by Calculated Risk on 2/29/2012 10:00:00 AM

Wednesday, February 29, 2012

Bernanke Testimony: Semiannual Monetary Policy Report to the Congress

Q4 GDP revised up to 3.0% from 2.8% in advance estimate.

Chicago PMI comes in at 64.0 well above expectations.

Chicago Purchasing Managers reported the February CHICAGO BUSINESS BAROMETER rose to its highest level in ten months. The barometer also marked a 29th month of expansion and its fourth consecutive month above 60. Increases were seen in six of eight Business Activity Indexes, highlighted by a very large advance in Employment. BUSINESS ACTIVITY: • EMPLOYMENT highest since May 1984; • ORDER BACKLOGS moved back into expansion; • INVENTORIES dipped; • NEW ORDERS highest level since March 2011:Note: Testimony starts at 10 AM ET.

Here is the CSpan feed

Here is the CNBC feed.

Prepared testimony from Fed Chairman Ben Bernanke: Semiannual Monetary Policy Report to the Congress

Misc: Purchase Mortgage Applications increase, ECB LTRO €530bn

by Calculated Risk on 2/29/2012 07:38:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 2.2 percent from the previous week. The seasonally adjusted Purchase Index increased 8.2 percent from one week earlier.From the Financial Times Alphaville on the ECB's Long-Term Refinancing Operation (LTRO): LTRO.2 €530bn

...

"Mortgage rates remained near survey lows last week, but refinance volume fell slightly," said Michael Fratantoni, Vice President of Research and Economics at the Mortgage Bankers Association. Fratantoni continued, "According to survey participants, more than 20 percent of refinance applications were for HARP loans. The HARP share of total refinance applications has increased over the past month. Purchase application volume increased over the week, but remains within the narrow and anemic range of activity we have seen since the expiration of the homebuyer tax credit in May 2010."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.07 percent from 4.09 percent

That’s €530bn with 800 bidders — 277 more than participated last time, when the uptake was €489bn.

Tuesday, February 28, 2012

Goldman Sachs and Wells Fargo receive Wells notices from SEC

by Calculated Risk on 2/28/2012 09:03:00 PM

From HousingWire: Wells Fargo, Goldman receive Wells notices over MBS disclosures

Wells Fargo and Goldman Sachs received Wells notices over mortgage-backed securities disclosures, according to regulatory filings.The earlier Goldman settlement was related to CDO derivatives (Collateralized Debt Obligations). Now the SEC is investigating the securitization of the underlying MBS.

Goldman Sachs disclosed the Wells notice in its 10-K, while Wells reported the notice in its 2011 annual report to shareholders.

The notice from the Securities and Exchange Commission concerns "the disclosures contained in the offering documents used in connection with a late 2006 offering of approximately $1.3 billion of subprime residential mortgage-backed securities underwritten by GS&Co.," Goldman said in its regulatory filing. "The firm will be making a submission to, and intends to engage in a dialogue with, the SEC staff seeking to address their concerns."

At Wells Fargo, the Wells notice also relates to the bank's disclosures in mortgage-backed securities offering documents.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in December

• Real House Prices and Price-to-Rent fall to late '90s Levels

• All current house price graphs

FDIC-insured institutions’ 1-4 Family Real Estate Owned (REO) decreased in Q4

by Calculated Risk on 2/28/2012 02:53:00 PM

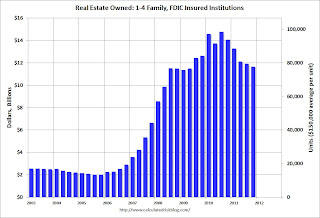

The FDIC released the Quarterly Banking Profile today for Q4. The report showed that 1-4 family Real Estate Owned (REO) by FDIC insured institutions declined to $11.64 billion in Q4, from $11.9 billion in Q3 - and from $14.05 billion in Q4 2010.

As economist Tom Lawler has pointed out before, the FDIC does not collect data on the number of properties held by FDIC-insured institutions, instead they aggregate the carrying value of 1-4 family residential REO on FDIC-insured institutions’ balance sheets.

Using an average of $150,000 per unit would suggest the number of 1-4 family REOs declined from 79,335 in Q3 to 77,584 in Q4.

Here is a graph of the 1-4 family REO carrying value for FDIC insured institutions since Q1 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The left scale is the dollars reported in the FDIC Quarterly Banking Profile, and the right scale is an estimate of REOs using an average of $150,000 per unit. Using this estimate for the average per REO gives 77.6 thousand REO at the end of Q4.

Note: FDIC insured institutions have other REO and this is just the 1-4 family residential REO (other REO includes Construction & Development, Multi-family, Commercial, Farm Land).

Of course this is just a small portion of the total 1-4 family REO. The FHA has already reported that REO declined sharply in Q4, and Fannie and Freddie are expected to report declines in REO later this week.

Although REO inventories declined over the last year - a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process - there are still many more foreclosures coming.

Real House Prices and Price-to-Rent fall to late '90s Levels

by Calculated Risk on 2/28/2012 12:06:00 PM

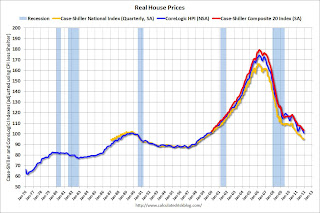

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to January 2003 levels, and the CoreLogic index is back to February 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to March 2000, and the CoreLogic index back to December 1999.

In real terms, all appreciation in the '00s - and more - is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to March 2000 levels, and the CoreLogic index is back to December 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in December

Misc: Richmond Fed shows expansion, Consumer confidence increases, FDIC problem banks decline

by Calculated Risk on 2/28/2012 10:48:00 AM

• From the Richmond Fed: Manufacturing Activity Expanded for the Third Straight Month; Expectations Remain Upbeat

In February, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — increased eight points to 20 from January's reading of 12.Every regional survey showed faster expansion in February compared to January. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

Labor market conditions at District plants strengthened further in February. The manufacturing employment index moved up nine points to end at 13, and the average workweek indicator increased six points to 10. In contrast, wage growth eased, losing three points to 7.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The ISM index for February will be released Thursday, March 1st and the regional surveys suggest another increase in February. The consensus is for a slight increase to 54.6 from 54.1 in January.

• The Conference Board Consumer Confidence Index® Increases

The Conference Board Consumer Confidence Index®, which had decreased in January, increased in February. The Index now stands at 70.8 (1985=100), up from 61.5 in January. The Present Situation Index increased to 45.0 from 38.8. The Expectations Index rose to 88.0 from 76.7 in January.This was well above expectations of an increase to 64.

• From the FDIC: Quarterly Banking Profile

Fourth-quarter earnings totaled $26.3 billion, an increase of $4.9 billion (23.1 percent) compared with the same period of 2010. ... For the third time in the last four quarters, net operating revenue posted a year-over-year decline. ... Net charge-offs totaled $25.4 billion in the fourth quarter, a decline of $17.1 billion (40.2 percent) from a year ago. The fourth quarter total represents the lowest level for quarterly charge-offs since first quarter 2008. This is the sixth consecutive quarter in which charge-offs have posted a year-over-year decline. Improvements occurred across all major loan types. ... The amount of loan balances that were noncurrent (90 days or more past due or in nonaccrual status) declined for the seventh quarter in a row, falling by $4.3 billion (1.4 percent).The number of problem institutions decreased to 813 in Q4 from 844 in Q3, and assets of problem institutions declined to $319.4 billion from $339 billion in Q3.

Case Shiller: House Prices fall to new post-bubble lows in December

by Calculated Risk on 2/28/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December (a 3 month average of October, November and December).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: All Three Home Price Composites End 2011 at New Lows According to the S&P/Case-Shiller Home Price Indices

Data through December 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that all three headline composites ended 2011 at new index lows. The national composite fell by 3.8% during the fourth quarter of 2011 and was down 4.0% versus the fourth quarter of 2010. Both the 10- and 20-City Composites fell by 1.1`% in December over November, and posted annual returns of -3.9% and -4.0% versus December 2010, respectively. These are worse than the -3.8% respective annual rates both reported for November. With these latest data, all three composites are at their lowest levels since the housing crisis began in mid-2006.

In addition to both Composites, 18 of the 20 MSAs saw monthly declines in December over November. Miami and Phoenix were up 0.2% and 0.8%, respectively. ...

“In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.0% from the peak, and down 0.5% in December (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and down 0.5% in December (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.9% compared to December 2010.

The Composite 20 SA is down 4.0% compared to December 2010. This was a slightly larger year-over-year decline for both indexes than in November.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next few months (this report was for the three months ending in December). I'll have more on house prices later this morning.

Durable Goods orders decline 4% in January

by Calculated Risk on 2/28/2012 08:39:00 AM

Durable goods is always very volatile. Durable goods orders were expected to decline due to lower aircraft orders (Nondefense aircraft and parts declined 19%) and the expiration of a tax credit that allowed for faster depreciation of equipment purchases.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

January 2012

New orders for manufactured durable goods in January decreased $8.6 billion or 4.0 percent to $206.1 billion,the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, followed a 3.2 percent December increase. Excluding transportation, new orders decreased 3.2 percent. Excluding defense, new orders decreased 4.5 percent.

Transportation equipment, down following two consecutive monthly increases, had the largest decrease, $3.6 billion or 6.1 percent to $55.2 billion. This was due to nondefense aircraft and parts, which decreased $3.8 billion.

Monday, February 27, 2012

Dallas Fed: Texas Manufacturing Expansion Strengthens in February

by Calculated Risk on 2/27/2012 09:19:00 PM

This was released earlier today. These high frequency surveys are useful because they provide a glimpse of what was happening just a week or two ago - as opposed to other data that is released with a long lag.

From the Dallas Fed: Texas Manufacturing Expansion Strengthens

Texas factory activity continued to increase in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.8 to 11.2, suggesting a pickup in the pace of growth.All of the regional surveys were stronger in February than in January; the last regional survey, from the Richmond Fed, will be released tomorrow.

Other measures of current manufacturing conditions also indicated expansion in February. The new orders index was positive for a second month in a row but fell from 9.5 to 5.8. Similarly, the shipments index moved down from 6.1 to 4.2. Capacity utilization increased further in February; the index edged up from 8.5 to 10.

...

The general business activity index rose to 17.8, its highest reading since November 2010.

...

Labor market indicators reflected a sharp increase in hiring and longer workweeks. The employment index jumped to 25.2, its highest level since the beginning of 2006.

...

Prices and wages increased in February. The raw materials price index was 25.2, little changed from January. The finished goods price index climbed from 9 to 16.2, suggesting selling prices rose at a faster pace.

FHFA: "Tremendous" interest in new HARP Refinance Program

by Calculated Risk on 2/27/2012 05:02:00 PM

From Bloomberg: U.S. Refinancing Program Garners ‘Tremendous Borrower Interest,’ FHFA Says

A program designed to help homeowners who have lost equity in their properties has generated “tremendous borrower interest,” said Edward J. DeMarco, acting director of the Federal Housing Finance Agency.The key to the new HARP program is the elimination of the representations and warranties on the original loan for the lenders. If the lenders can get borrowers to refinance (only loans owned or guaranteed by Fannie and Freddie), the lenders will no longer be responsible if the original loan defaults. This is important for the banks (these are well seasoned loans, so it makes sense for Fannie and Freddie too).

DeMarco made his comments in written testimony prepared for delivery tomorrow to the Senate Banking Committee.

The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until sometime in March. The lenders and servicers know which loans are 1) owned or guaranteed by Fannie and Freddie, and 2) qualify for HARP. The lenders are very motivated to get borrowers to refinance ... and the borrowers will be very motivated to get much lower mortgage rates. So it should be no surprise that there is "tremendous borrower interest"!