by Calculated Risk on 2/15/2012 02:00:00 PM

Wednesday, February 15, 2012

FOMC Minutes: A few members argued current conditions "could warrant" QE3 "before long"

From the Fed: Minutes of the Federal Open Market Committee, January 24-25, 2012. Excerpts:

In light of the economic outlook, almost all members agreed to indicate that the Committee expects to maintain a highly accommodative stance for monetary policy and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014, longer than had been indicated in recent FOMC statements. In particular, several members said they anticipated that unemployment would still be well above their estimates of its longer-term normal rate, and inflation would be at or below the Committee's longer-run objective, in late 2014. It was noted that extending the horizon of the Committee's forward guidance would help provide more accommodative financial conditions by shifting downward investors' expectations regarding the future path of the target federal funds rate. Some members underscored the conditional nature of the Committee's forward guidance and noted that it would be subject to revision in response to significant changes in the economic outlook.

The Committee also stated that it is prepared to adjust the size and composition of its securities holdings as appropriate to promote a stronger economic recovery in a context of price stability. A few members observed that, in their judgment, current and prospective economic conditions--including elevated unemployment and inflation at or below the Committee's objective--could warrant the initiation of additional securities purchases before long. Other members indicated that such policy action could become necessary if the economy lost momentum or if inflation seemed likely to remain below its mandate-consistent rate of 2 percent over the medium run. In contrast, one member judged that maintaining the current degree of policy accommodation beyond the near term would likely be inappropriate; that member anticipated that a preemptive tightening of monetary policy would be necessary before the end of 2014 to keep inflation close to 2 percent.

NAHB Builder Confidence index increases in February; Highest in over four years

by Calculated Risk on 2/15/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased in February to 29 from 25 in January. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Increases for Fifth Consecutive Month in February

Home builder confidence in the market for new single-family homes increased for the fifth consecutive month in February, rising from 25 to 29 on the NAHB/Wells Fargo Housing Market Index (HMI) released today. It is the highest level the index has reached in more than four years.

...

“This is the longest period of sustained improvement we have seen in the HMI since 2007, which is encouraging,” said NAHB Chief Economist David Crowe. “However, it is important to remember that the HMI is still very low, and several factors continue to constrain the market. Foreclosures are still competing with new home sales, and many builders are seeing appraisals come in at less than the cost of construction. Additionally, prospective home buyers are finding it difficult to qualify for a mortgage.”

...

Each of the HMI’s three components also improved for a fifth consecutive month in February. The component measuring traffic of prospective buyers rose from 21 to 22, and the component measuring sales expectations for the next six months increased from 29 to 34. The component measuring current sales rose from 25 to 30.

Click on graph for larger image.

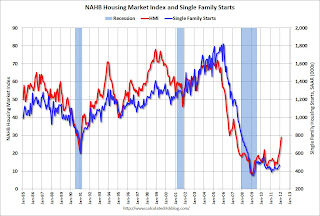

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up recently, and it appears starst are increasing a little too.

This is still very low, but this is the highest level since May 2007.

Industrial Production unchanged in January, Capacity Utilization declines

by Calculated Risk on 2/15/2012 09:27:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in January, as a gain of 0.7 percent in manufacturing was offset by declines in mining and utilities. Within manufacturing, the index for motor vehicles and parts jumped 6.8 percent and the index for other manufacturing industries increased 0.3 percent. The output of utilities fell 2.5 percent, as demand for heating was held down by temperatures that moved further above seasonal norms; the output of mines declined 1.8 percent. Total industrial production is now reported to have advanced 1.0 percent in December; the initial estimate had been an increase of 0.4 percent. This large upward revision reflected higher output for many manufacturing and mining industries. At 95.9 percent of its 2007 average, total industrial production in January was 3.4 percent above its level of a year earlier. The capacity utilization rate for total industry decreased to 78.5 percent, a rate 1.8 percentage points below its long-run (1972--2011) average.

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.8 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in January at 95.9; December was revised up sharply.

The consensus was for a 0.6% increase in Industrial Production in January, and for an increase to 78.6% for Capacity Utilization. Although below consensus, with the December revisions, this was about at expectations.

NY Fed Survey: Manufacturing activity expanded at a faster pace in February

by Calculated Risk on 2/15/2012 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The February Empire State Manufacturing Survey indicates that manufacturing activity in New York State expanded for a third consecutive month. The general business conditions index rose six points to 19.5, its highest level in more than a year. The new orders index, at 9.7, was positive but down slightly, and the shipments index was little changed at 22.8. ... Employment indexes, positive and little changed from last month, indicated a modest increase in employment levels and in the length of the average workweek. The index for number of employees was 11.8, and the average workweek index was 7.1. ... Indexes for the six-month outlook, while somewhat lower than last month, conveyed a widespread expectation that conditions would improve in the months ahead.This was above the consensus forecast of a reading of 14.1 (above 0 is expansion) and the highest level since June 2010.

MBA: Purchase Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/15/2012 07:25:00 AM

From the MBA: Purchase Applications Decrease in Latest MBA Weekly Survey

The Refinance Index increased 0.8 percent from the previous week to its highest level since August 8, 2011. The seasonally adjusted Purchase Index decreased 8.4 percent from one week earlier.The purchase index is still moving sideways at a very low level, but I expect the changes to HARP to lead to a surge in refinance activity in March.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.08 percent from 4.05 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)increased to 4.30 percent from 4.29 percent ...

Tuesday, February 14, 2012

Policy Update: Extension of payroll tax cut and extended unemployment benefits

by Calculated Risk on 2/14/2012 07:25:00 PM

Back in January I listed several policies and agreements that were expected soon. Now it looks like the payroll tax cut and extended unemployment benefits will be extended through the end of the year.

From the LA Times: Lawmakers near deal to extend payroll tax break

One day after House GOP leaders announced they would abandon their insistence that a payroll tax break be paid for with spending cuts, negotiators are now close to a broader deal that would also extend unemployment benefits and ensure Medicare doctors don't see a pay cut, sources said.

... with Congress scheduled to adjourn Friday for a weeklong Presidents Day recess, all sides want to avoid the appearance of being on vacation while workers see a tax hike, jobless Americans go without benefits or doctors face a pay cut.

Under emerging contours of the deal, the payroll tax would not be offset, but budget cuts would be made to pay for the other two items: the costs of extending long-term unemployment benefits and ensuring doctors that provide Medicare services would not see a pay cut, the sources said.

FHA REO Inventory declines to four-year low in December

by Calculated Risk on 2/14/2012 04:10:00 PM

From economist Tom Lawler:

FHA released the December Report to the FHA commissioner, and according to the report FHA’s SF REO inventory plunged to 32,170 at the end of December – the lowest REO property count since December 2007, and 47% lower than at the end of December 2010. Here is a table derived from the latest and past reports. I don’t rightly know what the “adjustments” category is, save that it is needed to make the report “stock/flow” consistent.

| Monthly Report to FHA Commissioner | ||||

|---|---|---|---|---|

| SF REO Inventory (EOM) | Conveyances | Sales | Adjustments | |

| Jun-10 | 44,850 | 8,487 | 8,893 | 41 |

| Jul-10 | 44,944 | 8,341 | 8,508 | 261 |

| Aug-10 | 47,007 | 9,810 | 7,686 | -61 |

| Sep-10 | 51,487 | 11,411 | 7,439 | 508 |

| Oct-10 | 54,609 | 9,908 | 7,289 | 503 |

| Nov-10 | 55,488 | 6,752 | 5,817 | -56 |

| Dec-10 | 60,739 | 7,728 | 2,749 | 272 |

| Jan-11 | 65,639 | 7,709 | 2,632 | -177 |

| Feb-11 | 68,801 | 7,383 | 4,221 | 0 |

| Mar-11 | 68,997 | 8,647 | 8,728 | 277 |

| Apr-11 | 65,063 | 7,410 | 11,375 | 31 |

| May-11 | 59,465 | 7,032 | 12,659 | 29 |

| Jun-11 | 53,164 | 7,240 | 13,600 | 59 |

| Jul-11 | 48,507 | 6,509 | 11,379 | 213 |

| Aug-11 | 44,749 | 8,005 | 11,701 | -62 |

| Sep-11 | 40,719 | 6,567 | 10,554 | -43 |

| Oct-11 | 37,922 | 6,541 | 9,883 | 545 |

| Nov-11 | 35,192 | 6,212 | 9,178 | 236 |

| Dec-11 | 32,170 | 5,997 | 8,800 | -219 |

The level of property conveyances is astonishingly low, especially given the rising level of seriously delinquent FHA-insured SF loans (711,082 at the end of December, up from 598,140 at the end of December 2010).

The report also showed a continuation of the recent downward trend in FHA loan modification activity.

It is not clear why both property conveyances AND loss mitigation activity slowed so dramatically in the latter part of last year, but the sharp slowdown in problem loan “resolutions” contributed to the significant rise in the number of seriously delinquent FHA-insured SF loans in the second half of last year.

| FHA SF "Home Retention" Activity | |||||

|---|---|---|---|---|---|

| Forbearance Agreements | Loan Modifications | Partial Claims | Total "Loss Mitigation Activity" | SDQ Loans | |

| Dec-09 | 1,840 | 8,514 | 968 | 11,322 | 549,667 |

| Jan-10 | 1,766 | 9,319 | 986 | 12,071 | 576,691 |

| Feb-10 | 1,618 | 11,359 | 846 | 13,823 | 570,799 |

| Mar-10 | 1,686 | 14,604 | 1,158 | 17,448 | 553,650 |

| Apr-10 | 1,228 | 11,525 | 1,603 | 14,356 | 544,464 |

| May-10 | 1,189 | 12,034 | 1,621 | 14,844 | 548,193 |

| Jun-10 | 1,074 | 17,072 | 1,479 | 19,625 | 551,330 |

| Jul-10 | 1,212 | 19,002 | 1,421 | 21,635 | 559,620 |

| Aug-10 | 1,152 | 16,090 | 1,676 | 18,918 | 558,316 |

| Sep-10 | 1,070 | 15,634 | 1,520 | 18,224 | 563,513 |

| Oct-10 | 2,361 | 12,667 | 1,194 | 16,222 | 532,938 |

| Nov-10 | 1,720 | 14,830 | 1,631 | 18,181 | 588,947 |

| Dec-10 | 3,301 | 18,000 | 2,328 | 23,629 | 598,140 |

| Jan-11 | 2,905 | 12,075 | 2,352 | 17,332 | 612,443 |

| Feb-11 | 2,628 | 10,412 | 1,991 | 15,031 | 619,712 |

| Mar-11 | 3,562 | 12,752 | 2,714 | 19,028 | 553,650 |

| Apr-11 | 2,503 | 13,564 | 2,366 | 18,433 | 575,950 |

| May-11 | 2,211 | 11,945 | 3,377 | 17,533 | 578,933 |

| Jun-11 | 2,655 | 13,368 | 3,082 | 19,105 | 584,822 |

| Jul-11 | 2,259 | 8,075 | 1,629 | 11,963 | 598,921 |

| Aug-11 | 2,068 | 9,950 | 1,815 | 13,833 | 611,822 |

| Sep-11 | 1,581 | 7,346 | 1,501 | 10,428 | 635,096 |

| Oct-11 | 2,109 | 7,183 | 1,426 | 10,718 | 661,554 |

| Nov-11 | 1,995 | 7,540 | 2,487 | 12,022 | 689,346 |

| Dec-11 | 2,537 | 5,560 | 976 | 9,073 | 711,082 |

Click on graph for larger image.

Click on graph for larger image.CR Note: This graph shows the REO inventory for the FHA through Q4 2011. There has been a sharp decline in REO inventory over the last year and FHA REO is at the lowest level since 2007.

Fannie and Freddie should report Q4 REO next week, and will probably report further declines in REO too.

Report: Wednesday euro zone finance minister meeting cancelled

by Calculated Risk on 2/14/2012 01:16:00 PM

From the Financial Times: Euro ministers cancel Greece meeting

“It has appeared that further technical work between Greece and the troika is needed in a number of areas, including the closure of the fiscal gap of €325m in 2012 and the debt sustainability analysis,” [Jean-Claude Juncker] said in a statement that followed a preparatory meeting for the event.There will be conference call instead, and then the regular meeting next Monday.

“Furthermore, I did not yet receive the required political assurances from the leaders of the Greek coalition parties on the implementation of the programme,” he said.

The €200bn "Private Sector Involvement" restructuring needs to begin pretty soon to make the March deadline ...

Ceridian-UCLA: Diesel Fuel index declined 1.7% in January

by Calculated Risk on 2/14/2012 11:35:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Dropped 1.7 Percent in January; Compared with Prior Year, the PCI is Down 2.2 Percent

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, fell 1.7 percent in January following the 0.4 percent decrease in December. January’s data places the PCI 2.2 percent below year-ago levels with essentially no growth in the year-and-a-half since the summer of 2010.

“It seems difficult to square the behavior of the PCI with the evident improvement in a number of economic indicators, most notably the increase in payroll jobs and the decrease in initial claims for unemployment,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and Director of the UCLA Anderson Forecast. “The PCI also seems out-of-sync with Industrial Production and with Real Retail Sales, which continue to grow in a healthy manner while the PCI is stalled out.”

The year-over-year changes in the PCI, however, make it look very accurate – the three-month moving average peaked at 8 percent in July 2010 and has fallen steadily to essentially zero percent in January. “The PCI year-over-year peak in 2010 and the deterioration throughout 2011 have correctly anticipated the same movement of Industrial Production, Total Business Real Inventories, and Real Retail Sales. The weakness in the PCI is suggesting either further weakness in these indicators or a big gain in trucking in February, March and April,” said Leamer.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than other measures of transportation such as the ATA trucking index or the AAR rail traffic report. In the full report, Dr. Leamer looks at several possible explanations for the divergence - a shift to rail traffic, the difference between diesel fuel transaction (up for the year) and gallons (down for the year), and possible efficiency due to the high price of diesel fuel. There isn't a clear explanation.

Note: This index does appear to track Industrial Production over time (with plenty of noise). From Ceridian: "Based on the latest PCI data, the forecast for January Industrial Production is a 0.44 percent decrease when the government estimate is released on February 15."

Retail Sales increased 0.4% in January

by Calculated Risk on 2/14/2012 08:46:00 AM

On a monthly basis, retail sales were up 0.4% from December to January (seasonally adjusted, after revisions), and sales were up 5.8% from January 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $401.4 billion, an increase of 0.4 percent (±0.5%)* from the previous month and 5.8 percent (±0.7%) above January 2011. ... The November to December 2011 percent change was revised from 0.1 percent (±0.5)* to virtually unchanged (±0.3%)*.

Click on graph for larger image.

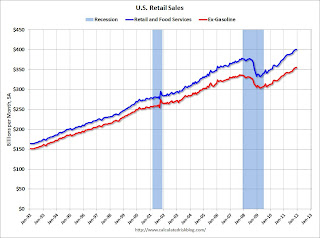

Click on graph for larger image.Sales for December were revised down from a 0.1% increase to "virtually unchanged".

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.7% from the bottom, and now 6.1% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 17.3% from the bottom, and now 5.6% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 17.3% from the bottom, and now 5.6% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.6% on a YoY basis (5.8% for all retail sales). Retail sales ex-gasoline increased 0.3% in January.

This was below the consensus forecast for retail sales of a 0.7% increase in January, but above the consensus for a 0.5% increase ex-auto.

This was below the consensus forecast for retail sales of a 0.7% increase in January, but above the consensus for a 0.5% increase ex-auto.