by Calculated Risk on 1/06/2012 08:30:00 AM

Friday, January 06, 2012

December Employment Report: 200,000 Jobs, 8.5% Unemployment Rate

From the BLS:

Nonfarm payroll employment rose by 200,000 in December, and the unemployment rate,The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

at 8.5 percent, continued to trend down, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in transportation and warehousing, retail trade, manufacturing, health care, and mining.

...

The change in total nonfarm payroll employment for October was revised from +100,000 to +112,000, and the change for November was revised from +120,000 to +100,000.

Click on graph for larger image.

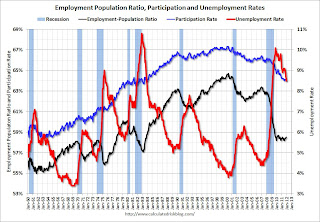

Click on graph for larger image.The unemployment rate declined to 8.5% (red line).

The Labor Force Participation Rate was unchanged 64.0% in December (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio was unchanged at 58.5% in December (black line).

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. This was a decent report and above consensus, but expectations are pretty low. I'll have much more soon ...

Reis: Office Vacancy Rate declines slightly in Q4 to 17.3%

by Calculated Risk on 1/06/2012 12:05:00 AM

From Reuters: Office vacancies fell in Q4 as rents rose: Reis

The vacancy rate dipped to 17.3 percent in the quarter from 17.4 percent in the third quarter and 17.6 percent at the end of 2010, Reis said. ... effective rents ... rose 0.5 percent ... Some 12.3 million square feet of new office space came to market last year, it said, the lowest such level in 15 years.

"After four quarters of squeezing out gains in occupancy, the office sector has assuredly turned the corner and begun the process of recovery," Reis research chief Victor Calanog said ... "Still, given the severity of the last downturn and the lackluster pace of economic growth, it will be years before the office sector climbs out of the hole."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate declined to 17.3% in Q4, down from 17.4% in Q3. The vacancy rate was at a cycle high of 17.6% in Q3 and Q4 2010. It appears the office vacancy rate peaked in 2010 and is declining very slowly.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

Thursday, January 05, 2012

Report: Greek Debt Deal Near

by Calculated Risk on 1/05/2012 07:30:00 PM

From the WSJ: Greece Debt Negotiations Move Toward Deal

The Greek government expects to wrap up talks seeking a 50% writedown on its debt owed to creditor banks by the end of this month ... Greece has agreed to consider that the new bonds be governed by English law, which means creditors would be allowed to seize Greek assets if the country fails on its payments. ... "If nothing changes we are hoping to have an agreement within the next three weeks or even earlier," a senior Greek government official said.Earlier this week I posted a few key dates for Europe, here are the next few (in addition to the Greek debt deal):

Jan 9th: German Chancellor Angela Merkel and French President Nicolas Sarkozy meet in Berlin.Meanwhile the Italian 10 year yield is back above 7%, and the Spanish 10 year yield is up to 5.64%.

Jan 24th: EU finance ministers meet in Brussels.

Jan 30th: European Union leaders meet in Brussels on debt crisis.

Earlier:

• Reis: Apartment Vacancy Rate falls to 5.2% in Q4, Lowest since 2001

• ADP: Private Employment increased 325,000 in December

• Weekly Initial Unemployment Claims decline to 372,000

• ISM Non-Manufacturing Index indicates slightly faster expansion in December

• Employment Situation Preview: Improved, but still not strong

Survey: Small Business Owners report small decline in employment, hiring plans positive

by Calculated Risk on 1/05/2012 03:51:00 PM

Note: NFIB’s monthly small business survey for December will be released on Tuesday, January 10, 2012.

From the National Federation of Independent Business (NFIB): NFIB Jobs Statement: No Rally in Jobs at Close of 2011, but Small Business is Cautiously Optimistic about 2012

Chief economist for the National Federation of Independent Business (NFIB) William C. Dunkelberg, issued the following statement on the December job numbers, based on NFIB’s monthly economic survey that will be released on Tuesday, January 10, 2012. ...Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“Unfortunately, December’s jobs numbers fizzled, with the net change in employment per firm turning negative again; small businesses lost an average .15 workers per firm. ... The good news is that the number of owners cutting jobs has ‘normalized’. In the past several months, reports of those cutting workers have been at the lowest levels since the recession started in December 2007. ... Over the next three months ... a seasonally adjusted net 6 percent of owners planning to create new jobs, a 1 point decline but still one of the strongest readings since September 2008.

Here is a graph of the net hiring plans for the next three months since 1986.

Here is a graph of the net hiring plans for the next three months since 1986.Hiring plans declined slightly in December, but the trend is up.

It is no surprise that small businesses are struggling due to the high concentration of real estate related companies in the survey. This is another slightly discouraging survey before the BLS report tomorrow.

Earlier:

• Reis: Apartment Vacancy Rate falls to 5.2% in Q4, Lowest since 2001

• ADP: Private Employment increased 325,000 in December

• Weekly Initial Unemployment Claims decline to 372,000

• ISM Non-Manufacturing Index indicates slightly faster expansion in December

• Employment Situation Preview: Improved, but still not strong

Employment Situation Preview: Improved, but still not strong

by Calculated Risk on 1/05/2012 01:29:00 PM

Tomorrow (Friday) the BLS will release the December Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 150,000 payroll jobs in December, and for the unemployment rate to increase slightly to 8.7%. The consensus is probably moving up based on recent reports.

Here is a summary of recent data:

• The ADP employment report showed an increase of 325,000 private sector payroll jobs in December. Although ADP seems to track the BLS over time, the ADP report hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 24,000 on average per month this year, so this suggests around 325,000 private nonfarm payroll jobs added, minus 24,000 government workers - or around 301,000 total jobs added in December.

However we need to use caution with the ADP report in December. From Jan Norman at the O.C. Register:

... Joel Prakken, chairman of Macroeconomic Advisers, cautioned that the number may be inflated by an annual accounting correction that ADP does with its customers' data every December. That procedure tends to overstate seasonal adjustment of job gains in the aftermath of a recession.And an explanation from Goldman's Andrew Tilton last year:

Because the ADP report counts the number of people on payrolls, regardless of how many hours they worked (or whether they worked at all), its accuracy depends on company payrolls being up to date. In reality, some companies do not immediately delete departing workers from their payroll records. Those that do not often wait until the end of the year. As a result, December in particular typically sees a meaningful decline in payrolls in the raw ADP data. The reported data are adjusted in an attempt to account for this behavior, but insofar as “purging” occurs to a greater or lesser extent than usual, it could affect the reported numbers. In particular, there was probably less purging in 2010 than in recent years, since data from the Labor Department make plain that the level of “separations” (layoffs or quits) declined this year. If this was less-than-fully accounted for by seasonal adjustment, the reported figure could show a large gain. (Note that the Labor Department’s survey does not suffer from the “purging” problem, since in that survey a person has to have actually reported hours in the survey period to be counted as employed.)So ADP is probably overstating employment gains again this year.

• The ISM manufacturing employment index increased to 55.1% from 51.8% in November. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests the gain of ten thousand or so private sector payroll jobs for manufacturing in December.

The ISM service employment index increased to 49.4% from 48.9% in November. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 45,000 private payroll jobs for services in December.

Overall the ISM surveys do not suggest a strong employment report.

• Initial weekly unemployment claims averaged about 375,000 in December, down from 396,000 per week in November, and down from 405,000 per week in October.

For the BLS reference week (includes the 12th of the month), initial claims were at the lowest level since May 2008. This is a very positive sign.

• The final December Reuters / University of Michigan consumer sentiment index increased to 69.9, up from the November reading of 64.1. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. In general this low level would suggest a weak labor market - but slightly better than in the July through November period (the BLS reported an average of 132,000 per month for those five months).

• And on the unemployment rate from Gallup: Gallup Finds U.S. Unemployment Holding at 8.5% in December

Gallup finds U.S. unemployment, not seasonally adjusted, at 8.5% in December -- the same as at the end of November, but down from 9.6% a year ago. Gallup's unemployment measure suggests the government is likely to report essentially no change for December 2011 in its seasonally adjusted unemployment rate, though this December is especially hard to predict.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. This does suggest little change in the headline seasonally adjusted unemployment rate.

There always seems to be some randomness to the employment report, but the overall situation has improved (lower initial weekly unemployment claims, more job openings). However the ADP report is probably overstating December job growth, and the ISM surveys still suggest sluggish job growth - I'll take the over (above 150,000), but I don't expect a strong report as suggested by ADP.

ISM Non-Manufacturing Index indicates slightly faster expansion in December

by Calculated Risk on 1/05/2012 10:00:00 AM

The December ISM Non-manufacturing index was at 52.6%, up from 52.0% in November. The employment index increased in December to 49.4%, up from 48.9% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 25th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52.6 percent in December, 0.6 percentage point higher than the 52 percent registered in November, and indicating continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 56.2 percent, which is the same reading as reported in November, reflecting growth for the 29th consecutive month. The New Orders Index increased by 0.2 percentage point to 53.2 percent. The Employment Index increased 0.5 percentage point to 49.4 percent, indicating contraction in employment for the third time in the last four months. The Prices Index decreased 1.3 percentage points to 61.2 percent, indicating prices increased at a slower rate in December when compared to November. According to the NMI, 11 non-manufacturing industries reported growth in December. Respondents' comments are mixed and vary by industry and company. Economic growth continues to be slowed by the lag in employment."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.4% and indicates slightly faster expansion in December than in November.

Weekly Initial Unemployment Claims decline to 372,000

by Calculated Risk on 1/05/2012 08:40:00 AM

The DOL reports (press release added):

In the week ending December 31, the advance figure for seasonally adjusted initial claims was 372,000, a decrease of 15,000 from the previous week's revised figure of 387,000. The 4-week moving average was 373,250, a decrease of 3,250 from the previous week's revised average of 376,500.The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 373,250.

This is the lowest level for the 4-week average since June 2008.

And here is a long term graph of weekly claims:

The 4-week moving average is still falling and is now well below 400,000.

The 4-week moving average is still falling and is now well below 400,000.This suggests fewer layoffs and more payroll jobs added in December.

ADP: Private Employment increased 325,000 in December

by Calculated Risk on 1/05/2012 08:15:00 AM

ADP reports:

Private-sector employment increased by 325,000 from November to December on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The ADP National Employment Report, created by Automatic Data Processing, Inc. (ADP®), in partnership with Macroeconomic Advisers, LLC, is derived from actual payroll data and measures the change in total nonfarm private employment each month. The estimated gain in employment from October to November was revised down slightly to 204,000 from the initially reported 206,000.This was well above the consensus forecast of an increase of 160,000 private sector jobs in December. The BLS reports on Friday, and the consensus is for an increase of 150,000 payroll jobs in December, on a seasonally adjusted (SA) basis.

Government payrolls have been shrinking by about 24,000 per month this year. So this suggests around 325,000 private nonfarm payroll jobs added, minus 24,000 government workers - or around 301,000 total jobs added in December. Of course ADP hasn't been very useful in predicting the BLS report.

Reis: Apartment Vacancy Rate falls to 5.2% in Q4, Lowest since 2001

by Calculated Risk on 1/05/2012 12:36:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 5.2% in Q4 from 5.6% in Q3. The vacancy rate was at 6.6% in Q4 2010 and peaked at 8.0% at the end of 2009.

From the WSJ: Apartment-Vacancy Rate Tumbles to 2001 Level

The nation's apartment-vacancy rate in the fourth quarter fell to its lowest level since late 2001 ... In the fourth quarter, the vacancy rate fell to 5.2% from 6.6% a year earlier and 5.6% at the end of the third quarter, according to Reis.

During the depths of the downturn, landlords had to offer incentives such as flat-screen TVs and months with no rent to attract tenants. But in the fourth quarter of 2011, landlords in 71 of the 82 of the markets that Reis follows were able to raise rents. ... Nationwide, landlords raised asking rents an average of 0.4% in the fourth quarter, to $1,064 a month. That's up from $1,026 in 2009.

But rent increases showed signs of moderating in some markets and, overall, they were less than Reis had expected.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere. More from Bloomberg: U.S. Apartment Vacancies Decline to a Decade Low of 5.2%, Rents Increase

“The sector is benefiting from some of the lowest figures for new construction on record,” Calanog said. “By 2013, the influx of new units may begin eroding any benefit the sector derives from tight supply conditions.”A few key points we've been discussing all year:

A total of 8,865 new units became available in the fourth quarter, the second-fewest for any three-month period in Reis records dating to 1999. The first quarter of 2011 had the fewest units, at 7,473.

For all of 2011, 37,678 units were completed, the lowest annual total in 31 years of Reis data. The previous record was 49,303 in 1993 during the savings and loan crisis.

• Apartment vacancy rates are falling fast.

• A record low number of multi-family units were completed in 2011.

• Multi-family starts are increasing, and that is helping both GDP and employment growth this year. These new starts will not be completed until 2012 or 2013, so vacancy rates will probably continue to decline.

Wednesday, January 04, 2012

Misc: ISM Seasonality, Economic predictions with Search Engines and more

by Calculated Risk on 1/04/2012 09:10:00 PM

A few interesting reads ...

• From FT Alphaville: ‘Tis (still) the seasonality, ISM edition. An interesting discussion of seasonality, and how recent the recent ISM survey might be overstating strength.

• From the NY Fed: Forecasting with Internet Search Data. This is an attempt to get more recent information since data is released with a lag. I tried this with "New Homes" and it appears to track, but it is a little too noisy to use to predict new home sales from the Census Bureau.

• From Jon Lansner at the O.C. Register: Van line: Calif. jumps to No. 7 U.S. destination

Allied Van Lines’ 44th annual “Magnet States Report” says that at least by its own business patterns California is back as on the “inbound list” — states with more folks moving in than out. ... Illinois had the most net outbound losses followed by Pennsylvania, Michigan, New Jersey and New York.• From Tim Duy at Fed Watch: Still Cautious Heading Into 2012

Bottom Line: I want to believe the recent improvement in the tenor of economic data signals that activity is set to accelerate substantially in 2012. But the ups and downs on the past two years smoothed out to nothing exciting or catastrophic, just a moderate path of activity that remains woefully insufficient to return the US economy to its pre-recession trend. For now, I will stick to that middle ground, while remaining watchful of the all-too-many downside risks that leave me just a little bit sleepless each night.Earlier:

• U.S. Light Vehicle Sales at 13.56 million SAAR in December

• From the Federal Reserve: The U.S. Housing Market: Current Conditions and Policy Considerations

• Question #6 for 2012: Unemployment Rate