by Calculated Risk on 3/21/2012 09:35:00 PM

Wednesday, March 21, 2012

Housing: "Signs of Life"

A couple of excerpts from an article by Neil Shah and Nick Timiraos at the WSJ: Housing Shows Signs of Life

For the first time since 2005, investment in residential real-estate, including home building and renovation, has contributed to U.S. economic output for the past three quarters.A few comments:

...

"Housing bottoming is going to surprise a lot of people," said Kenneth Rosen, a housing economist at the University of California, Berkeley. "Housing was pulling us down consistently, quarter after quarter, for years. That was really over in 2011."

...

Home-purchase contracts in January and February are up about 20% from a year earlier for HomeServices, a subsidiary of Berkshire Hathaway Inc., and Mr. [Ronald Peltier, chief executive of HomeServices of America Inc.] said the firm now expects sales growth of around 10% this year, upgrading its forecast last fall for flat sales levels in 2012.

• There are two bottoms for housing: 1) for residential investment, new home sales and housing starts, and 2) for house prices. (see my post on February on Housing: The Two Bottoms). With residential investment adding to GDP and employment growth over the last several quarters, it appears the first bottom has already happened.

• On prices (the 2nd bottom), I'll be looking closely at year-over-year changes in various price indexes. If we are at the housing price bottom on a national basis, then year-over-year price changes should start to get smaller soon - and eventually turn positive in early 2013.

• Professor Rosen was a "housing bear" back at the peak. See these comments from Rosen in February 2006: Barron's: Is It Crunch Time for Housing?

Rosen calls himself a real-estate bear who endorses the doom-and-gloom scenario of Yale University professor Robert Shiller ... We've already passed stage one, characterized by "a falloff in new sales and orders," says Rosen, and are just entering stage two, in which unsold inventories build up.Earlier:

That may be where the crunch begins.

...

The final phase is when we see massive defaults or delinquencies on mortgage loans. That's several years away, he says, and this time the damage could be worse because of the large number of exotic loans giddy lenders extended to desperate home buyers.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

by Calculated Risk on 3/21/2012 06:12:00 PM

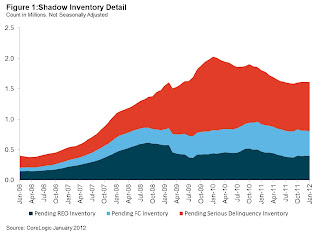

Note: there are different measures of "shadow" inventory. CoreLogic tries to add up the number of properties that are seriously delinquent, in the foreclosure process, and already REO (lender Real Estate Owned) that are NOT currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

From CoreLogic: CoreLogic® Reports Shadow Inventory as of January 2012 Remains Flat

CoreLogic ... reported today that the current residential shadow inventory as of January 2012 was 1.6 million units (6-months’ supply), approximately the same level reported in October 2011. On a year-over-year basis, shadow inventory was down from January 2011, when it stood at 1.8 million units, or 8-months’ supply. Currently, the flow of new seriously delinquent (90 days or more) loans into the shadow inventory has been offset by the roughly equal flow of distressed sales (short and real estate owned).

“Almost half of the shadow inventory is not yet in the foreclosure process,” said Mark Fleming, chief economist for CoreLogic. “Shadow inventory also remains concentrated in states impacted by sharp price declines and states with long foreclosure timelines.”

...

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent, in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 800,000 units are seriously delinquent (3.1-months’ supply), 410,000 are in some stage of foreclosure (1.6-months’ supply) and 400,000 are already in REO (1.6-months’ supply).

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. More from CoreLogic:

The highest concentration of shadow inventory is for loans with loan balances between $100,000 and $125,000. More importantly while the overall supply of homes in the shadow inventory is declining versus a year ago, the declines are being driven by higher balance loans. For loans with balances of $75,000 or less, however, the shadow is still growing and is up 3 percent from a year ago.So the key number in this report is that as of January, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

...

Florida, California and Illinois account for more than a third of the shadow inventory. The top six states, which would also include New York, Texas and New Jersey, account for half of the shadow inventory.

The shadow inventory is approximately four times higher than its low point (380,000 properties) at the peak of the housing bubble in mid-2006.

Note: The unlisted REO still seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 3/21/2012 02:37:00 PM

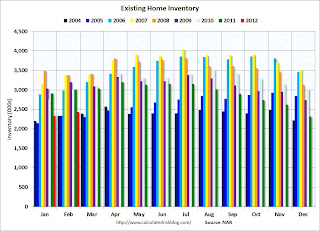

The NAR reported inventory increased seasonally to 2.43 million in February. This is down 19.3% from February 2011, and up 4% from the inventory level in February 2005 (mid-2005 was when inventory started increasing sharply). This decline in inventory has been a significant story over the last year.

There are several possible reasons for the decline:

• The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is down sharply year-over-year.

• There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply. When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less listed inventory now means less downward pressure on prices now.

• There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.7 million by July (up from 2.33 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.7 to 7.1 months from the current 6.4 months. The inventory increase from January to February was the normal seasonal increase.

• The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and some increase in the level of inventory.

I don't think this increase will be huge. My guess is that at most this will add 200 thousand listed REOs to the expected seasonal increase that would put listed inventory at 2.75 to 2.9 million in mid-summer - or about 7.2 to 7.6 months-of-supply at the current sales rate. That is higher than normal, but inventory would still be down 10% or more from 2011.

• Tom Lawler has pointed out that there has been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years and this is probably another reason for the decline in invnetory.

The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for a February since 2005. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales rose to 33 percent of transactions in February from 31 percent in January; they were 33 percent in February 2011. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 23 percent of homes in February, unchanged from January; they were 20 percent in February 2011.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales graphs

AIA: Architecture Billings Index indicated expansion in February

by Calculated Risk on 3/21/2012 12:21:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Remains Positive for Fourth Straight Month

Led by the commercial sector, the Architecture Billings Index (ABI) has remained in positive territory four months in a row. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 51.0, following a mark of 50.9 in January. This score reflects a slight increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 63.4, up from mark of 61.2 the previous month and its highest reading since July 2007.

“This is more good news for the design and construction industry that continues to see improving business conditions,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The factors that are preventing a more accelerated recovery are persistent caution from clients to move ahead with new projects, and a continued difficulty in accessing financing for projects that developers have decided to pursue.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in February (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing mid-year.

Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

by Calculated Risk on 3/21/2012 10:00:00 AM

The NAR reports: February Existing-Home Sales Slip But Up Strongly From a Year Ago

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 0.9 percent to a seasonally adjusted annual rate of 4.59 million in February from an upwardly revised 4.63 million in January [revised up from 4.57], but are 8.8 percent higher than the 4.22 million-unit level in February 2011.

...

Total housing inventory at the end of February rose 4.3 percent to 2.43 million existing homes available for sale, which represents a 6.4-month supply at the current sales pace, up from a 6.0-month supply in January. Even so, unsold listed inventory has trended down from a record 4.04 million in July 2007, and is 19.3 percent below a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2012 (4.59 million SAAR) were 0.9% lower than last month, and were 8.8% above the February 2011 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.43 million in February from 2.33 million in January. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.

According to the NAR, inventory increased to 2.43 million in February from 2.33 million in January. Inventory is not seasonally adjusted, and usually inventory increases from the seasonal lows in December and January to the seasonal high in mid-summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.Months of supply increased to 6.4 months in February, up from 6.0 months in January.

This was close to expectations of sales of 4.61 million.

LPS: Percent of delinquent mortgage loans declined in February

by Calculated Risk on 3/21/2012 09:00:00 AM

LPS released their First Look report for February today. LPS reported that the percent of loans delinquent declined in February from January. However the percent of loans in the foreclosure process only declined slightly.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) declined to 7.57% from 7.97% in January. This is the lowest delinquency rate since 2008; however the percent of delinquent loans is still way above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen a little more than halfway back to normal.

The following table shows the LPS numbers for February 2012, and also for last month (Jan 2012) and one year ago (Feb 2012).

| LPS: Loans Delinquent and in Foreclosure | |||

|---|---|---|---|

| Feb-12 | Jan-12 | Feb-11 | |

| Delinquent | 7.57% | 7.97% | 8.80% |

| In Foreclosure | 4.13% | 4.15% | 4.15% |

| Less than 90 days | 2,059,000 | 2,226,000 | 2,495,000 |

| More than 90 days | 1,722,000 | 1,772,000 | 2,165,000 |

| In foreclosure | 2,065,000 | 2,084,000 | 2,196,000 |

| Total | 5,846,000 | 6,082,000 | 6,856,000 |

Note that the number of loans in the foreclosure process has only declined slightly year-over-year. This remains far above the "normal" level of around 0.5%.

MBA: Mortgage Refinance activity slows as rates rise, "Sand States" now "HARP states"

by Calculated Risk on 3/21/2012 08:01:00 AM

From the MBA: Interest Rates Highest Since December, Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 9.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1.0 percent from one week earlier.The purchase index was only off slightly - and this doesn't include the high percentage of cash buyers.

...

The refinance share of mortgage activity decreased to 73.4 percent of total applications, the lowest since July 2011, from 75.1 percent the previous week.

...

"With the rate increase last week, refinances are obviously slowing, and the refinance share at 73% is down to its lowest level since last July. With rate/term refinances falling as we go forward, HARP will be a bigger percentage of refinances but will be more concentrated in certain states," said Jay Brinkmann, MBA's Senior Vice President of Research and Education. Brinkmann continued, "Some of the largest institutions are reporting that the HARP share of their refinances remained at about 30% last week, but HARP volume is not equal across the country. The states that I started referring to years ago as the sand states that had the worst delinquencies we now should start calling the HARP states for mortgage refinances. We saw big state-level differences in refinance applications for February over January: Florida was up 49%, Arizona was up 61%, and Nevada was up 71%. Refinances in the rest of the country were generally flat or even down. For example, Texas had no change, Colorado was down 3%, Connecticut was up only 2%, and Virginia was up 1%. HARP clearly is a driving force in those states that saw the most defaults and the biggest drops in home equity."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.19 percent from 4.06 percent,with points increasing to 0.47 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Tuesday, March 20, 2012

Greece: Parliament Approves Bailout

by Calculated Risk on 3/20/2012 09:23:00 PM

No surprise ... from the WSJ: Greek Parliament Approves Second Bailout

Greece's Parliament approved a new international bailout deal ... setting the stage for a round of harsh measures that the country's international creditors have set as a precondition for the funds.Next up is an election in late April or early May.

The approval came in the early hours of Wednesday, with 213 lawmakers supporting the loan deal, and with 79 deputies voting against it. Eight didn't cast a vote.

Earlier:

• Housing Starts decline slightly in February

• Starts and Completions: Multi-family and Single Family

Bernanke: "The Federal Reserve and the Financial Crisis" Part 1

by Calculated Risk on 3/20/2012 05:55:00 PM

Update: Here are the slides. Link to lecture series (next is on Thursday)

This is part 1 of 4 of a lecture series on the Federal Reserve. The first lecture (about 1 hour) discusses monetary policy history, the tools and goals of the reserve - and he spent some time on the gold standard.

There should be slides available soon at the Federal Reserve. Joe Weisenthal at Business Insider has some of the slides (and Bernanke's comments on the gold standard).

LPS: 91,086 completed foreclosures in January 2012

by Calculated Risk on 3/20/2012 04:18:00 PM

There has been some discussion on when activity would increase for completed foreclosures. Last month, LPS reported that foreclosure sales increased 29% month-over-month in January.

LPS Applied Analytis was kind enough to provide me their estimates of foreclosure sales, by month, since January 2008.

Note: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed "foreclosure sale" and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes during this process, the loan will cure or a short sale approved, and not all loans in the foreclosure inventory reach "foreclosure sales".

Click on graph for larger image.

Click on graph for larger image.

This graph shows the number of foreclosure sales per month since January 2008 according to LPS Applied Analytics.

There was a significant decline in foreclosure sales in late 2010 due to the foreclosure process issues.

There is plenty of month-to-month variability, but it appears foreclosure sales have picked up again (sales were up 29% compared to December 2011, and up 15% compared to January 2011).

This will be very useful data to track the expected increase in foreclosure activity.