by Calculated Risk on 11/10/2011 08:30:00 AM

Thursday, November 10, 2011

Weekly Initial Unemployment Claims decline to 390,000

The DOL reports:

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 390,000, a decrease of 10,000 from the previous week's revised figure of 400,000. The 4-week moving average was 400,000, a decrease of 5,250 from the previous week's revised average of 405,250.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 400,000.

This is the lowest level for the 4 week average since April - although this is still elevated.

And here is a long term graph of weekly claims:

Italian Update: Bond yields decline

by Calculated Risk on 11/10/2011 07:32:00 AM

• The Italian 10 year bond yield fell to 6.89% after hitting 7.48% yesterday.

• From Bloomberg: Italy’s Senate Speeds Austerity Vote

Italy’s Senate rushed to pass debt- reduction measures that clear the way for establishing a new government that may be led by former European Union Competition Commissioner Mario Monti in a bid to restore confidence in Europe’s second-biggest debtor.• From the NY Times: Debt Sale in Italy Steadies Markets

The Senate is set to vote tomorrow on a package of measures including asset sales and an increase in the retirement age. The Chamber of Deputies may vote the following day ... Monti may be nominated as soon as Nov. 13, newspaper Il Sole 24 Ore reported.

Italy raised €5 billion, or $6.8 billion, in an auction Thursday of one-year securities. The Italian Treasury sold the full allotment of bonds on offer, but it paid an average rate of 6.09 percent to do so, far above the 3.57 percent it paid for a similar offering on Oct. 3. It also marked the most Italy has had paid for such debt since September 1997, when the country still used the lira.UPDATE on Greece: Reports are Former ECB Vice President Lucas Papademos will be named Prime Minister. From the Athens News:

"The new Greek interim government will be sworn in at 2:00 p.m. on Friday, according to sources.

Dr. Lucas Papademos, former governor of the central bank of Greece and former vice president of the European Central Bank (ECB), was on Thursday named as the new prime minister of Greece.

Papoulias gave Papademos a mandate to form the new interim government, a Presidency announcement said.

The 64-year-old Papademos, economic adviser to outgoing Premier Papandreou since 2010, was on Thursday named as the prime minister who will head a coalition government in Greece agreed by prime minister George Papandreou (ruling PASOK party leader) and main opposition New Democracy (ND) leader Antonis Samaras that is being formed to pass through parliament a second EU-IMF bailout package for Greece agreed at an extraordinary eurozone summit on October 26 before leading the country to early general elections in three months' time, with the most likely date being February 19.

Wednesday, November 09, 2011

Distressed House Sales using Sacramento Data for October

by Calculated Risk on 11/09/2011 08:15:00 PM

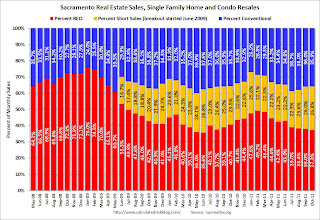

I've been following the Sacramento market to see the change in mix over time (conventional, REOs, and short sales) in a distressed area. The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

This will be interesting once something changes - and that hasn't happened yet. At some point, the number (and percent) of distressed sales should start to decline without market distortions.

The percent of distressed sales in Sacramento increased in October compared to September. In October 2011, 64.1% of all resales (single family homes and condos) were distressed sales. This is up from 64.0% in September, and down slightly from 64.3% in October 2010.

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO, short sales and conventional sales. There is a seasonal pattern for conventional sales (strong in the spring and summer), and distressed sales happen all year - so the percentage of distressed sales decreases every summer and the increases in the fall and winter.

Total sales were up 19.6% compared to October 2010. Active Listing Inventory is down 34.6% from last October, although "short sale contingent" has increased. Cash buyers accounted for 28.7% of all sales (frequently investors), and mean/medium prices are off about 10% from last October.

Once the foreclosure delays end, this data might be helpful in determining when the market is improving. So far it looks like REO sales have declined slightly, offset by an increase in short sales, so overall there is no improvement.

Lawler: SF REO Inventories at Fannie, Freddie, PLS, and a “Guess” at FHA

by Calculated Risk on 11/09/2011 05:38:00 PM

CR note: Here is some more REO data from economist Tom Lawler.

From Tom Lawler: Using data from Barclays Capital for private-label RMBS, the latest reports from Fannie and Freddie, and a “reasonable guess” for FHA (which is having “problems” with its September report), here is a chart showing SF REO inventories for “the F’s” and PLS.

Note that the FHA SF REO inventories shown in this chart are from various “Monthly Reports to the FHA Commissioner,” even though the REO data in these reports are not “stock/flow” consistent, and not quite accurate.

Click on graph for larger image.

Click on graph for larger image.

CR: This chart does not include REO owned by FDIC insured institutions (we will get an estimate when the Q3 Quarterly Banking Profile is released in a few weeks). Last quarter, Lawler estimated that REO inventory at FDIC insured institutions was about 81,000. That has probably declined slightly in Q3.

Also, as Tom Lawler noted before: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories."

CR: Although we still need more data, my initial guess is total REO was around 500,000 in Q3.

Of course there are many more foreclosures to come - see my post this morning: Housing: REO and Mortgage Delinquencies

Europe

by Calculated Risk on 11/09/2011 03:34:00 PM

Although Italian Prime Minister Silvio Berlusconi pledged to resign, it is unclear when - and what will happen next. The yield on 10 year Italian bonds is at 7.25%.

Meanwhile in Greece, there is still no decision on a new Prime Minister or coalition government. Two rudderless ships ...

A few stories:

From the NY Times: As Italy’s Cost of Borrowing Surges, Europe Shudders

Italian bond rates crossed a crucial level of 7 percent, prompting questions about whether Italy could soon need an international bailout just as the financially strapped nations of Greece, Ireland and Portugal did before it.From the Athens Times: Coalition deal collapses; new meeting Thursday

The difference this time is that Italy, the third largest economy in the euro zone, is on a different scale than those other, much smaller European nations.

A meeting of political leaders with the country's president has been postponed until 10am Thursday morning, the president's office has said, in a sign consensus on a new prime minister has yet to be sealed.From the LA Times: Italy at breaking point, Merkel calls for "new Europe"

The meeting was called off after outgoing Prime Minister George Papandreou and opposition New Democracy leader Antonis Samaras began talks with President Karolos Papoulias on a new coalition.

[German Chancellor Angela] Merkel said Europe's plight was now so "unpleasant" that deep structural reforms were needed quickly, warning the rest of the world would not wait. "That will mean more Europe, not less Europe," she told a conference in Berlin.A few comments:

She called for changes in EU treaties after French President Nicolas Sarkozy advocated a two-speed Europe in which euro zone countries accelerate and deepen integration while an expanding group outside the currency bloc stayed more loosely connected -- a signal that some members may have to quit the euro if the entire structure is not to crumble.

"It is time for a breakthrough to a new Europe," Merkel said. "A community that says, regardless of what happens in the rest of the world, that it can never again change its ground rules, that community simply can't survive."

1) Europe has the resources to solve the problem, but not the political mechanism.

2) I'm frequently told by European analysts: Never underestimate the desire of EU policymakers to hold the eurozone together.

3) The ECB is just passively buying sovereign debt - and that probably will not change any time soon.

4) Other than the ECB, Europe probably does not have the mechanism to help Italy. The EFSF lacks the firepower.

A few other bond yields: The Greek 2 year yield is up to 108%. The Greek 1 year yield is up to 222%.

The Portuguese 2 year yield is down to 18.4% and the Irish 2 year yield is down to 9.2% (from 8.8%).

The Spanish 10 year yield is at 5.8%, the Belgian 10 year yield is at 4.4% and the French 10 year yield is down to 3.2%.

Housing: REO and Mortgage Delinquencies

by Calculated Risk on 11/09/2011 12:11:00 PM

Yesterday Fannie Mae reported their third quarter results. Fannie's REO inventory fell to 122,616 houses from 135,719 at the end of Q2. Fannie's REO inventory has declined for four straight quarters.

Below is a graph of Fannie Mae REO acquisitions (completed foreclosure or deed-in-lieu) and dispositions (sales).

Note the slowdown in REO acquisitions in Q4 2010, and the increase in sales.

Since sales have been higher than acquisitions, REO inventory has been falling. However there are many properties delayed in the foreclosure process, and acquisitions will pick up when the mortgage servicer settlement is reached.

Click on graph for larger image.

Click on graph for larger image.

If we just looked at REO inventory, we might think that the situation is getting better pretty quickly. However there are a large number of properties in the "90 days delinquent" and "in foreclosure" buckets.

The second graph shows the delinquent and REO buckets over time. The delinquency data is from LPS, and the REO estimates are based on work by Tom Lawler and my own calculations.

The dashed lines are "normal" historical levels for each bucket. The 30 day bucket is only slightly elevated (as of September), and the 60 day buckets is somewhat elevated. But the glaring problems are in the 90 day and in-foreclosure buckets.

The dashed lines are "normal" historical levels for each bucket. The 30 day bucket is only slightly elevated (as of September), and the 60 day buckets is somewhat elevated. But the glaring problems are in the 90 day and in-foreclosure buckets.

There are 4.1 million seriously delinquent loans (90 day and in-foreclosure). This is about 3.1 million more properties than normal. Probably when the mortgage settlement is announced, some of these loans will cure as part of the settlement with loan modifications that include principal reduction, but many of these properties will become REOs fairly quickly.

So even though REO inventory is declining, there are still many more to come.

Ceridian-UCLA: Diesel Fuel index increased 1.1% in October

by Calculated Risk on 11/09/2011 09:00:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 1.1 Percent in October, Offsetting the 1.0 Percent Decline in September

The Ceridian-UCLA Pulse of Commerce Index®(PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 1.1 percent in October after three consecutive months of negative numbers.

Over the past three months, compared to the prior three months, the PCI declined at an annualized rate of 5.8 percent and the PCI remains lower than it was during most of the first half of 2011. “The October data offer some welcome relief from the double-dip fears that were rampant a month ago, but one month does not mean a new trend. Until we get a series of positive months, it remains a she-loves-me, she-loves-me-not economy with bad news followed by good followed by bad,” said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.

On a year-over-year basis, the PCI was up 1.3 percent in October compared to the -0.2 percent decrease in the prior month. ... Based on the latest PCI data, our forecast for October Industrial Production is a 0.12 percent increase when the government estimate is released on November 16.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index declined sharply in late summer and this small rebound only offsets some of the recent decline.

Note: This index does appear to track Industrial Production over time (with plenty of noise).

Italian Bond Yields hit 7.4%

by Calculated Risk on 11/09/2011 07:57:00 AM

• The Italian 10 year yield is at 7.32% after hitting 7.48% this morning.

• From Reuters: LCH.Clearnet Raises Initial Margin Call on Italian Debt

LCH.Clearnet increased the margin on debt from the [Italy] at a time when its bonds yields are close to levels deemed unsustainable.• European stocks are off today with the FTSE down 2%, and the DAX down 3%.

...

When LCH.Clearnet Ltd took similar action on Portuguese and Irish debt as bond yields soared, it added to selling pressure on the paper. Both countries were later forced to seek bailouts.

MBA: Mortgage Purchase Application Index increased

by Calculated Risk on 11/09/2011 07:40:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 12.1 percent from the previous week. The seasonally adjusted Purchase Index increased 4.8 percent from one week earlier to the highest level since August 2011.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Treasury rates dropped last week, as renewed turmoil in Europe once again led to a flight to quality, and 30-year mortgage rates dropped to their second lowest level of the year," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Refinance applications jumped more than 12 percent to their highest level in a month and some lenders experienced even larger increases. As has been the case all year, many refinance applicants are opting to deleverage by choosing 15-year mortgages."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.22 percent from 4.31 percent.

Click on graph for larger image.

Click on graph for larger image.Although the purchase index increased, the index is still sharply below the levels of June and July - and at about the same level as in 1996. This does not include cash buyers, but this suggests weak home sales over the next couple of months.

Tuesday, November 08, 2011

Greek Politics

by Calculated Risk on 11/08/2011 09:41:00 PM

An apt headline from the Athens News: Sinking with no captain

The European Union’s shattered trust in Greece and interparty wrangling have delayed the announcement of Greece’s new coalition government ...I don't know if this story is accurate, but if the plan is to default - just say so.

The humiliating demand by EU Economic and Monetary Affairs Commissioner Olli Rehn that the next tranche of loans will not be disbursed unless New Democracy leader Antonis Samaras signs a declaration that he will support full implementation of the October 27 bailout threw his party into a tailspin.

The demand came a day after ND issued a nonpaper saying that the party will support the new government’s policies, only to reverse them when the conservatives come to power.

Designed to beat Samaras into complete submission, Rehn’s demand triggered an uproar in the ND party base ...