by Calculated Risk on 12/07/2011 06:09:00 PM

Wednesday, December 07, 2011

FT: "We cannot afford another half-baked solution"

A few excerpts from a Financial Times editorial: We cannot afford another half-baked solution (ht Pat)

... there are but hours to save the euro ... The world cannot afford another half-baked solution. ... What [Merkel and Sarkozy] laid out was little more than a stability plan on steroids, based on a misdiagnosis of the crisis that divides the eurozone into nations that are fiscally virtuous and those deemed to be profligate “sinners”.In the short run, some fiscal agreements combined with ECB intervention will help. And it looks like the ECB will take more action tomorrow, from Bloomberg: ECB to Consider More Measures to Stimulate Bank Lending

A politically sustainable plan needs ... the hope of rebalancing within the eurozone, not just an endless vista of austerity.

The European Central Bank may announce a range of measures tomorrow to stimulate bank lending ...But that isn't enough. Some time soon, private investors will have to be enticed to buy sovereign bonds - and somehow the eurozone has to be rebalanced. "An endless vista of austerity" will not survive the polling booths for long.

Options on the table include loosening collateral criteria so that institutions have more access to cheap ECB cash and offering them longer-term loans to grease the flow of credit to the economy ... an interest rate cut is likely ...

Labor Force Participation Rate by Age Group

by Calculated Risk on 12/07/2011 02:26:00 PM

As the economy slowly recovers, an important question is: What will happen to the participation rate over the next few years?

On Sunday I pointed out that demographers expected the participation rate to start declining even before the great recession started. The expected gradual decline was due to the aging of the overall population.

Note: The participation rate is the percentage of the working age population in the labor force.

One difficultly in projecting the participation rate is that the age group participation rates change over time. The participation rate for the '16 to 19' age group has been declining for some time, and the participation rate has been increasing for older age groups - perhaps because of necessity, perhaps because of fewer "back breaking" jobs.

Here is a graph showing the trends by age group since 1990.

Click on graph for larger image.

Click on graph for larger image.

The participation rate is low for those in the '16 to 19' age group. The rate increases sharply for those in the '20 to 24' age group, and the rate is at its peak from 25 to 49 - and drops off a little for the '50 to 54' age group.

After 55 workers start leaving the labor force, and the participation rate falls off with age.

The participation rate has been declining for the younger age groups, although some of the recent decline for the '20 to 24' age group is probably related to the recession (perhaps more people staying in school).

Even though the participation rate is rising for the older age groups, the increase doesn't offset the aging of the population. As an example, when the current '55 to 59' age group moves into the '60 to 64' bracket, the participation rate for that cohort will decline from 73% to 55% or so. And with a fairly large cohort moving into the older age brackets, the overall participation rate will probably decline.

Forecasting the participation rate is important (along with population growth and other factors) in projecting how many jobs are needed to bring the economy back to full employment. So I'll be writing more about this ...

Europe Update

by Calculated Risk on 12/07/2011 11:28:00 AM

Not much news yet ... although the ECB is expected to cut interest rates ...

From the Financial Times: Germany insists on new treaty for Europe

Germany has thrown down the gauntlet to its European partners, insisting that they must agree on treaty change for the whole European Union, or at the least a binding new eurozone treaty, to bring lasting stability to the common currency, and reassure the financial markets.From the WSJ: Crisis Live Blog: Sarkozy, Merkel Issue Treaty Proposal

Excerpt with permission

In an open letter to European Council President Herman Van Rompuy, Mr. Sarkozy and Ms. Merkel issued an ultimatum to the 27 EU governments, saying they must decide whether they will accept greater central control over their national budgets.The Italian 2 year yield is up slightly to 5.6%, and the 10 year yield is up to 6.02%. Both were above 7% not long ago.

Should some countries decide not to participate, the 17 countries in the euro zone will press ahead with a more integrated union by signing a new agreement outside EU treaties, they said.

The Spanish 2 year yield is up sharply to 4.4%, and the 10 year yield is up to 5.44%. The ten year was at 6.7% on November 24th.

MBA: Mortgage Purchase Application Index increased

by Calculated Risk on 12/07/2011 08:52:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

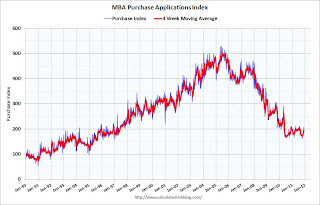

The Refinance Index increased 15.3 percent from the previous week. The seasonally adjusted Purchase Index increased 8.3 percent from one week earlier to its highest level since August 5, 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Coming out of the Thanksgiving holiday, applications increased significantly as mortgage rates dropped to their lowest levels in about two months," said Michael Fratantoni, MBA's Vice President of Research and Economics. "In particular, refinance applications increased sharply, with some lenders seeing refinance volume double. Despite this surge, aggregate refinance activity is still below levels reported two weeks ago. Some lenders indicated they are beginning to see an increase in HARP loans, but that increase is still a small portion of the move this week."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.18 percent, the lowest rate since September 30, 2011 ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500)decreased to 4.52 percent, the lowest rate since September 30, 2011 ...

Click on graph for larger image.

Click on graph for larger image.Although the purchase index increased, the index has mostly been sideways for the last 2 years - and at about the same level as in 1997.

Tuesday, December 06, 2011

Mortgage Settlement Update: California and Nevada join forces

by Calculated Risk on 12/06/2011 09:47:00 PM

From Alejandro Lazo at the LA Times: California and Nevada join forces in mortgage probe

An alliance by California and Nevada to jointly investigate misconduct and fraud in the mortgage business further divides efforts by the nation's attorneys general to bring the home-lending industry to account for improper foreclosure practices.It is appearing less and less likely that there will be a settlement any time soon ...

...

The agreement to work together, announced in Los Angeles on Tuesday by California Atty. Gen. Kamala D. Harris and Nevada Atty Gen. Catherine Cortez Masto, comes a week after Massachusetts said it was suing the nation's five largest mortgage servicers over alleged foreclosure illegalities. The moves escalate pressure on the nation's biggest financial institutions already in high-level negotiations with a coalition of state attorneys general over their alleged abuses.

Lawler on "Real Estate Investors, the Leverage Cycle, and the Housing Crisis"

by Calculated Risk on 12/06/2011 05:49:00 PM

CR Note: The following is a long discussion by Tom Lawler of the recent Fed paper looking at the role of real estate "investors" (really speculators) during the housing bubble. Lawler cautions about drawing quick conclusions from the graphs.

First, a quote from Lawler in 2005:

“The investor share of the purchase market has increased dramatically, to levels not seen since at least the late 1980’s. The investor share increase has been concentrated in MSAs with exceptionally rapid home price growth”People were warned! (In April 2005, I wrote Housing: Speculation is the Key)

“(C)onditions in many parts of the country mirror past conditions that preceded regional housing ‘busts’.”

Tom Lawler, NAHB Spring Construction Conference, May 25, 2005

From economist Tom Lawler:

In a relatively recent Federal Reserve Bank of New York “Staff Report” entitled “Real Estate Investors, the Leverage Cycle, and the Housing Crisis,” FRB of NY economists Andrew Haughwout, Donghoon Lee, Joseph Tracy, and Wilbert van der Klaauw utilize data from the FRBNY’s Consumer Credit Panel (CCP) data set of US individuals with credit files to attempt to document the role of mortgage-financed purchases of real estate by “investors” in last decade’s housing boom and bust. Here is a summary. Here is the abstract:

“We explore a mostly undocumented but important dimension of the housing market crisis: the role played by real estate investors. Using unique credit-report data, we document large increases in the share of purchases, and subsequently delinquencies, by real estate investors. In states that experienced the largest housing booms and busts, at the peak of the market almost half of purchase mortgage originations were associated with investors. In part by apparently misreporting their intentions to occupy the property, investors took on more leverage, contributing to higher rates of default. Our findings have important implications for policies designed to address the consequences and recurrence of housing market bubbles.”

In re the data, here’s an excerpt from the report.

“We can use this information (in the datset) to separate mortgage borrowers based on how many distinct first-lien mortgage accounts appear on their credit reports. Since each property can secure at most a single first-lien mortgage, the number of such mortgages on a borrower’s credit report is a reliable, non-self reported, indicator of the minimum number of properties a given individual has borrowed against.24 This kind of information about individual borrowers is not available in loan-level data sets and thus the FRBNY CCP data provide a unique perspective into important questions about who is originating new mortgages at any point in time, as well as their subsequent behavior.”

Folks who read the paper should read it carefully, as a “quick read” can lead to a bit of confusion on what some of the data and charts mean. E.g., there are charts on investor shares of new purchase mortgage borrowing that a “quick” reader might conclude represent estimates of the shares of mortgage-financed purchases FOR investment by non-owners as opposed to estimates of the share of mortgage-financed purchases BY folks who own more than one property with a mortgage (i.e., BY investors), even if the a GIVEN purchase by an “investor” happens to be for his/her primary residence. (By and For mean very different things!)

Similarly, there are charts showing the share of first-lien mortgages outstanding owed BY “investors,” which the casual reader might incorrectly conclude represent the share of mortgages outstanding on non-owner-occupied properties owned FOR investment, as opposed to the share of first-lien mortgages owed by folks who happen to own more than one mortgage-financed property, one of which is likely to the be the real estate investor’s primary residence! (Many real-estate “investors” actually live in a home with a mortgage!

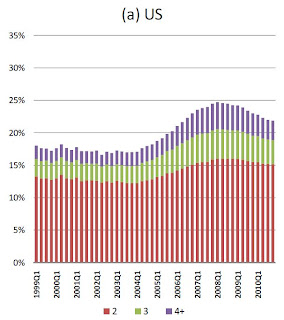

E.g., here is a chart from the report showing the “investor share” of new purchase-mortgage borrowing.

Click on graph for larger image.

Click on graph for larger image. (Shares are, I believe, shares of purchases by folks with “x” number of first-lien mortgages on their credit reports)

A casual reader might look at this chart and say, “holy crap,” in 2006 the share of mortgage-financed purchases FOR investment (or vacation homes) was almost 35%!

That would be an incorrect interpretation. Rather, the above chart represents an estimate of the share of mortgage-financed purchases BY individuals who had a mortgage on more than one property. That is a non-trivial distinction.

E.g., if a person who had a mortgage on his/her primary residence AND who had a mortgage on a different property (such as a vacation home) used a mortgage to finance the purchase of his/her new primary residence, that transaction would count as an “investor purchase” by the authors’ definition (a purchase BY an investor, not necessarily FOR investment).

Ah! Now inquiring minds probably want to know how the authors deal with folks who moved, but either (1) who moved before selling their previous primary residence and who carried two mortgages for a period of time; or (2) who, because of “reporting delays” on credit reports, were “shown” as carrying two mortgages when in fact they were not. Here’s how the authors attempt to deal with that.

“We observe borrowers’ credit reports on the final day of each quarter. Because there can be delays in credit reporting such that a mortgage that has been paid off may stay on the credit report for a period of time, we use the data’s panel structure to correct for these delays. Throughout this section of our analysis investor status is determined based on the maximum number of first mortgages that appear in both of the two most recent quarters. Thus we can be more confident that each first-lien we consider is in fact associated with a unique property.”

I did confirm with the authors that if I financed the purchase of our current residence in July 2007, but did not sell my previous residence until a year later (and if it had a mortgage), that I would have been classified as a “2 first mortgages” holder for the intervening period. Similarly, if I had a mortgage on our beach house as well, for a brief period I would have been classified as a “3 first mortgages” holder, and after the sale of our previous primary residence I’d be back down to a “2 first mortgages” holder. (In real life I don’t have any mortgages).

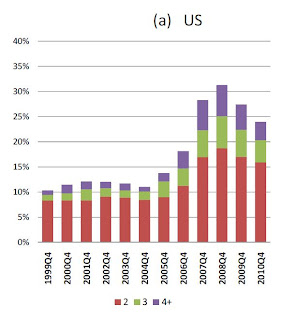

Similarly, consider another chart from the report.

Investor share of number of first mortgages outstanding

Investor share of number of first mortgages outstandingAgain, a “casual” reader might look at this chart and conclude that in the first quarter of 2008 the “share” of non-owner-occupied first mortgages outstanding was almost 25%. That would be incorrect.

The authors, by the way, are not meaning to confuse. One just needs to read the report carefully.

E.g., in the above chart it seems reasonable to conclude that for most borrowers with 2 first mortgages, one is a mortgage on their primary residence. The same is probably true for the 3- and 4+- holders. That would lead one to conclude (Q&D) that in the first quarter of 2008 the % of non-owner-occupied first mortgages outstanding was more like half what is shown above1.

1 Hope Now estimates that non-owner-occupied share of residential first-lien mortgages outstanding at the end of September was 9.4%, but that figure is likely understated.

A final chart I’m going to show from the paper is one that estimates the “investor” share of seriously-delinquent mortgages.

Investor share of 90% DPD first mortgage balances

Investor share of 90% DPD first mortgage balancesOne of the intriguing and important issues raised in the “conclusions” section of the paper relates to a question many folks, including myself, would like answered: what % of properties backing seriously delinquent loans are actually occupied by the owner of the property? The authors believe that the CCP data suggest that the % may be significantly greater than many folks believe, though, as noted above, the data aren’t “conclusive.” E.g., Hope Now estimates that at the end of September the % of residential first-lien loans 60+ days delinquent that were non-owner-occupied properties was 11.5%,, though its 60+ numbers don’t include loans in the foreclosure process. Unfortunately, I can’t for sure tell from the above chart what the RIGHT % is – but it makes a difference both in terms of how effective mod programs targeted at owner-occupied homes will be in terms of addressing the TOTAL delinquency/foreclosure issue, AND in terms of the wisdom of foreclosure moratoria/delays/etc. E.g., for vacant properties with delinquent loans, or properties with delinquent loans that are being rented out but not adequately maintained, it probably makes sense from a policy perspective to ACCELERATE the foreclosure process!

All in all, the paper is quite interesting and does shed some new light about the role real estate “investors” played in the housing boom/bust, and it is worth reading. The paper also shows some “investor” shares for “bubble” states that are quite illuminating.

Amusingly, the paper cites the amazingly bad paper by the clueless economists Himelberg, Mayer, and Sinai from 2005 (FRBNY Staff Report) entitled “Assessing High Home Prices: Bubbles, Fundamentals, and Misperceptions,” where the authors not only displayed a complete lack of knowledge of mortgage data sources, but who also DID NOT MENTION subprime, alt-A, low/no documentation mortgages, real-estate investor behavior. In a shocking but refreshing “mea culpa” piece on the FRBNY’s blog site entitled “Failure to Forecast the Great Recession,” Simon Potter not only documents the poor performance of the FRBNY’s economic projections, but also notes that FRBNY research (1) “misunderstood” the housing boom (citing the embarrassing HMS paper, as well as the silly 2004 McCarthy and Peach paper), and (2) there was “a lack of analysis of the rapid growth of new mortgage finance.” (See The Failure to Forecast the Great Recession)

While it now appears that “occupancy fraud” was distressingly common during the real-estate boom (one wonders, by the way, why mortgage originators didn’t check credit reports to see if a buyer claiming that he/she was going to purchase a home for his/her primary residence had more than one first mortgage outstanding!), there was still evidence that the non-owner-occupied share of mortgage-financed purchases was rising during the housing boom based on “accurately” reported occupancy purposes. E.g., here are some data from HMDA.

[This data was] taken from various annual articles from the Federal Reserve Bulletin on the HMDA data. I don’t know for sure what the 2000 and beyond data were “revised.”

[This data was] taken from various annual articles from the Federal Reserve Bulletin on the HMDA data. I don’t know for sure what the 2000 and beyond data were “revised.”Data from the old LoanPerformance “prime conventional conforming” database, which was not loan level but which had aggregate stats for PCC loans, also showed rising investor shares, especially in “bubble” markets. [The next] chart [is] from a presentation I made at the NAHB Fall Construction Forecast Conference in October, 2007.

“Second” refers to second homes such as vacation homes, while “investor” refers to investment (rental income) properties.

“Second” refers to second homes such as vacation homes, while “investor” refers to investment (rental income) properties.At the NAHB Spring Construction Conference on May 25th, 2005 I noted (using this data source) to support my statement that “(t)he investor share of the purchase market has increased dramatically, to levels not seen since at least the late 1980’s. The investor share increase has been concentrated in MSAs with exceptionally rapid home price growth.”

The National Association of Realtors “Investment and Vacation Home Buyers also suggested a big increase in buying of properties “for investment” in the middle of last decade. Unfortunately I only have data back to 2003, and I should note that I’ve never been able to “reconcile” this data to either the NAR’s Profile of Home Buyers and Sellers (which is based almost but not completely on a survey of principal-residence buyers) or to other sources).

According to this survey, 68% of buyers of “investment” properties used a mortgage to finance the purchase in 2006, compared to just 39% in 2010. While I can’t find the shares for earlier years, the NAR’s “Profile of Second Home Owners” published in 2006 suggested that about 76% of folks who purchased an investment property from 2003 to 2005 used a mortgage to finance the purchase.

According to this survey, 68% of buyers of “investment” properties used a mortgage to finance the purchase in 2006, compared to just 39% in 2010. While I can’t find the shares for earlier years, the NAR’s “Profile of Second Home Owners” published in 2006 suggested that about 76% of folks who purchased an investment property from 2003 to 2005 used a mortgage to finance the purchase. This is all a long-winded way of saying that despite what appears to have been a decent amount of “lying” on mortgage applications on a borrower’s intended use of his/her home purchase, there was still a significant amount of evidence available DURING the housing bubble that the share of mortgage-financed purchases by investors was rising SIGNIFICANTLY, and was rising exceptionally rapidly in the “most bubbly” of areas.

There was also, of course, LOTS of data on the rise in the subprime share of the mortgage market, the rise in the low/no doc share of the mortgage market, the rise in piggyback financing and low/no down payment purchases, the rise in interest-only/pay-option mortgages, etc.

CR Note: This was from economist Tom Lawler.

Financial Times: EU negotiators prepare "Bazooka"

by Calculated Risk on 12/06/2011 03:04:00 PM

From the Financial Times: EU talks on doubling financial firewall. The story suggests negotiators are considering allowing the EFSF to continue even after the €500bn European Stability Mechanism (ESM) takes effect next July.

Under the plans being considered, the ESM is unlikely to have its headline €500bn from the start, now envisioned for July. But leveraging up the existing EFSF, which could raise its disposable resources to about €600bn, and adding new IMF and ESM resources could create the so-called “bazooka” effect leaders have been searching for.Also there are discussions about the ECB lending money via the IMF (see FT Alphaville).

excerpt with permission

Will this bring private investors back into the European sovereign bond markets? And this doesn't address Germany's large current account surplus (and the current account deficits of other countries).

Meanwhile bond yields are much lower than 2 weeks ago ... the Italian 2 year yield is down to 5.59%, and the 10 year yield is down to 5.87%. Both were above 7% not long ago.

The Spanish 2 year yield is down to 4.01%, and the 10 year yield was down to 5.21%. The ten year was at 6.7% on November 24th.

The Belgian 10 year yield is at 4.3% (down from 5.86% on Nov 24th), and the French 10 year yield is at 3.24% (down from 3.72% on Nov 23rd).

Fed Chairman responds to "inaccurate" Bloomberg article

by Calculated Risk on 12/06/2011 01:38:00 PM

There was a Bloomberg article last week that I ignored (it appeared inaccurate to me).

Fed Chairman Ben Bernanke has responded today. This includes a staff memo. (Click on the link for the entire memo).

A excerpt:

[O]ne article incorrectly asserted that banks "reaped an estimated $13 billion of income by taking advantage of the Fed's below-market rates." Most of the Federal Reserve's lending facilities were priced at a penalty over normal market rates so that borrowers had economic incentives to exit the facilities as market conditions normalized, and the rates that the Federal Reserve charged on its lending programs did not provide a subsidy to borrowers.My comment: This is the Federal Reserve doing exactly what it should during a financial crisis: lending freely at a penalty rate on good collateral. Walter Bagehot wrote about this in Lombard Street (1873):

If it is known that the Bank of England is freely advancing on what in ordinary times is reckoned a good security—on what is then commonly pledged and easily convertible—the alarm of the solvent merchants and bankers will be stayed. But if securities, really good and usually convertible, are refused by the Bank, the alarm will not abate, the other loans made will fail in obtaining their end, and the panic will become worse and worse.I've criticized the Fed, sometimes harshly, and especially about the lack of regulatory oversight during the housing bubble. But this is the Fed acting as lender of last resort and I think this criticism was both inaccurate and way off base.

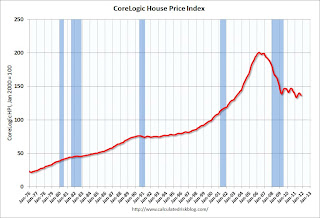

CoreLogic: House Price Index declined 1.3% in October

by Calculated Risk on 12/06/2011 10:29:00 AM

Notes: This CoreLogic Home Price Index report is for October. The Case-Shiller index released last week was for September. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of August, September and October (October weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® October Home Price Index Shows Third Consecutive Month-Over-Month Decline

CoreLogic ...today released its October Home Price Index (HPI®) which shows that home prices in the U.S. decreased 1.3 percent on a month-over-month basis, the third consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 3.9 percent on a year-over-year basis in October 2011 compared to October 2010. ... Excluding distressed sales, year-over-year prices declined by 0.5 percent in October 2011 compared to October 2010 and by 2.1* percent in September 2011 compared to September 2010. Distressed sales include short sales and real estate owned (REO) transactions.

“Home prices continue to decline in response to the weak demand for housing. While many housing statistics are basically moving sideways, prices continue to correct for a supply and demand imbalance. Looking forward, our forecasts indicate flat growth through 2013,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.3% in October, and is down 3.9% over the last year.

The index is off 32.0% from the peak - and up just 2.5% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index in early 2012.

Existing Home Inventory declines 17.5% year-over-year in early December

by Calculated Risk on 12/06/2011 08:58:00 AM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

In the near future, the NAR is expected to release revisions for their existing home sales and inventory numbers for the last few years. The sales and inventory revisions will be down (the NAR has pre-announced this).

Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be below the December 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through October (left axis) and an adjusted inventory using the HousingTracker.net data for the last few years.

HousingTracker is reporting that inventory in the 54 metro area is down 17.5% from the same week in 2010. If this adjustment is close, existing home inventory is now below the levels of late 2005 - and that is when inventory started rising sharply.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too, but visible inventory has clearly declined in many areas.

In a previous post, I used this data to estimate the coming NAR downward revision for sales, see: A few comments on the expected NAR existing home sales revisions. Here is a repeat of the table:

Here is what the adjustment to the NAR sales would look like using the HousingTracker data (this is NOT the NAR adjustment):

| Year | Sales, as Reported | YoY Change, as Reported | Adjustment | Sales, Adjusted | YoY Change, Adjusted |

|---|---|---|---|---|---|

| 2007 | 5,652,000 | -12.7% | -2.8% | 5,495,000 | -15.2% |

| 2008 | 4,913,000 | -13.1% | -4.5% | 4,691,000 | -14.6% |

| 2009 | 5,156,000 | 4.9% | -10.0% | 4,642,000 | -1.0% |

| 2010 | 4,908,000 | -4.8% | -13.4% | 4,250,000 | -8.4% |

| 20112 | 4,950,000 | 0.9% | -15.1% | 4,201,000 | -1.2% |

| 1An example of adjustment, this is NOT the NAR adjustment, 2estimate for 2011 | |||||

Hopefully the revisions will be released soon.