by Calculated Risk on 5/01/2012 10:09:00 AM

Tuesday, May 01, 2012

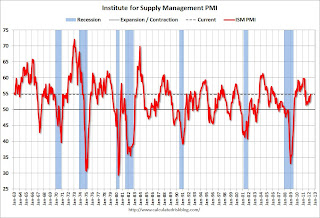

ISM Manufacturing index indicates faster expansion in April

PMI was at 54.8% in April, up from 53.4% in March. The employment index was at 57.3%, up from 56.1%, and new orders index was at 58.2%, up from 54.5%.

From the Institute for Supply Management: April 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in April for the 33rd consecutive month, and the overall economy grew for the 35th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 54.8 percent, an increase of 1.4 percentage points from March's reading of 53.4 percent, indicating expansion in the manufacturing sector for the 33rd consecutive month. Sixteen of the 18 industries reflected overall growth in April, and the New Orders, Production and Employment Indexes all increased, indicating growth at faster rates than in March. The Prices Index for raw materials remained at 61 percent in April, the same rate as reported in March. Comments from the panel generally indicate stable to strong demand, with some concerns cited over increasing oil prices and European stability."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in April than in March. It appears manufacturing employment expanded faster in April with the employment index at 57.3%.

CoreLogic: 69,000 completed foreclosures in March 2012

by Calculated Risk on 5/01/2012 09:32:00 AM

From CoreLogic: CoreLogic® Reports 69,000 Completed Foreclosures Nationally in March

CoreLogic ... today released its National Foreclosure Report for March, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ day delinquency rates. There were 69,000 completed foreclosures in March 2012 compared to 85,000 in March 2011 and 66,000 in February 2012. Through the first quarter of 2012, there were 198,000 completed foreclosures compared to 232,000 through the first quarter of 2011. Since the start of the financial crisis in September 2008, there have been approximately 3.5 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the national foreclosure inventory as of March 2012 compared to 1.5 million, or 3.5 percent, in March 2011 and 1.4 million, or 3.4 percent, in February 2012. The number of loans in the foreclosure inventory decreased by nearly 100,000, or 6.0 percent, in March 2012 compared to March 2011.

"The overall delinquency level was unchanged in March, remaining at its lowest point since July 2009," said Mark Fleming, chief economist for CoreLogic. "Non-judicial foreclosure markets like Nevada, Arizona, and California are experiencing significant improvements in their shares of delinquent borrowers. Some judicial foreclosure states are also improving, like Florida, but not to the extent of non-judicial markets."

...

"Compared to a year ago, the number of completed foreclosures has slowed," said Anand Nallathambi, chief executive officer of CoreLogic. "Since the foreclosure inventory is also coming down, this suggests that loan modifications, short sales, deeds-in-lieu are increasingly being used as an alternative to foreclosures to clear distressed assets in our communities."

So far we haven't seen a surge in completed foreclosures - or a large increase in REO (lender Real Estate Owned) coming on the market. The foreclosure inventory is also declining (properties in the foreclosure process), although the decline is slow according to recent LPS data. My guess is the "surge" in foreclosures will be less than many people expect (see from two weeks ago: Some thoughts on housing and foreclosures).

Chrysler: U.S. April sales increased 20% year-over-year

by Calculated Risk on 5/01/2012 08:37:00 AM

From Retuers: Chrysler April US Sales Jump 20 Percent

Chrysler Group's U.S. new-vehicle sales rose 20 percent last month, marking the best April performance in four yearsThe key number for the economy is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers. Once all the reports are released, I'll post a graph of the estimated total April light vehicle sales (SAAR) - usually around 4 PM ET.

...

The U.S. automaker said it expects the April annual selling rate for the industry to finish at 14.6 million vehicles. That would be stronger than the 14.4 million 41 analysts surveyed by Thomson Reuters had forecast and would also top the March rate of 14.4 million.

The consensus is for an increase to 14.4 million SAAR, from 14.3 million in March.

I'll add the reports from the other major auto companies as updates to this post.

Monday, April 30, 2012

Contest Questions and April Winner

by Calculated Risk on 4/30/2012 09:59:00 PM

For the question contest in April, the leaders were:

1) Bill (Calculated Risk)

2) Liye Ma

3) (4 way tie) Billy Forney (Finished 2nd in March)

3) Eggert Ólafsson

3) Makesh Pravin

3) Rik Osmer

Congratulations to all.

For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login. Contestants receive 1 point for each correct answer. At the end of each month, I list the leaders in a post on the blog.

Here are the questions for this week (2 on Tuesday, 1 on Thursday, 2 on Friday):

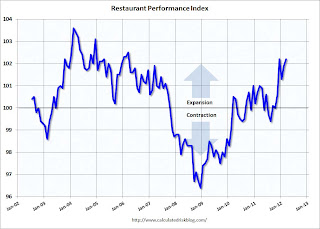

Restaurant Performance Index increases in March

by Calculated Risk on 4/30/2012 07:04:00 PM

From the National Restaurant Association: Restaurant Performance Index Closes Out Q1 at Post-Recession High

Driven by solid same-store sales and traffic results and an increasingly bullish outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) matched its post-recession high in March. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.2 in March, up 0.3 percent from February and equaling its post-recession high that was previously reached in December 2011.

“The first quarter finished strong with a solid majority of restaurant operators reporting higher same-store sales and customer traffic levels in March,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are solidly optimistic about sales growth and the economy in the months ahead, which propelled the Expectations component of the RPI to its highest level in 15 months.”

“Bolstered by improving sales and traffic results, restaurant operators’ outlook for capital spending reached its highest level in more than four years,” Riehle added. “This will have positive implications throughout the supply chain of the restaurant industry.”

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.2 in March, up from 101.9 in February (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and the index was fairly strong in March.

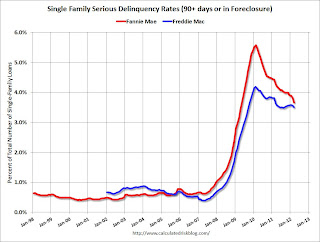

Fannie Mae and Freddie Mac Serious Delinquency rates declined in March

by Calculated Risk on 4/30/2012 04:47:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in March to 3.67%, down from 3.82% in February. The serious delinquency rate is down from 4.44% in March 2011, and is at the lowest level since April 2009. Some of the decline over the last two months is seasonal.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.51% in March, down from 3.57% in February. Freddie's rate is down from 3.63% in Feburary 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year or so.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Note: LPS reported the serious delinquency rate (including in foreclosore) was about 7.5% in March. That includes the Fannie and Freddie loans with serious delinquency rates at less than half the industry average. This is also a reminder of how bad the non-Fannie/Freddie loans are performing.

Fed: On net, Domestic Banks eased their lending standards and experienced stronger demand over the last 3 months

by Calculated Risk on 4/30/2012 02:27:00 PM

From the Federal Reserve: The April 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices

Overall, in the April survey, modest net fractions of domestic banks generally reported having eased their lending standards and having experienced stronger demand over the past three months. ... However, moderate to large net fractions of domestic banks eased many terms on C&I loans to firms of all sizes, with most indicating that they had done so in response to more aggressive competition from other banks or nonbank lenders. Domestic banks also reported an increase in demand from firms of all sizes.

...

Regarding loans to households, standards on prime residential mortgage loans and home equity lines of credit (HELOCs) were about unchanged. However, the April survey indicated a moderate strengthening in demand for prime residential mortgage loans. With respect to consumer loans, moderate net fractions of banks reported that they had eased standards on most types of these loans over the past three months. In addition, demand for all types of consumer loans increased somewhat, on net, with demand for auto loans showing the largest increase.

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards from the previous quarterly for commercial real estate (CRE). Lenders are now easing standards a little for CRE. A little easing doesn't mean standards are "loose", just not as tight as over the last several years.

The second graph shows the change in demand for CRE loans.

The second graph shows the change in demand for CRE loans. Increasing demand and some easing in standards - this is another indicator suggesting the drag from non-residential investment will probably end mid-year.

Q1 2012 GDP Details: Office and Mall Investment falls to record low, Single Family investment increases

by Calculated Risk on 4/30/2012 12:25:00 PM

The BEA released the underlying details today for the Q1 Advance GDP report. As expected, key non-residential categories - offices, malls and lodging - saw further declines in investment in Q1.

Note: Last year, there was a small overall increase in non-residential structure investment due to investment for power and communication, and mining and exploration of petroleum. This masked some of the decline in other categories.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and then declined sharply.

Investment as a percent of GDP fell to a new low in Q1 and is now down 64% from the peak. This decline will probably slow mid-year based on the architectural billings index, but with the high office vacancy rate, investment will probably not increase (as a percent of GDP) for several years.

Click on graph for larger image.

Click on graph for larger image.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 68% from the peak and at a new low in Q1 (note that investment includes remodels, so this will not fall to zero).

Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by about 82%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). This is happening again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures is finally increasing after mostly moving sideways for almost three years (the increase in 2009-2010 was related to the housing tax credit).

Investment in home improvement was at a $164 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (over 1.0% of GDP), significantly above the level of investment in single family structures of $114 billion (SAAR) (or 0.74% of GDP). Eventually single family structure investment will overtake home improvement as the largest category of residential investment.

Brokers' commissions increased slightly in Q1, and has been moving sideways as a percent of GDP.

And investment in multifamily structures increased slightly as a percent of GDP. This is a small category, and even though investment is increasing, the positive impact on GDP will be relatively small.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

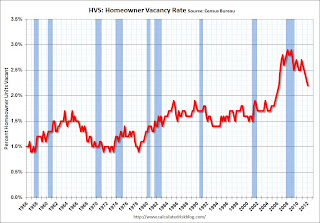

HVS: Q1 Homeownership and Vacancy Rates

by Calculated Risk on 4/30/2012 10:15:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high.

It might show the trend, but I wouldn't rely on the absolute numbers.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate declined to 65.4%, down from to 66.0% in Q4 2011 and at the lowest level for this survey since the mid-90s.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The Census researchers are investigating differences in Census 2010, ACS 2010, and HVS 2010 vacant housing unit estimates, but there is no scheduled date for any report.

The HVS homeowner vacancy rate declined to 2.2% from 2.3% in Q4. This is the lowest level since Q2 2006 for this report.

The homeowner vacancy rate has peaked and is now declining. However - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate declined to 8.8% from 9.4% in Q4.

The rental vacancy rate declined to 8.8% from 9.4% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates are falling.

Chicago PMI declines to 56.2

by Calculated Risk on 4/30/2012 09:52:00 AM

Chicago PMI: The overall index declined to 56.2 in April, down from 62.2 in March. This was below consensus expectations of 60.8 and indicates slower growth in April. Note: any number above 50 shows expansion. From the Chicago ISM:

April 2012: The Chicago Purchasing Managers reported the April Chicago Business Barometer decreased for a second consecutive month. After five months above 60, the Chicago Business Barometer fell to 56.2, a 29 month low. The index has remained in expansion since October 2009.New orders declined to 57.4 from 63.3, and employment increased to 58.7 from 56.3.

...

• PRODUCTION lowest level since September 2009;

• PRICES PAID down from March's 7 month high;