by Calculated Risk on 1/30/2012 10:52:00 PM

Monday, January 30, 2012

A few policies I expect soon

Housing, payroll tax extension, a Greek deal and more ...

• Mortgage Servicer Settlement. Loren Berlin at the HuffPo writes: As Mortgage Settlement Deal Nears Feb. 3 Deadline, Nevada AG Raises Concerns

As the Obama administration, state attorneys general and the nation's biggest banks close in on a settlement over allegations of widespread mortgage fraud, Nevada's attorney general is pushing back with concerns and questions. Meanwhile a Feb. 3 deadline looms for states to declare whether they are joining the settlement.It sounds like these issues will be clarified, and I expect most states (if not all) to join the settlement. Note that Masto has been working closely with California AG Harris.

In a letter sent Friday, emailed to federal officials and obtained by The Huffington Post, Nevada's attorney general, Catherine Cortez Masto, asked 38 questions relating to a variety of concerns, including fears that states would play second fiddle to the federal government in making decisions. She also questioned if states would lose their ability to pursue certain types of lawsuits against banks and whether states would get their fair share of the housing assistance for their borrowers.

• A surge in refinance activity in March. Not a new policy - this was announced last October when the FHFA made changes to Home Affordable Refinance Program (HARP) to allow more homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans.

The key to this program - for the lenders - was that the lender was not responsible for any of the representations and warranties associated with the original loan (this is huge for the lenders). The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

• REO to Rental Program: This rental program for Fannie and Freddie REO is being pushed by several agencies, and was discussed earlier this month in the Fed white paper "The U.S. Housing Market: Current Conditions and Policy Considerations" and by NY Fed President William Dudley: Housing and the Economic Recovery

This program could include bulk REO sales to investors, but might also include Fannie and Freddie renting out more REOs. There will be a similar effort for non-GSE properties as regulators relax the rules on banks renting out properties. Note: This program isn't needed in many areas because of the strong demand from small investor groups.

• Extension of payroll tax cut and extended unemployment benefits: The two month extension expires Feb 29th, and I expect these two programs will be extended through the end of the year. From Bloomberg: Boehner Says He’s Confident Congress Will Extend Payroll Tax-Cut

House Speaker John Boehner said he’s confident that Republicans and Democrats in Congress will agree to a payroll tax-cut extension supported by President Barack Obama.And on Europe:

“We are in a formal conference with the Senate, and I’m confident that we’ll be able to resolve this fairly quickly,” Boehner, an Ohio Republican, said on ABC’s “This Week” program yesterday.

• Although a default is possible, I expect the Greek debt deal and next bailout agreement to be reached sometime in February. From the Athens News: Troika stick delays PSI carrot

Despite its agreement with bondholders on all the parameters of private-sector involvement (PSI) in the Greek debt writedown, the government will have to wait for another week before winning approval from the EU-IMF-ECB troika for a second bailout package worth 130bn euros.These deals always happen at the last minute, and this will be no exception.

A timely PSI deal for the haircut of 50 percent – or 100bn euros – from the 205bn euro privately held portion of Greek debt was crucial to avert a Greek default before March 20 when a 14.4bn euro bond redemption comes due.

• The second round of the ECB's 3 year Long Term Refinancing Operation (LTRO) will probably be for over €1 trillion (the first 3 year LTRO was for €489 billion). The second auction will be held on February 29th. From the Financial Times: Banks set to double crisis loans from ECB

Several of the eurozone’s biggest banks have told the Financial Times that they could well double or triple their request for funds ... “Banks are not going to be as shy second time round,” said the head of one eurozone bank .. “We should have done more first time.”It may be well over €1 trillion.

excerpt with permission

Research: Weak labor demand explains increase in unemployment duration

by Calculated Risk on 1/30/2012 07:28:00 PM

The average duration of unemployment in the US increased sharply during the recent recession, and was still near the record high in December. One of the reasons the average has stayed high is because of a change in the measurement methodology, but even after accounting for that change, the duration is still near record levels.

Another measure - the median duration of unemployment - has declined slightly from a peak of 25 weeks in June 2010, to 21 weeks in December 2011. In the severe recession of the early '80s, the median duration peaked at 12.3 weeks, even though the unemployment rate was higher in the early '80s than during the recent employment recession.

Researchers Rob Valletta and Katherine Kuang at the San Francisco Fed look at the reasons the duration increased: Why Is Unemployment Duration So Long?

During the recent recession, unemployment duration reached levels well above those of past downturns. Duration has continued to rise during the uneven economic recovery that began in mid-2009. Elevated duration reflects such factors as changes in survey measurement, the demographic characteristics of the unemployed, and the availability of extended unemployment benefits. But the key explanation is the severe and persistent weakness in aggregate demand for labor.This seems obvious, but it is important for policymakers to understand that the primary cause of the increase in duration is not extended unemployment benefits or changes in demographics, but weak aggregate demand.

Mortgage Settlement: States face "end-of-the-week deadline"

by Calculated Risk on 1/30/2012 03:42:00 PM

From Reuters: States to decide this week on mortgage deal

State and federal officials are close to a settlement with the largest U.S. banks over mortgage abuses, with states facing an end-of-the-week deadline to decide whether they will sign on, people close to the talks said.If this settlement goes forward (and I expect it will), then there will be more modification and foreclosure activity in coming months.

... negotiators have overcome a sticking point and agreed on Joseph Smith, North Carolina's banking commissioner, as a monitor to ensure the banks comply with the terms of the settlement ...

In exchange for up to $25 billion, much in the form of cutting mortgage debt for distressed homeowners, the banks will resolve civil state and federal lawsuits about servicing misconduct and faulty foreclosures, and state lawsuits about how they made some of the loans.

This is just one of several policy changes in the works including the automated HARP refinance program (starts in March) and a possible GSE REO to rental program. Plus the Federal Reserve is "contemplating issuing guidance to banking organizations and examiners" to allow banks to also rent more residential REO.

Currently, according to LPS, there are 1.79 million loans 90+ days delinquent and an additional 2.07 million loans in the foreclosure process.

As I noted earlier this year, it appears the overall goal of these policy changes is to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

Fed Senior Loan Officer Survey: Lending standards "little changed", "somewhat stronger loan demand"

by Calculated Risk on 1/30/2012 02:00:00 PM

The Federal Reserve released the quarterly January 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices today. The survey had "three sets of special questions: the first set asked banks about lending to firms with European exposures; the second set asked banks about changes in their lending policies on commercial real estate (CRE) loans over the past year; and the third set asked banks about their outlook for credit quality in 2012."

Overall, in the January survey, domestic banks reported that their lending standards had changed little and that they had experienced somewhat stronger loan demand, on net, over the past three months.On Europe:

...

On the household side, lending standards and demand for loans to purchase residential real estate were reportedly little changed over the fourth quarter on net. Standards on home equity lines of credit (HELOCs) were about unchanged, while demand for such loans weakened on balance. Moderate net fractions of banks reported that they had eased standards on all types of consumer loans over the past three months, and some banks also eased terms on auto loans. Demand for credit card and auto loans reportedly had increased somewhat, while demand for other types of consumer loans was about unchanged.

Large fractions of domestic and foreign respondents again reported having tightened standards on loans to European banks or their affiliates and subsidiaries. There was more widespread tightening of standards than in the previous survey on loans to nonfinancial firms that have operations in the United States and significant exposures to European economies. Demand for credit was reportedly little changed, on net, from European banks (or their affiliates and subsidiaries) and from nonfinancial firms with significant European exposures.On CRE:

A new special question asked if domestic respondents had experienced an increase in business over the past six months as a result of decreased competition from European banks (or their affiliates and subsidiaries). About half of the respondents who reported competing with European banks noted such an increase in business.

The January survey also included a question regarding changes in terms on CRE loans over the past year (repeated annually since 2001). During the past 12 months, on net, some domestic banks reportedly eased maximum CRE loan sizes and many domestic banks trimmed loan rate spreads. A few large domestic banks, on balance, reported that they had lengthened maximum loan maturities. Other terms for CRE loans were reportedly little changed. The January results were the first in five years to find a net easing in some of the CRE loan terms covered in the survey.On credit quality in 2012:

The January survey contained a set of special questions that asked banks about their outlook for delinquencies and charge-offs across major loan categories in the current year, assuming that economic activity progresses in line with consensus forecasts. These questions have been asked once each year for the past six years. Overall, between 15 and 60 percent of domestic banks, on net, expected improvements in delinquency and charge-off rates during 2012 in the major loan categories included in the survey.There are several charts here.

So far the European financial crisis hasn't led to tighter lending standards in the U.S., but standards remain pretty tight.

Dallas Fed Manufacturing Survey shows expansion in January

by Calculated Risk on 1/30/2012 10:39:00 AM

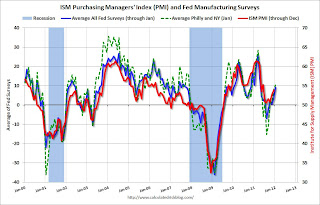

This is the last of the regional Fed surveys for January. The regional surveys provide a hint about the ISM manufacturing index - and all of the regional surveys were stronger in January.

From the Dallas Fed: Texas Manufacturing Activity Picks Up

Texas factory activity increased in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 0.2 to 5.8, suggesting growth resumed this month.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing conditions also indicated growth in January. The new orders index jumped to 9.5, its highest reading in six months, after two months in negative territory. ... Perceptions of broader economic conditions were notably more positive in January. The general business activity index shot up to 15.3 after dipping into negative territory in December.

...

Labor market indicators reflected continued labor demand growth. The employment index came in at 12.2, up from 9.9 in December. ... The hours worked index continued to suggest average workweeks lengthened.

...

Expectations regarding future business conditions were markedly more optimistic in January.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

The ISM index for January will be released Wednesday, Feb 1st and the regional surveys suggest another small increase in January. The consensus is for a slight increase to 54.5 from 53.9 in December.

Personal Income increased 0.5% in December, Spending decreased slightly

by Calculated Risk on 1/30/2012 08:32:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $61.3 billion, or 0.5 percent ... in December, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $2.0 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through December (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in December ... PCE price index -- The price index for PCE increased 0.1 percent in December, in contrast to a decrease of less than 0.1 percent in

November. The PCE price index, excluding food and energy, increased 0.2 percent, compared with an increase of 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.PCE decreased less than 0.1% in December, and real PCE decreased 0.1%.

Note: The PCE price index, excluding food and energy, increased 0.2 percent.

The personal saving rate was at 4.0% in December.

Not much of an increase in PCE since October.

Sunday, January 29, 2012

European Leaders: Austerity alone not answer

by Calculated Risk on 1/29/2012 07:28:00 PM

The European Union leaders meet in Brussels tomorrow and there is a growing recognition that austerity alone will not work. From the NY Times: E.U. Leaders Set to Admit Austerity Is Not Enough

European leaders are expected to conclude this week that what the debt-laden, sclerotic countries of the Continent need are a dose of economic growth.And on Greece from the NY Times: Greek Coalition Partners to Back New Reforms

...

A draft of the European Union summit meeting communiqué calls for ‘‘growth-friendly consolidation and job-friendly growth,’’ an indication that European leaders have come to realize that austerity measures, like those being put in countries like Greece and Italy, risk stoking a recession and plunging fragile economies into a downward spiral.

As Greece tries to reach a debt-swap agreement with its private creditors, the country’s prime minister suggested on Sunday that the three leaders in his fractious coalition were prepared to back additional austerity measures and reforms needed to receive a second bailout.Prime Minister Lucas Papademos is in the middle of a three ring circus negotiating with private creditors, negotiating with the "troika" (European Union, ECB, IMF), and negotiating with the various political parties in Greece.

Yesterday:

• Summary for Week Ending January 27th

• Schedule for Week of Jan 29th

Existing Home Inventory declines 17% year-over-year in January

by Calculated Risk on 1/29/2012 02:11:00 PM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this last year.

According to the deptofnumbers.com for monthly inventory (54 metro areas), listed inventory is probably back to early 2005 levels. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

This graph shows the NAR estimate of existing home inventory through December (left axis) and the HousingTracker data for the 54 metro areas through January.

Click on graph for larger image.

Click on graph for larger image.

Since the NAR released their revisions for sales and inventory, the NAR and HousingTracker inventory numbers are tracking pretty well.

Seasonally, housing inventory usually bottoms in December and January and then starts to increase again in February. So inventory should increase over the next 6+ months.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the January listings - for the 54 metro areas - declined 17% from the same month last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

HousingTracker reported that the January listings - for the 54 metro areas - declined 17% from the same month last year. The year-over-year decline will probably start to slow since listed inventory is getting close to normal levels. Also if there is an increase in foreclosures (as expected), this will give some boost to listed inventory.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. Shadow inventory could include bank owned properties (REO: Real Estate Owned), properties in the foreclosure process, other properties with delinquent mortgages (both serious delinquencies of over 90+ days, and less serious), condos that were converted to apartments (and will be converted back), investor owned rental properties, and homeowners "waiting for a better market", and a few other categories - as long as the properties are not currently listed for sale. Some of this "shadow inventory" will be forced on the market, such as completed foreclosures, but most of these sellers will probably wait for a "better market".

However listed inventory has clearly declined in many areas. And it is the listed months-of-supply (currently 6.2 months) combined with the number of distressed sales that mostly impacts prices.

Yesterday:

• Summary for Week Ending January 27th

• Schedule for Week of Jan 29th

Mortgage Settlement and New Investigation

by Calculated Risk on 1/29/2012 11:15:00 AM

Last week President Obama announced a new task force to investigate abuses related to the origination and securitization of mortgages during the housing bubble: "I am asking my Attorney General to create a special unit of federal prosecutors and leading state attorneys general to expand our investigations into the abusive lending and packaging of risky mortgages that led to the housing crisis."

Some people have argued that his will derail the proposed mortgage settlement.

Even though Eric Schneiderman, the New York attorney general will be a co-chair, it sounds like this will be a federal investigation and will be focused on origination and securtization abuses.

Loren Berlin at the HuffPo noted:

Senior officials at the Department of Justice were quick to emphasize that the fate of the settlement talks is unrelated to the new unit. "We have certainly heard criticisms that the settlement would give immunity for all [the mortgage-related misconduct], but that's simply not true ...This [unit] is addressing a very different problem than the servicing settlement," said one official.I've seen several commentaries that lump servicing and origination abuses together. Obviously the banks wanted broad immunity in any mortgage settlement, and the state attorneys general wanted narrower releases.

According to reports about the mortgage settlement, the banks would be released from claims brought by the states and the federal government for servicing and foreclosure abuses, but injured homeowners could still bring legal action.

And the states (but not the federal government) would release the banks from origination claims. Note: I could have the details wrong, but that is what has been reported.

Since the new task force is a federal investigation, my guess is this is intended to address complaints from some attorneys general about origination and securitization, since the states were being asked to release the banks on origination claims. So this new investigation doesn't sound like it will derail the mortgage servicer settlement - it might even lead to more states joining the settlement (although the banks may not like it).

Saturday, January 28, 2012

Europe Update: Greece nears debt deal

by Calculated Risk on 1/28/2012 08:43:00 PM

The European Union leaders meet in Brussels on Monday, and two key topics will be a "re-focus on growth and job creation"1 and Greece. Even if a deal is reached on the debt - and enough bondholders can be persuaded to participate - Greece still needs to come to terms on the next round of financing.

1Quote from European Council President Herman Van Rompuy.

From the WSJ: Greek Debt Deal, New Loan Agreement to Finish Next Week

Greece and its private sector creditors said Saturday they were on the verge of a deal to write off €100 billion ($132 billion) worth of the country's debt, pending the outcome of separate talks on a new, multi-billion euro bailout for Athens.From the NY Times: Greek Debt Talks Again Seem to Be on the Verge of a Deal

...

Effectively, the focus now shifts to a European summit in Brussels Monday where the continent's leaders will sanctify -- or not -- the terms of the debt restructuring and the new loan. But complicating those discussions are concerns that Greece's funding needs might be bigger than originally thought ...

[C]reditors now seem willing to accept a rate below 4 percent for the 30-year bonds — perhaps as low as 3.6 percent. ... Officials from the three institutions that are keeping the near-bankrupt nation financially afloat — the European Commission, the monetary fund and the European Central Bank — are demanding another round of spending cuts and reforms to justify a release of as much as 30 billion euros ($39 billion) in the months ahead.Here are a few key dates in Europe:

Jan 30th: European Union leaders meet in Brussels on debt crisis.

Feb 9th: ECB holds rate meeting.

Feb 20th: Euro-area finance ministers meet in Brussels.

Feb 29th to March 1st: Italy redeems 46.5 billion euros of bonds.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: Greece redeems 14.4 billion euros of bonds.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

Earlier:

• Summary for Week Ending January 27th

• Schedule for Week of Jan 29th