by Calculated Risk on 4/20/2012 01:11:00 PM

Friday, April 20, 2012

Residential Investment and the Housing Industry Recovery

Earlier this week I wrote:

"There is no question that housing starts and residential investment have bottomed. And it appears new home sales have also bottomed. For the housing industry, the recovery has started. The debate is about the strength of the recovery, not whether there is a recovery (I think housing will remain sluggish for some time, and I expect 2012 to be another weak year, but better than 2011)."I've received several questions about this. We could look at several measures: construction employment is up about 100 thousand payroll jobs from the bottom, housing starts are up 36% from the bottom (thanks to multi-family), and residential investment has been adding to GDP for three consecutive quarters (probably four consecutive quarters once Q1 2012 GDP is released next week).

What is residential investment? According to the Bureau of Economic Analysis residential investment (RI) is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales.

Here is a graph of the contribution of RI to the percent change in GDP since 2004:

Note that RI made a large negative contribution in every quarter in 2006, 2007 and 2008. In 2009 and 2010, RI was impacted by the housing tax credit, but otherwise RI was still mostly negative.

Starting in Q2 2011, RI started making a small positive contribution to the change in GDP. This was an important change (something I mentioned at the beginning of 2011.)

I expect RI to make further positive contributions to GDP growth in 2012, and not just from multi-family and home improvement. I also expect single family investment to increase from the very low rate in 2011.

Here is an article that mentions a little new single family construction, from Diana Olick at CNBC: Phoenix's Hard-Hit Housing Starts to Rise From Ashes

Mike Ripson hasn't built a home in three years, but he is about to. He has been sitting on one hundred sixty acres of land just outside Phoenix, Arizona, which he intends to divide into 121 one-acre lots.This is just a few homes and doesn't suggest a surge in new home sales. But I expect some increase this year from 2011, and yes, the housing recovery has started (note: this isn't a comment about home builders, just about the turn in residential investment - a positive for the economy).

"Now's the time because we've been studying the marketplace, and we noticed beginning late last summer, early fall, that for homes priced less than $100,000, the market was becoming very tight," says Ripson, whose company is celebrating its ten year anniversary this week.

"Over the last several months that price point has increased such that today, homes priced less than 300,000 dollars, there's less than a thirty-day supply in the marketplace," Ripson adds.

"To give you an example, within a five mile radius of where we sit here at Sonoran Acres, two months ago there were 18 homes on the market. Today there's only one," says Ripson.

That's why he re-opened his model home two weeks ago, and immediately saw high buyer traffic. He filed permits for two new homes, which he expects to sell in the next few weeks, thanks to his low, $200,000 price point.

State Unemployment Rates decline in 30 states in March

by Calculated Risk on 4/20/2012 10:30:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in March. Thirty states recorded unemployment rate decreases, 8 states posted rate increases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while New York experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.0 percent in March. Rhode Island and California posted the next highest rates, 11.1 and 11.0 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Spanish 10 year bond yields near 6%

by Calculated Risk on 4/20/2012 08:53:00 AM

From Dow Jones: Italian, Spanish Bonds Suffer As Crisis Fears Mount

Italian and Spanish government bond prices continued to fall early Friday after Thursday's Spanish bond auction failed to inspire renewed confidence in peripheral markets, while French bonds also suffered ahead of Sunday's presidential election. ... Italian 10-year bond yields climbed 10 basis points to 5.68%, while Spanish yields were up 10 basis points at 5.97%, according to Tradeweb. German 10-year bund yields were at 1.61%, having briefly hit a record low of just below 1.6%, while French 10-year yields climbed four basis points to 3.11%.Here are the Spanish and Italian 10-year yields from Bloomberg. Both are still well below the highs of last November. Both the election in France, and the election in Greece scheduled for May 6th, are making investors uneasy. Sarkozy will probably lose in a runoff, and the smaller parties in Greece will probably do very well. At some point current policies will not survive at the ballot box.

Thursday, April 19, 2012

State and Local Government Payroll Employment Stabilizing?

by Calculated Risk on 4/19/2012 08:50:00 PM

A few months ago I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.It is time for an update - it is early in the year, but it is possible the employment drag from state and local governments has already ended. In fact, state and local government have added 14 thousand jobs since December.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (53,000 over the last year), but it looks like state and local government employment is stabilizing.

Homeowner Financial Obligation Ratio near normal, Mortgage obligations still high

by Calculated Risk on 4/19/2012 05:16:00 PM

From Floyd Norris at the NY Times: Debt Burden Lifting, Consumers Open Wallets a Crack

One measure of the financial health of householders is the level of financial obligations, like required mortgage and credit card payments, to disposable income. By the fall of 2007, those obligations took up 14 percent of disposable income, more than at any time since the Federal Reserve began calculating the statistic in 1980.Norris is referring to the Debt Service Ratio (DSR) from the Federal Reserve.

But now the situation has turned around. The latest figures, for the final quarter of 2011, show that required debt service payments now make up just 10.9 percent of disposable income, the lowest proportion since 1994. A broader measure — which adds in such obligations as property tax and insurance premiums for homeowners, and rent for those who do not own their homes — has fallen to the lowest level since 1984.

There is little mystery in how that happened. First, debt levels have fallen. ... Second, low interest rates mean that servicing that debt costs less. ...

Getting those debt levels down was not a simple matter of making payments, of course. The McKinsey Global Institute estimates that about two-thirds of the reduction came from the cancellation of debt, through write-offs and foreclosures.

I also like to look at the Financial Obligation Ratio (FOR) for homeowners.

Note: This series is useful to look for changes over time, but there are limitations. From the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

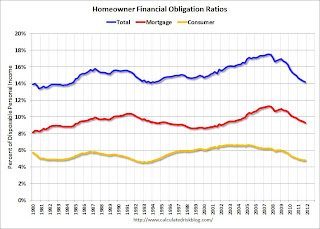

Click on graph for larger image.This graph shows the Total, Mortgage and Consumer financial obligation ratios for homeowners.

With some decline in debt, and much lower interest rates, the total homeowner financial obligations ratio is back to normal levels. However the mortgage ratio - even with record low mortgage rates - is still somewhat high.

Back in the early '90s, following the previous surge in mortgage obligations, the mortgage ratio declined for about 9 years. For the mortgage ratio to decline further, it would take a combination of more debt reduction and - hopefully - more disposable income.

Philly Fed: "Regional manufacturing activity expanded modestly" in April Survey

by Calculated Risk on 4/19/2012 01:48:00 PM

Earlier from the Philly Fed: April 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged down from a reading of 12.5 in March to 8.5. Indexes for new orders and shipments remained positive but were slightly weaker than their March readings. The indexes for new orders and shipments, which decreased about 1 point, remain at relatively low readings.

...

Firms’ responses suggested a notable pickup in levels of employment this

month. The current employment index, which has been positive for eight consecutive months, increased 11 points, to its highest reading in 11 months. ... The average workweek was near steady this month, with 75 percent of the firms surveyed reporting no change in average hours.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys declined in April, and is at the lowest level this year.

Both the NY and Philly Fed surveys indicated expansion in April, at a slower pace than in March, and both were below the consensus forecast. However both surveys showed a strong increase in employment.

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 4/19/2012 11:52:00 AM

The NAR reported inventory decreased to 2.37 million in March, down from 2.40 million in February. This is down 21.8% from March 2011, and up 3% from the inventory level in March 2005 (mid-2005 was when inventory started increasing sharply). Inventory was down slightly from March 2004. This decline in inventory has been a significant story over the last year.

Here are some of the reasons for the decline in inventory (mostly a repeat from a post last month):

• The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. However, in the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

• There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply. When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less listed inventory now means less downward pressure on prices now.

• There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.7 million by July (up from 2.33 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.8 to 7.2 months from the current 6.3 months. The 1.7% inventory increase from January to March was below the normal seasonal increase of around 8%.

• The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and some increase in the level of inventory.

I don't think this increase will be huge. My guess is that at most this will add 200 thousand listed REOs to the expected seasonal increase that would put listed inventory at 2.75 to 2.9 million in mid-summer - or about 7.4 to 7.8 months-of-supply at the current sales rate. That is higher than normal, but inventory would still be down 10% or more from 2011.

• Tom Lawler has pointed out that there has been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years and this is probably another reason for the decline in inventory.

The bottom line is the decline in listed inventory is a big deal, and will take the downward pressure off of house prices. Just like last year, inventory will be something to watch closely all year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for a March since 2005, and actually slightly below the level in 2004 (not counting contingent sales). Inventory is still elevated - especially with the much lower sales rate.

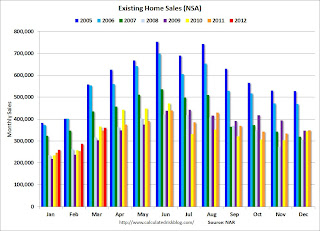

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the 2008, 2009 and 2011 (2010 was higher because of the tax credit). Sales are well below the bubble years of 2005 and 2006.

It is also important to note that distressed sales were down in March. From the NAR:

Distressed homes – foreclosures and short sales .. – accounted for 29 percent of March sales (18 percent were foreclosures and 11 percent were short sales), compared with 34 percent in February and 40 percent in March 2011.A decline in existing home sales due to fewer distressed sales is a positive for the housing market. Of course distressed sales will probably increase again following the mortgage servicer settlement.

Earlier:

• Existing Home Sales in March: 4.48 million SAAR, 6.3 months of supply

• Existing Home Sales graphs

Existing Home Sales in March: 4.48 million SAAR, 6.3 months of supply

by Calculated Risk on 4/19/2012 10:00:00 AM

The NAR reports: Existing-Home Sales Decline in March but Inventory Down, Prices Stabilizing

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 2.6 percent to a seasonally adjusted annual rate of 4.48 million in March from an upwardly revised 4.60 million in February, but are 5.2 percent above the 4.26 million-unit pace in March 2011.

...

Total housing inventory at the end of March declined 1.3 percent to 2.37 million existing homes available for sale, which represents a 6.3-month supply at the current sales pace, the same as in February. Listed inventory is 21.8 percent below a year ago and well below the record of 4.04 million in July 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2012 (4.48 million SAAR) were 2.6% lower than last month, and were 5.2% above the March 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.37 million in March from 2.40 million in February. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory decreased to 2.37 million in March from 2.40 million in February. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 21.8% year-over-year in March from March 2011. This is the thirteenth consecutive month with a YoY decrease in inventory.

Inventory decreased 21.8% year-over-year in March from March 2011. This is the thirteenth consecutive month with a YoY decrease in inventory.Months of supply was unchangted at 6.3 months in March.

This was below to expectations of sales of 4.62 million.

Weekly Initial Unemployment Claims at 386,000

by Calculated Risk on 4/19/2012 08:30:00 AM

The DOL reports:

In the week ending April 14, the advance figure for seasonally adjusted initial claims was 386,000, a decrease of 2,000 from the previous week's revised figure of 388,000. The 4-week moving average was 374,750, an increase of 5,500 from the previous week's revised average of 369,250.The previous week was revised up to 388,000 from 380,000. Claims for two weeks ago were revised down.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 374,750.

This is the highest level for the 4-week moving average since January.

And here is a long term graph of weekly claims:

The recent upward increase in claims isn't large, but it is concerning.

Wednesday, April 18, 2012

Some thoughts on housing and foreclosures

by Calculated Risk on 4/18/2012 07:40:00 PM

Some musings ... One of the "givens" for 2012 is that the number of foreclosures will increase following the mortgage servicer settlement agreement. But I've been wondering just how big that increase will be...

A key recent development is the decline in distressed sales; distressed sales are a combination of short sales and lender real estate owned (REO) sales. I've been tracking this for a couple of years, at first just using data for Sacramento, and more recently data for several other cities too (compiled by Tom Lawler). This data shows two important trends: 1) overall distressed sales have been declining, and 2) there has been a shift from REO sales to short sales.

Of course the percent of overall distressed sales could, and probably will, increase soon now that the mortgage settlement agreement has been signed off. But the increase might be less than many people expect. Here are a few reasons:

• According to LPS, there are currently about 2 million properties in the foreclosure process and another 1.7 million loans 90+ delinquent. However many of these loans are in judicial states, and even with the mortgage settlement, it will take some time to work through the courts. So it is hard to imagine a huge wave of foreclosures, if anything it will be more like a sustained high tide in certain judicial foreclosure areas.

• Meanwhile the lenders are offering cash incentives to these same borrowers to do short sales. These incentives are one of the reasons short sales are now at about the same level as REO sales according to LPS. Just yesterday Fannie and Freddie announced new short sale timelines to try to streamline this process further. Sure short sales are still distressed sales, but the impact of short sales on the market is probably less than foreclosures. And more short sales will reduce the number of REOs on the market (listed inventory is what impacts prices).

• Meanwhile the GSEs are trying a new REO-to-rental pilot program, and the regulators are allowing banks to hold REOs as rentals for an extended period. This will probably also reduce the number of REOs hitting the market in the near future. These properties will eventually hit the market, but that is more an argument for why prices will not rise quickly as opposed to prices falling further.

• At the same time, the HARP refinance program is aimed at underwater borrowers who are current on their loan. These borrowers have been making payments for some time, and a new lower mortgage rate will incentivize them to keep paying their mortgage (and also reduce the time until the borrowers have positive equity). This will reduce the pipeline of new delinquencies. HARP is still ramping up, but the number of HARP refinance applications is up sharply according to the MBA.

All and all, I think the number of foreclosures listed for sale might be less than some people expect.

The distressed sales data that I post monthly will probably tell us the size of the wave. But this reminds me a little of the Option ARM issue a few years ago. At first everyone thought there would be a flood of new foreclosures when Option ARMs reset – but over time it became apparent that many borrowers defaulted before the reset, had received a modification, or had refinanced – and there was no flood of reset related defaults.

Last year, for housing, the key was the decline in inventory (something I've been watching closely for the last couple of years). This year inventory is still critical, but any change in the level of distressed sales will be especially important. Just jotting down some thoughts ...