by Calculated Risk on 1/13/2012 01:49:00 PM

Friday, January 13, 2012

Ceridian-UCLA: Diesel Fuel index increased 0.2% in December

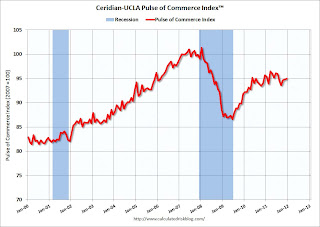

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.2 Percent in December

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.2 percent in December following the 0.1 percent increase in November and the 1.1 percent increase in October.

Although December’s news is positive, the combined effect of the three consecutive positive months was not enough to offset the weakness of trucking last summer and the PCI in December 2011 is 1.2 percent below its June 2011 level.

...

Based on the latest PCI data, the forecast for December Industrial Production is a 0.29 percent increase when the government estimate is released on January 18.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and has only partially rebounded over the last three months. Mostly this index moved sideways in 2011 (down 0.7% from December 2010).

Note: This index does appear to track Industrial Production over time (with plenty of noise).

Financial Times: France and Austria face Downgrades, Greek Debt talks "collapse"

by Calculated Risk on 1/13/2012 11:39:00 AM

From the Financial Times: Eurozone nations face S&P downgrade

Eurozone governments are bracing ... after Standard & Poor’s, the rating agency, told them it would downgrade two of the eurozone’s six triple A nations.From the Financial Times: Greek debt restructuring talks collapse

One official told the Financial Times that France and Austria were due to be downgraded but this was not confirmed ...

excerpt with permission

Talks over Greece’s debt restructuring collapsed on Friday ... makes it more likely Athens will become the first government of a developed country in more than 60 years to suffer a full-scale default on its debt.

Lead negotiators for Greek bondholders said the latest offer made by Athens “has not produced a constructive consolidated response from all parties”– a clear reference to International Monetary Fund conclusions that bondholder losses must be increased significantly or a second Greek bail-out would have to be bigger than the agreed €130bn.excerpt with permission

Consumer Sentiment increases in January

by Calculated Risk on 1/13/2012 09:55:00 AM

The preliminary January Reuters / University of Michigan consumer sentiment index increased to 74.0, up from the December reading of 69.9.

Click on graph for larger image.

Most of the recent sharp decline was event due to the debt ceiling debate, and sentiment has rebounded as expected. Now it is all about jobs, wages - and gasoline prices.

Sentiment is still fairly weak, although above the consensus forecast of 71.5.

Trade Deficit increased in November to $47.8 Billion

by Calculated Risk on 1/13/2012 08:48:00 AM

The Department of Commerce reports:

[T]otal November exports of $177.8 billion and imports of $225.6 billion resulted in a goods and services deficit of $47.8 billion, up from $43.3 billion in October, revised. November exports were $1.5 billion less than October exports of $179.4 billion. November imports were $2.9 billion more than October imports of $222.6 billion.The trade deficit was above the consensus forecast of $45.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through November 2011.

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in November. Imports had been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 10% compared to November 2010; imports are up about 13% compared to November 2010.

The second graph shows the U.S. trade deficit, with and without petroleum, through November.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $102.50 per barrel in November. The trade deficit with China declined slightly to $27 billion.

Exports to eurozone countries declined 6.9% in November. And the trade deficit with the European Union widened to $9.7 billion from $7.2 billion in November 2010.

Thursday, January 12, 2012

Foreclosures and Short Sale percentages for a few areas

by Calculated Risk on 1/12/2012 09:45:00 PM

CR Note: There are only a few areas where the MLS breaks down monthly sales by foreclosure, short sales and conventional (non-distressed) sale. I've been tracking the Sacramento market to watch for changes in the mix over time. (here was my post earlier this week: Distressed House Sales using Sacramento Data)

Economist Tom Lawler sent me the following today for a few other areas:

"The below table is based on reports from local realtor associations/boards based on MLS data, which may not be fully and completely accurate (heh, heh!)

Note that (1) for most of the areas, the distressed share of sales is down from last December, though in many cases it remains quite elevated; and (2) the short-sales share of sales increased in all areas – in some cases by quite a bit – while the foreclosure-sales share fell in all areas, in a few cases by a boatload, especially Phoenix."

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| Dec-10 | Dec-11 | Dec-10 | Dec-11 | Dec-10 | Dec-11 | |

| Las Vegas | 25.3% | 26.6% | 49.8% | 46.0% | 75.1% | 72.6% |

| Reno | 30.0% | 35.0% | 39.0% | 34.0% | 69.0% | 69.0% |

| Phoenix | 21.3% | 32.2% | 48.3% | 27.6% | 69.6% | 59.8% |

| Sacramento | 22.6% | 30.2% | 44.4% | 33.9% | 67.0% | 64.1% |

| Minneapolis | 12.7% | 14.6% | 41.7% | 34.6% | 54.4% | 49.2% |

| Mid-Atlantic (MRIS) | 11.3% | 14.3% | 23.7% | 15.4% | 35.0% | 29.7% |

CR Note: The table is a percentage of total sales.

Short sales are up in all areas, and foreclosures are down. It appears that the total percent of distressed sales is declining too - although this could be related to the foreclosure process issues. At some point, the number and percent of distressed sales should start to decline significantly.

Lawler: Early Read on December Existing Home Sales

by Calculated Risk on 1/12/2012 06:48:00 PM

From economist Tom Lawler:

Based on the incoming reports I’ve seen so far, I estimate that existing home sales based on the NAR’s methodology and reflecting last month’s controversial benchmark revisions, ran at a seasonally adjusted annual rate of about 4.64 million, up about 5% from November’s pace, and up about 4.3% from last December’s pace.

On the inventory front, MLS across the country reported some hefty monthly declines in listings, and most reported YOY declines for December that exceeded November. As I’ve noted before, however, “matching” reported listings with the NAR inventory numbers has been challenging in any given month. My “best guess” is that the NAR will report an existing home inventory number in December of around 2.44 million, down 5.4% from November and down 19.2% from last December.

The plunge in home listings, to levels not seen since 2005, has only been highlighted by a few analysts and folks in the media, but it’s actually a BIG DEAL.

On the median sales price front, I expect the NAR to report a median existing home sales price that is about 3.5% lower than last December.

CR Note: The NAR is scheduled to release December existing home sales on Friday, January 20th at 10:00 AM ET. Based on Tom's estimates of sales and inventory, this would put months-of-supply at around 6.3 months (lowest since early 2006), and would put listed inventory at the lowest level since early-2005.

Record Low Mortgage Rates compared to Refinance Index

by Calculated Risk on 1/12/2012 04:11:00 PM

From Freddie Mac: Mortgage Rates Continue Trend of Record-Breaking Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates easing to new all-time record lows for all products covered in the survey ... The average for the 30-year fixed mortgage rate has been below 4.00 percent for six consecutive weeks.

...

30-year fixed-rate mortgage (FRM) averaged 3.89 percent with an average 0.7 point for the week ending January 12, 2012, down from last week when it averaged 3.91 percent. Last year at this time, the 30-year FRM averaged 4.71 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971. Mortgage rates are currently at the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a huge refinance boom - and rates might not fall that far - 30 year conforming mortgage rates were at 4.23% in October 2010, so a 50 bps drop would be 3.73%.

However there will probably be a significant increase in refinance activity in March from borrowers with negative equity and loans owned or guaranteed by Fannie or Freddie (the automated HARP starts in March).

The FOMC 2006 Transcripts

by Calculated Risk on 1/12/2012 01:39:00 PM

The FOMC transcripts for 2006 are now online.

Binyamin Appelbaum at the NY Times is reading through them. A few comments from his twitter feed (most recent first):

Bies, cont. " However... let me just say that the bottom line is that overall mortgage credit quality is still very, very strong. "

Bies, Oct. '06: "We are also seeing in a small way increased predatory activity with loans..."

Yellen, Oct. '06: "Of course, housing is a relatively small sector of the economy, and its decline should be self-correcting."

Stern, Oct. '06: "The housing situation notwithstanding, I remain somewhat more optimistic about our prospects for real growth..."

Mishkin, Sept. '06: "The excesses in the housing sector seem to be unwinding in an acceptable way... I'm actually quite positive."

Warsh, Sept. '06: "Capital markets are probably more profitable and more robust at this moment... than they have perhaps ever been."

Geithner, cont. "If we see a more-pronounced actual decline in housing prices, will that have greater damage on confidence and spending?"

Geithner, Sept. '06: "We just don’t see troubling signs yet of collateral damage, and we are not expecting much."

Guynn, stepping down from the FOMC: "I’m counting on all of you to protect the buying power of my hard-earned retirement savings."

Lacker, Sept. '06: "I’m still fairly skeptical of large indirect spillover effects on employment or consumption.”

Minehan, cont. "So it is hard actually for me to see that residential investment will be that hard hit that long."

Minehan, Sept. 06: "Buyers should recognize housing [is] more affordable & resume purchases, perhaps w/out further major price declines."

Yellen, cont. "Houses [in Boise]... are now being dressed up to look occupied... so as not to discourage potential buyers."

Yellen, Sept. '06: "The speed of the falloff in housing activity and the deceleration in house prices continue to surprise us..."

Fed staff, Sept. '06: "We are not projecting large declines nationwide in house prices."

Fed staff, Aug. '06: "We forecast single-family starts will bottom out at annual rate of 1.43m units." //Actual low (so far): 445k in '09

Bies, cont. "...rather than being a drain going forward and that will also get the growth rate more positive."

Bies, June '06: "So I really believe that the drop in housing is actually on net going to make liquidity available for other sectors..."

Geithner, June '06: "We see a pretty healthy adjustment process under way... The world economy still looks pretty robust to us."

Guynn, June '06: "...Of greater concern to me, however, is the inflation outlook."

Guynn, June '06: "We are geting reports that builders are now making concessions... even throwing in a free Mini Cooper -- [LAUGHTER]."

Fed staff report, June '06: "We have not seen—and don’t expect—a broad deterioration in mortgage credit quality."

Bernanke, March 2006: "Again, I think we are unlikely to see growth being derailed by the housing market."

Remittances to Mexico Rebound

by Calculated Risk on 1/12/2012 11:34:00 AM

This is another indication of an improving labor market.

From Ricardo Lopez at the LA Times: Remittances to Mexico are rebounding

Head to 4th Street and Broadway in downtown Los Angeles and you'll see signs of a labor market on the mend.

At a Continental Currency Services Inc. branch, a check-cashing and money-transfer business, housekeeper Maria Guadalupe Gutierrez waited patiently in line on a recent afternoon to wire $200 to her mother in Chiapas, Mexico.

...

Ending a three-year slump, remittances to Mexico are finally on the upswing, thanks to an improving U.S. job market. Analysts expect that money sent home last year by Mexicans living abroad, most of them residing in the United States, will top $23 billion when Mexico's central bank releases annual figures this month. Although still below the peak of $26 billion in 2007, that would be a solid 8% increase over 2010.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of the annual remittances to Mexico. This is money sent home by Mexicans worldwide, although this is mostly from the US. The data is from Banco de México.

Remittances increased sharply during the housing bubble, and declined by about 15% in 2009. Remittances will probably increase about 8% this year.

Retail Sales increased 0.1% in December

by Calculated Risk on 1/12/2012 09:00:00 AM

On a monthly basis, retail sales were up 0.1% from November to December (seasonally adjusted, after revisions), and sales were up 6.5% from December 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $400.6 billion, an increase of 0.1 percent (±0.5%)* from the previous month and 6.5 percent (±0.7%) above December 2010.Sales for November were revised up from a 0.2% increase to 0.4%. Retail sales excluding autos decreased 0.2% in December.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.4% from the bottom, and now 5.9% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.1% on a YoY basis (6.5% for all retail sales). Retail sales ex-gasoline increase 0.3% in December.

Retail sales ex-gasoline increased by 6.1% on a YoY basis (6.5% for all retail sales). Retail sales ex-gasoline increase 0.3% in December.This was well below the consensus forecast for retail sales of a 0.4% increase in December, and a 0.4% increase ex-auto.