by Calculated Risk on 12/06/2011 03:04:00 PM

Tuesday, December 06, 2011

Financial Times: EU negotiators prepare "Bazooka"

From the Financial Times: EU talks on doubling financial firewall. The story suggests negotiators are considering allowing the EFSF to continue even after the €500bn European Stability Mechanism (ESM) takes effect next July.

Under the plans being considered, the ESM is unlikely to have its headline €500bn from the start, now envisioned for July. But leveraging up the existing EFSF, which could raise its disposable resources to about €600bn, and adding new IMF and ESM resources could create the so-called “bazooka” effect leaders have been searching for.Also there are discussions about the ECB lending money via the IMF (see FT Alphaville).

excerpt with permission

Will this bring private investors back into the European sovereign bond markets? And this doesn't address Germany's large current account surplus (and the current account deficits of other countries).

Meanwhile bond yields are much lower than 2 weeks ago ... the Italian 2 year yield is down to 5.59%, and the 10 year yield is down to 5.87%. Both were above 7% not long ago.

The Spanish 2 year yield is down to 4.01%, and the 10 year yield was down to 5.21%. The ten year was at 6.7% on November 24th.

The Belgian 10 year yield is at 4.3% (down from 5.86% on Nov 24th), and the French 10 year yield is at 3.24% (down from 3.72% on Nov 23rd).

Fed Chairman responds to "inaccurate" Bloomberg article

by Calculated Risk on 12/06/2011 01:38:00 PM

There was a Bloomberg article last week that I ignored (it appeared inaccurate to me).

Fed Chairman Ben Bernanke has responded today. This includes a staff memo. (Click on the link for the entire memo).

A excerpt:

[O]ne article incorrectly asserted that banks "reaped an estimated $13 billion of income by taking advantage of the Fed's below-market rates." Most of the Federal Reserve's lending facilities were priced at a penalty over normal market rates so that borrowers had economic incentives to exit the facilities as market conditions normalized, and the rates that the Federal Reserve charged on its lending programs did not provide a subsidy to borrowers.My comment: This is the Federal Reserve doing exactly what it should during a financial crisis: lending freely at a penalty rate on good collateral. Walter Bagehot wrote about this in Lombard Street (1873):

If it is known that the Bank of England is freely advancing on what in ordinary times is reckoned a good security—on what is then commonly pledged and easily convertible—the alarm of the solvent merchants and bankers will be stayed. But if securities, really good and usually convertible, are refused by the Bank, the alarm will not abate, the other loans made will fail in obtaining their end, and the panic will become worse and worse.I've criticized the Fed, sometimes harshly, and especially about the lack of regulatory oversight during the housing bubble. But this is the Fed acting as lender of last resort and I think this criticism was both inaccurate and way off base.

CoreLogic: House Price Index declined 1.3% in October

by Calculated Risk on 12/06/2011 10:29:00 AM

Notes: This CoreLogic Home Price Index report is for October. The Case-Shiller index released last week was for September. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of August, September and October (October weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® October Home Price Index Shows Third Consecutive Month-Over-Month Decline

CoreLogic ...today released its October Home Price Index (HPI®) which shows that home prices in the U.S. decreased 1.3 percent on a month-over-month basis, the third consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 3.9 percent on a year-over-year basis in October 2011 compared to October 2010. ... Excluding distressed sales, year-over-year prices declined by 0.5 percent in October 2011 compared to October 2010 and by 2.1* percent in September 2011 compared to September 2010. Distressed sales include short sales and real estate owned (REO) transactions.

“Home prices continue to decline in response to the weak demand for housing. While many housing statistics are basically moving sideways, prices continue to correct for a supply and demand imbalance. Looking forward, our forecasts indicate flat growth through 2013,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

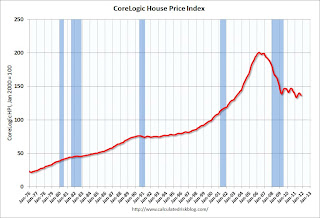

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.3% in October, and is down 3.9% over the last year.

The index is off 32.0% from the peak - and up just 2.5% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through February or March 2012 - the normal seasonal pattern. It is likely that there will be new post-bubble lows for this index in early 2012.

Existing Home Inventory declines 17.5% year-over-year in early December

by Calculated Risk on 12/06/2011 08:58:00 AM

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June (Tom also discussed how the NAR estimates existing home inventory - they don't aggregate data from local boards!)

In the near future, the NAR is expected to release revisions for their existing home sales and inventory numbers for the last few years. The sales and inventory revisions will be down (the NAR has pre-announced this).

Using the deptofnumbers.com for monthly inventory (54 metro areas), it appears inventory will be below the December 2005 levels this month. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the NAR estimate of existing home inventory through October (left axis) and an adjusted inventory using the HousingTracker.net data for the last few years.

HousingTracker is reporting that inventory in the 54 metro area is down 17.5% from the same week in 2010. If this adjustment is close, existing home inventory is now below the levels of late 2005 - and that is when inventory started rising sharply.

This is just "visible inventory" (inventory listed for sales). There is a large percentage of distressed inventory, and various categories of "shadow inventory" too, but visible inventory has clearly declined in many areas.

In a previous post, I used this data to estimate the coming NAR downward revision for sales, see: A few comments on the expected NAR existing home sales revisions. Here is a repeat of the table:

Here is what the adjustment to the NAR sales would look like using the HousingTracker data (this is NOT the NAR adjustment):

| Year | Sales, as Reported | YoY Change, as Reported | Adjustment | Sales, Adjusted | YoY Change, Adjusted |

|---|---|---|---|---|---|

| 2007 | 5,652,000 | -12.7% | -2.8% | 5,495,000 | -15.2% |

| 2008 | 4,913,000 | -13.1% | -4.5% | 4,691,000 | -14.6% |

| 2009 | 5,156,000 | 4.9% | -10.0% | 4,642,000 | -1.0% |

| 2010 | 4,908,000 | -4.8% | -13.4% | 4,250,000 | -8.4% |

| 20112 | 4,950,000 | 0.9% | -15.1% | 4,201,000 | -1.2% |

| 1An example of adjustment, this is NOT the NAR adjustment, 2estimate for 2011 | |||||

Hopefully the revisions will be released soon.

Monday, December 05, 2011

FT Alphaville: Post-euro currency values

by Calculated Risk on 12/05/2011 09:43:00 PM

I've been wondering how weak the drachma and other currencies would be if there was a break up of the eurozone. The following is just a rough estimate ... but imagine how much more expensive gasoline will be in Greece?

Note: I've added FT Alphaville feeds to the sidebar. It is a must read on the European financial crisis.

From Joseph Cotterill at the Financial Times Alphaville: Post-euro currencies, charted

Along with “redenomination risk” for eurozone financial assets, this is another of those pieces of bank research that’s as interesting for being considered necessary to be written in the first place, as much as for its conclusion.

(Yes, we know it’s a dampener to talk about a euro break-up when the German and French governments are promising European unification, sweetness and light on a scale not seen since Charlemagne. But since it really is about either complete fiscal union, or this – it’s worth noting.)

Click on graph for larger image.

Click on graph for larger image.Once again it’s Nomura taking the plunge on covering the break-up issue. In his December 4 note, the bank’s FX analyst Jens Nordvig warned that conclusions about the value of a post-euro currencies would have to be extremely provisional:

... we want to stress up-front that these estimates are unlikely to be particularly precise. They are intended to give a sense of potential magnitudes involved over a 5-year forward time frame, after which we believe temporary transition effects should be smaller.

...

A eurozone break-up will create additional short-term risks and require new risk premia for investors. These extraordinary risk premia will vary by country depending on factors such as market volatility, liquidity conditions, as well as issues relating to capital controls, including possible taxes on capital flows. Since our analysis is focussed on equilibrium considerations over a 5-year period, we will not focus directly on these more temporary effects, although we recognize that they could be crucial in the short-term.

Research: New paper on the role of investors in the housing bubble

by Calculated Risk on 12/05/2011 06:25:00 PM

Several readers have asked me to comment on this new paper from Fed economists Haughwout, Lee, Tracy, and van der Klaauw: “Flip This House”: Investor Speculation and the Housing Bubble (ht Josh)

[W]e present new findings from our recent New York Fed study that uses unique data to suggest that real estate “investors”—borrowers who use financial leverage in the form of mortgage credit to purchase multiple residential properties—played a previously unrecognized, but very important, role. These investors likely helped push prices up during 2004-06; but when prices turned down in early 2006, they defaulted in large numbers and thereby contributed importantly to the intensity of the housing cycle’s downward leg.It was pretty obvious that investor buying was pushing up prices in 2004 and 2005. I wrote a post in April 2005 (over six years ago!) on that subject: Housing: Speculation is the Key (Note: in that 2005 post I treated speculation as storage and showed how speculation pushes up prices during the bubble - and pushes down prices after the bubble bursts).

The Fed economists have added some data. Although I think the data suggests a significant role for speculation - especially in certain bubble areas - I think the data is a little confusing. One problem is that many move up buyers tend to buy their new home before selling their old home. So they have two mortgages while the old home is on the market. This was especially common during the bubble because move up buyers didn't want to sell until they were sure they had found something to buy. The Fed data appears to count these people as investors.

Another problem is the Fed didn't try to adjust for 2nd home owners.

But one thing is clear: investor buying did contribute to the bubble, but it wasn't the cause. But - as I noted in 2005:

Speculation tends to chase appreciating assets, and then speculation begets more speculation, until finally, for some reason that will become obvious to all in hindsight, the "bubble" bursts.It was no surprise that investors piled in after prices really took off. But the real causes of the bubble were rapid changes in the mortgage lending industry combined with a lack of regulatory oversight. The speculators just added to the fire.

LPS: House Price Index Shows 1.2 Percent decline in September

by Calculated Risk on 12/05/2011 04:18:00 PM

Another house price index ...

The LPS HPI is a repeat sales index that uses public disclosure by county recorders or loan origination data for purchase loans (if the sales price isn't disclosed).

From LPS: LPS Home Price Index Shows 1.2 Percent Decline in September U.S. Home Prices; Early Data Suggests Further 1.1 Percent Drop in October Likely

“Home prices in September were consistent with the seasonal pattern that has been occurring since 2009,” explained Kyle Lundstedt, managing director for LPS Applied Analytics. “Each year, prices have risen in the spring, but revert in autumn to a downward trend that has not only erased the gains, but has led to an average 3.7 percent annual drop in prices to date. The partial data available for October suggests a further approximate decline of 1.1 percent. Partial data from last month proved to be a good indicator for September's performance: it showed a preliminary 1.1 percent estimated decline, compared to the 1.2 percent as shown by the full month’s data.”

The LPS HPI national average home price for transactions during September was $202,000 – a decline of 1.2 percent for the month. As in previous years, this decline follows a 0.9 percent decline during August (Figure 1).

Click on graph for larger image.

Click on graph for larger image.Figure 1: "Prices have fallen since autumn 2008 with brief interruptions each spring. Except for February of this year, prices have not been at the current level since January 2003."

LPS HPI average national home prices continue the downward trend begun after the market peak in June 2006, when the total value of U.S. housing inventory covered by the LPS HPI stood at $10.6 trillion. The value has declined 30.2 percent since that peak to $7.56 trillion.It appears all of the price indexes will show new post-bubble lows later this year - or early in 2012.

During the period of most rapid price declines, from June 2007 through December 2008, the LPS HPI national average home price dropped $56,000 from $282,000, which corresponds to an average annual decline of 13.8 percent. Since December 2008, prices have fallen more slowly, interrupted by brief seasonal intervals of rising prices. During this period of more slowly declining prices, the national average price has fallen approximately $24,000 from $226,000. ... Price changes were consistent across the country during September, declining in all ZIP codes in the LPS HPI.

Fed's Evans on "Forward Guidance"

by Calculated Risk on 12/05/2011 01:45:00 PM

Over the weekend, the WSJ had an article about a new communication strategy at the Fed: Federal Reserve Prepares to Make Itself Perfectly Clear

Here are some related comments from Chicago Fed president Charles Evans today: A Risk Management Approach to Monetary Policy

The Fed could sharpen its forward guidance in two directions by implementing a state-contingent policy. The first part of such a policy would be to communicate that we will keep the funds rate at exceptionally low levels as long as unemployment is somewhat above its natural rate. The second part of the policy is to have an essential safeguard — that is, a commitment to pull back on accommodation if inflation rises above a particular threshold. This inflation safeguard would insure us against the risks that the supply constraints central to the structural impediments scenario are stronger than I think. Rates would remain low as long as the conditions were unmet.

Furthermore, I believe the inflation-safeguard threshold needs to be above our current 2 percent inflation objective — perhaps something like 3 percent. Now, the “3 percent inflation” number may seem shocking coming from a conservative central banker. However, as Kenneth Rogoff recently wrote in a Financial Times piece, “Any inflation above 2 percent may seem anathema to those who still remember the anti-inflation wars of the 1970s and 1980s, but a once-in-75-year crisis calls for outside-the-box measures.”[5] I agree wholeheartedly with Professor Rogoff.

And actually, this middle ground policy guidance is not as out-of-the box as one might think. Importantly, it is consistent with the most recent liquidity trap research, which shows that improved economic performance during a liquidity trap requires the central bank, if necessary, to allow inflation to run higher than its target for some time over the medium term. Such policies can generate the above-trend growth necessary to reduce unemployment and return overall economic activity to its productive potential. In fact, I have seen model simulation results that suggest to me that core inflation is unlikely to rise as high as 3 percent under such a policy.

...

If, as I fear, the liquidity trap scenario describes the present environment, we risk being mired in recession-like circumstances for an unacceptably long period. Indeed, each passing month of stagnation represents real economic losses that are borne by all. In addition, I worry that even when the economy does regain traction, its new potential growth path will be permanently impaired. The skills of the long-term unemployed may atrophy and incentives for workers to invest in acquiring new skills may be diminished. Similarly, businesses facing uncertain demand are less inclined to invest in new productive capacity and technologies. All of these factors may permanently lower the path of potential output.

As I said in the fall of 2010 and I repeat the message again today: I think state-contingent policies such as those I just described are a productive way to provide such necessary monetary accommodation. There is simply too much at stake for us to be excessively complacent while the economy is in such dire shape. It is imperative to undertake action now.

ISM Non-Manufacturing Index indicates slower expansion in November

by Calculated Risk on 12/05/2011 10:00:00 AM

The November ISM Non-manufacturing index was at 52.0%, down from 52.9% in October. The employment index decreased in November to 48.9%, down from 53.3% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2011 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 24th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 52 percent in November, 0.9 percentage point lower than the 52.9 percent registered in October, and indicating continued growth at a slightly slower rate in the non-manufacturing sector. This is the lowest reading since January 2010, when the index registered 50.7 percent. The Non-Manufacturing Business Activity Index increased 2.4 percentage points to 56.2 percent, reflecting growth for the 28th consecutive month. The New Orders Index increased by 0.6 percentage point to 53 percent. The Employment Index decreased 4.4 percentage points to 48.9 percent, indicating contraction in employment after one month of growth. The Prices Index increased 5.4 percentage points to 62.5 percent, indicating prices increased at a faster rate in November when compared to October. According to the NMI, 12 non-manufacturing industries reported growth in November. Respondents' comments for the most part project continued slow, incremental growth. There still remains a strong concern about lagging employment."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.8% and indicates slower expansion in November than in October.

Europe: More Austerity, Planning for "fiscal union"

by Calculated Risk on 12/05/2011 08:46:00 AM

From the Financial Times Rolling blog: Eurozone crisis lists today's events in Europe:

• Italy’s technocrat-prime minister, Mario Monti, has unveiled tough austerity measures and economic reformsFrom the WSJ: Italy Plan Opens Pivotal Week for Euro

• Nicolas Sarkozy ... and Angela Merkel ... will meet in Paris ... the structure and rules of a new “fiscal union” in Europe

• Herman Van Rompuy, the European Council president ... meets with foreign ministers to outline the scope of the talks leading up to Friday

• The Irish government presents its austerity budget ...

Italian Prime Minister Mario Monti, in his first test since taking office two weeks ago, outlined a three-year plan made up of €30 billion ($40.2 billion) in tax increases, spending cuts, pension overhauls and growth-boosting measures.From the NY Times: Italy’s Leader Unveils Radical Austerity Measures

The package—equivalent to 1.9% of Italy's €1.6 trillion gross domestic product—will likely be followed by Franco-German proposals on Monday to create a new regime for budget policies in the euro zone, which European leaders could adopt at a summit on Dec. 8-9.

Telling Italians that the fate of their country and the euro was at stake, Prime Minister Mario Monti unveiled a radical and ambitious package of spending cuts and tax increases on Sunday, including deeply unpopular moves like raising the country’s retirement age.Weekend:

...

The standard retirement age, now 60 for many women and 65 for most men, would quickly rise to 62 and 66, with incentives to keep working until age 70; the standard age for women would eventually rise to match that for men. Pensions would be based on the number of years of contributions, not on the worker’s salary at the time of retirement, as is common now.

• Summary for Week ending Dec 2nd

• Schedule for Week of Dec 4th