by Calculated Risk on 3/01/2012 03:45:00 PM

Thursday, March 01, 2012

U.S. Light Vehicle Sales at 15.1 million annual rate in February

Based on an estimate from Autodata Corp, light vehicle sales were at a 15.1 million SAAR in February. That is up 14.1% from February 2011, and up 6.9% from the sales rate last month (14.13 million SAAR in Jan 2012).

This was well above the consensus forecast of 14.0 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 15.1 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The annualized sales rate is up sharply over the last two months, and this is the highest sales rate since February 2008 - and above the August 2009 rate with the spike in sales from "cash-for-clunkers".

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales will make another strong positive contribution GDP in Q1 2012 GDP.

CoreLogic: 11.1 Million U.S. Properties with Negative Equity in Q4

by Calculated Risk on 3/01/2012 01:54:00 PM

CoreLogic released the Q4 2011 negative equity report today.

CoreLogic ... today released negative equity data showing that 11.1 million, or 22.8 percent, of all residential properties with a mortgage were in negative equity at the end of the fourth quarter of 2011. This is up from 10.7 million properties, 22.1 percent, in the third quarter of 2011. An additional 2.5 million borrowers had less than five percent equity, referred to as near-negative equity, in the fourth quarter. Together, negative equity and near-negative equity mortgages accounted for 27.8 percent of all residential properties with a mortgage nationwide in the fourth quarter, up from 27.1 in the previous quarter. Nationally, the total mortgage debt outstanding on properties in negative equity increased from $2.7 trillion in the third quarter to $2.8 trillion in the fourth quarter.Here are a couple of graphs from the report:

“Due to the seasonal declines in home prices and slowing foreclosure pipeline which is depressing home prices, the negative equity share rose in late 2011. The negative equity share is back to the same level as Q3 2009, which is when we began reporting negative equity using this methodology. The high level of negative equity and the inability to pay is the ‘double trigger’ of default, and the reason we have such a significant foreclosure pipeline. While the economic recovery will reduce the propensity of the inability to pay trigger, negative equity will take an extended period of time to improve, and if there is a hiccup in the economic recovery, it could mean a rise in foreclosures.” said Mark Fleming, chief economist with CoreLogic.

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest negative equity percentage with 61 percent of all of its mortgaged properties underwater, followed by Arizona (48 percent), Florida (44 percent), Michigan (35 percent) and Georgia (33 percent). This is the second consecutive quarter that Georgia was in the top five, surpassing California (29 percent) which previously had been in the top five since tracking began in 2009. The top five states combined have an average negative equity share of 44.3 percent, while the remaining states have a combined average negative equity share of 15.3 percent."

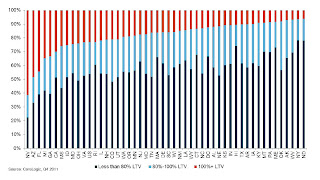

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.

The second graph shows the distribution of equity by state- black is Loan-to-value (LTV) of less than 80%, blue is 80% to 100%, red is a LTV of greater than 100% (or negative equity). Note: This only includes homeowners with a mortgage - about 31% of homeowners nationwide do not have a mortgage.Some states - like New York - have a large percentage of borrowers with more than 20% equity, and Nevada, Arizona and Florida have the fewest borrowers with more than 20% equity.

Some interesting data on borrowers with and without home equity loans from CoreLogic: "Of the 11.1 million upside-down borrowers, there are 6.7 million first liens without home equity loans. This group of borrowers has an average mortgage balance of $219,000 and is underwater by an average of $51,000 or an LTV ratio of 130 percent.

The remaining 4.4 million upside-down borrowers had both first and second liens. Their average mortgage balance was $306,000 and they were upside down by an average of $84,000 or a combined LTV of 138 percent."

Construction Spending declines slightly in January

by Calculated Risk on 3/01/2012 12:05:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending declined slightly in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2012 was estimated at a seasonally adjusted annual rate of $827.0 billion, 0.1 percent (±1.1%)* below the revised December estimate of $827.6 billion. The January figure is 7.1 percent (±1.8%) above the January 2011 estimate of $772.0 billion.Private construction spending was unchanged in January:

Spending on private construction was at a seasonally adjusted annual rate of $538.7 billion, nearly the same as (±1.1%)* the revised December estimate of $538.7 billion. Residential construction was at a seasonally adjusted annual rate of $253.6 billion in January, 1.8 percent (±1.3%) above the revised December estimate of $249.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $285.0 billion in January, 1.5 percent (±1.1%) below the revised December estimate of $289.5 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 62.5% below the peak in early 2006, and up 13% from the recent low. Non-residential spending is 31% below the peak in January 2008, and up about 17% from the recent low.

Public construction spending is now 11% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and it appears the bottom is in for residential investment.

Earlier:

• ISM Manufacturing index indicates slower expansion in February

• Personal Income increased 0.3% in January, Spending 0.2%

• Weekly Initial Unemployment Claims decline slightly to 351,000

ISM Manufacturing index indicates slower expansion in February

by Calculated Risk on 3/01/2012 10:00:00 AM

PMI was at 52.4% in February, down from 54.1% in January. The employment index was at 53.2%, down from 54.3%, and new orders index was at 54.9%, down from 57.6%.

From the Institute for Supply Management: January 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the 31st consecutive month, and the overall economy grew for the 33rd consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 52.4 percent, a decrease of 1.7 percentage points from January's reading of 54.1 percent, indicating expansion in the manufacturing sector for the 31st consecutive month. The New Orders Index registered 54.9 percent, a decrease of 2.7 percentage points from January's reading of 57.6 percent, reflecting the 34th consecutive month of growth in new orders. Prices of raw materials increased for the second consecutive month, with the Prices Index registering 61.5 percent. As was the case in January, new orders, production and employment all grew in February — although at somewhat slower rates than in January. Comments from the panel continue to reflect a generally positive outlook for the next few months."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.6%. This suggests manufacturing expanded at a slower rate in February than in January (the opposite of all the regional surveys). It appears manufacturing employment expanded slowly in February with the employment index at 53.2%.

Personal Income increased 0.3% in January, Spending 0.2%

by Calculated Risk on 3/01/2012 08:57:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $37.4 billion, or 0.3 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $23.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through January (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in January, in contrast to a decrease of less than 0.1 percent in December. ... The price index for PCE increased 0.2 percent in January, compared with an increase of 0.1 percent in December. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.2% in January, and real PCE increased less than 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.6% in January.

Real PCE has been essentially flat since October.

Weekly Initial Unemployment Claims decline slightly to 351,000

by Calculated Risk on 3/01/2012 08:30:00 AM

The DOL reports:

In the week ending February 25, the advance figure for seasonally adjusted initial claims was 351,000, a decrease of 2,000 from the previous week's revised figure of 353,000. The 4-week moving average was 354,000, a decrease of 5,500 from the previous week's revised average of 359,500.The previous week was revised up to 353,000 from 351,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 354,000.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down.

Note: Nomura analysts recently argued some of the recent improvement is related to seasonal distortions, see Financial Times Alphaville: US jobs and seasonality: the DeLorean edition.

Wednesday, February 29, 2012

Restaurant Performance Index declines in January, Still "solidly positive"

by Calculated Risk on 2/29/2012 09:04:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Remains Positive Despite Slight Dip in Restaurant Performance Index

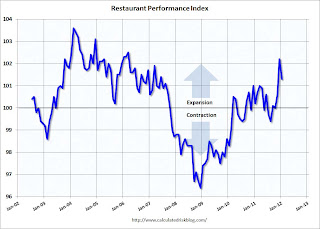

The outlook for the restaurant industry is positive for the coming months, as the National Restaurant Association’s Restaurant Performance Index (RPI) remained well above 100 in January. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in January, down from December’s strong level of 102.2. Despite the decline, January represented the third consecutive month that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Although the Restaurant Performance Index dipped somewhat from December’s nearly six-year high, it remained solidly in positive territory,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported positive same-store sales for the eighth consecutive month, and a majority of them expect business to continue to improve in the months ahead.”

...

Restaurant operators reported positive same-store sales for the eighth consecutive month in January. ... Restaurant operators also reported positive customer traffic results in January.

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in January from 102.2 in December (above 100 indicates expansion).

The data for this index only goes back to 2002.

This is "D-list" data (at best), but restaurant spending is discretionary and can tell us a little something about the overall economy. This index showed contraction in July and August, but is now solidly positive.

Fannie Mae Serious Delinquency rate declines, Freddie Mac rate increases

by Calculated Risk on 2/29/2012 04:31:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.90%, down from 3.91% in December. This is down from 4.45% in January 2011. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.59% in January, up from 3.58% in December. This is the fifth month in a row with a small increase in the delinquency rate. Freddie's rate is down from 3.82% in January 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly. The recent uptrend for Freddie Mac would seem to require an explanation (I have none). The reason for the slow decline is most likely the backlog of homes in the foreclosure process due to processing issues (aka robo-signing), and with the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Fed's Beige Book: Economic activity increased at "modest to moderate" pace

by Calculated Risk on 2/29/2012 02:00:00 PM

Reports from the twelve Federal Reserve Districts suggest that overall economic activity continued to increase at a modest to moderate pace in January and early February. Activity expanded at a moderate pace in the Cleveland, Chicago, Kansas City, Dallas, and San Francisco Districts. St. Louis noted a modest pace of growth and Minneapolis characterized the pace of growth as firm. Economic activity rose at a somewhat faster pace in the Philadelphia and Atlanta Districts, while the New York District noted a somewhat slower pace of expansion. The Boston and Richmond Districts, in turn, noted that economic activity expanded or improved in most sectors.And on real estate:

...

Reports of consumer spending were generally positive except for sales of seasonal items, and the sales outlook for the near future was mostly optimistic.

Residential real estate activity increased modestly in most Districts. Boston, Cleveland, Richmond, Atlanta, Kansas City, and Dallas reported growth in home sales, while New York noted steady to slightly softer home sales. Philadelphia reported strong residential real estate activity. In contrast, home sales declined in St. Louis and San Francisco noted that home demand persisted at low levels. Contacts' outlooks on home sales growth were mostly optimistic.This was based on data gathered on or before February 17th. Mostly sluggish growth, but perhaps the most "positive" comments on residential real estate a long long time.

...

Commercial real estate markets displayed positive results in some Districts, as leasing showed overall improvement. Minneapolis, Richmond, Chicago, and Dallas noted increased leasing. Boston, however, reported mostly unchanged leasing fundamentals with some modest improvement since the previous report.

Fannie Mae: REO inventory declines 27% in 2011

by Calculated Risk on 2/29/2012 12:20:00 PM

This morning Fannie Mae reported results for Q4 and all of 2011. Fannie reported that they acquired 47,256 REO in Q4 (Real Estate Owned via foreclosure or deed-in-lieu) and disposed of 51,344 REO. This has been the pattern all year; Fannie has sold more REO than they acquired (acquisitions slowed because of the process issues, but dispositions picked up sharply in 2011). Here is a table for the last two years:

| Fannie Mae REO Acquisitions and Dispositions | ||

|---|---|---|

| 2011 | 2010 | |

| Acquisitions | 199,696 | 262,078 |

| Dispositions | 243,657 | 185,744 |

| Net | -43,961 | 76,334 |

This has been true for most lenders - they sold more REO than they acquired in 2011 - not just Fannie and Freddie. A common misperception is that when the lenders start foreclosing again at a higher level, that there will be a surge in REO sales. Fannie could increase acquisitions by 20%, and keep the sales pace the same, and their REO inventory wouldn't increase.

The following graph shows Fannie REO inventory, acquisition and dispositions over the last several years.

Click on graph for larger image.

Click on graph for larger image.When the blue line is above the red line, acquisitions are higher than dispositions, and REO inventory increases. In 2011 the opposite was true, and REO inventory declined by 27% from Q4 2010.

A few comments from Fannie:

Foreclosures generally take longer to complete in states where judicial foreclosures are required than in states where non-judicial foreclosures are permitted. For foreclosures completed in 2011, measuring from the last monthly period for which the borrowers fully paid their mortgages to when we added the related properties to our REO inventory, the average number of days it took to ultimately foreclose ranged from a low of 391 days in Missouri, a non-judicial foreclosure state, to a high of 890 days in Florida, a judicial foreclosure state. As of December 31, 2011, Florida accounted for 30% of our loans that were in the foreclosure process.The non-judicial states will recover first.

The FHFA announced a pilot program to sell REO, and many analysts were surprised that most of the REO in the pilot were already leased. That will not continue since Fannie only has 9,000 leased properties:

We currently lease properties to tenants who occupied the properties before we acquired them into our REO inventory, which can minimize disruption by providing additional time to find alternate housing, help stabilize local communities, provide us with rental income, and support our compliance with federal and state laws protecting tenants in foreclosed properties. As of December 31, 2011, over 9,000 tenants leased our REO properties.Freddie is expected to report results tomorrow.

In February 2012, FHFA announced that it was beginning the pilot phase of an REO initiative that will allow qualified investors to purchase pools of foreclosed properties from us with the requirement to rent the purchased properties for a specified number of years. During the pilot phase, we will offer for sale pools of various types of assets including rental properties, vacant properties and nonperforming loans with a focus on the hardest-hit areas. The pilot transactions are expected to provide insight into how the participation of private investors can maximize the value of foreclosed properties and stabilize communities. We do not yet know whether this initiative will have a material impact on our future REO sales and REO inventory levels.