by Calculated Risk on 2/24/2012 06:13:00 PM

Friday, February 24, 2012

Bank Failure #11 in 2012: Home Savings of America, Little Falls, Minnesota

Where the Feds often will play

Where seldom is heard,

A bid for this turd,

And the skies are not cloudy all day

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of Home Savings of America, Little Falls, Minnesota

As of December 31, 2011, Home Savings of America had $434.1 million in total assets and $432.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $38.8 million. Home Savings of America is the eleventh FDIC-insured institution to fail in the nation this year, and the second in Minnesota.We haven't seen a payout in some time ... I guess no one wanted this one.

Bank Failure #10 in 2012: Central Bank of Georgia, Ellaville, Georgia

by Calculated Risk on 2/24/2012 05:10:00 PM

Feds in Georgia discover

Deposits to dust

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Assumes All of the Deposits of Central Bank of Georgia, Ellaville, Georgia

As of December 31, 2011, Central Bank of Georgia had approximately $278.9 million in total assets and $266.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $67.5 million. ... Central Bank of Georgia is the tenth FDIC-insured institution to fail in the nation this year, and the second in Georgia.Here is a "central bank" that failed ...

Lawler: Declining Inventory of Existing Homes for Sale: Don’t Forget Conversion to Rentals

by Calculated Risk on 2/24/2012 03:16:00 PM

CR Note: Yesterday I posted some thoughts on the sharp decline in listed inventory. Here are some additional comments from housing economist Tom Lawler:

While there has been a lot of discussion among analysts on the reasons behind the “stunning” plunge in existing SF homes listed for sale over the past several years, few have mentioned what appears to have been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years. One reason, of course, is that there are not good, reliable, and timely statistics on the number of SF homes rented out, much less any data at all on the intended holding-period of folks renting out SF homes. There are, of course, lots of anecdotal stories about a surge in the number of investors (including LLCs, hedge funds, etc.) buying SF properties, especially REO properties, because of attractive rental yields; there are some data from local MLS on leasing activity showing a surge in the past several years; and there are certainly surveys pointing not just to an increase in investor buying of homes, but a rise in the cash share of investors purchases over the past several years. But there is a dearth of actual data.

Data from the ACS does suggest that the share of occupied SF detached homes that were occupied by renters increased rather dramatically in the latter part of last decade, The below table is based on decennial Census data for 2000, and the 5-year, 3-year, and 1-year estimates from the ACS for 2006-10, 2008-10, and 2010.

While last year there was a drop in completed foreclosures, there was no corresponding drop in the sales of REO properties, many of which were to investors not planning to “flip” properties, but to rent them out. Short sales also increased last year, and anecdotal evidence suggests that a non-trivial share were to investors looking to rent the properties out. I’d guess that the 2011 data will suggest that the share of occupied SF detached homes occupied by renters will come in at around 16%.

Net, a not insignificant share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties.

| Percent of Occupied Single Family Detached Homes Occupied by Renters | ||||

|---|---|---|---|---|

| 2000 | 2006-07 Avg. | 2008-09 Avg. | 2010 | |

| US | 13.2% | 12.8% | 14.3% | 15.1% |

| Maricopa County | 10.4% | 13.5% | 16.8% | 19.8% |

| Clark County | 12.5% | 18.2% | 22.0% | 24.4% |

| Sacramento County | 18.8% | 16.7% | 20.2% | 22.4% |

| Lee County | 10.6% | 12.3% | 14.6% | 17.3% |

New Home Sales: 2011 Still the Worst Year, "Distressing Gap" remains very wide

by Calculated Risk on 2/24/2012 12:09:00 PM

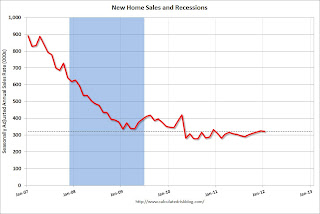

Even with the upward revisions to new home sales in October, November and December, 2011 was the worst year for new home sales since the Census Bureau started tracking sales in 1963. The three worst years were 2011, 2010, and 2009 with sales of 304, 323 and 375 thousand respectively.

Sales will probably increase in 2012, and sales will also probably be higher than the 323 thousand in 2010. But I expect this year will still be the third worst on record.

The following graph shows the recent minor increase off the bottom for new home sales:

Click on graph for larger image.

Click on graph for larger image.

Not much of an increase.

Last month I posted a few housing forecasts for 2012. The forecasts for new home sales ranged from 330 thousand to 365 thousand (excluding Moody's) - and that wouldn't be much of an increase from the current level.

The second graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

I expect this gap to eventually close once the number of distressed sales starts to decline.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

On January New Home Sales:

• New Home Sales in January at 321,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in January: 4.57 million SAAR, 6.1 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales in January at 321,000 Annual Rate

by Calculated Risk on 2/24/2012 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 321 thousand. This was down from a revised 324 thousand in December (revised up from 307 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in January 2011 were at a seasonally adjusted annual rate of 321,000. This is below the revised December rate of 324,000 and is 3.5 percent above the January 2011 estimate of 310,000.

Click on graph for larger image.

Click on graph for larger image.

The second graph shows New Home Months of Supply.

Months of supply decreased to 5.6 in January. This is the lowest level since January 2006.

The all time record was 12.1 months of supply in January 2009.

This is now normal (less than 6 months supply is normal).

This is now normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of January was 151,000. This represents a supply of 5.6 months at the current sales rate.

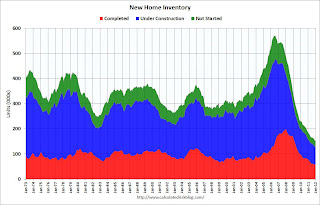

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 57,000 units in January. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2012 (red column), 22 thousand new homes were sold (NSA). This was the second weakest January since this data has been tracked. The record low for January was 21 thousand set in 2011. The high for January was 92 thousand in 2005.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.

This was above the consensus forecast of 315 thousand, and sales for October, November and December were revised up.It appears New Home sales have started to slowly increase. I'll have more later.

An "Upbeat" report on the Phoenix Housing Market

by Calculated Risk on 2/24/2012 08:44:00 AM

Just passing along some of what I'm reading ...

From Catherine Reagor the Arizona Republic: Report: Upbeat findings for Arizona housing market

Metro Phoenix home prices are up. Fewer inexpensive homes are for sale, and the number of pending foreclosures is down.We have to be careful using median prices because the median can be impacted by the mix. As an example, fewer foreclosures at the low end could lead to higher median prices, even if repeat sale prices are still falling. However the most recent Case-Shiller price index for Phoenix (through November) did show a small increase over the previous three months.

The positive housing-market update comes from Arizona State University's newest real-estate report.

...

The median price of all home sales, including new homes, reached $120,500 in January of this year, Orr reports. That compares with $113,166 a year earlier.

The average price per square foot of Valley houses has climbed 3 percent since last year.

...

"Many people think there's a glut of homes the banks are hiding somewhere, and that may be the case in other markets, but not here in the Phoenix area," [Mike Orr, director of the Center for Real Estate Theory and Practice for ASU's W.P. Carey School of Business].

"We've gone through so many foreclosures that the system has been working itself out for about five years."

...

The supply of homes listed for sale in metro Phoenix is down 42 percent from a year earlier.

The sharp decline in inventory is a clear positive, although in most areas there will be more foreclosures this year - and that will add to inventory a little (for more on inventory, see my post yesterday: Comments on Existing Home Inventory)

Thursday, February 23, 2012

BofA to Stop Selling Mortgages to Fannie Mae

by Calculated Risk on 2/23/2012 08:37:00 PM

From Jacob Gaffney at HousingWire: Bank of America stops selling mortgages to Fannie Mae

Bank of America is faced with numerous reps and warrants challenges on the mortgage front, and as a result of growing uncertainty, it will no longer sell certain mortgage refinances into Fannie Mae mortgage-backed securities.I'm not sure what to say about this. BofA will continue to make HARP refinance loans through BofA (reps and warrants will be waived starting in March), and will also sell loans to Freddie Mac.

"The issue is tied to ongoing disagreements between Bank of America and Fannie Mae in regards to repurchases," said Dan Frahm, spokesman for BofA.

Specifically, Bank of America will no longer place non-Making Home Affordable Program (MHA) refinance first-lien residential mortgage products into Fannie mortgage-backed securities.

...

"We continue to deliver MHA programs, including loan modifications and refinancing[sp] through HARP to our customers whose loans are owned by Fannie Mae," Frahm said, adding mortgage origination levels will not drop at the bank. "We're adequately prepared for this, there will be no impact to our customers." BofA will likely do more business with Freddie Mac and Ginnie Mae as a result of this decision.

...

At the heart of the decision is recent changes in mortgage insurance policies. The filing notes Fannie Mae policy where MI rescission must be resolved in a timely fashion. As of Dec. 31, 2011, 74% of the MI rescission notices received had not been resolved, and Fannie began exercising repurchases with Bank of America.

Hotels: RevPAR increases 4.4% compared to same week in 2011

by Calculated Risk on 2/23/2012 06:36:00 PM

From HotelNewsNow.com: New Orleans benefits from Mardi Gras visitors

Overall, the U.S. hotel industry reported a 1.5% increase in occupancy to 59.7%, a 2.9% increase in ADR to $102.59 and a 4.4% increase in RevPAR to $61.27.Hotel occupancy and RevPAR have improved from 2011, but are still below the per-recession levels.

Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

The following graph shows the seasonal pattern for the hotel occupancy rate using a four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2012, yellow is for 2011, blue is "normal" and black is for 2009 - the worst year since the Great Depression for hotels.

Better than 2011, but the 4-week average of the occupancy rate is still below normal. Looking forward, business travel usually increases in the March to May period - and then increases during the summer with all the leisure travel.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Comments on Existing Home Inventory

by Calculated Risk on 2/23/2012 02:54:00 PM

Analysts are trying to explain the recent sharp decline in existing home inventory and trying to estimate the impact of less inventory on house prices. As an example, Goldman Sachs economist Zach Pandl wrote yesterday:

Inventory of existing homes on the market declined by 21% in the year to January, or by 600,000 units. The “months supply” of existing homes—homes for sale divided by the current sales pace—fell to 6.1 in January, the lowest level since April 2006. Although we consider these declines a modest positive for the housing market outlook, we also think they exaggerate the improvement in excess supply.

...

Active listings—which are what the existing home sales report measures—decline if a house is sold, but also if a current homeowner pulls their home off the market. They can also be held down by prospective home sellers who decide not to sell due to weak demand conditions. Available data suggest that the latter two factors may have been an important reason behind the improvement in existing home inventory and months supply.

Click on graph for larger image.

Click on graph for larger image.Here is a graph showing the months-of-supply and the year-over-year decline in inventory.

The two factors that Pandl identifies - homeowners pulling their homes off the market and prospective sellers not listing - can be grouped as 1) sellers waiting for a better market.

There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply (I've even included it is part of the "shadow inventory" in earlier posts). When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less inventory means less downward pressure on prices now.

There are other factors pushing down inventory and months-of-supply too:

2) There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.65 million by July (up from 2.31 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.7 to 7.0 months from the current 6.1 months.

The second graph shows nationwide inventory for existing homes and shows the seasonal pattern.

The second graph shows nationwide inventory for existing homes and shows the seasonal pattern. So some increase in inventory and months-of-supply is expected just based on seasonal factors.

3) The NAR reports active listing, and there a large number of "contingent short sales". This is another key point. The NAR reports active listings, although there is some variability across the country in what is considered active, most "contingent short sales" are not included. These are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory.

When we comparing inventory to 2005, we probably need to remember there were no "short sale contingent" listings in 2005 - so with the same inventory now, we probably shouldn't expect prices to increase by 16% in 2012! (just joking of course, but this is reminder that with just a little less listed inventory - and no distressed sales - prices increased 16% in 2005 according to Case-Shiller - and of course insanely loose underwriting too and a bubble attitude - This is a joke!! that I know some people won't understand).

And finally, in the areas I track, the number of "short sale contingent" listings is down sharply year-over-year.

4) The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and an increase in the level of inventory. Tom Lawler and I have both mentioned this before.

Jonathan Miller mentioned this yesterday at the Big Picture:

Declining foreclosure volume is one of the key reason inventory levels are dropping. The 1/3 decline in foreclosure volume in 2011 has resulted in a sharp drop in foreclosure inventory resulting in a sharp drop in total inventory. ... With a 2 million more homes expected to go into foreclosure over the next 2 years, a year long internal review of procedure after the 2010 “robo-signing” scandal and the 50 State AG settlement with the largest services/banks, distressed inventory is expected to rise sharply over the next several years.Although the number of completed foreclosures declined in 2011 from 1.07 million in 2010 to 843 thousand in 2011 (see here), the number of short sales increased - and increased significantly in Q4.

Also the number of lender REO declined sharply in 2011 (listings are a portion of REO owned, not all REO is listed immediately since it takes some time between acquisition and listing the property to make sure the property is in OK condition). So what would happen if completed foreclosures increased by 200 thousand units in 2012? Or by 400 thousand units? At most that would increase listed inventory by 200 to 400 thousand units and probably by much less since the lenders are currently selling REO faster than they are acquiring REO.

If we add 200 thousand most listed REO to the expected seasonal increase that would put listed inventory at 2.75 to 2.85 million in mid-summer - or about 7.2 to 7.5 months-of-supply at the current sales rate. That is higher than normal, but still well below the 9.3 months in July 2011, and the lowest level for July since 2006 (or even 2005). As I mentioned yesterday, Michelle Meyer and Ethan Harris at Merrill Lynch expect months-of-supply to reach 8 months this year (I think that is a little high).

The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year.

Misc: Tenth District manufacturing increases, FHFA House Prices decline slightly in Q4

by Calculated Risk on 2/23/2012 11:00:00 AM

• Kansas City Fed: Tenth District Manufacturing Activity Increased Further in February

The month-over-month composite index was 13 in February, up from 7 in January and -2 in December, and the highest since last June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity increased in both durable and nondurable goods-producing plants, with notable strength in machinery, fabricated metals, and aircraft production. Other month-over-month indexes were mixed in February but remained solid. The production and order backlog indexes moved higher, and the employment index edged up from 9 to 11. In contrast, the shipments and new order indexes fell slightly, and the new orders for exports index dropped from 10 to -7. Both inventory indexes increased.All of the regional manufacturing surveys released so far have indicated stronger expansion in February (Empire state, Philly, and Kansas City). The Richmond survey is scheduled for release on Feb 28th, and the Dallas Fed survey on Monday, Feb 27th.

...

Most indexes for future factory activity strengthened from the previous month. The future composite index climbed from 12 to 20, and the future production, shipments, and new orders indexes also rose. The future order backlog index jumped from 9 to 24, and the future employment index posted its highest level in a year.

• From the FHFA: U.S. House Prices Fell 0.1 Percent in Fourth Quarter 2011

U.S. house prices fell modestly in the fourth quarter of 2011 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The HPI, calculated using home sales price information from Fannie Mae and Freddie Mac-acquired mortgages, was 0.1 percent lower on a seasonally adjusted basis in the fourth quarter than in the third quarter. ... Over the past year, seasonally adjusted prices fell 2.4 percent from the fourth quarter of 2010 to the fourth quarter of 2011.The expanded-data index is closer to Case-Shiller and CoreLogic and includes non-GSE houses (and the worst mortgages). Note that real prices were down over 6% in 2011 according to the FHFA.

...

FHFA’s expanded-data house price index, a metric introduced in August that adds transactions information from county recorder offices and the Federal Housing Administration to the HPI data sample, fell 0.8 percent over the latest quarter.

...

While the national, purchase-only house price index fell 2.4 percent from the fourth quarter of 2010 to the fourth quarter of 2011, prices of other goods and services rose 4.0 percent over the same period. Accordingly, the inflation-adjusted price of homes fell approximately 6.2 percent over the latest year.

• From Freddie Mac: Average 30-Year Fixed-Rate Mortgage Up From All-Time Record Low

30-year fixed-rate mortgage (FRM) averaged 3.95 percent with an average 0.8 point for the week ending February 23, 2012, up from last week when it also averaged 3.87 percent. Last year at this time, the 30-year FRM averaged 4.95 percent.