by Calculated Risk on 12/14/2011 11:48:00 AM

Wednesday, December 14, 2011

The Excess Vacant Housing Supply

Over the last few days, there has been some more discussion on the current number of excess vacant housing units in the United States.

There are always a large number of vacant housing units - this includes second homes, housing units for rent, homes sold but not yet occupied, and several other categories. The key is the "excess". Once the excess is absorbed in a local area, then new construction will pickup (we are already seeing an increase in apartment construction in many areas).

Here is the recent discussion, first from an article by Catherine Rampell over the weekend in the NY Times:

Household formation has slowed dramatically since the recession, as cash-strapped families double up and unemployed recent college graduates are unable to leave behind their parents’ couches. To judge just from demographic statistics, more than a million households that should have been formed in the last few years weren’t, according to Mark Zandi of Moody’s Analytics.Dean Baker responded: Mark Zandi and the NYT Hugely Underestimate the Number of Vacant Homes

The tally of missing households is approximately equal to the country’s current surplus of vacant homes.

The NYT cited Mark Zandi as saying the number of vacant homes is roughly 1 million, which he puts as equal to the gap in household formation that resulted from the recession. According to the Commerce Department, if the vacancy rate was back at its pre-bubble level, there would be 3 million fewer vacant units.Unfortunately Dr. Baker is using the Census Bureau's Housing Vacancies and Homeownership (CPS/HVS) survey, and there are serious questions about this survey. See Be careful with the Housing Vacancies and Homeownership report and Lawler to Census on Housing Data: "Splainin" Needed Not Just on Vacancy Rate. The HVS is based on a fairly small sample, and does not track the decennial Census data. Dr. Baker's estimate of 3 million excess vacant housing units is probably far too high.

Using the Census 2010 national data, Tom Lawler estimated "a number in the 1.6 to 1.7 million range seems about right.” (as of April 1, 2010) and "probably in the 1.2 to 1.4 million range on May 1, 2011."

Using the Census 2010 state data, I estimated that the number of excess vacant housing units was above 1.8 million on April 1, 2010 (the date of the Census). See: The Excess Vacant Housing Supply. The number of excess units is lower today - even with sluggish household formation - because the builders are completing a record low number of housing units this year.

Lawler's most recent estimate was as of May 1, 2011. We can walk that forward to today. The decline in the excess vacant housing units is equal to new households formed, minus completions, minus scrappage (demolitions). Completions are still at record lows, and the excess vacant housing supply has probably declined conservatively by another 200 to 300 thousand units over the last seven months - so the excess vacant housing supply is probably close to 1 million or so as the NY Times reported.

MBA: "Refinance Applications Increase as Rates Drop to 2011 Lows"

by Calculated Risk on 12/14/2011 08:38:00 AM

From the MBA: Refinance Applications Increase as Rates Drop to 2011 Lows

The Refinance Index increased 9.3 percent from the previous week to its highest level since November 4, 2011. The seasonally adjusted Purchase Index decreased 8.2 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.12 percent, the lowest rate this year, from 4.18 percent, with points decreasing to 0.45 from 0.48 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)decreased to 4.47 percent, the lowest rate this year, from 4.52 percent, with points decreasing to 0.45 from 0.47 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. ...

Click on graph for larger image.

Click on graph for larger image.The purchase index decreased last week, but the 4-week average increased slightly. This index has mostly been sideways for the last 2 years - and at about the same level as in 1997.

The MBA index was one of the indicators that NAR was overestimating existing home sales for the last several years.

Tuesday, December 13, 2011

DataQuick on SoCal: November Home Sales Rise

by Calculated Risk on 12/13/2011 10:15:00 PM

From DataQuick: Southland November Home Sales Rise; Median Price Still Below Year Ago

The number of homes sold in Southern California rose modestly last month from both October and a year earlier as investors and first-time buyers targeted homes priced below $400,000. Sales above $500,000 fell nearly 16 percent from a year earlier amid a troubled market for larger home loans ...Over half of existing home sales in SoCal were distressed sales in November; a very unhealthy market.

While November sales of existing (not new) houses and condos combined rose 5.8 percent from a year earlier, sales of newly built homes fell 15.2 percent to the lowest level on record for a November. [CR note: the Census Bureau reports new home sales when contracts are signed, DataQuick reports at closing - so this fits with the record low contracts reported earlier this year]

...

Distressed property sales accounted for 51.3 percent of the Southland resale market last month, down from 52.3 percent in October and down from 53.4 percent a year earlier. Nearly one out of three homes resold last month was a foreclosure, while roughly one in five was a “short sale.”

...

Absentee buyers, mainly investors and vacation-home buyers, purchased a near-record 24.8 percent of the Southland homes sold in November, paying a median $200,000.

NAR is scheduled to report November existing home sales on Wednesday, December 21st. The big story this month will be the downward revisions to sales and inventory for the years 2007 through 2011.

I expect the NAR to report sales in November in the low 4 million range on a seasonally adjusted annual rate basis (the NAR reported October sales at 4.97 million SAAR, but that will be revised down significantly).

Earlier:

• Retail Sales increased 0.2% in November

• BLS: Job Openings "essentially unchanged" in October

• Ceridian-UCLA: Diesel Fuel index increased 0.1% in November

• NFIB: Small Business Optimism Index increases in November

• Lawler on NAR Revisions for 2007 through 2011

Update: MF Global

by Calculated Risk on 12/13/2011 06:42:00 PM

I posted yesterday about some speculation that the losses at MF Global might be related to rehypothecation. Several people who know better than me have told me that is unlikely.

Terrence Duffy, the chief executive of the CME Group, suggested today that there was a "loan" of customer money to MF Global.

From the NY Times DealBook on the Senate Panel Hearing on MF Global

Terrence Duffy, the chief executive of the CME Group, the exchange responsible for regulating MF Global, says he has information that indicates Mr. Corzine knew about some of the missing customer money.

...

Mr. Duffy is claiming that he was told of this revelation on Saturday by someone in his legal department, and did not know it when he testified before Congress last week.

“Somebody went in and violated the rules of the CME and the rules of the government,” he said.

...

While Mr. Duffy clearly aimed to throw the attention on what Mr. Corzine knew of the illegal transfers, subsequent guidance (or lack thereof) from CME has softened the accusation. They are now saying that the information they received indicated Mr. Corzine knew about the loans, but not whether they knew these loans were illegal or improper. They cannot comment on that, they said.

Lawler on NAR Revisions for 2007 through 2011

by Calculated Risk on 12/13/2011 03:35:00 PM

CR Note: Economist Tom Lawler first noted that the NAR appeared to be overestimating sales in 2009. In late 2010 other economists approached NAR with questions. From Nick Timiraos at the WSJ in Feb 2010: Home Sales Data DoubtedSeveral economists approached NAR late last year [late 2010] with questions about its modeling. NAR economists promised to study the issue during a December conference call that included economists from the Mortgage Bankers Association, Fannie Mae, Freddie Mac, the Federal Reserve, the Federal Housing Finance Agency and CoreLogic.

In January, I hinted about this meeting and that there would be significant downward revisions. The revisions will be announced on Dec 21st.

From economist Tom Lawler: NAR to Release Existing Home Sales Revisions this Month

The National Association of Realtors yesterday sent out a media advisory [announcing] that it would release its benchmark revisions to its existing home sales estimates on December 21st. Here is what the NAR sent out:

The National Association of Realtors will release benchmark revisions to existing-home sales at the December 21 lock-up news briefing for the November report, which will begin 30 minutes before the normal briefing at 9:30 a.m. for monthly data. All data can be released at 10:00 a.m. EST.While the NAR did not hint at the magnitude of the downward revisions, the “consensus” is that 2010 existing home sales will be revised downward by about 13% or so (yup, there’s a “consensus” for everything!).

Although there are downward revisions for total sales in recent years, there is little change to previously reported monthly comparisons or characterizations based on percentage change. There is a comparable downward revision to unsold inventory, so there is no change to relative month’s supply. Also, there is no change to median home prices.

An up-drift in sales projections developed over time between the fixed model for calculating sales rates and the actual marketplace, including growth in multiple listing service coverage areas, geographic population shifts, a decline in for-sale-by-owner transactions, some new-home sales trickling into MLS data and some individual sales being recorded in more than one MLS. Divergence of the data with other housing data metrics began in 2007, so revisions for 2007 through the present will be released.

NAR began to capture a larger share of actual transactions than was assumed in the calculation model based on the 2000 Census; resolving these issues has taking longer than anticipated in the absence of decennial data from the U.S. Census Bureau, which are no longer collected. Other major statistical series such as Gross Domestic Product and employment figures go through comparable periodic benchmark revisions to produce the most accurate data possible; the new benchmark process will permit much more frequent revisions.

NAR began its normal process for benchmarking sales at the beginning of this year in consultation with outside housing market experts. Data for the new benchmark was presented to and discussed with representatives of organizations including the Federal Reserve Board, Department of Housing and Urban Development, Freddie Mac, Fannie Mae, Mortgage Bankers Association, National Assocation of Home Builders, CoreLogic, etc.; and some individual economists.

Normal annual revisions will be released with January existing-home sales on February 22, 2012. Those revisions are expected to be minor and will fine-tune the data back though 2007.

In the past the NAR has done benchmark revisions based on decennial Census data (for owner-occupied transactions) and the decennial Residential Finance Survey (for “investor/vacant home” transactions, with this latter estimate being pretty “squishy"). Because of data availability lags, past benchmark revisions have not been released until MANY years after the end of a decade. The benchmark revisions for 1999 were not released until February 2005, and resulted in decline in estimated existing SF home sales of about 11%.

This decade, of course, the NAR could not continue with the same methodology, as the decennial Census no longer included the so-called “long form” with the data needed for the benchmarking (the “long form” is used in the ACS).

What drove the ACCELERATED benchmarking, however, were reports indicating that in many parts of the country existing home sales based on publicly recorded sales were showing SUBSTANTIALLY lower sales [than] the NAR estimates.

E.g., long-time readers will remember that I first started writing about this trend back in 2009, with my first piece focused on the widening “gap” between the NAR’s estimate of existing home sales in California and Dataquick’s data on “arms-length” existing home sales based on deeds recorded in the Golden State. DQ’s coverage of transactions in California is pretty complete, and its process for weeding out “non-arms-length” transactions seems pretty robust.

This issue got more media attention, however, when CoreLogic wrote a piece in its February 2011 “U.S. Housing and Mortgage Trends” report indicating that its data on existing sales based on public records covering “over 80%” of the US housing market strongly suggested that the NAR’s existing home sales estimates during the housing downturn were significantly overstated.

Many analysts were hoping that the NAR’s new methodology would be based on publicly recorded transactions, and apparently the NAR’s staff actually did explore this avenue. Rumor has it, however, that the new “benchmark” revisions will NOT be based on publicly recorded transactions – in part, apparently, because data coverage in many states is not comprehensive; data quality in many states/counties is poor; AND there are disparities among various private vendor estimates of sales based on publicly-recorded transactions.

An alternative for the NAR would be to use an approach similar to its old “Census/RFS” approach, but instead (1) to use the American Community Survey data for owner-occupied existing transactions; and (2) to make “crude” assumptions about turnover rates (and use some American Housing Survey data (ick!) to “guesstimate” transactions on investor/vacant homes.

Any approach, however, will result in a material reduction in estimated sales over the last few years – though the result will still be estimates and not actuals.

CR Note: This was from economist Tom Lawler.

FOMC Statement:: Economy expanding "moderately", Global growth slowing

by Calculated Risk on 12/13/2011 02:16:00 PM

Information received since the Federal Open Market Committee met in November suggests that the economy has been expanding moderately, notwithstanding some apparent slowing in global growth. While indicators point to some improvement in overall labor market conditions, the unemployment rate remains elevated. Household spending has continued to advance, but business fixed investment appears to be increasing less rapidly and the housing sector remains depressed. Inflation has moderated since earlier in the year, and longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee continues to expect a moderate pace of economic growth over coming quarters and consequently anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation will settle, over coming quarters, at levels at or below those consistent with the Committee’s dual mandate. However, the Committee will continue to pay close attention to the evolution of inflation and inflation expectations.

To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The Committee also decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was Charles L. Evans, who supported additional policy accommodation at this time.

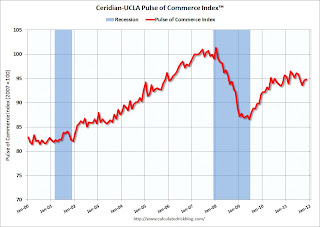

Ceridian-UCLA: Diesel Fuel index increased 0.1% in November

by Calculated Risk on 12/13/2011 12:44:00 PM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.1 Percent in November

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.1 percent in November following a 1.1 percent increase in October.

On a year-over-year basis, the PCI grew 0.9 percent in November compared to the 1.3 percent year-over-year increase in October. “The continuing weakness in the PCI is out-of-sync with real retail sales. The year-over-year increase in real retail sales through October was 3.6 percent compared with an increase in the PCI of 1.3 percent. The disconnect between real retail sales and the PCI suggests that retailers have learned to better manage their inventory. Therefore, shoppers can anticipate fewer bargains in the month ahead, and relatively little stock left for the after-Christmas sales,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.

...

Based on the latest PCI data, our forecast for November Industrial Production is a 0.06 percent increase when the government estimate is released on December 15.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and has only partially rebounded over the last two months. Mostly this has been sideways this year (only up 0.9% from November 2010).

Note: This index does appear to track Industrial Production over time (with plenty of noise).

BLS: Job Openings "essentially unchanged" in October

by Calculated Risk on 12/13/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in October was 3.3 million, essentially unchanged from 3.4 million in September. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in October was 1.2 million higher than in July 2009 (the most recent trough for the series). The number of job openings has increased 35 percent since the end of the recession in June 2009.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings declined slightly in October, but the number of job openings (yellow) has generally been trending up, and are up about 13% year-over-year compared to October 2010.

Quits declined in October, but have mostly been trending up - and quits are now up about 10% year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Retail Sales increased 0.2% in November

by Calculated Risk on 12/13/2011 08:30:00 AM

On a monthly basis, retail sales were up 0.2% from October to November (seasonally adjusted, after revisions), and sales were up 6.7% from November 2010. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $399.3 billion, an increase of 0.2 percent (±0.5%)* from the previous month and 6.7 percent (±0.7%) above November 2010.Retail sales excluding autos increased 0.2% in November.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.7% for all retail sales).

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.7% for all retail sales). This was below the consensus forecast for retail sales of a 0.5% increase in November, and a 0.4% increase ex-auto.

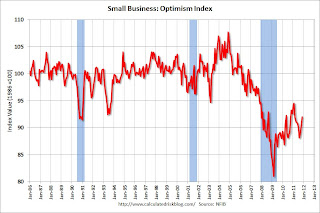

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/13/2011 07:43:00 AM

From the National Federation of Independent Business (NFIB): Small-Business Confidence Rises for Third Consecutive Month: Is Hope for the Economy on the Horizon?

Small-business optimism rose for the third consecutive month, gaining 1.8 points in November, and settling at a still weak 92.0, according to the National Federation of Independent Business’ (NFIB’s) latest index. ... Optimism appears to have climbed because fewer owners expect business conditions or sales to be worse in six months, indicating some hope on the horizon. Improvement, although small, was widespread with the forward-looking components indicating positive trends for the first time in many months.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

“After so many months of pessimism, November’s modest gain made it feel like spring, again,” said NFIB Chief Economist Bill Dunkelberg. “We have good reason to be optimistic about last month’s report and hopeful about what it means for the future."

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This is the third increase in a row after declining for six consecutive months.

The second graph shows the net hiring plans for the next three months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months.

Hiring plans were still fairly low in November, but the trend is up - and this is the strongest reading in 38 months. According to NFIB: “The employment picture brightened last month, ending five months of decline. In November, NFIB owners reported an overall increase in employment of 0.12 workers per firm in November. ... Future hiring plans were also positive. Over the next three months, a seasonally adjusted net seven percent of owners plan to create new jobs—a 4 point improvement from October and the strongest reading in 38 months."

Twenty five percent of small business owners reported that weak sales continued to be their top business problem in November.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly over the last three months. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.