confidence in the market for newly built, single-family homes gained five points in May from a downwardly revised reading in the previous month to reach a level of 29 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This is the index’s strongest reading since May of 2007.

“Builders in many markets are reporting that buyer traffic and sales have picked back up after a pause this April,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Fla. “It seems we have resumed the gradual upward trend in confidence that started at the beginning of this year, as stabilizing prices and excellent affordability encourage more people to pursue a new-home purchase.”

“While home building still has quite a way to go toward a fully healthy market, the fact that the HMI has returned to trend is an excellent sign that firming home values, improving employment and low mortgage rates are drawing consumers back,” said NAHB Chief Economist David Crowe.

...

Each of the index’s components rebounded from declines in the previous month. The component gauging current sales conditions and the component gauging traffic of prospective buyers each rose five points in May to 30 and 23, respectively, with the traffic component hitting its highest level since April of 2007. The component gauging sales expectations in the next six months rose three points to 34.

Three out of four regions registered improving builder sentiment in May. This included a six-point gain to 32 in the Northeast, and five-point gains to 27 and 28 in the Midwest and South, respectively. The West posted a two-point decline, to 29.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the May release for the HMI and the March data for starts (April housing starts will be released tomorrow).

Retail Sales increased 0.1% in April

by Calculated Risk on 5/15/2012 08:47:00 AM

On a monthly basis, retail sales were up 0.1% from March to April (seasonally adjusted), and sales were up 6.4% from April 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $408.0 billion, an increase of 0.1 percent from the previous month and 6.4 percent above April 2011.Ex-autos, retail sales also increased 0.1% in April.

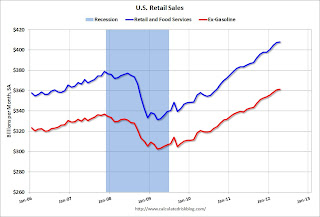

Click on graph for larger image.

Click on graph for larger image.Sales for March was revised down to a 0.7% increase from 0.8%, and February was revised down to 1.0% from 1.1%.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 23.1% from the bottom, and now 7.7% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 19.4% from the bottom, and now 7.3% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.4% on a YoY basis (6.4% for all retail sales). Retail sales ex-gasoline increased 0.2% in April.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto.

This was at the consensus forecast for retail sales of a 0.1% increase in April, and below the consensus for a 0.2% increase ex-auto. Monday, May 14, 2012

Look Ahead: Retail sales, CPI, Home Builder Confidence, NY Fed Manufacturing Survey

by Calculated Risk on 5/14/2012 09:37:00 PM

Tuesday will be a busy day with the release of several key economic indicators including retail sales, CPI, home builder confidence, and the NY Fed manufacturing survey:

• Retail sales for April will be released at 8:30 AM ET. Retail sales were very strong in February and March, increasing 1.1% and 0.8%, respectively. The consensus is for retail sales to increase 0.1% in April, and for retail sales ex-autos to increase 0.2%. This report could be weak. Note: The annual revision for retail sales was released on April 30th including new seasonal adjustments using the Census Bureau’s X-13ARIMA-SEATS (yes, a new model).

• Also at 8:30 AM, the Consumer Price Index for April will be released. The consensus is for no change in headline CPI (with the decline in energy prices) and for core CPI to increase 0.2%. From Merrill:

With gasoline prices peaking in early April, we expect headline CPI to soften, dropping 0.1% monthly, after a 0.3% rise in March. ... Overall, the annual headline CPI inflation rate is likely to decelerate in April to 2.2%, its slowest year-on-year rise since the rapid run-up in global oil prices in February 2011.• Also at 8:30 am, the NY Fed Empire Manufacturing Survey for May will be released. The consensus is for a reading of 10.0, up from 6.6 in April (above zero is expansion).

• At 10 AM, the May NAHB home builder confidence survey will be released. The consensus is for a reading of 26, up slightly from 25 in April. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

• The Manufacturing and Trade: Inventories and Sales report for March will be released at 10 AM, and Fed Governor Elizabeth Duke speaks at 9.30 AM: "Prescriptions for Housing Recovery".

For the monthly economic question contest:

Update on Gasoline Prices: West Coast Refinery Problems

by Calculated Risk on 5/14/2012 07:09:00 PM

Earlier I noted that gasoline prices will probably follow the price of Brent oil down, but that there were some refinery issues.

Here is a story from the Mercury News last Friday: Rising California gas prices expected to increase even more

Prices could rise an additional 20 cents in the next few days, as refinery problems continue to choke supplies for California's special blend of clean burning gas. On Thursday, many Bay Area stations saw jumps of several cents to a dime.Gasoline prices on the west coast are up about 20 cents this month, and about 10 cents over the last several days. Hopefully this is a short term problem.

"Prepare to get clobbered," said Patrick DeHaan, the senior petroleum analyst with GasBuddy.com.

West Coast gas inventories are at their lowest level in 20 years, he said, and the blame is with production on the West Coast.

"Refineries have been having a lousy spring with not just one massive facility outage," DeHaan said, "but smaller, more widespread issues."

Housing: The Return of Multiple Offers

by Calculated Risk on 5/14/2012 04:34:00 PM

I've mentioned this before, but here are a couple more excerpts from articles ...

From Susan Straight at the WaPo: How to buy a house in D.C.’s sellers’ market

If you’ve dipped a toe into the Washington-area real estate market these days, you know it’s returned to an era of multiple offers, escalation clauses and competitive bidding. According to RealEstate Business Intelligence, the active inventory of homes in March was down more than 25 percent from March 2011.From the Jon Lansner at the O.C. Register: O.C. homes draw multiple-offer ‘avalanche’ (an excerpt from Steve Thomas' report)

...

Sellers are in heaven; buyers are feeling the stress. These days you can go to any open house of a home in good condition in a desirable neighborhood, and you’ll find you’re one of a steady stream of potential buyers.

Below $500,000 range is NUTS. Homes priced at or near their market value are generating an avalanche of multiple offers. A home in this range is placed on the market and, within moments, cars filled with buyers are touring the home. ...The local economies in these two areas are probably better than most of the country, and anything priced right is selling pretty quickly. The key reason for the multiple offers is the sharp decline in inventory.

Upon writing an offer, buyers quickly find that they are one of many, sometimes over ten, offers on the home. Suddenly ... In the end, the seller factors the highest price with the largest down payment. I know, you are thinking, “What about the appraisal?” In many instances, shrewd sellers and Realtors are leveraging the competition to drop the appraisal contingency and require the buyer to make up the difference between the appraisal price and the purchase price, IF there is an appraisal problem. ...

Supply has dropped to levels not seen since June 2005. ... The expected market time for all of Orange County is 1.5 months, or six weeks.

Although this might remind some people of 2005, I think the dynamics are very different. This is only happening in a few parts of the country, the buyers are usually making substantial down payments, and I suspect any clear increase in prices would be met with more supply ("sellers waiting for a better market").

Oil and Gasoline Prices, and the Reversal of Seaway Pipeline

by Calculated Risk on 5/14/2012 12:15:00 PM

Oil prices have fallen sharply, and once again gasoline prices are lagging. But if oil prices stay at this level - or fall further - then gasoline prices should decline further too (there are always some refinery issues).

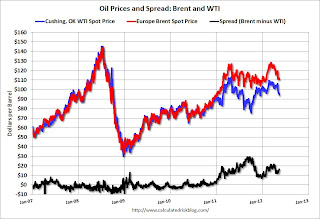

First, gasoline prices tend to track international oil prices, so we need to compare gasoline to Brent oil prices, and not WTI (West Texas Intermediate). A "glut" of oil at Cushing pushed down WTI prices relative to Brent over the last few years, but the spread has narrowed some now that a key pipeline is being reversed.

From Bloomberg: Sweet Crude From Seaway Pipeline Offered in the U.S. Gulf

Low-sulfur oil delivered from the soon-to-be reversed Seaway pipeline is being offered in the U.S. Gulf Coast for June delivery.This following graph shows the prices for Brent and WTI over the last few years.

Enterprise Product Partners LP (EPD) and Enbridge Inc. (ENB) are reversing the pipeline and on May 17 will begin shipping oil from the storage hub at Cushing, Oklahoma, to the Gulf. It is expected to narrow the discount of inland U.S. grades to imports and Gulf Coast production.

The first phase will carry 150,000 barrels a day on the 500-mile (800-kilometer) line, with subsequent phases expanding capacity to 850,000 barrels a day by mid-2014.

Click on graph for larger image.

Click on graph for larger image.The spread narrowed last year with the announcement of the partial reversal of the Seaway pipeline. The spread will probably narrow further as the capacity is expanded.

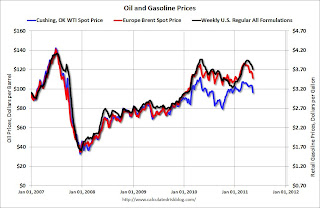

The second graphs shows that gasoline prices track Brent more than WTI.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.

Before the spread emerged, WTI and Brent tracked closely - and retail gasoline prices tracked pretty closely too.Once the "glut" emerged, gasoline prices tracked Brent oil prices. Brent was as high as $128 per barrel in March, and gasoline prices peaked at $3.94 (weekly basis) in early April.

We will probably see a similar lag this time, with gasoline prices falling to below $3.50 per gallon by early June (if oil prices stay at this level). It wouldn't be a surprise if most of the decline in gasoline prices happened after Memorial Day (May 28th).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early April. Note: The graph below shows oil prices for WTI; as noted above, gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Spanish and Italian Bond Yields Increase

by Calculated Risk on 5/14/2012 08:54:00 AM

From the WSJ: Global Stocks Hit by Greece Worries

Worries about what a Greek exit would mean for other euro-zone nations with hefty deficits pushed yields on 10-year Spanish government bonds above 6% to the highest levels seen since December.Here are the Spanish and Italian 10-year yields from Bloomberg.

The Spanish yields are at 6.3%, the highest level since last November. Compared to the German yield, Spanish borrowing costs at euro-era high:

Spreads on Spanish 10-year bonds over German Bunds hit a euro-era high of 486 basis points, surpassing the record hit last November. Yields on Spanish benchmark debt reached 6.30 per cent while German 10-year Bunds were at an all-time low of 1.44 per cent.The Italian yields are at 5.74%, the highest level since January.

excerpt with permission

The US 10-year yield is down to 1.78%, close to the record low of 1.7% last September.