by Calculated Risk on 1/23/2012 08:46:00 PM

Monday, January 23, 2012

FHFA Analysis on Principal Forgiveness

The FHFA released their analysis on the effectiveness of principal reductions for Fannie and Freddie loans. The FHFA analysis showed that principal reductions would be more costly for taxpayers than other alternatives.

Here is the letter: FHFA Releases Analysis on Principal Forgiveness As Loss Mitigation Tool

Here is the analysis: FHFA Analyses of Principal Forgiveness Loan Modifications.

In considering principal forgiveness, FHFA compared taxpayer losses from principal forgiveness versus principal forbearance, which is an alternate approach that the Enterprises currently undertake to fulfill their mission at a lower cost to the taxpayer. FHFA based its conclusion that principal forgiveness results in a lower net present value than principal forbearance on an analysis initially prepared in December 2010, which is attached, along with updated analyses produced in June and December 2011, which are also attached.This is reminder that Fannie and Freddie loans were much better than the private label loans.

Putting this determination in context, as of June 30, 2011, the Enterprises had nearly three million first lien mortgages with outstanding balances estimated to be greater than the value of the home, as measured using FHFA’s House Price Index. FHFA estimates that principal forgiveness for all of these mortgages would require funding of almost $100 billion to pay down mortgages to the value of the homes securing them. This would be in addition to the credit losses both Enterprises are currently experiencing.

Another factor to consider is that nearly 80 percent of Enterprise underwater borrowers were current on their mortgages as of June 30, 2011. (Even for more deeply underwater borrowers – those with mark-to-market loan-to-value ratios above 115 percent, 74 percent are current.) This trend contrasts with non-Enterprise loans, where many underwater borrowers are delinquent.

Given that any money spent on this endeavor would ultimately come from taxpayers and given that our analysis does not indicate a preservation of assets for Fannie Mae and Freddie Mac substantial enough to offset costs, an expenditure of this nature at this time would, in my judgment, require congressional action.

...

While it is not in the best interests of taxpayers for FHFA to require the Enterprises to offer principal forgiveness to high LTV borrowers, a principal forgiveness strategy might reduce losses for other loan holders. Indeed, in several of the examples cited, such as Ocwen and Wells Fargo, principal forgiveness is being offered to borrowers whose loans the investor or servicer purchased at a discount, which would likely change the analytics significantly. ... Additionally, less than ten percent of borrowers with Enterprise loans have negative equity in their homes (9.9 percent in June 2011), whereas loans backing private label securities were more than three times more likely to have negative equity (35.5 percent in June 2011).

As an aside: Here is a table from the report (as of June 30, 2010). This shows the total loans, the UPB (Unpaid Principal Balance) and the number of loans current. Of course house prices have fallen over the last 18 months, and there have been other changes (refinances, foreclosures, home sales), but this gives an idea of the number of HARP eligible loans for refinancing once the program becomes automated in March. HARP will apply to all current loans with LTV greater than 80% (about 7 million loans).

Note: There are just over 50 million first mortgage liens, so as of June 2010, Fannie and Freddie held about 60% of the mortgages - but a much smaller percentage of the delinquent loans.

| Fannie and Freddie: MTM LTV Distribution June 30, 2010 | |||||

|---|---|---|---|---|---|

| UPB ($ Billions) | Total Loans (000s) | Percent of UPB | Current (000s) | Percent Current | |

| LTV Missing | $27.5 | 346 | 1.1% | 315 | 91.0% |

| LTV <= 80% | $2,994.4 | 21,547 | 71.2% | 20,821 | 96.6% |

| 80 < LTV < 105 | $1,206.5 | 6,461 | 21.4% | 5,801 | 89.8% |

| 105 < LTV < 115 | $140.2 | 704 | 2.3% | 512 | 72.8% |

| 115 < LTV <= 150 | $235.9 | 1,069 | 3.5% | 804 | 75.2% |

| LTV > 150% | $29.6 | 135 | 0.4% | 43 | 31.8% |

| Total | $4,634.1 | 30,262 | 100.0% | 28,296 | |

| Source: Historical Loan Performance dataset. Excludes modifications and foreclosure alternatives. LTVs updated using FHFA's Monthly Purchase Only House Price Index. | |||||

DOT: Vehicle Miles Driven declined 0.9% in November

by Calculated Risk on 1/23/2012 06:58:00 PM

The Department of Transportation (DOT) reported:

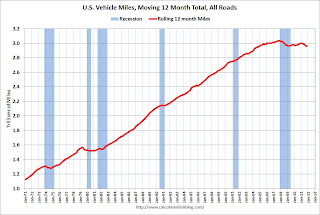

• Travel on all roads and streets changed by -0.9% (-2.1 billion vehicle miles) for November 2011 as compared with November 2010.The following graph shows the rolling 12 month total vehicle miles driven.

• Travel for the month is estimated to be 240.9 billion vehicle miles.

• Cumulative Travel for 2011 changed by -1.4% (-38.3 billion vehicle miles).

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 48 months - and still counting! And not just moving sideways ... the rolling 12 month total is still declining.

The second graph shows the year-over-year change from the same month in the previous year.

This is the ninth straight month with a year-over-year decline in miles driven, although this is the smallest decline for 2011.

This is the ninth straight month with a year-over-year decline in miles driven, although this is the smallest decline for 2011. The decline in miles driven is probably due to a combination of high gasoline prices, a sluggish economy and some changes in driving habits.

Hotels: STR on 2011 results, 2012 forecast

by Calculated Risk on 1/23/2012 03:21:00 PM

A few numbers and a forecast from STR Chairman Randy Smith: Operating margins expected to rise in 2012

2011 numbers:

Demand increased 5%.

Supply (room available) increased 0.6%.

ADR (average daily rates) increased 3.8%.

RevPAR (Revenue per available room) increased 8.2%

2012 forecast from STR:

Demand: "We are currently forecasting room demand to grow about 1.3% during 2012."

Supply: "At this time, we are forecasting a modest increase in room supply for 2012 of 0.8%, which should not impact occupancy significantly."

ADR (average daily rates): 3.8% increase

RevPAR (Revenue per available room): "With modest gains in occupancy and stronger increases in room rates, we expect RevPAR to increase about 4.3% during 2012."

STR expect hotel construction to pickup soon with more deliveries in 2013: "As we enter 2012, room supply barely is keeping pace with room closures, and it could be the beginning of 2013 before we start seeing significant growth in room supply."

Since it takes some time to build hotel rooms, it might take until 2014 or later to see "significant growth in room supply".

Click on graph for larger image.

Click on graph for larger image.

This graph shows investment in lodging as a percent of GDP. There was a sharp boom in lodging investment during the bubble, and lodging investment peaked at 0.32% of GDP in Q2 2008. However investment has fallen over 80% since then and investment is now near historic lows. With limited supply, increased demand translates to a higher occupancy rate, higher room rates and improved margins for hotels - and eventually more new construction and jobs.

It is still far from rosy for hotel owners, as Smith mentions RevPAR and occupancy are still below the pre-recession levels. And there are still plenty of distressed hotels since a number of investors bought at the top, see: California hotel foreclosures jump in 2011

Lenders foreclosed on 230 hotels in 2010, up from 138 the year before, Atlas Hospitality Group said in a report.

AP reports $25B Mortgage Settlement goes to states for review

by Calculated Risk on 1/23/2012 12:27:00 PM

From the AP: $25B US mortgage deal goes to states (ht Terry)

The AP reports that a draft settlement "has been sent to state officials for review".

The agreement could be a adopted within "weeks".

As I noted over the weekend, President Obama will probably mention several housing initiatives - including this settlement - in the SOTU address tomorrow night.

There are some details in the article.

Weekend:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview

Morning Greece: Euro Zone Finance Ministers discuss possible debt deal

by Calculated Risk on 1/23/2012 09:09:00 AM

The new goal is to have a deal by next Monday, January 30th, when the EU leaders meet in Brussls.

From Reuters: Euro Zone Finance Ministers to Rule on Glacial Greek Debt Talks

Euro zone finance ministers will decide on Monday what terms of a Greek debt restructuring they are ready to accept as part of a second bailout package for Athens after negotiators for private creditors said they could not improve their offer.Here are a few key dates in Europe:

...

"We will listen to the report on the negotiations, see how far they have gotten and have the ministers say what is acceptable and what is not in terms of outcome of the negotiations," one Eurogroup official said.

Once the guidance from the finance ministers, known as the Eurogroup, is clear, talks on the restructuring could be finalized later in the week.

Jan 30th: European Union leaders meet in Brussels on debt crisis.

Feb 9th: ECB holds rate meeting.

Feb 20th: Euro-area finance ministers meet in Brussels.

Feb 29th to March 1st: Italy redeems 46.5 billion euros of bonds.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: Greece redeems 14.4 billion euros of bonds.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France holds a presidential election.

Weekend:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview

Sunday, January 22, 2012

Greece: Still no deal on debt

by Calculated Risk on 1/22/2012 09:20:00 PM

Another update ... still a mess.

From Landon Thomas at the NY Times: Greek Talks Hit a Snag Over Rates

While considerable progress has been made, Greece’s financial backers — Germany and the International Monetary Fund — have been unyielding in their insistence that the longer-term bonds that would replace the current securities must carry yields in the low 3 percent range, officials involved in the negotiations said on Sunday.Earlier:

...

Also holding up discussions was the question of what to do about the European Central Bank’s 55 billion euros in Greek bonds. ... To get around this, officials are now discussing the possibility that Europe’s rescue fund might lend money to Greece to allow it to buy the bonds back from the European Central Bank at the price the bank paid for them — thought to be about 75 cents on the euro.

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

• FOMC Meeting Preview

FOMC Meeting Preview

by Calculated Risk on 1/22/2012 03:20:00 PM

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to "extend the average maturity of its holdings of securities" (scheduled to end in June 2012), or to the program to "reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities". I don't expect further accommodation (aka "QE3") to be announced at this meeting.

On Wednesday the FOMC statement will be released around 12:30PM and Fed Chairman Ben Bernanke will hold a quarterly press briefing at 2:15 PM ET.

A few things to look for:

1) FOMC participants' projections of the appropriate target federal funds rate. This will the first quarterly release of the participants' view of the appropriate path for the Fed funds rate. On Friday the Fed released blank templates for reporting participants' views. The first chart "Appropriate Timing of Policy Firming" will show when participants judge that the first increase in the target federal funds rate from its current range will occur. The second chart will the participants' view of the "Appropriate Pace of Policy Firming".

These charts will probably show that most participants judge that the first rate increase will occur in 2014 or later, and that most participants believe the appropriate policy path through 2013 will be no change in the Fed's fund rate.

2) Fed Chairman Press Briefing. At the press briefing, Chairman Bernanke will discuss the new FOMC forecasts including the two new charts on the Fed funds rate. Growth forecasts were routinely revised down all through 2011, and it is likely that GDP growth for 2012 will be revised down slightly again this month. However the unemployment rate for 2012 might be revised down or left unchanged.

I expect Bernanke will be asked about the possibility of a large scale MBS purchase program, but it appears too early for "QE3".

Here are the updated forecasts from the November meeting. The GDP projection for 2012 will probably be revised down slightly from the 2.5% to 2.9% range.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 1.6 to 1.7 | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

The unemployment rate declined to 8.5% in December, and the projection for 2012 will probably be revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 9.0 to 9.1 | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

The forecasts for overall and core inflation will probably be mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 2.7 to 2.9 | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2011 | 2012 | 2013 | 2014 |

| November 2011 Projections | 1.8 to 1.9 | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

If the economy under performs or even tracks the November projections, QE3 would seem likely at either of the two day meetings in April or June. Some have argued that QE3 could happen sooner, perhaps at the March meeting. If the economy performs better than expected, then the Fed will probably wait longer.

3) Possible Statement Changes. The FOMC met in December, and not much has changed - so the statement will probably be very similar to the December statement.

Investors will probably focus on any change to the sentence in the second paragraph: "Strains in global financial markets continue to pose significant downside risks to the economic outlook."

The FOMC will probably reiterate that they stand ready to take further action: "The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools to promote a stronger economic recovery in a context of price stability."

The sentence "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013" will be removed and replaced with the Fed funds rate projections.

I expect the focus will be on the press briefing and the FOMC forecasts.

Yesterday:

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

Q4 GDP Forecasts: Sluggish Growth

by Calculated Risk on 1/22/2012 10:53:00 AM

The advance Q4 GDP report will be released on Friday. The consensus is that real GDP increased 3.0% annualized in Q4. Here are a few forecasts:

From Merrill Lynch:

We expect real GDP advanced 2.7% annualized in the fourth quarter after rising 1.8% in Q3. Nearly a full percentage of the growth last quarter stemmed from inventory accumulation, which means that domestic final sales rose just 1.7%. ... Stepping back, the broader story is that as the shocks of last summer have dissipated, the economy has picked up momentum. However, the bounce we’ve seen is fairly feeble ...From Goldman Sachs:

We estimate that real GDP increased by 3.2% (annualized) in Q4, up from 1.8% in Q3. Despite this momentum in the recent data, we still expect growth to slow somewhat in the first half of 2012. ... we expect the Euro-area crisis to weigh somewhat more heavily on growth than it has done so far, mainly via financial channels.And a few more forecasts from a week ago via the WSJ MarketBeat:

Macroeconomic Advisers cut their estimate of fourth-quarter GDP from 3.3% to 3% today on the trade news. ... J.P. Morgan economists also cut their fourth-quarter estimates ... to 3% from 3.5%.Still sluggish growth.

Bank of America Merrill Lynch economist Neil Dutta cut his estimate ... "A wider trade gap implies weaker GDP; our Q4 tracking estimate is running 2.7% from 3.0% post retail sales. The broader story is that growth net of inventory accumulation – domestic demand – is softening as we head into 2012."

Saturday, January 21, 2012

Greek Debt Deal Update: Talks Continue

by Calculated Risk on 1/21/2012 08:37:00 PM

The talks are continuing, but it is unclear if a deal will be reached before the eurozone finance minister meeting on Monday.

From the Athens News: Dallara leaves Athens, talks to continue: sources

The representatives of Greece's private creditors have left Athens and debt swap talks will continue over the phone during the weekend, sources close to the negotiations said, adding that it was unlikely that a deal would be clinched before next week.From the Financial Times: Bondholders face additional losses on Greek debt

...

Athens is anxious to strike a deal before a meeting on Monday of eurozone finance ministers, just in time to set in motion the paperwork and approvals necessary to receive a new injection of aid to avoid a messy bankruptcy in March.

"The elements of an unprecedented voluntary PSI are coming into place," the Institute of International Finance said in a statement after Friday's three-hour evening negotiation session, referring to the bond swap scheme.

The Institute of International Finance, representing holders of some €200bn of Greek debt, on Saturday denied rumours the talks had stalled, saying that experts from its steering committee “will be working with Greek government officials on many aspects of the PSI."Earlier:

excerpt with permission

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd

Unofficial Problem Bank list declines to 963 Institutions

by Calculated Risk on 1/21/2012 05:24:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 20, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

With the FDIC back to closings and the OCC releasing its enforcement actions through mid-December 2011, the Unofficial Problem Bank List underwent several changes during the week. In all, there were seven removals and one addition, which leaves the list standing at 963 institutions with assets of $389.2 billion. A year ago, the list held 937 institutions with assets of $409.4 billion.Earlier:

Five of the seven removals were rehabilitations as the OCC terminated actions against Central National Bank, Junction City, KS ($834 million); Citizens National Bank of Paintsville, Paintsville, KY ($563 million); National Bank of Commerce, Superior, WI ($534 million); The First National Bank of Wynne, Wynne, AR ($255 million); and The First National Bank of Ipswich, Ipswich, MA ($276 million), which had been under an action since 2006.

There were three failures this week, but only two were on the Unofficial Problem Bank List -- Central Florida State Bank, Belleview, FL ($79 million Ticker: CEFB); and American Eagle Savings Bank, Boothwyn, PA ($20 million). The other failure, The First State Bank, Stockbridge, GA ($537 million), was not on the list. It seems unusual for a bank to fail these days without being under a formal action. After some research, the bank in a 10-Q filing on August 13, 2010 disclosed the entering of a Consent Order with the FDIC on May 7, 2010. What is odd is this action does not seem to appear in an FDIC monthly press release or on its website (http://www.fdic.gov/bank/individual/enforcement/begsrch.html). Should anyone have luck finding this action at the FDIC let us know, otherwise it appears they were on double secret probation. First State Bank was costly as the FDIC estimates it will cost around 40 percent of the failed bank's assets.

Added this week was Naugatuck Valley Savings and Loan, Naugatuck, CT ($582 million Ticker: NVSL). Other changes include the OCC issuing Prompt Corrective Action Orders against Home Savings of America, Little Falls, MN ($440 million); and Charter National Bank and Trust, Hoffman Estates, IL ($98 million). Next week, we anticipate the FDIC to release its actions through December 2011.

• Summary for Week ending January 20th

• Schedule for Week of Jan 22nd