by Calculated Risk on 2/16/2012 08:54:00 AM

Thursday, February 16, 2012

Housing Starts increase in January

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 699,000. This is 1.5 percent (±16.8%)* above the revised December estimate of 689,000 and is 9.9 percent (±14.2%)* above the January 2011 rate of 636,000.

Single-family housing starts in January were at a rate of 508,000; this is 1.0 percent (±19.0%)* below the revised December figure of 513,000. The January rate for units in buildings with five units or more was 175,000.

CR Note: Single-family starts were revised up for November and December (by 43 thousand in December).

Building Permits:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 676,000. This is 0.7 percent (±1.2%)* above the revised December rate of 671,000 and is 19.0 percent (±2.4%) above the January 2011 estimate of 568,000.

Single-family authorizations in January were at a rate of 445,000; this is 0.9 percent (±1.1%)* above the revised December figure of 441,000. Authorizations of units in buildings with five units or more were at a rate of 208,000 in January.

Click on graph for larger image.

Click on graph for larger image.Total housing starts were at 699 thousand (SAAR) in January, up 1.5% from the revised December rate of 689 thousand (SAAR). Note that December was revised up from 657 thousand.

Single-family starts declined 1.0% to 508 thousand in January, however December was revised up by 43 thousand from 470 thousand. There were the first two months above 500 thousand since the expiration of the tax credit.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years..

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after sideways for about two years and a half years..It now appears both multi-family and single-family starts are moving up, but from very low levels.

This was above expectations of 670 thousand starts in January. I'll have more on housing starts and completions later.

Weekly Initial Unemployment Claims decline to 348,000

by Calculated Risk on 2/16/2012 08:30:00 AM

The DOL reports:

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 13,000 from the previous week's revised figure of 361,000. The 4-week moving average was 365,250, a decrease of 1,750 from the previous week's revised average of 367,000.The previous week was revised up to 361,000 from 358,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 365,250.

The 4-week moving average is at the lowest level since early 2008.

And here is a long term graph of weekly claims:

The 4-week average of weekly claims is still moving down and is now well below 400 thousand.

Wednesday, February 15, 2012

DataQuick: Southland Home Sales Flat, Record Investor Buying

by Calculated Risk on 2/15/2012 09:36:00 PM

This report is only for Southern California, but it contains useful information for analyzing the housing market. Plenty of "records" in January: Record investor buying, record percentage of short sales, and record low new home sales. Note: DataQuick reports new home sales at closing and the Census Bureau reports when contracts are signed - so this is for contracts signed about six months ago.

From DataQuick: Southland Home Sales Flat, Prices Edge Down

A total of 14,523 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 24.5 percent from 19,247 in December, and up 0.4 percent from 14,458 in January 2011, according to DataQuick of San Diego.The National Association of Realtors (NAR) will report January existing home sales next Wednesday, February 22nd.

Sales have increased year-over-year for five of the last six months. The sharp sales decline from December is normal for the season.

Last month’s sales count was 17.8 percent below the 17,671 average for all the months of January since 1988.

A total of 669 newly built homes sold in January, the lowest number for any month since DataQuick started keeping track in 1988.

“January numbers have never been very good at providing an indication of what upcoming activity will be like. For that we need to wait until March. What we can determine is that the mortgage market remains dysfunctional. It will be interesting to see how a potential surge of refinance activity plays into the purchase market once the administration’s new guidelines are implemented,” said John Walsh, DataQuick president.

...

Distressed sales made up more than half of January’s resale market. ... Foreclosure resales ... made up 32.6 percent of resales last month ... Short sales ... made up an estimated 21.3 percent of Southland resales last month. That was a high for the current real estate cycle and compares with 19.6 percent in both December and January 2011.

...

Absentee buyers – mostly investors and some second-home purchasers – bought a record 26.8 percent of the Southland homes sold in January, paying a median $193,500. The Inland Empire saw absentee purchases rise to a record 33.6 percent of all sales.

LA area Port Traffic mostly unchanged year-over-year in January

by Calculated Risk on 2/15/2012 05:55:00 PM

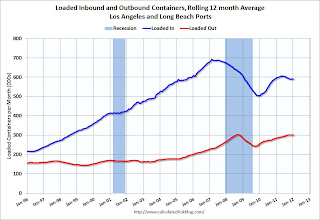

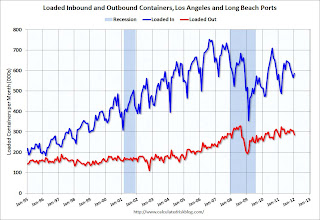

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is up 0.1% from December, and outbound traffic is flat.

On a rolling 12 month basis, outbound traffic is moving "sideways" for the last 4 or 5 of months, and it appears inbound traffic has halted the recent decline.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of January, loaded inbound traffic was up 1% compared to January 2011, and loaded outbound traffic was flat compared to January 2010.

For the month of January, loaded inbound traffic was up 1% compared to January 2011, and loaded outbound traffic was flat compared to January 2010.

On both a rolling 12 month and year-over-year basis, imports and exports were mostly unchanged.

Lawler: Short Sales increased significantly in Q4

by Calculated Risk on 2/15/2012 03:43:00 PM

Hope Now released its December report which estimates delinquencies, foreclosure starts, completed foreclosure sales, loan modifications, and other loan “workout” plans for the US first-lien residential mortgage market. According to the report, Hope Now estimates that completed foreclosure sales totaled 842,777 last year, down about 21.2% from 2010. While Hope Now does not explicitly release estimates for short sales/DILs, it does release estimates for (1) “other workout plans,” which is the sum of repayment plans initiated, “other” (non-mod) retention plans completed, and “liquidation plans” – which are short sales and DILs; and (2) separate estimates for repayment plans and other retention plans. One can thus “solve” for Hope Now’s estimates for short sales/DILs.

Using my proprietary “subtraction” software, I was able to derive Hope Now’s estimates for short sales/DILs in 2011 – 397,280, up over 12% from 2010. HN’s short sales/DILs estimate hit an all-time monthly high of 40,533 in December, and last quarter’s estimate of 110,123 was the highest quarter on record. Other industry data suggest that DILs in both years were “diddly,” so bottom line short sales appear to have increased significantly last quarter.

Of last year’s estimated 842,777 completed foreclosure sales, 628,014 were owner-occupied properties, down about 20% from 2010, and 208,933 were non-owner-occupied properties, down about 26.4% from 2010. HN’s data do not allow one to break out short sales/DILs by occupancy.

Hope Now industry-wide estimates are based on activity of its members. Hope Now’s “derived” estimates of short sales/DILs are not available prior to 2010. Based on other industry data, however, I have my own estimates for 2008 and 2009, so here are some estimates of completed foreclosure sales and short sales/DILs for 2008, 2009, 2010, and 2011.

| Completed Foreclosure Sales and Short Sales (estimates, thousands) | |||||

|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Completed Foreclosure Sales | 514 | 914 | 949 | 1,070 | 843 |

| Short Sales/DILs | N.A. | 103 | 274 | 354 | 397 |

| Total | N.A. | 1,017 | 1,223 | 1,424 | 1,240 |

CR Note: I added 2007 foreclosure numbers. It appears short sales were running at a rate of just under 500 thousand per year at the end of 2011. The shift from foreclosures to short sales is continuing (although short sale shenanigans are still rampant). Jim the Realtor noted the shift to short sales today while discussing an REO:

"This might be - this is, there is no question about it - the last REO listing I'll ever have in Carmel Valley. They have turned off the spigot. Foreclosures are going the way of the dodo bird. It is going to be short sales from now on."Carmel Valley is a fairly high end area of San Diego, and the lenders might be targeting higher end areas for short sales - but Jim's comments highlight the trend toward short sales.

FOMC Minutes: A few members argued current conditions "could warrant" QE3 "before long"

by Calculated Risk on 2/15/2012 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 24-25, 2012. Excerpts:

In light of the economic outlook, almost all members agreed to indicate that the Committee expects to maintain a highly accommodative stance for monetary policy and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014, longer than had been indicated in recent FOMC statements. In particular, several members said they anticipated that unemployment would still be well above their estimates of its longer-term normal rate, and inflation would be at or below the Committee's longer-run objective, in late 2014. It was noted that extending the horizon of the Committee's forward guidance would help provide more accommodative financial conditions by shifting downward investors' expectations regarding the future path of the target federal funds rate. Some members underscored the conditional nature of the Committee's forward guidance and noted that it would be subject to revision in response to significant changes in the economic outlook.

The Committee also stated that it is prepared to adjust the size and composition of its securities holdings as appropriate to promote a stronger economic recovery in a context of price stability. A few members observed that, in their judgment, current and prospective economic conditions--including elevated unemployment and inflation at or below the Committee's objective--could warrant the initiation of additional securities purchases before long. Other members indicated that such policy action could become necessary if the economy lost momentum or if inflation seemed likely to remain below its mandate-consistent rate of 2 percent over the medium run. In contrast, one member judged that maintaining the current degree of policy accommodation beyond the near term would likely be inappropriate; that member anticipated that a preemptive tightening of monetary policy would be necessary before the end of 2014 to keep inflation close to 2 percent.

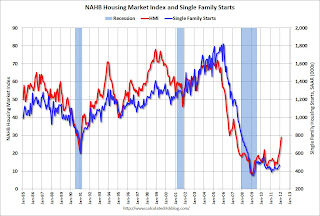

NAHB Builder Confidence index increases in February; Highest in over four years

by Calculated Risk on 2/15/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in February to 29 from 25 in January. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Increases for Fifth Consecutive Month in February

Home builder confidence in the market for new single-family homes increased for the fifth consecutive month in February, rising from 25 to 29 on the NAHB/Wells Fargo Housing Market Index (HMI) released today. It is the highest level the index has reached in more than four years.

...

“This is the longest period of sustained improvement we have seen in the HMI since 2007, which is encouraging,” said NAHB Chief Economist David Crowe. “However, it is important to remember that the HMI is still very low, and several factors continue to constrain the market. Foreclosures are still competing with new home sales, and many builders are seeing appraisals come in at less than the cost of construction. Additionally, prospective home buyers are finding it difficult to qualify for a mortgage.”

...

Each of the HMI’s three components also improved for a fifth consecutive month in February. The component measuring traffic of prospective buyers rose from 21 to 22, and the component measuring sales expectations for the next six months increased from 29 to 34. The component measuring current sales rose from 25 to 30.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up recently, and it appears starst are increasing a little too.

This is still very low, but this is the highest level since May 2007.

Industrial Production unchanged in January, Capacity Utilization declines

by Calculated Risk on 2/15/2012 09:27:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in January, as a gain of 0.7 percent in manufacturing was offset by declines in mining and utilities. Within manufacturing, the index for motor vehicles and parts jumped 6.8 percent and the index for other manufacturing industries increased 0.3 percent. The output of utilities fell 2.5 percent, as demand for heating was held down by temperatures that moved further above seasonal norms; the output of mines declined 1.8 percent. Total industrial production is now reported to have advanced 1.0 percent in December; the initial estimate had been an increase of 0.4 percent. This large upward revision reflected higher output for many manufacturing and mining industries. At 95.9 percent of its 2007 average, total industrial production in January was 3.4 percent above its level of a year earlier. The capacity utilization rate for total industry decreased to 78.5 percent, a rate 1.8 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.8 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in January at 95.9; December was revised up sharply.

The consensus was for a 0.6% increase in Industrial Production in January, and for an increase to 78.6% for Capacity Utilization. Although below consensus, with the December revisions, this was about at expectations.

NY Fed Survey: Manufacturing activity expanded at a faster pace in February

by Calculated Risk on 2/15/2012 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The February Empire State Manufacturing Survey indicates that manufacturing activity in New York State expanded for a third consecutive month. The general business conditions index rose six points to 19.5, its highest level in more than a year. The new orders index, at 9.7, was positive but down slightly, and the shipments index was little changed at 22.8. ... Employment indexes, positive and little changed from last month, indicated a modest increase in employment levels and in the length of the average workweek. The index for number of employees was 11.8, and the average workweek index was 7.1. ... Indexes for the six-month outlook, while somewhat lower than last month, conveyed a widespread expectation that conditions would improve in the months ahead.This was above the consensus forecast of a reading of 14.1 (above 0 is expansion) and the highest level since June 2010.

MBA: Purchase Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/15/2012 07:25:00 AM

From the MBA: Purchase Applications Decrease in Latest MBA Weekly Survey

The Refinance Index increased 0.8 percent from the previous week to its highest level since August 8, 2011. The seasonally adjusted Purchase Index decreased 8.4 percent from one week earlier.The purchase index is still moving sideways at a very low level, but I expect the changes to HARP to lead to a surge in refinance activity in March.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.08 percent from 4.05 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)increased to 4.30 percent from 4.29 percent ...